AUD Initiates a Decline Wave. The analysis also encompasses the performance of EUR, GBP, JPY, CHF, Brent, Gold, and the S&P 500 index.

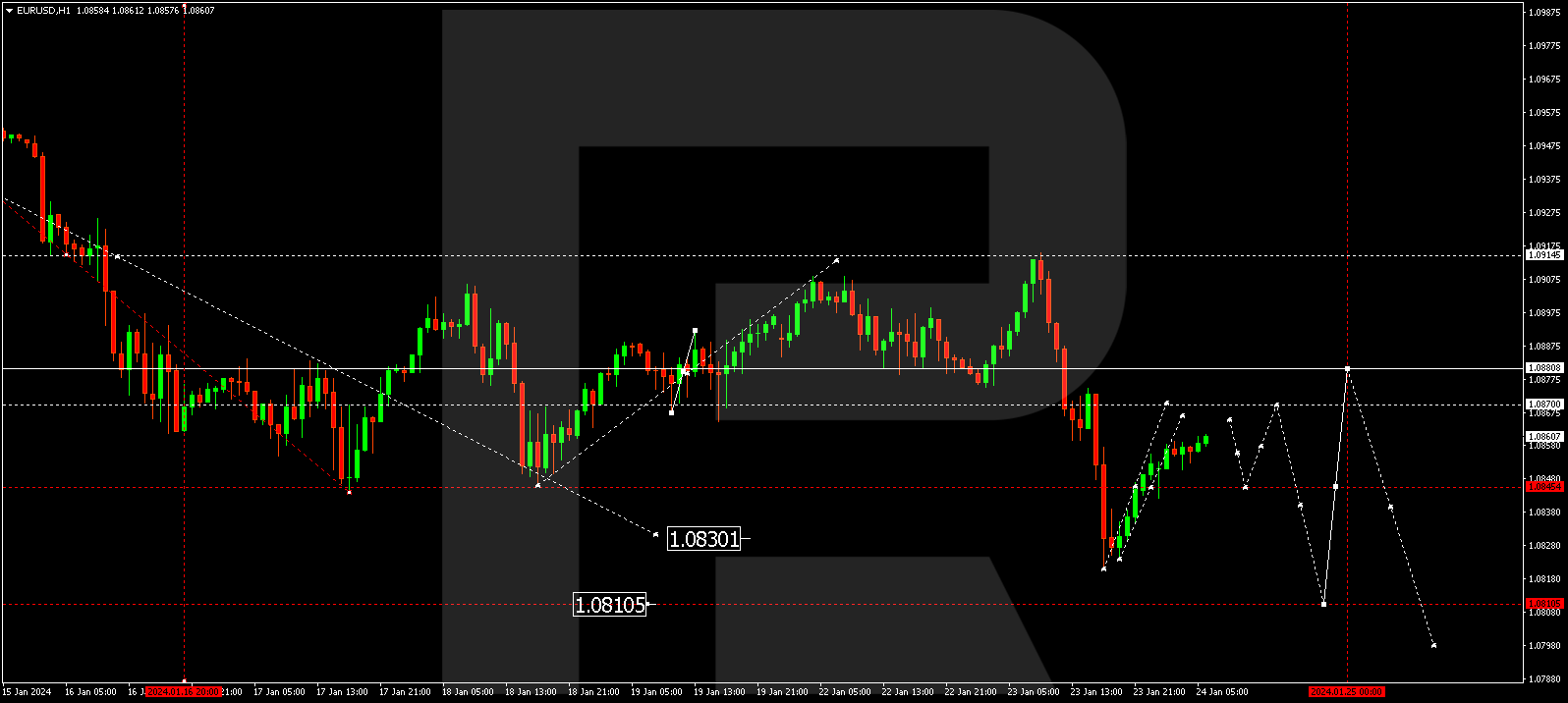

EUR/USD (Euro vs US Dollar)

EUR/USD has concluded a decline wave, touching 1.0821. Today, it displayed upward momentum towards 1.0845. A narrow consolidation range has emerged, and upon breaking it upwards, the market will continue a corrective wave to 1.0866. Following this level, a potential decline to 1.0845 might occur (a test from above). Subsequently, the price could ascend to 1.0870 and descend to 1.0810.

