GBP is in the midst of a correction. This overview also delves into the dynamics of EUR, JPY, CHF, AUD, Brent, Gold, and the S&P 500 index.

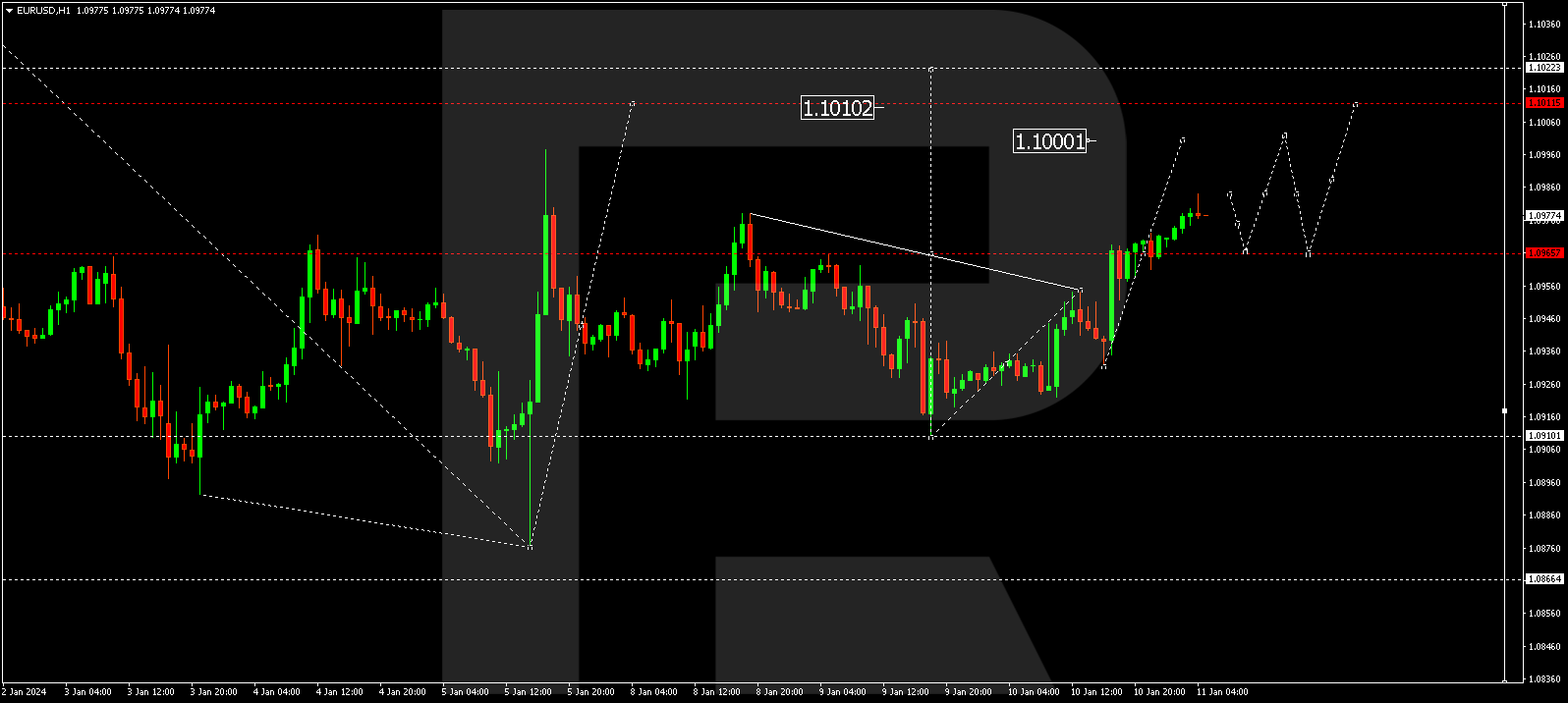

EUR/USD (Euro vs US Dollar)

The EUR/USD pair has broken the 1.0966 level upwards and is constructing a growth structure to 1.1000. Following this level, there might be a decline to 1.0966 (a test from above). Subsequently, another growth structure to 1.1010 could emerge, succeeded by a new decline wave to 1.0866.

