Gold Prepares for Correction Ahead of Decline – Analysis of EUR, GBP, JPY, CHF, AUD, Brent, and S&P 500 Index Included.

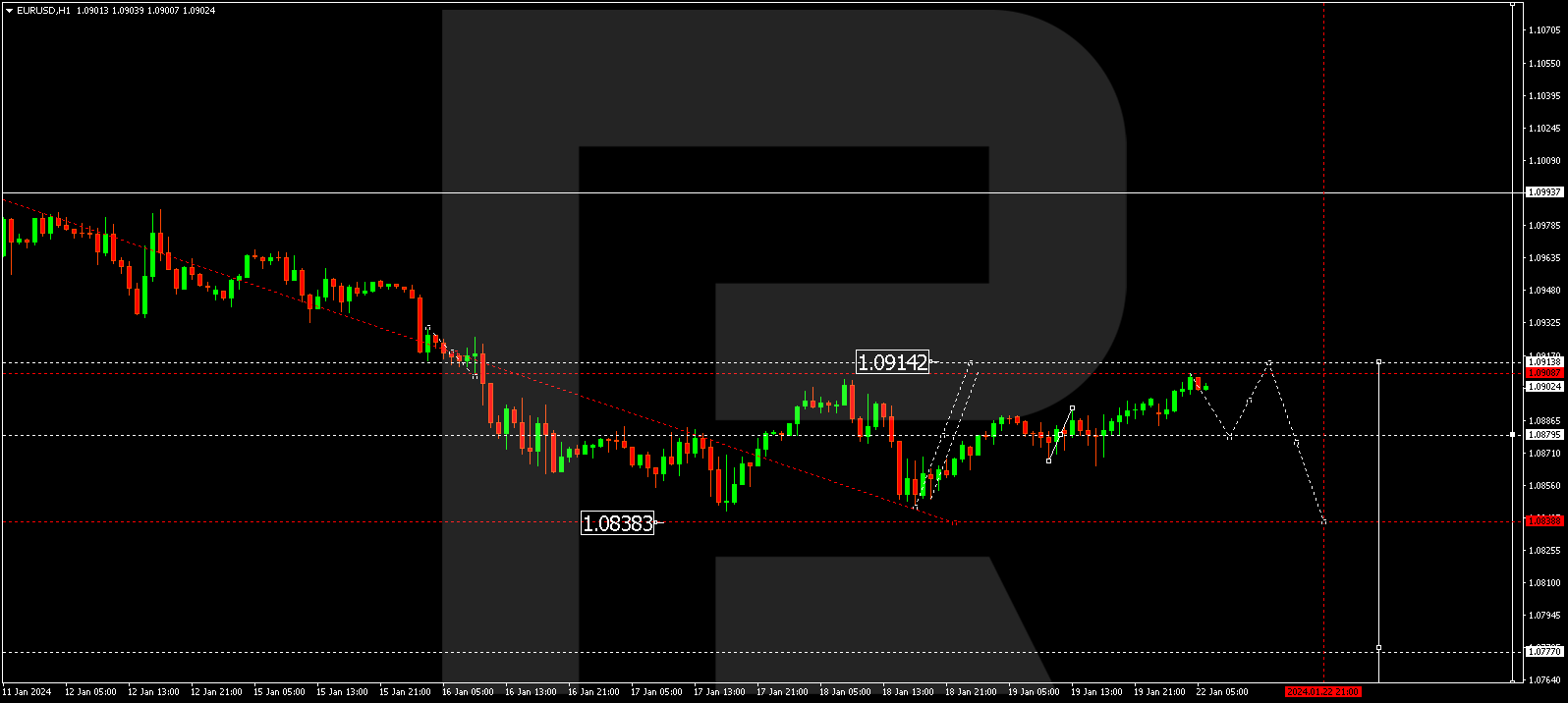

EUR/USD (Euro vs US Dollar)

EUR/USD is in the midst of a correction, having reached the local target at 1.0908. Anticipate a decline to 1.0880, followed by a subsequent rise to 1.0913. Upon completing the correction, another decline link to 1.0838 might initiate.