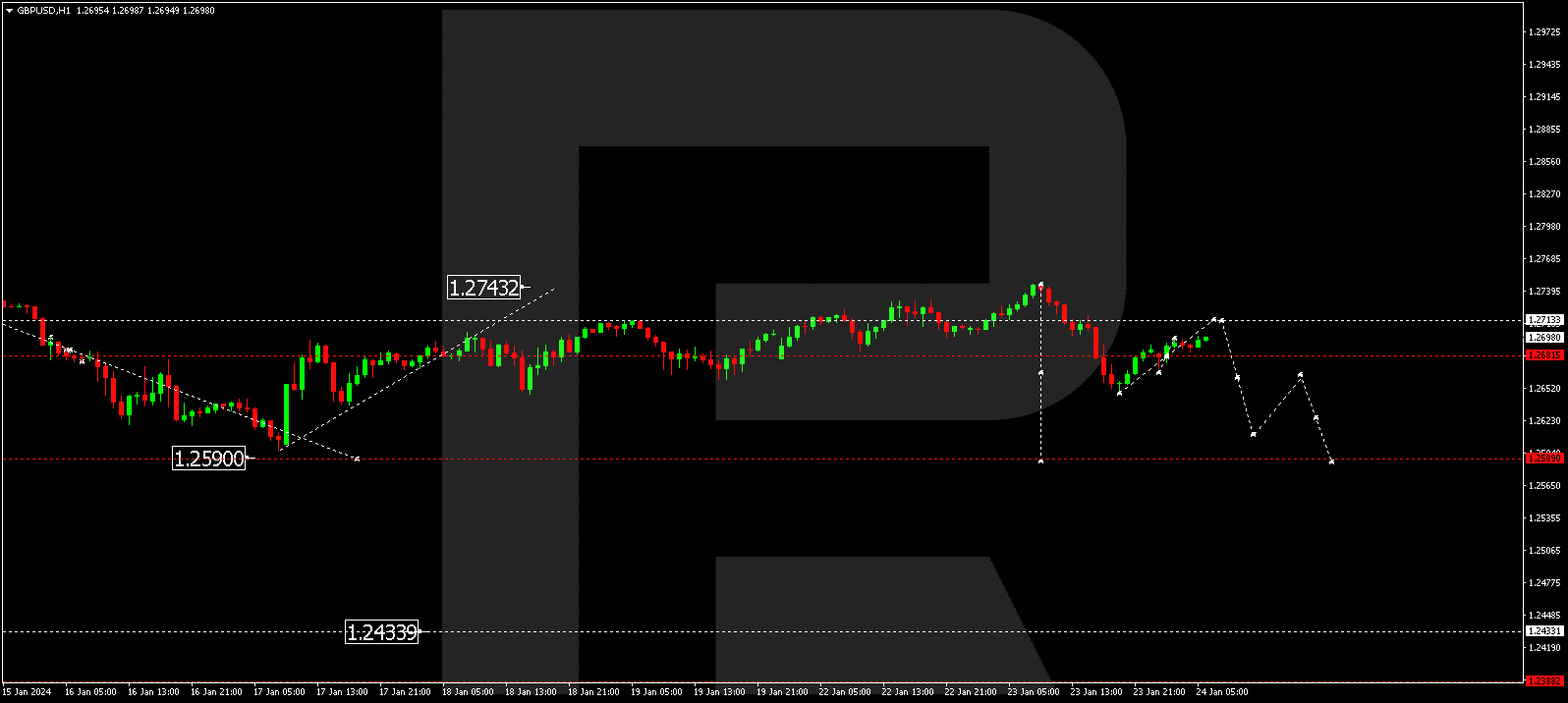

GBP/USD (Great Britain Pound vs US Dollar)

GBP/USD has completed a decline wave to 1.2648. The market is currently correcting the decline today, with the correction target at 1.2713. Following the correction, the price is anticipated to fall to 1.2589. This is a local target.