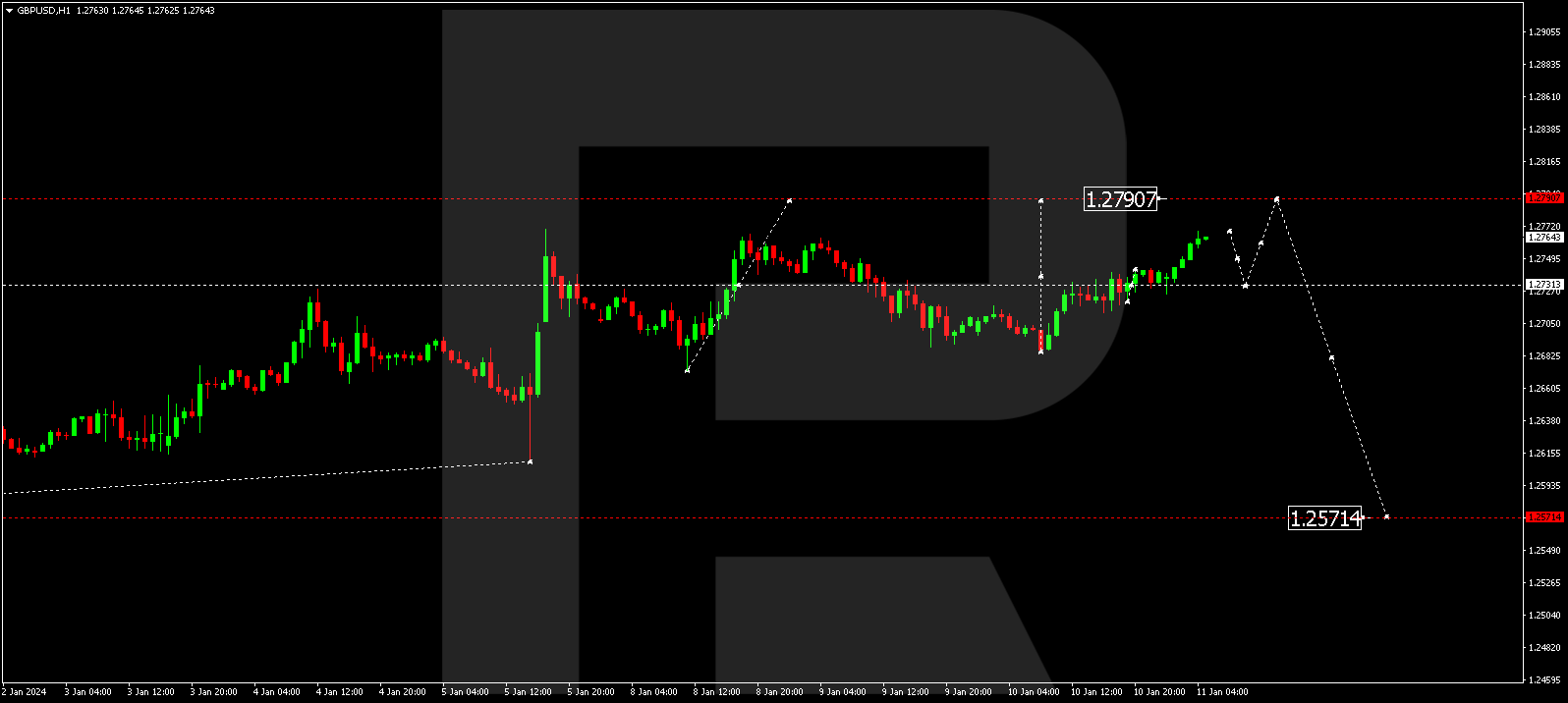

GBP/USD (Great Britain Pound vs US Dollar)

GBP/USD has surpassed the 1.2733 level upwards and is currently in the process of a corrective structure towards 1.2790. After the correction concludes, a new decline wave to 1.2751 might commence. This is a local target.

