Gold Initiates a New Upward Movement. This analysis covers the dynamics of EUR, GBP, JPY, CHF, AUD, Brent, and the S&P 500 index.

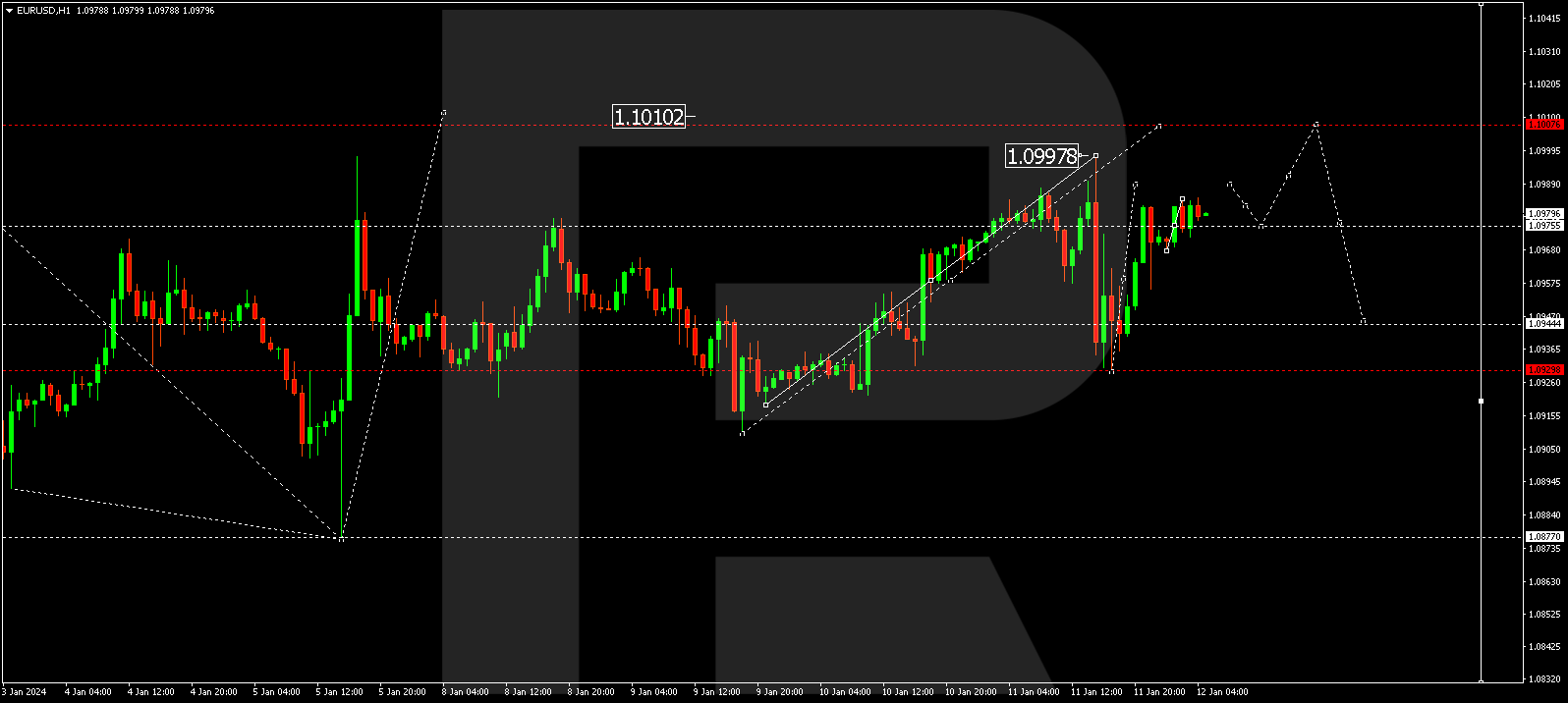

EUR/USD (Euro vs US Dollar)

Having concluded a growth phase at 1.0997 and a correction to 1.0930, EUR/USD is currently establishing a fresh upward structure towards 1.1010. Following this level, an anticipated decline to 1.0944 may occur, potentially extending the trend to 1.0877 as a local target.