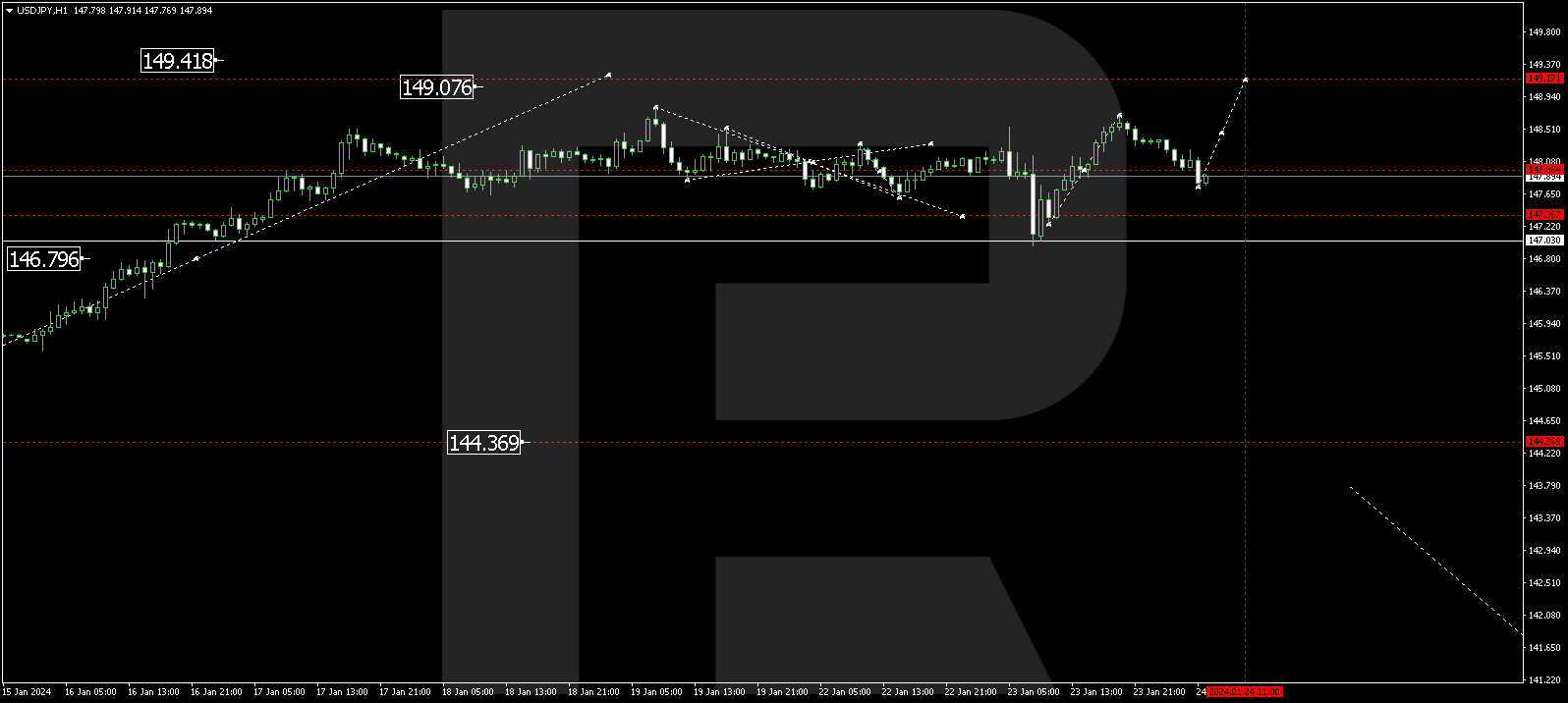

USD/JPY (US Dollar vs Japanese Yen)

USD/JPY has concluded a growth wave, reaching 148.69. Today, a correction towards 147.77 has unfolded. Another growth structure is projected to develop, targeting 149.17. Once the price reaches this level, a decline wave to 147.00 could commence.