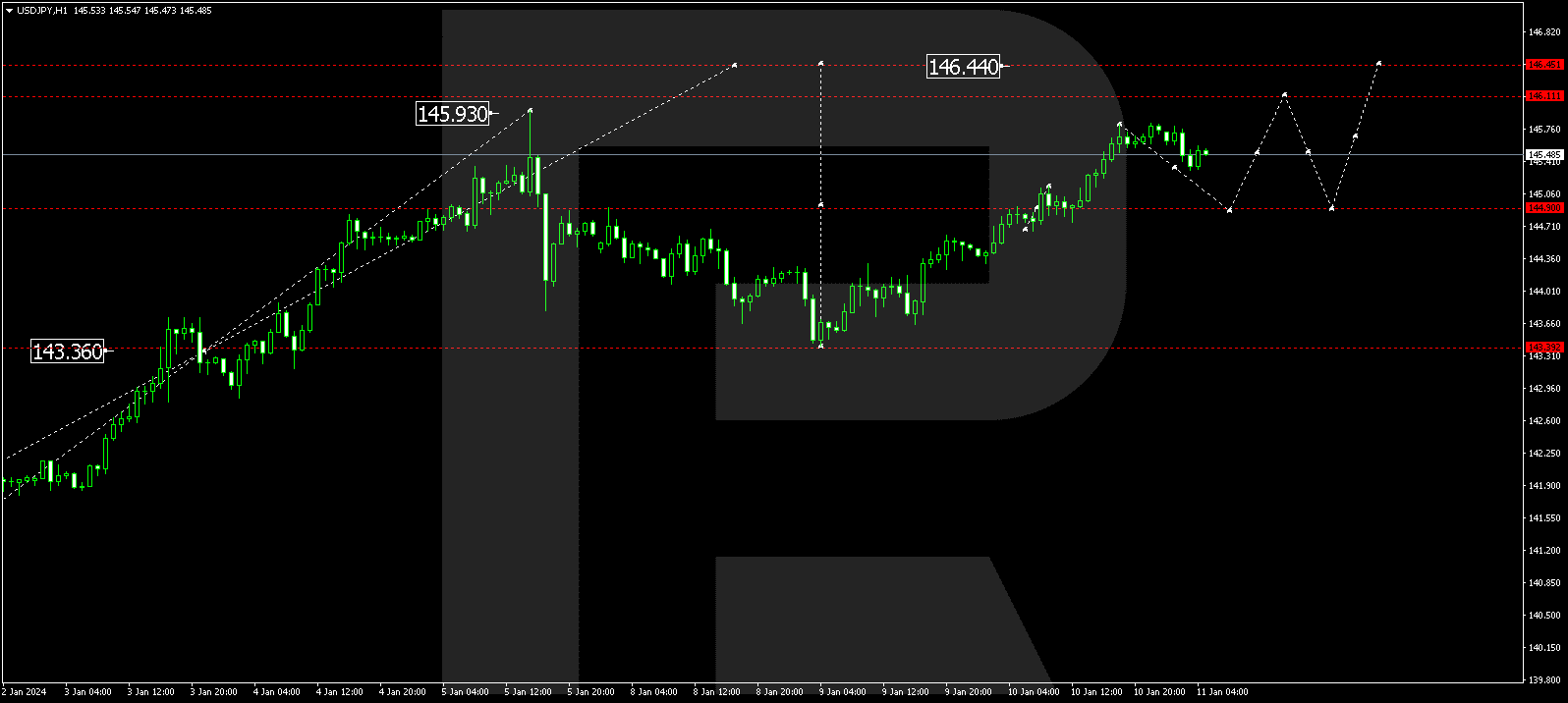

USD/JPY (US Dollar vs Japanese Yen)

The USD/JPY pair has completed a growth wave to 145.81, and a correction to 144.90 is anticipated today. Following the correction, a new growth wave to 146.44 could initiate. This is the first target.