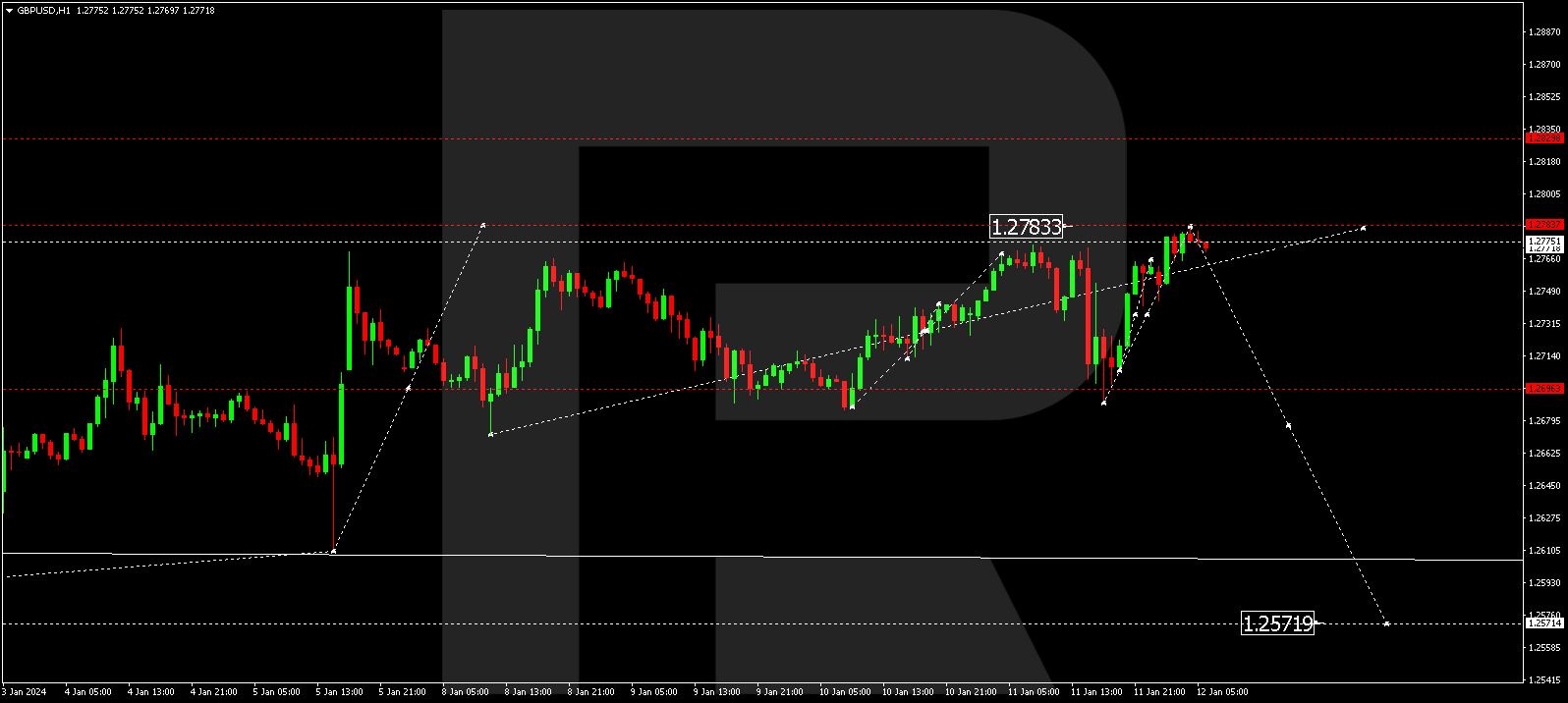

GBP/USD (Great Britain Pound vs US Dollar)

After completing a decline to 1.2690, GBP/USD has initiated an upward wave reaching 1.2782. A consolidation range might form beneath this level. In the event of a downward breakout, quotes could fall to 1.2772, while an upward breakout might lead to a growth continuation to 1.2840. Subsequently, a potential decline to 1.2666 becomes a local target.