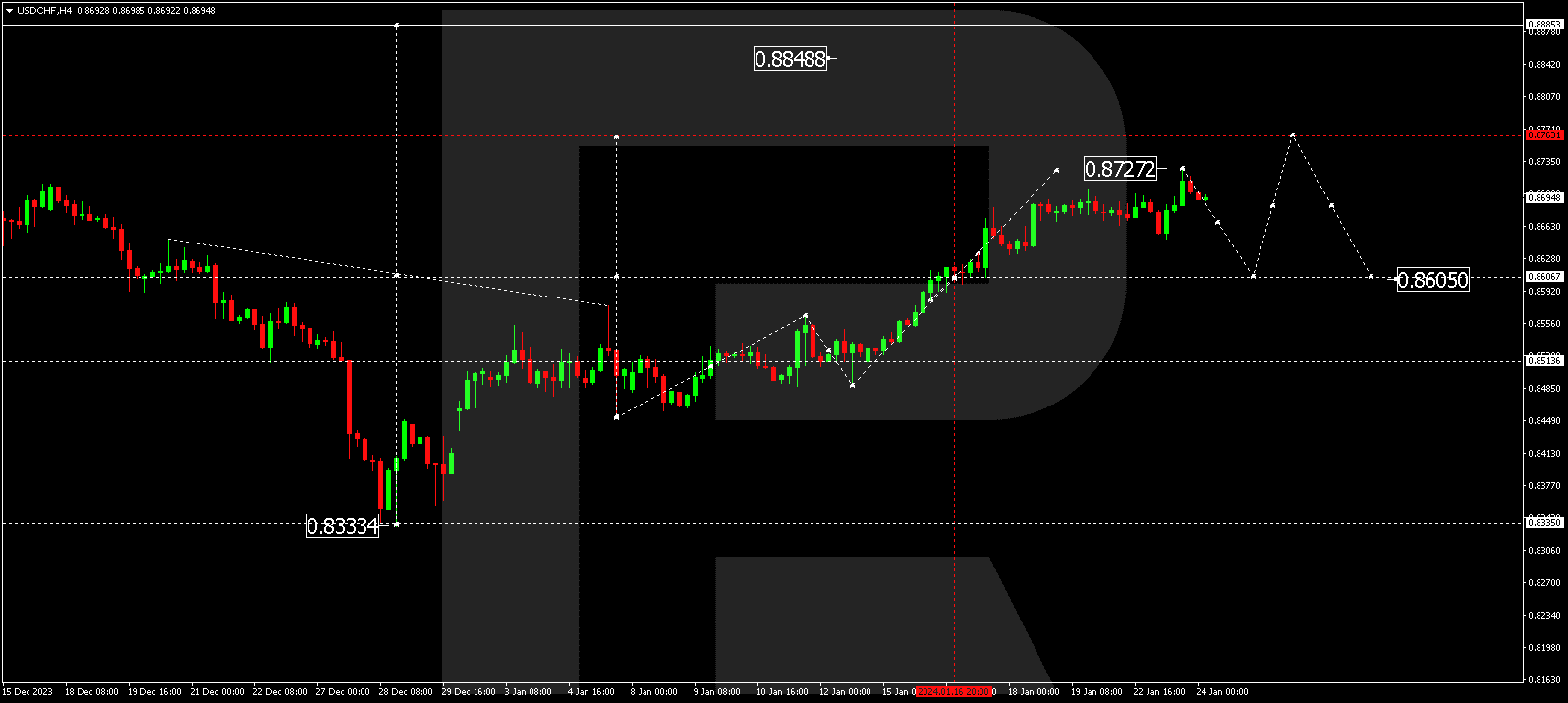

USD/CHF (US Dollar vs Swiss Franc)

USD/CHF has completed a growth wave to 0.8727. A consolidation range may form below this level today. A downward breakout will open the potential for a corrective decline to 0.8605, followed by an upward movement to 0.8763.

