The S&P 500 Index Initiates a Decline. This technical analysis covers the evolving dynamics of EUR, GBP, JPY, CHF, AUD, Brent, and Gold alongside the current movement of the S&P 500 index.

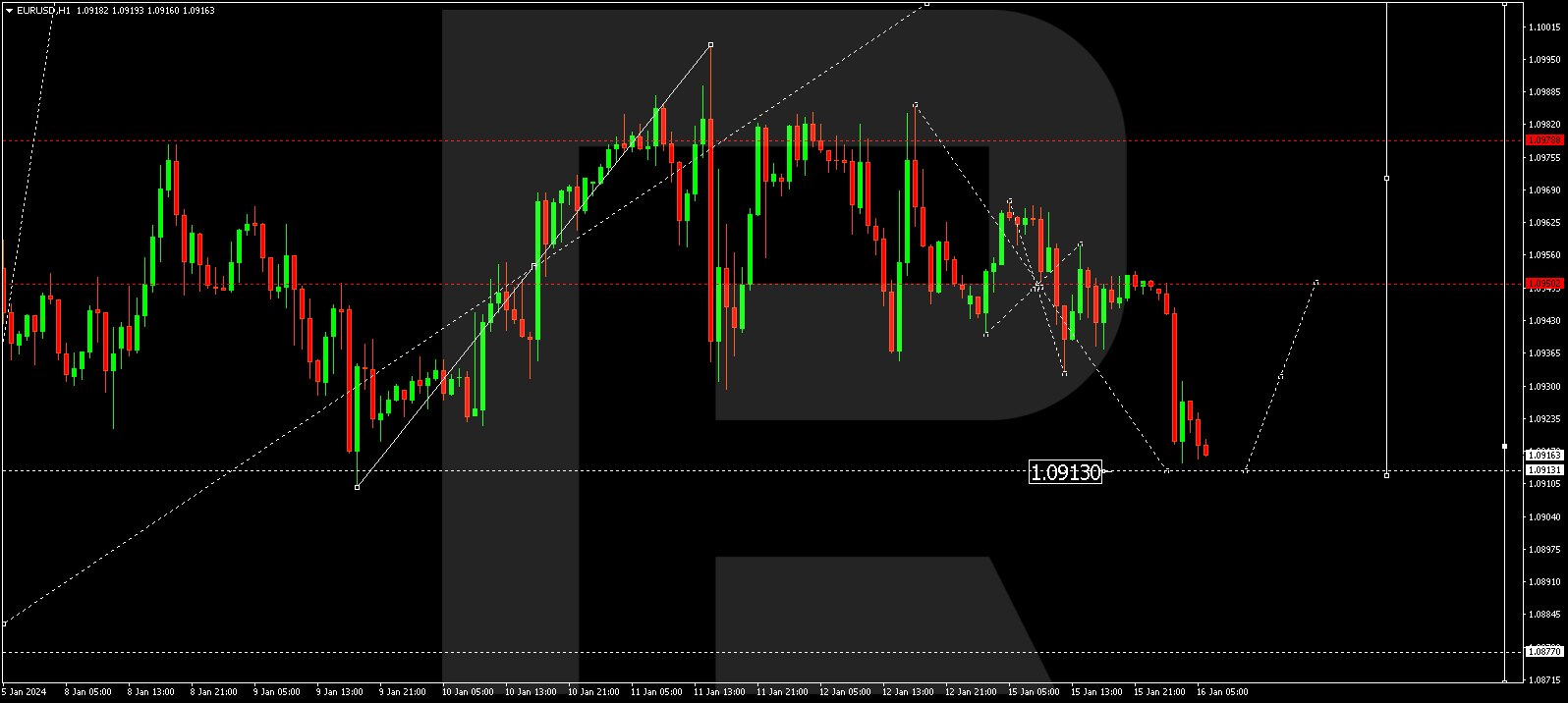

EUR/USD (Euro vs US Dollar)

EUR/USD has broken below the 1.0950 level and is extending the range to the lower boundary, targeting 1.0913. Upon reaching this level, a potential new consolidation range might form below it. An upward breakout from the range could lead to a growth structure to 1.0950, while a downward breakout holds the potential for a decline wave to 1.0877, constituting a local target.