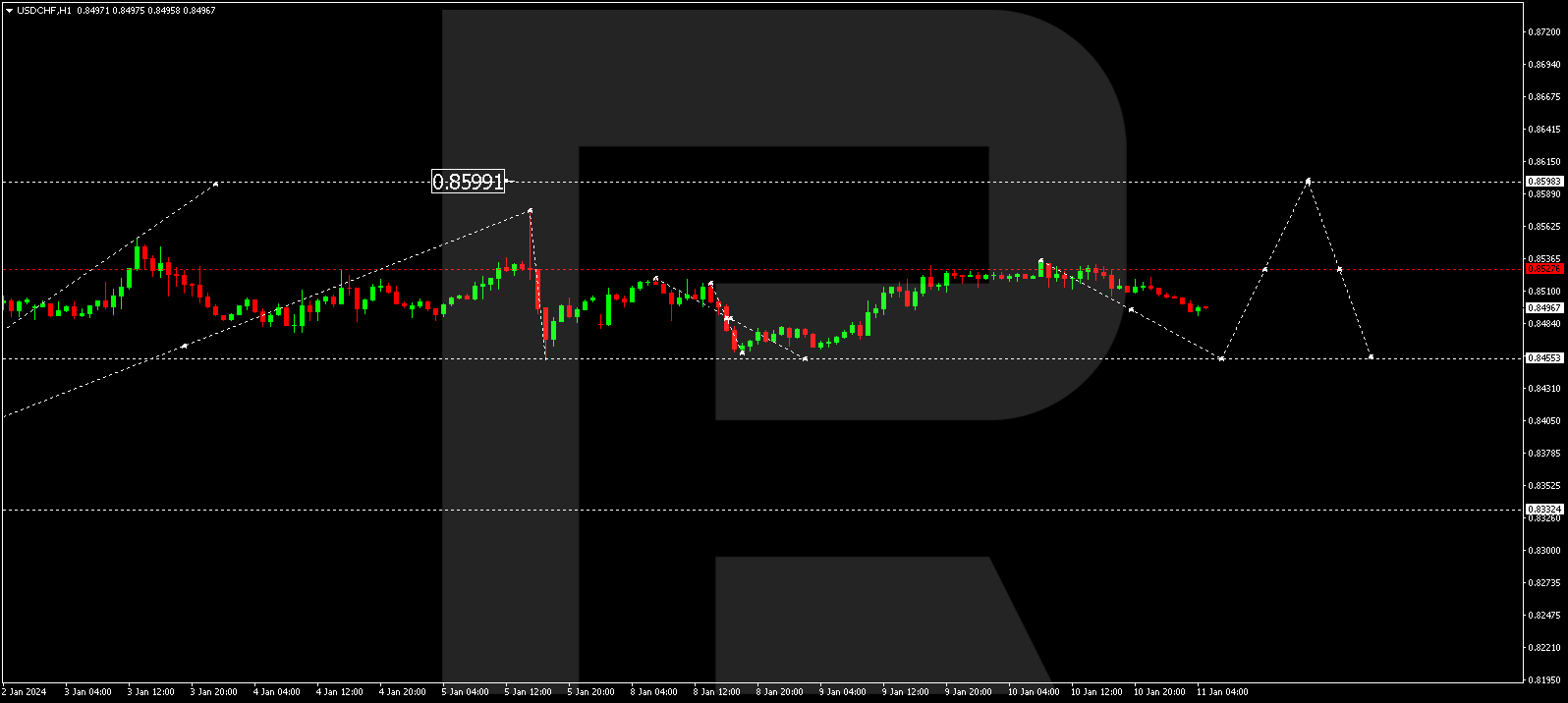

USD/CHF (US Dollar vs Swiss Franc)

USD/CHF is persisting in a consolidation range under 0.8527, and today the range is expected to extend downwards to 0.8455. Next, a growth wave to 0.8598 might commence. This is the first target.