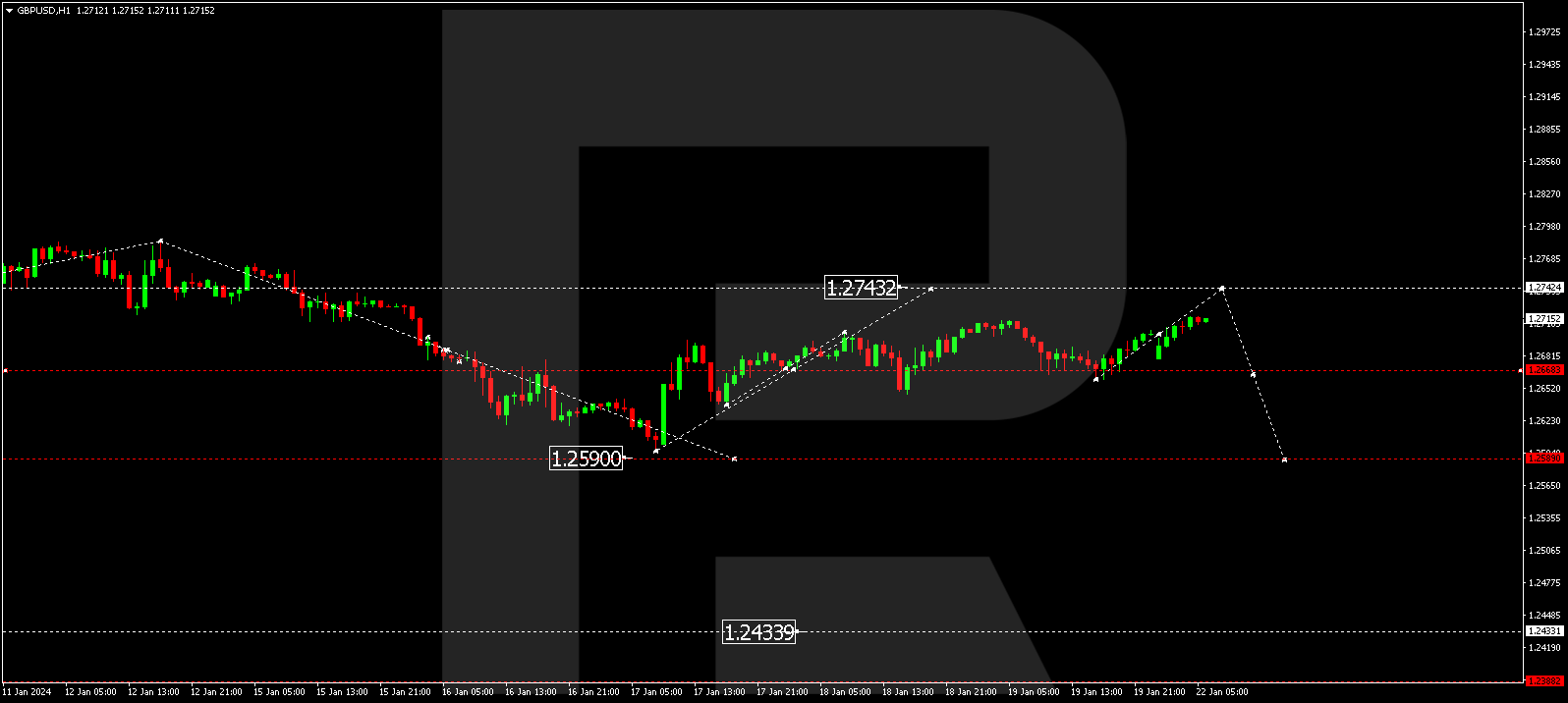

GBP/USD (Great Britain Pound vs US Dollar)

GBP/USD is consolidating around 1.2668, potentially expanding the range to 1.2742. This movement serves as a correction for the initial decline wave. After concluding this correction, a new upward wave to 1.2588 could commence, representing a local target.