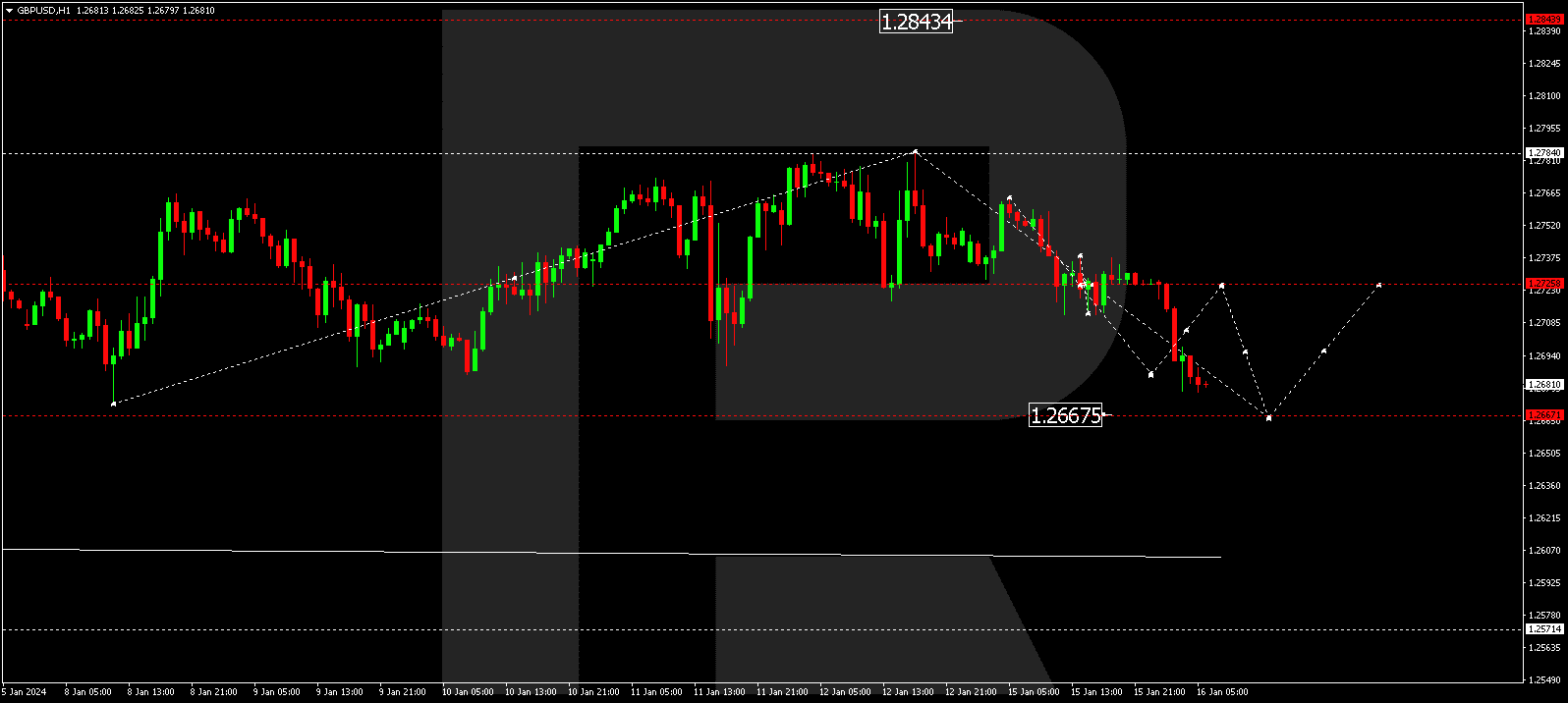

GBP/USD (Great Britain Pound vs US Dollar)

GBP/USD has breached the 1.2727 level downward and is continuing its decline toward the lower boundary of the consolidation range, targeting 1.2667. Upon reaching this level, a potential new consolidation range might form. An upward breakout could result in a growth structure to 1.2727, while a downward breakout might extend the decline wave to 1.2608, serving as a local target.