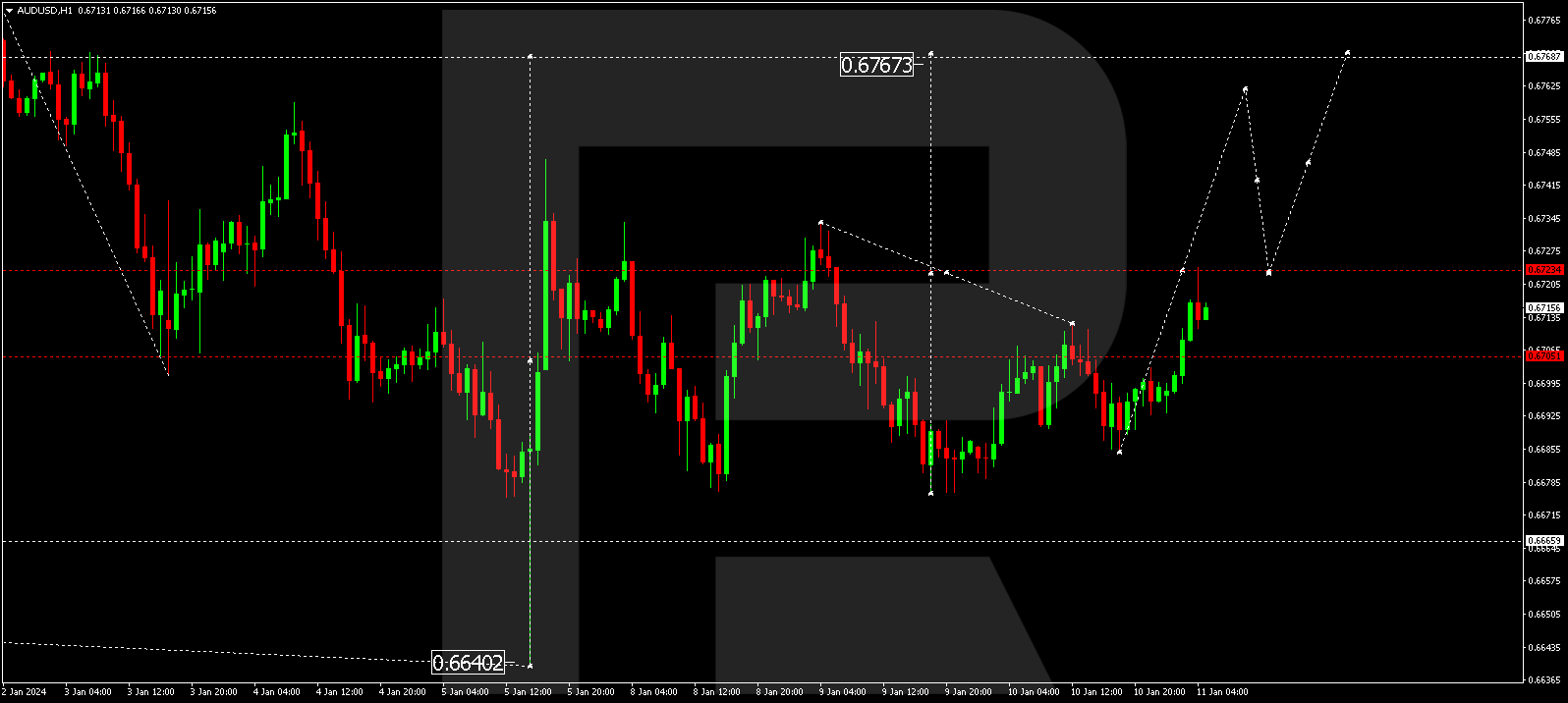

AUD/USD (Australian Dollar vs US Dollar)

AUD/USD has concluded a growth structure at 0.6723. A narrow consolidation range might manifest around this level today. If there’s an upward escape, the corrective wave to 0.6767 might persist. After the correction, a new decline wave to 0.6600 could commence following the trend.