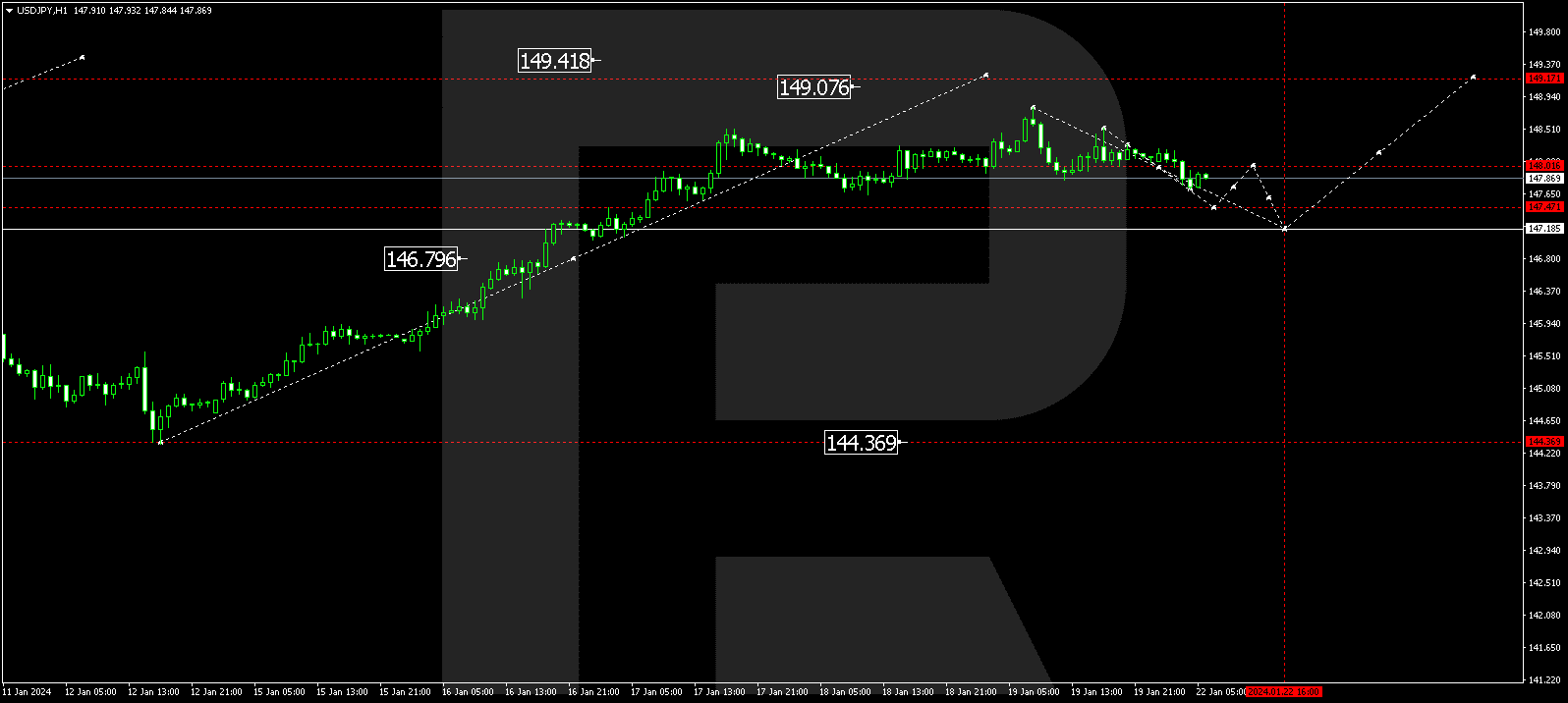

USD/JPY (US Dollar vs Japanese Yen)

USD/JPY is within a consolidation range around 148.01, which may extend to 147.18. Upon reaching this level, a new upward wave to 149.17 could unfold.