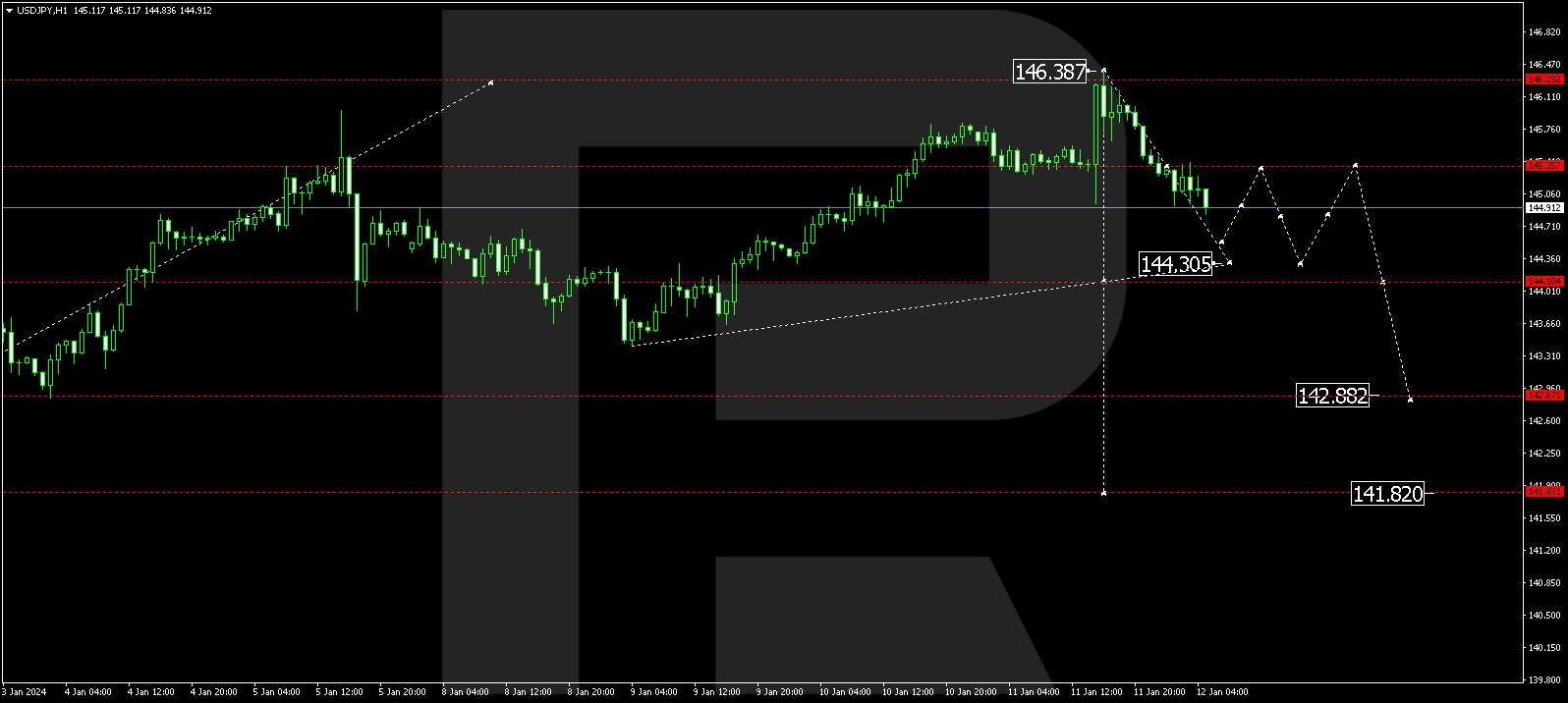

USD/JPY (US Dollar vs Japanese Yen)

USD/JPY is currently in a declining phase towards the 144.30 level. A projected correction to 145.35 may follow, succeeded by a trend-driven decline to 142.88, serving as a local target.