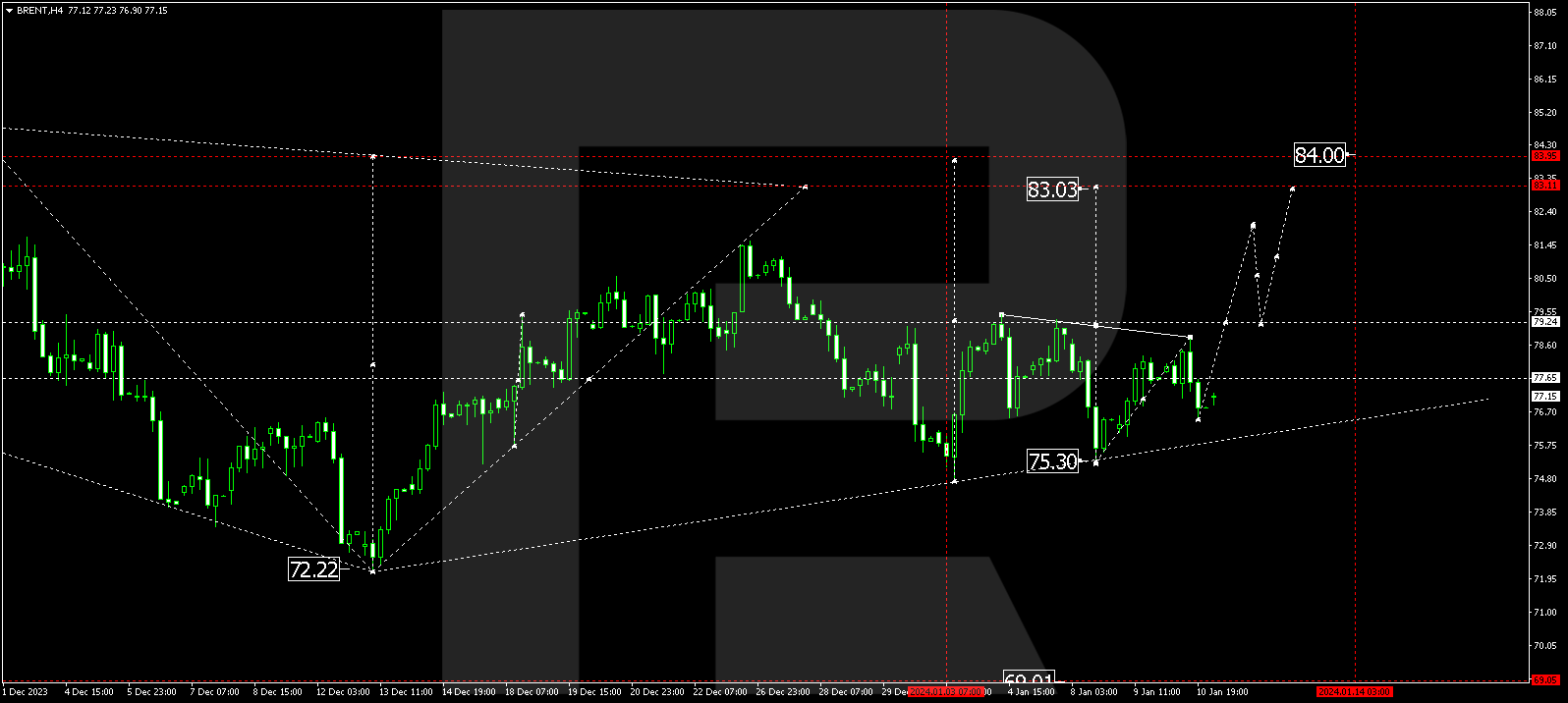

BRENT

Brent is evolving within a consolidation range around 77.65 without any pronounced trend. A growth link to 79.24 might shape up today, and upon breaking this level upwards, the potential for a wave to 83.00 might unfold, from where the trend could extend to 84.00.