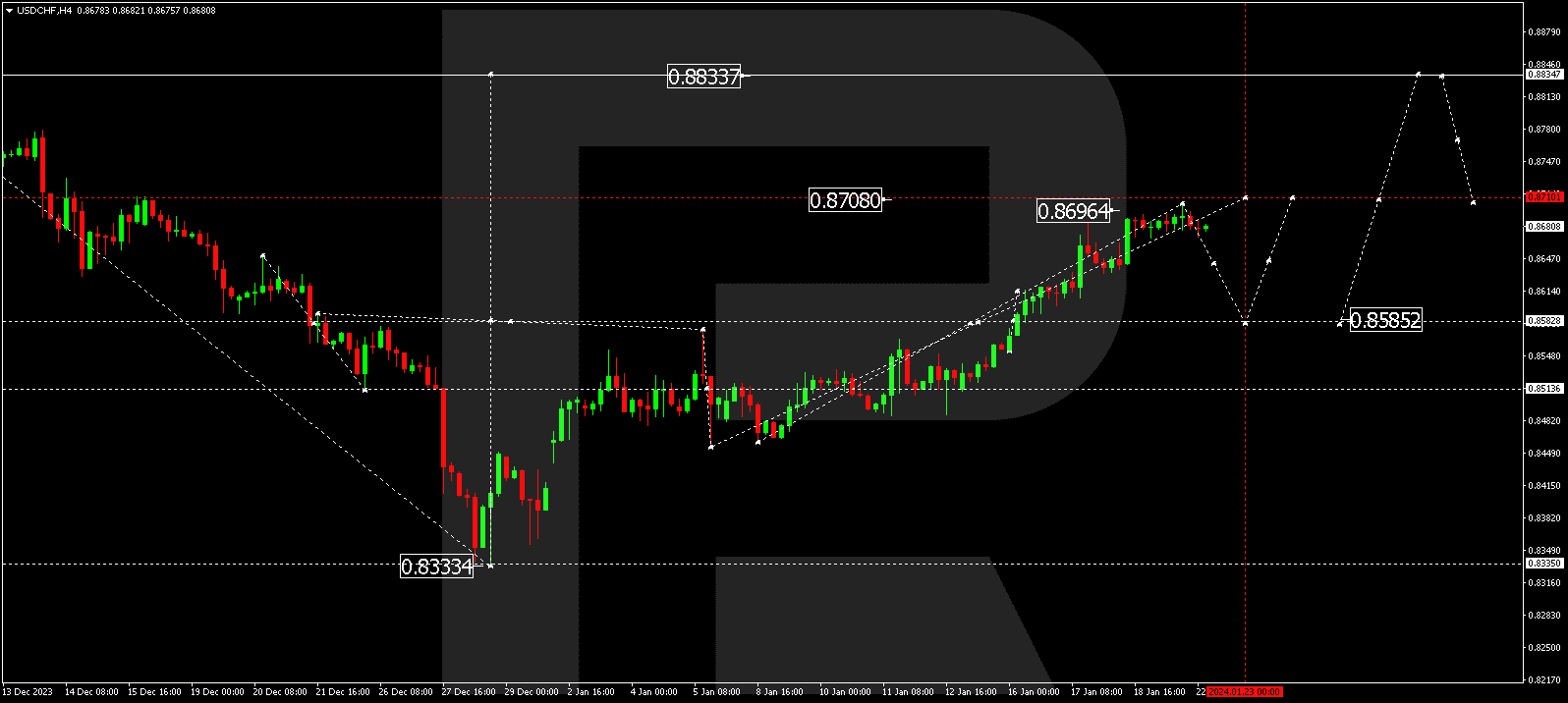

USD/CHF (US Dollar vs Swiss Franc)

USD/CHF has achieved the local target of the growth wave at 0.8696. Currently, a consolidation range is forming below this level. A downward breakout from the range may lead to a correction to 0.8585, followed by a rise to 0.8705, marking the first target.