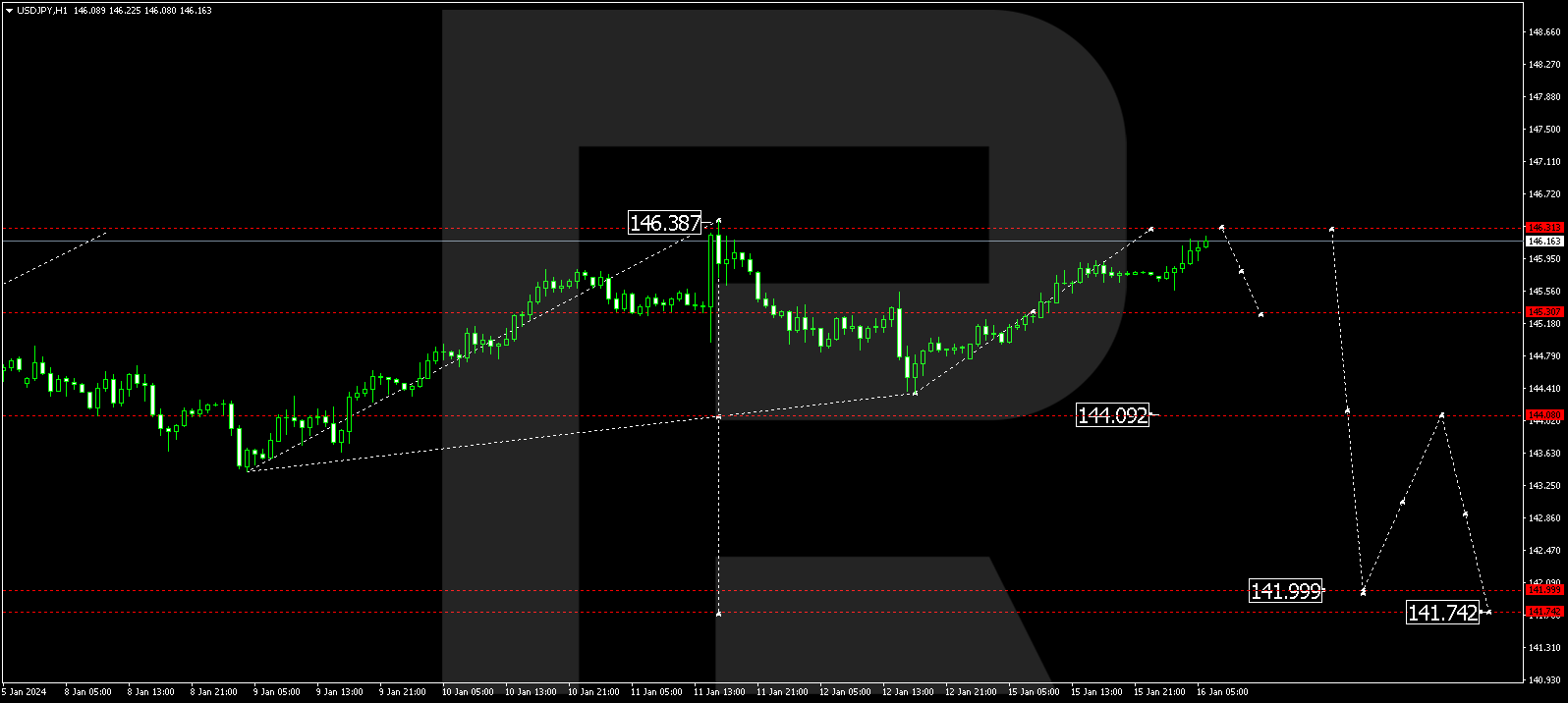

USD/JPY (US Dollar vs Japanese Yen)

USD/JPY is in the process of developing a growth wave to 146.30. Subsequently, a decline to 145.30 is expected. If this level is also breached downward, the potential for a decline to 144.08 might unfold, constituting a local target.