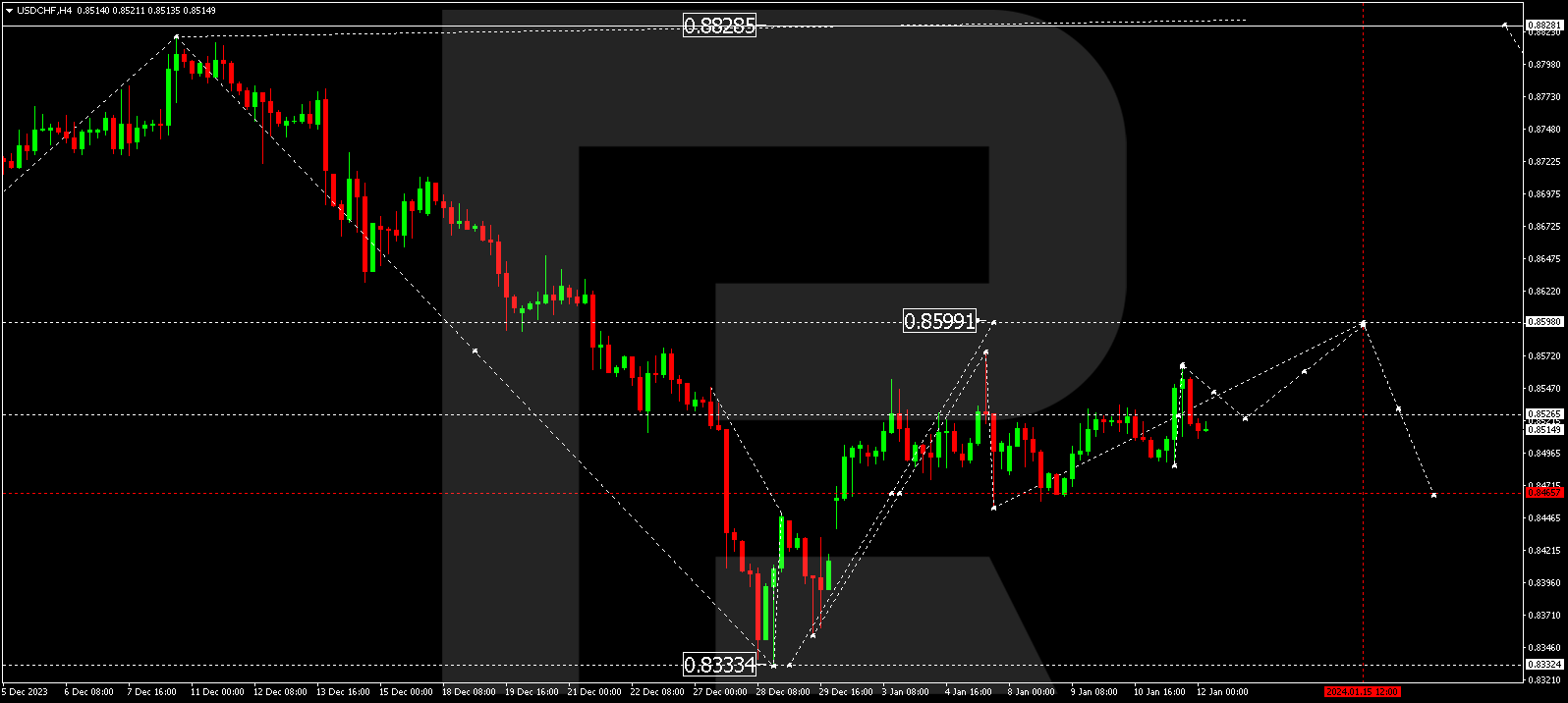

USD/CHF (US Dollar vs Swiss Franc)

USD/CHF is in the midst of a consolidation range around 0.8530, with expectations for an upward extension to 0.8598. This marks the initial target, followed by a potential correction to 0.8457.