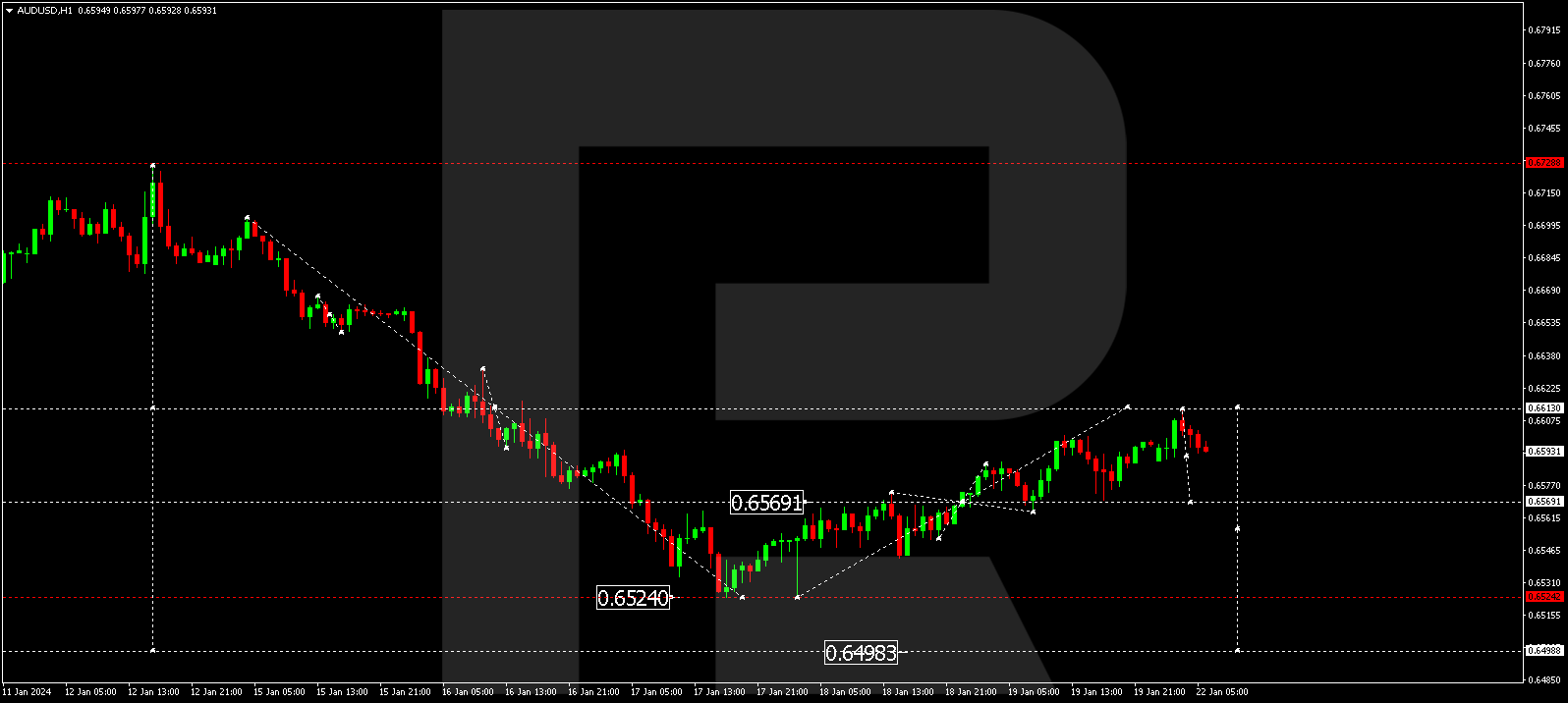

AUD/USD (Australian Dollar vs US Dollar)

AUD/USD has concluded a correction wave to 0.6612. The market is now forming a consolidation range under this level, potentially extending to 0.6590. A downward breakout could open the door to a decline wave to 0.6524, followed by a continuation to 0.6498.