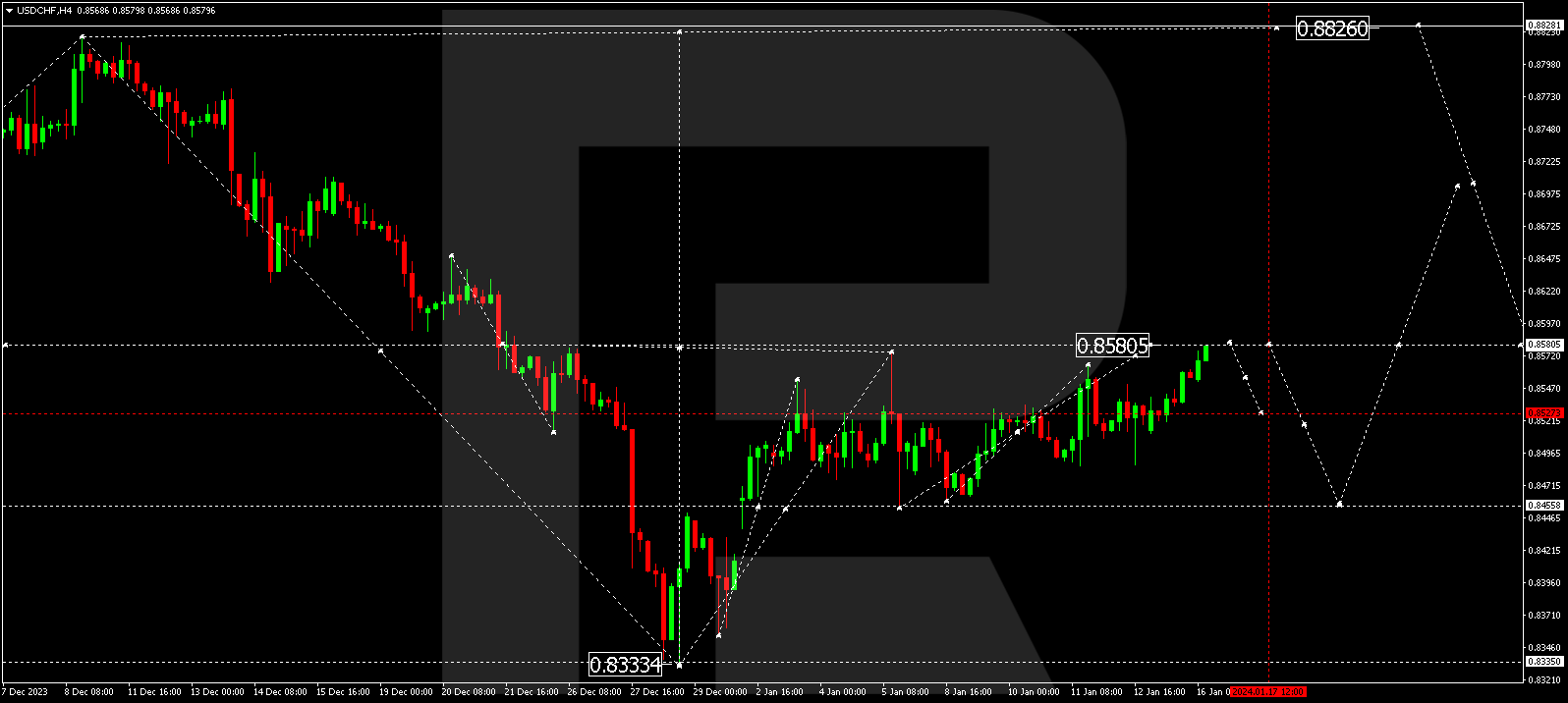

USD/CHF (US Dollar vs Swiss Franc)

USD/CHF is continuing its growth structure toward 0.8580. Once this level is reached, a potential drop to 0.8530 may occur, forming a new consolidation range. An upward breakout from the range could extend the wave to 0.8700, constituting a local target. Conversely, a downward breakout might continue the correction to 0.8455, followed by a rise to 0.8700.