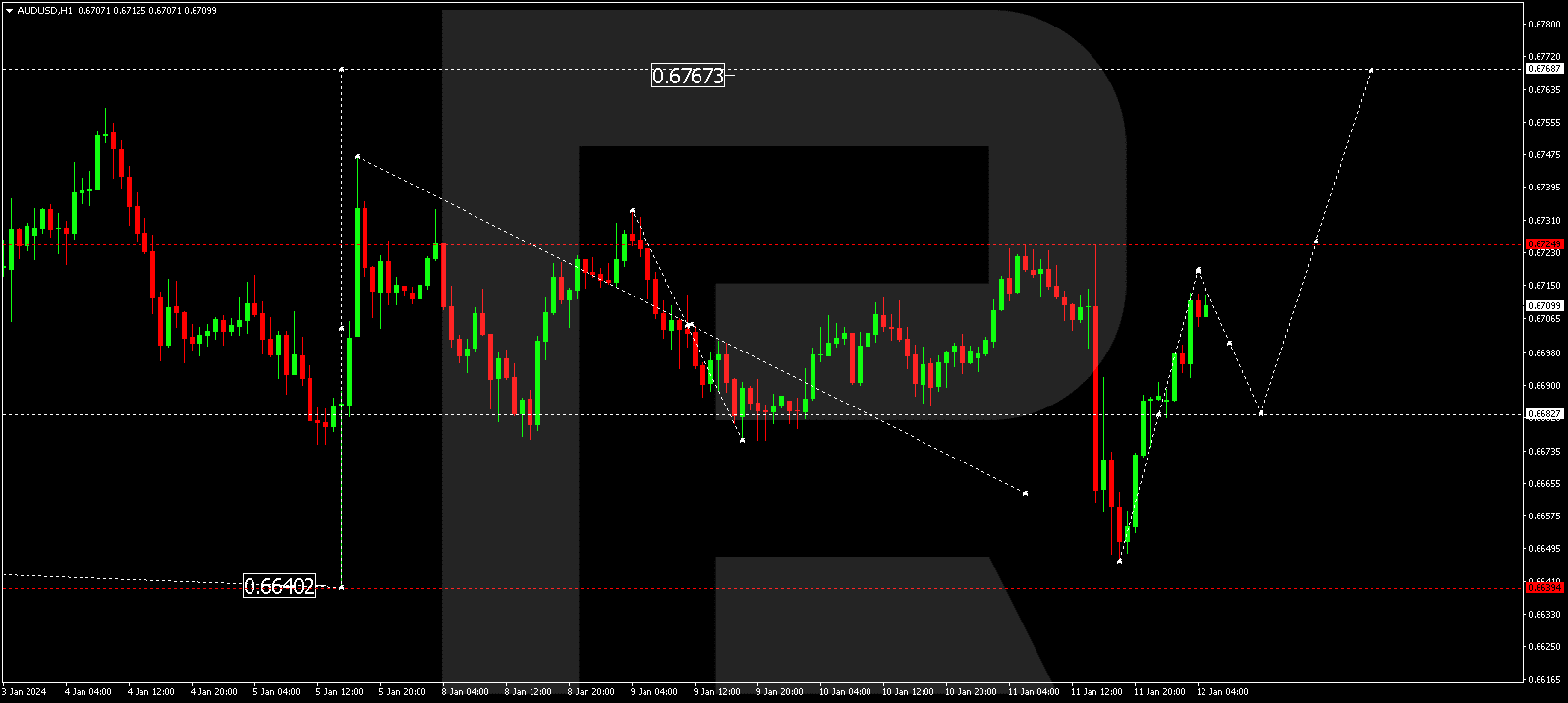

AUD/USD (Australian Dollar vs US Dollar)

Continuing its upward trajectory to 0.6720, AUD/USD may experience a subsequent decline to 0.6680, leading to a potential extension of the trend to 0.6640 as a local target.