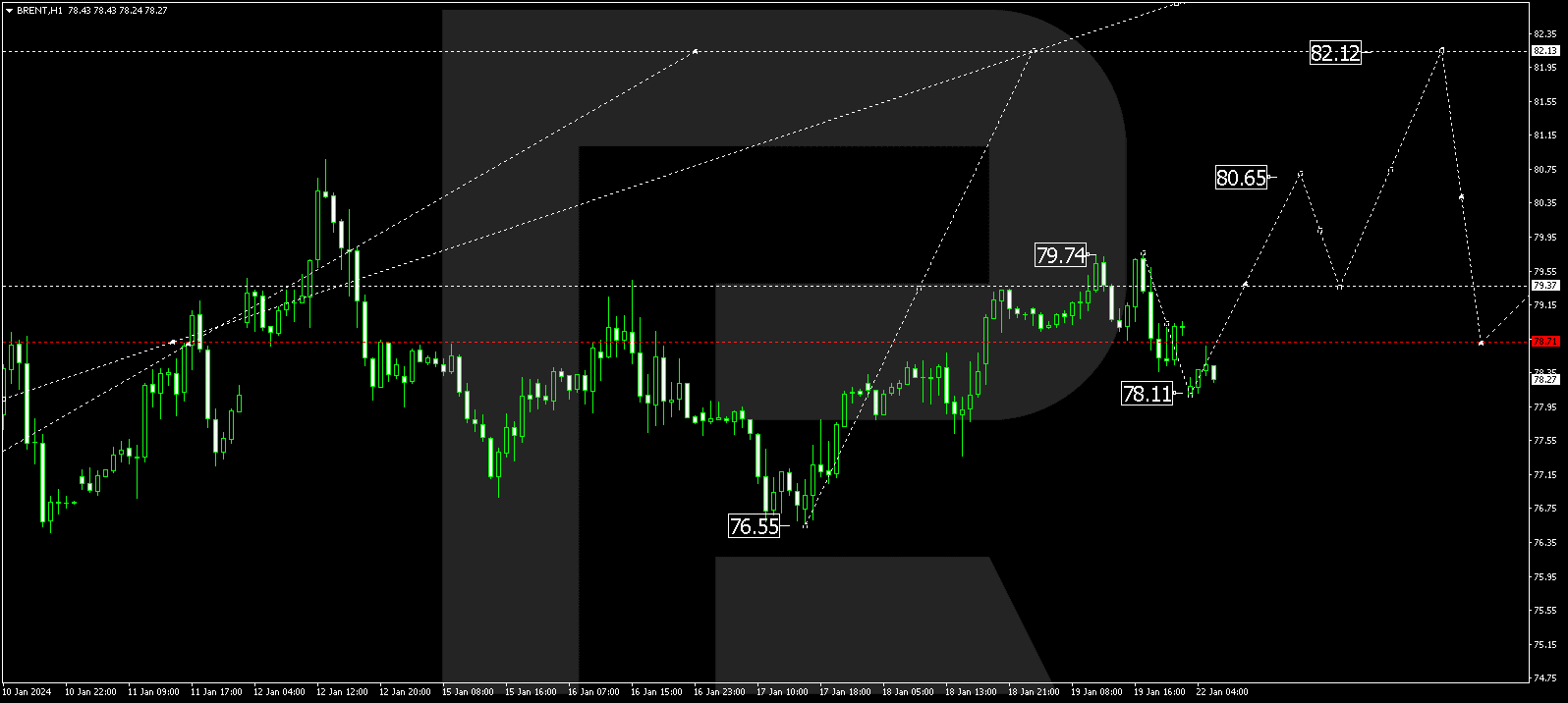

BRENT

Brent has completed a growth wave to 79.74, and a correction to 78.11 is in progress. Following the correction, a new upward wave to 80.65 may develop, leading to a continuation of the trend to 82.12. This is considered a local target.