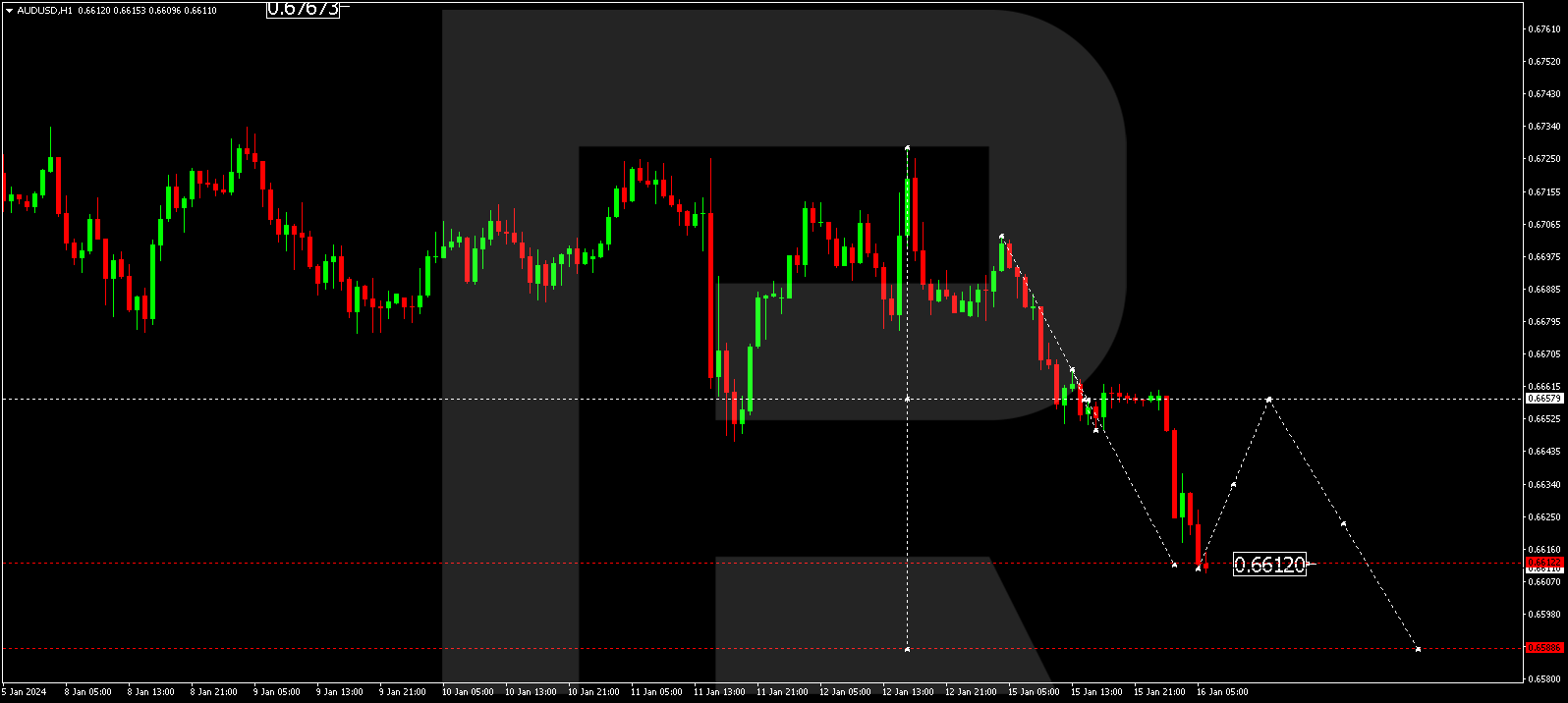

AUD/USD (Australian Dollar vs US Dollar)

AUD/USD has concluded a decline wave to 0.6612, with a consolidation range forming around this level. An upward breakout from the range could lead to a correction to 0.6657, while a downward breakout might continue the decline wave to 0.6588.