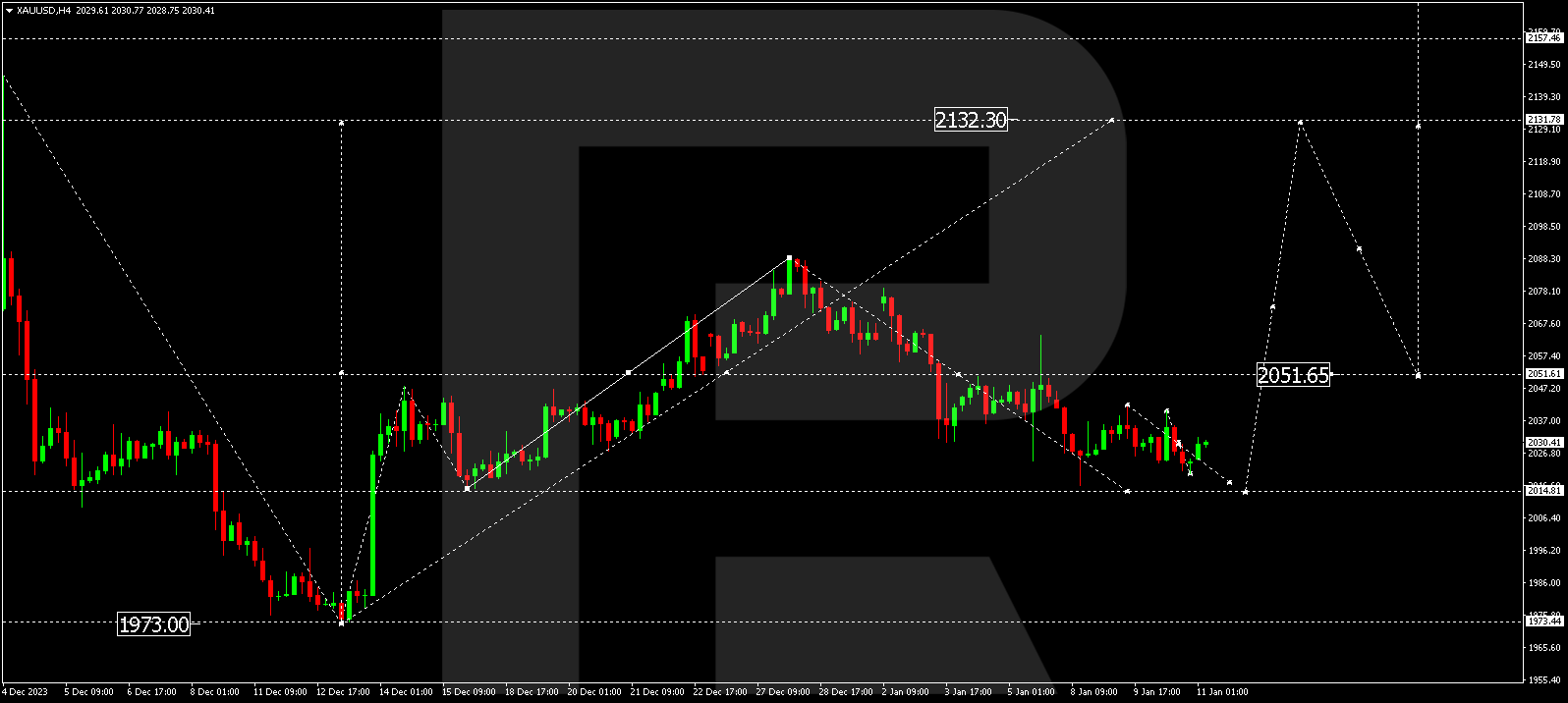

XAU/USD (Gold vs US Dollar)

Gold is progressing with a decline wave to 2014.80. Once it reaches this level, a new growth wave to 2051.65 might initiate. Breaking this level upwards as well could signify the continuation of the trend to 2131.78.