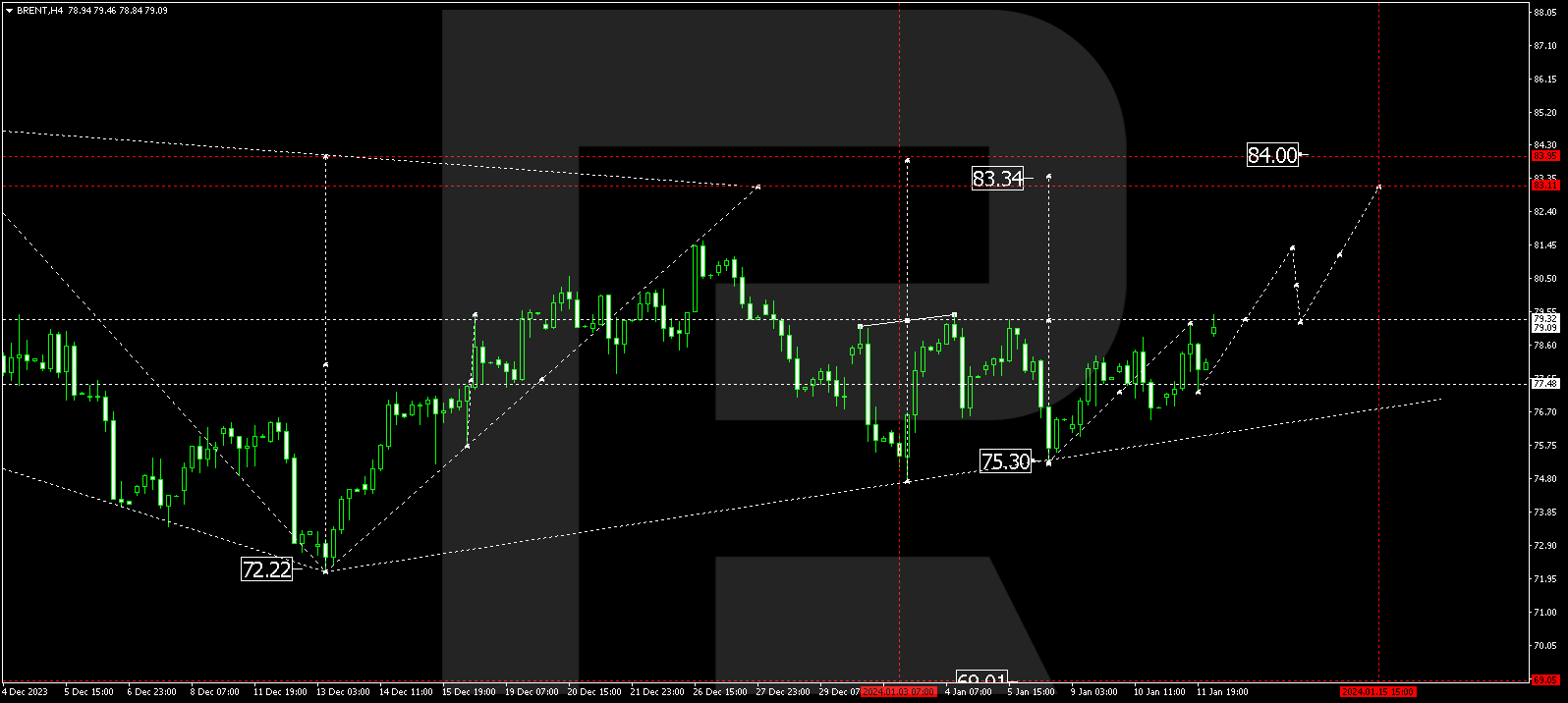

BRENT

After completing an upward phase to 73.46, Brent is forming a consolidation range. An expected upward breakout could propel the growth wave to 83.11, serving as a local target. Subsequently, corrections to 79.50 may precede a further rise to 84.00.