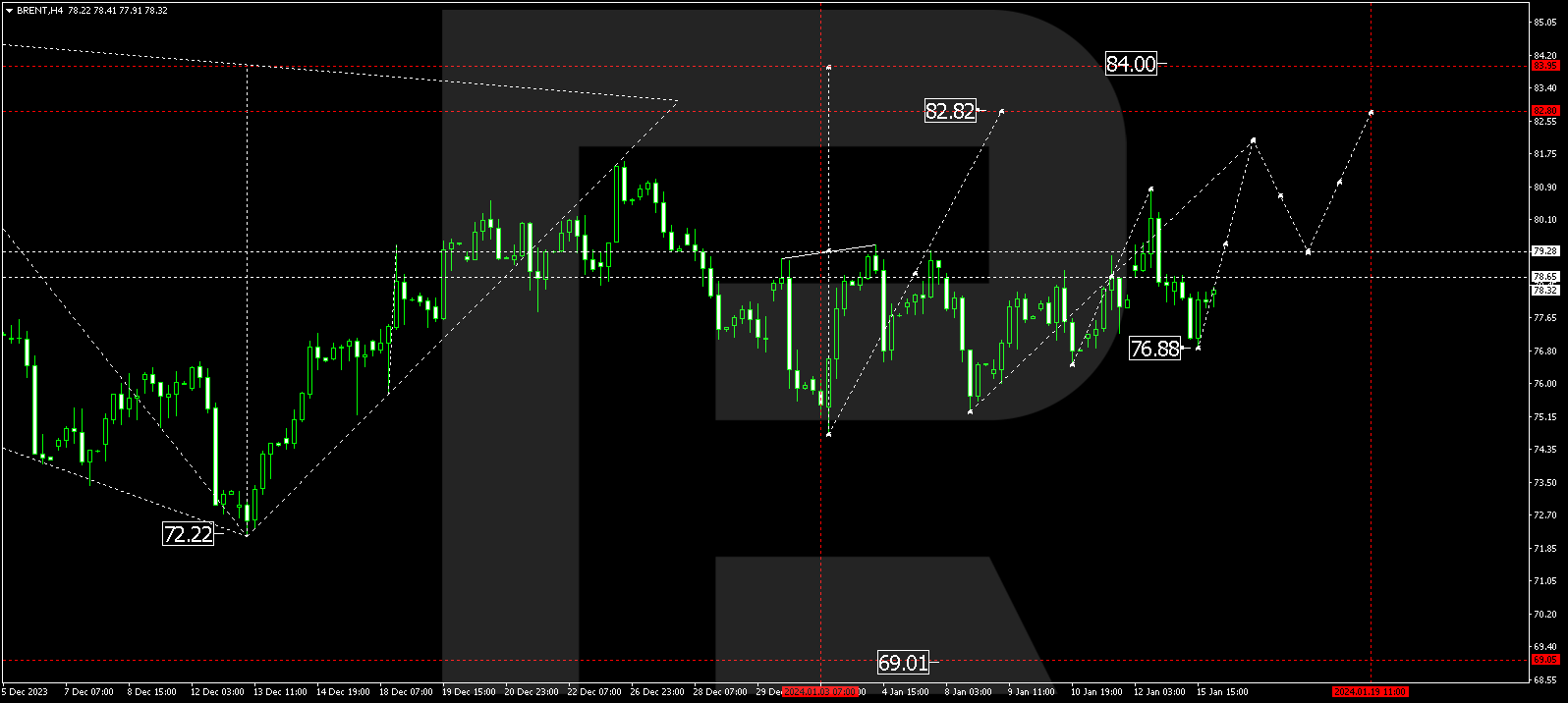

BRENT

Brent has completed a correction to 76.88, with the growth wave extending to 79.30. From there, the trend might continue to 82.00, constituting a local target. Subsequently, a decline to 79.30 (a test from above) and a rise to 82.82 might follow.