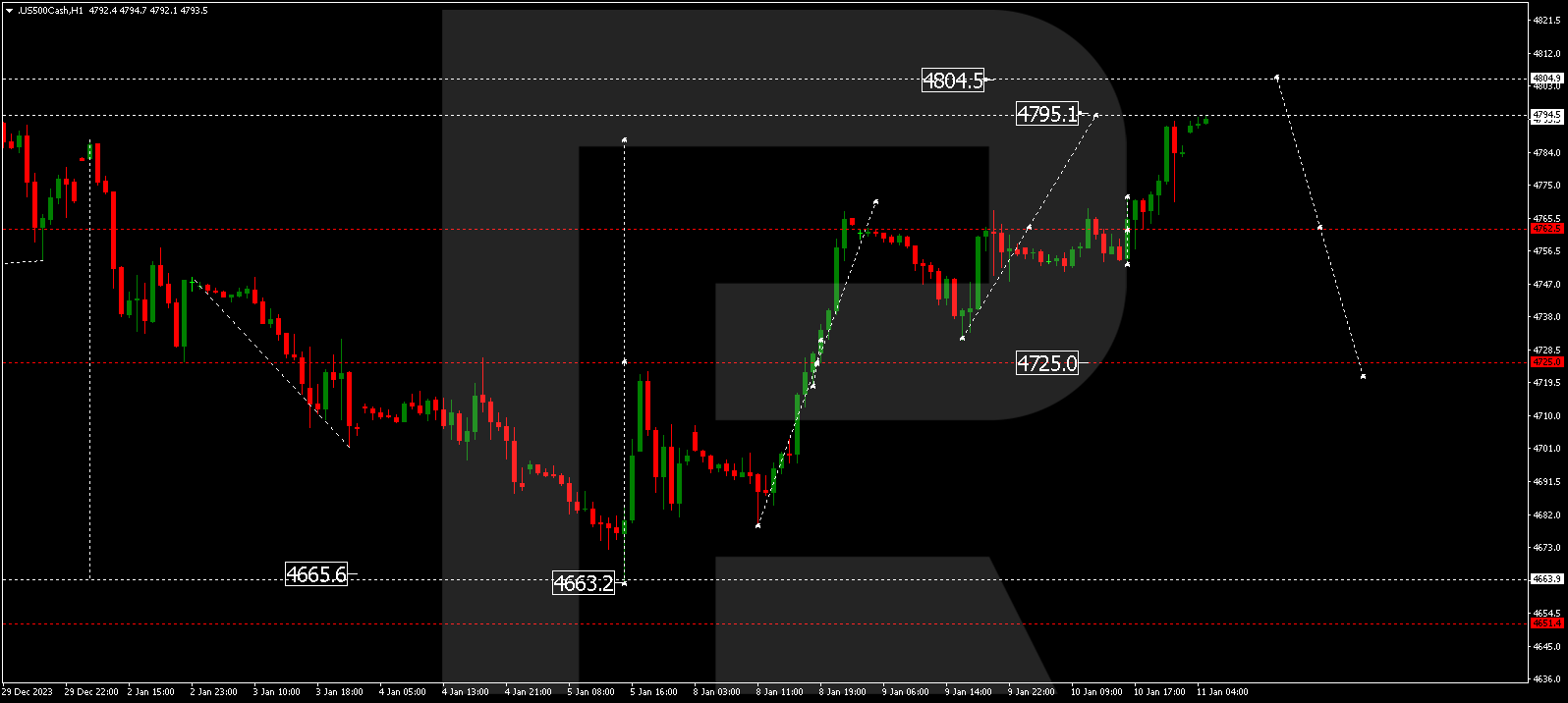

S&P 500

The stock index is currently in the process of developing a growth structure to 4795.0. After reaching this level, a new consolidation range might form below this level. If there’s a downward escape, a correction to 4725.0 might commence. An upward escape could lead to a price rise to 4805.0, from where the trend might extend to 4900.0.

The post Technical Analysis & Forecast January 11, 2024 appeared first at R Blog – RoboForex.