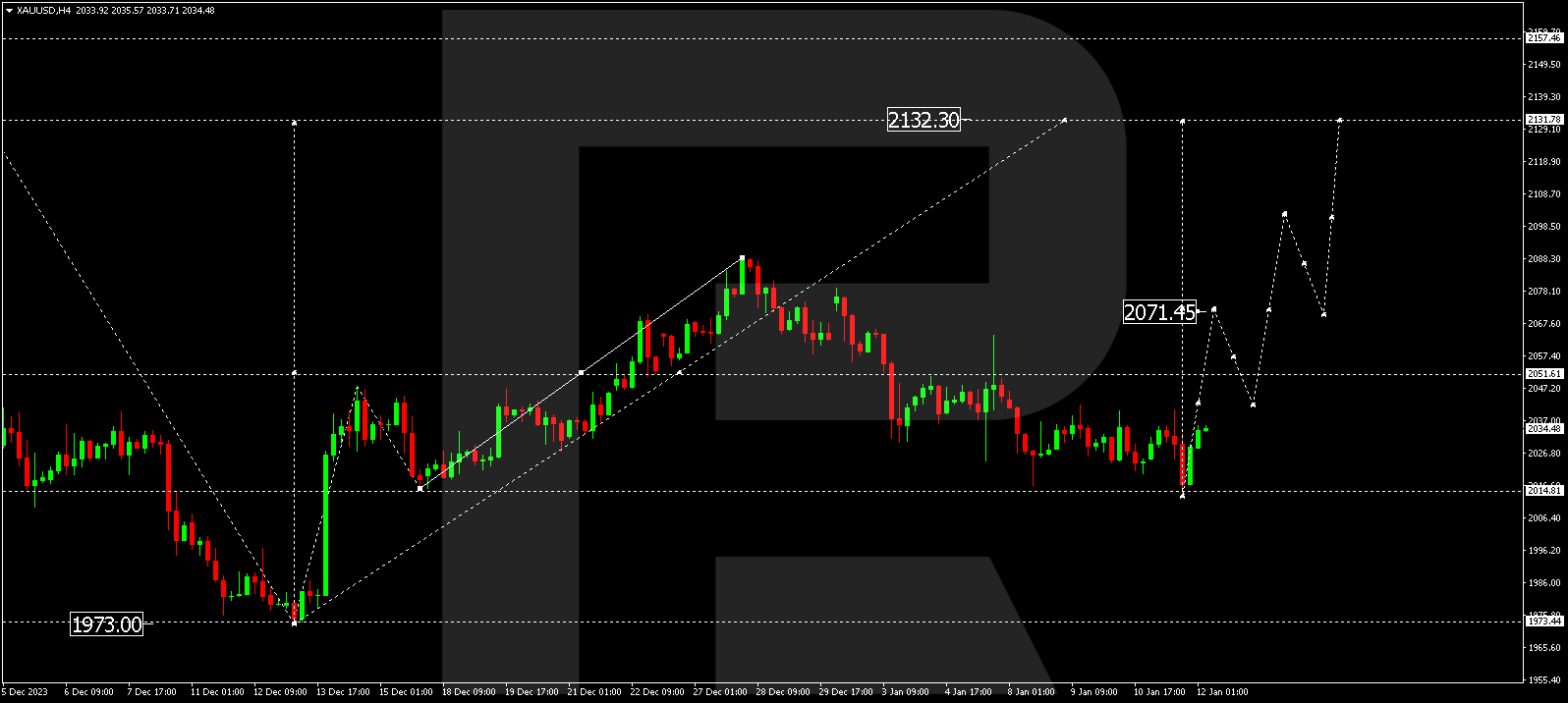

XAU/USD (Gold vs US Dollar)

Gold has concluded a correction to 2013.22 and initiated a new upward wave to 2071.45, constituting the first target. Following this, a potential correction to 2045.00 may transpire, paving the way for a rise to 2099.00. The trend could then continue to 2131.80.