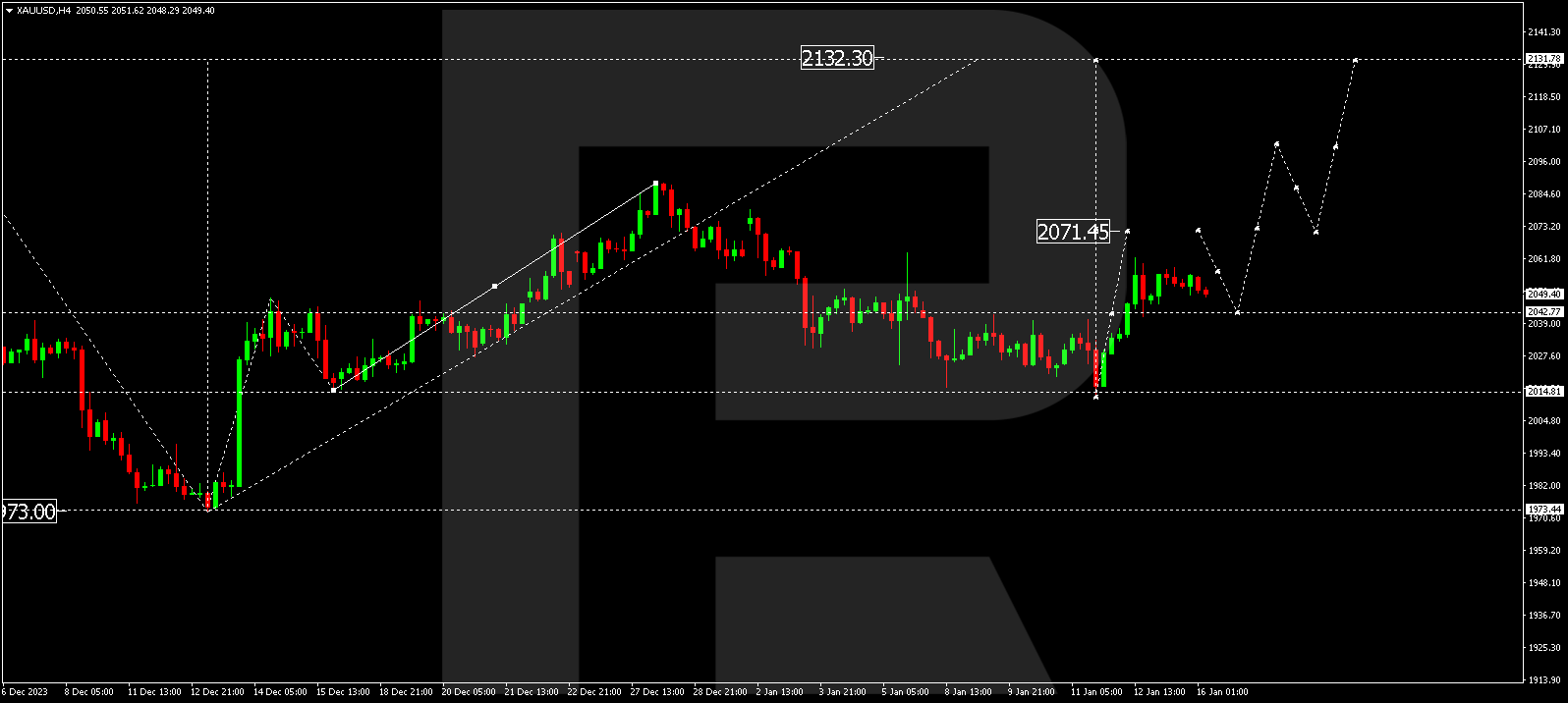

XAU/USD (Gold vs US Dollar)

Gold is continuing its correction to 2042.77. Once this level is reached, a potential growth wave to 2073.00 is not excluded, followed by a new correction to 2042.77 and a rise to 2131.77, marking the first target.