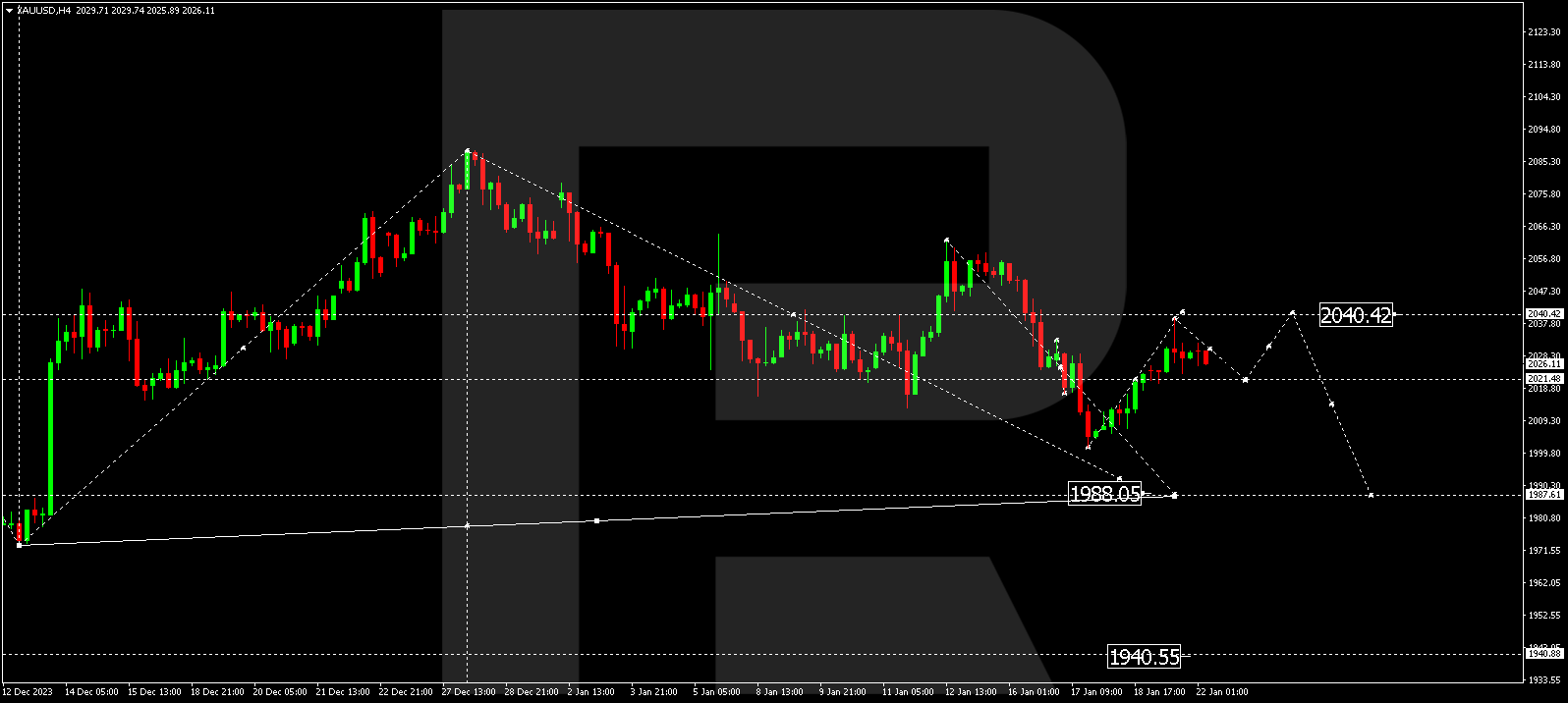

XAU/USD (Gold vs US Dollar)

Gold has finalized a correction to 2039.35, forming a decline structure to 2021.50. Expect a new correction link to 2040.40. Once complete, a new decline link to 1988.00 might emerge.