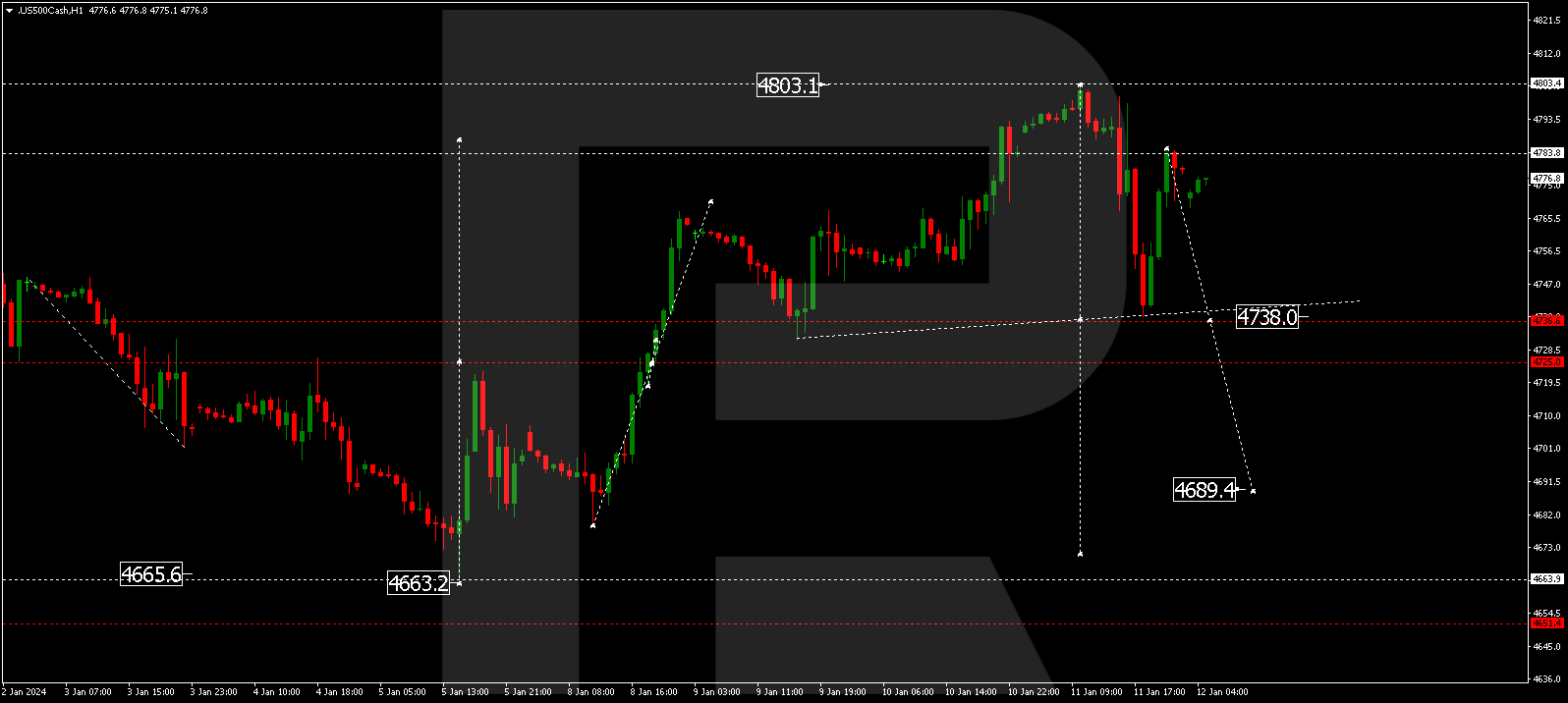

S&P 500

Having completed a decline to 4738.0 and a correction to 4783.8, the S&P 500 index may form a consolidation range beneath this level. A downward breakout holds the potential for a decline wave to 4689.5, representing a local target.

The post Technical Analysis & Forecast January 12, 2024 appeared first at R Blog – RoboForex.