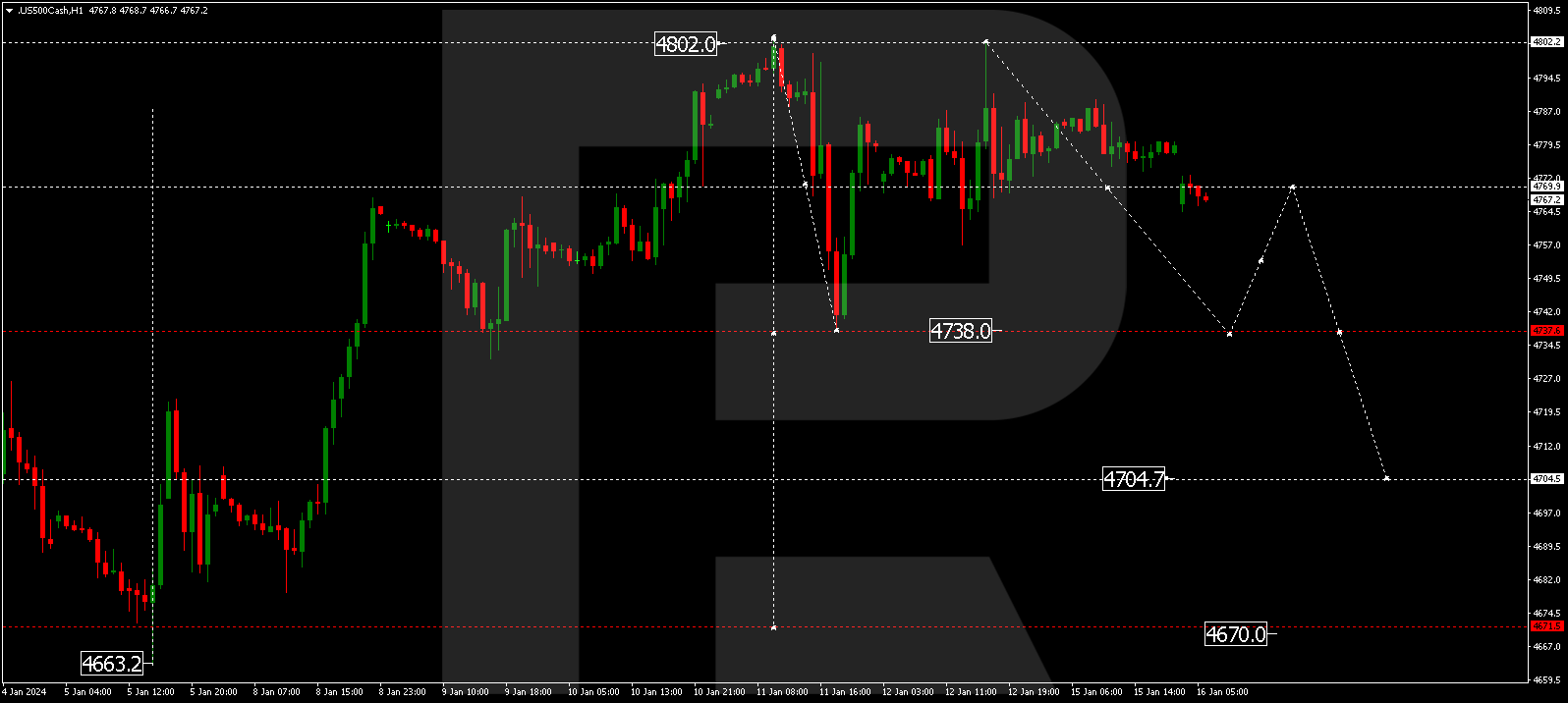

S&P 500

The stock index has broken below the 4770.0 level, with the decline wave expected to continue to the lower boundary of the consolidation range, targeting 4737.7. Upon reaching this level, a correction to 4770.0 is not excluded, followed by a decline to 4705.0, serving as a local target.

The post Technical Analysis & Forecast January 16, 2024 appeared first at R Blog – RoboForex.