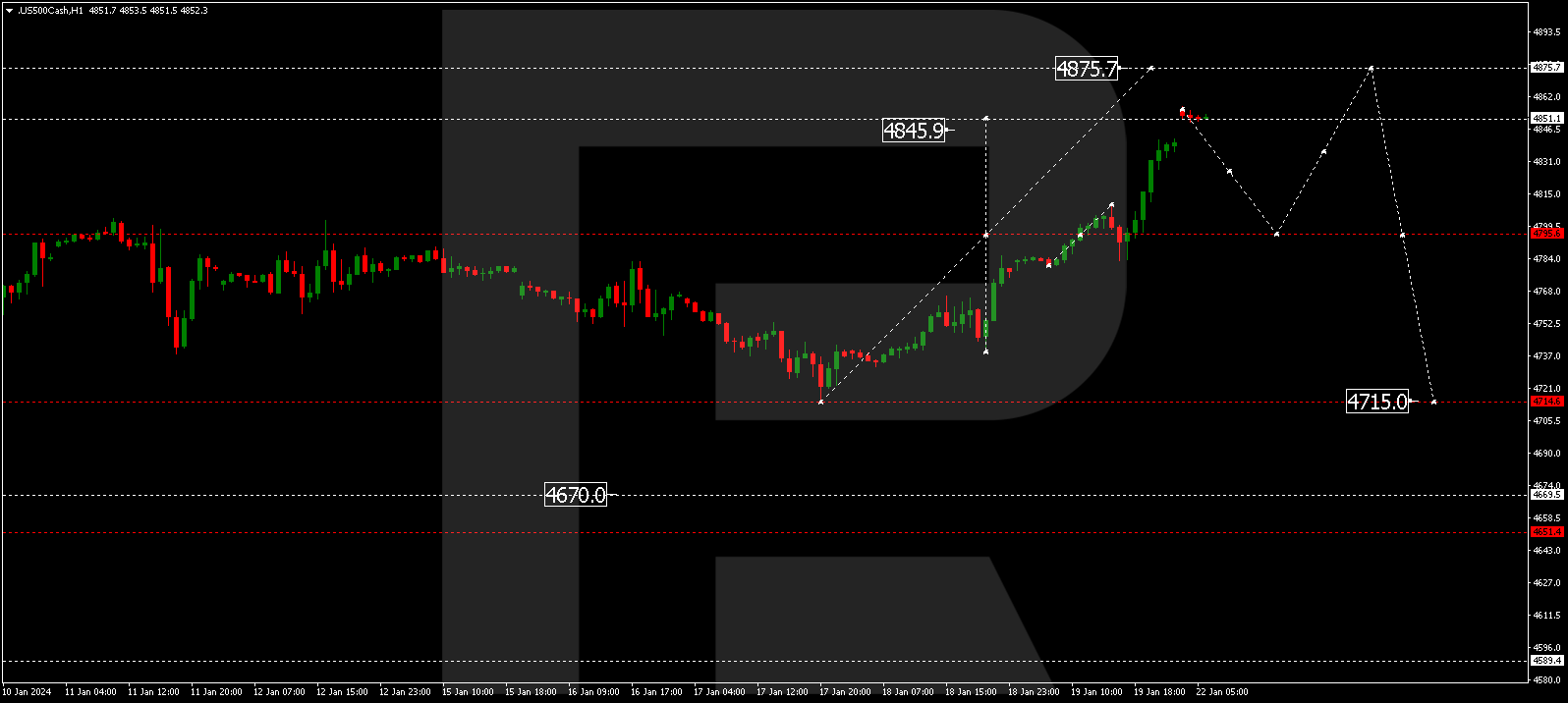

S&P 500

The stock index has established a consolidation range around 4795.0. Breaking out upwards, it continues to extend the growth wave. Currently at the local target of 4857.0, a decline link to 4795.0 is possible (a test from above). Subsequently, anticipate a rise to 4875.5.

The post Technical Analysis & Forecast January 22, 2024 appeared first at R Blog – RoboForex.