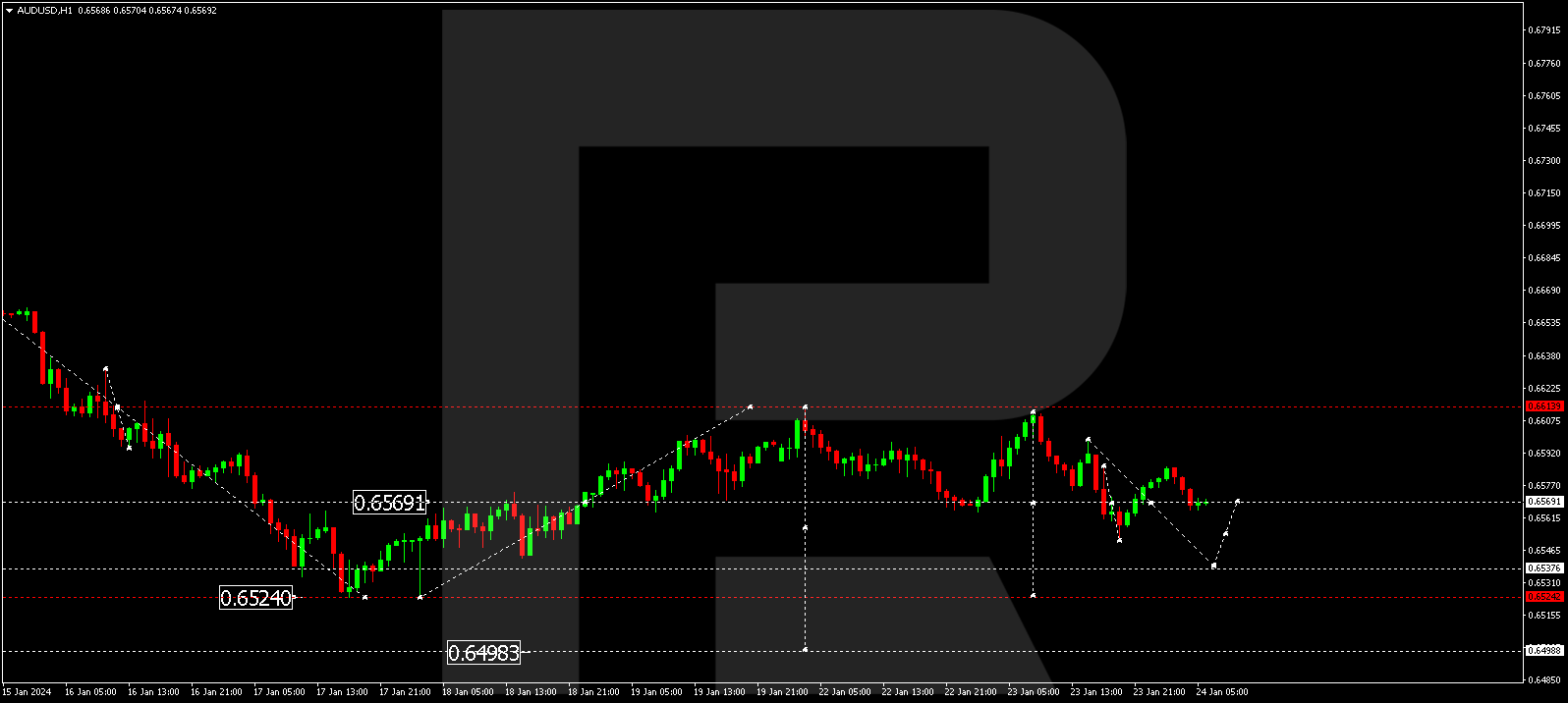

AUD/USD (Australian Dollar vs US Dollar)

AUD/USD has concluded a decline wave to 0.6550, with the market currently correcting to 0.6585. A new decline wave targeting 0.6537 could initiate at the moment. This is a local target.

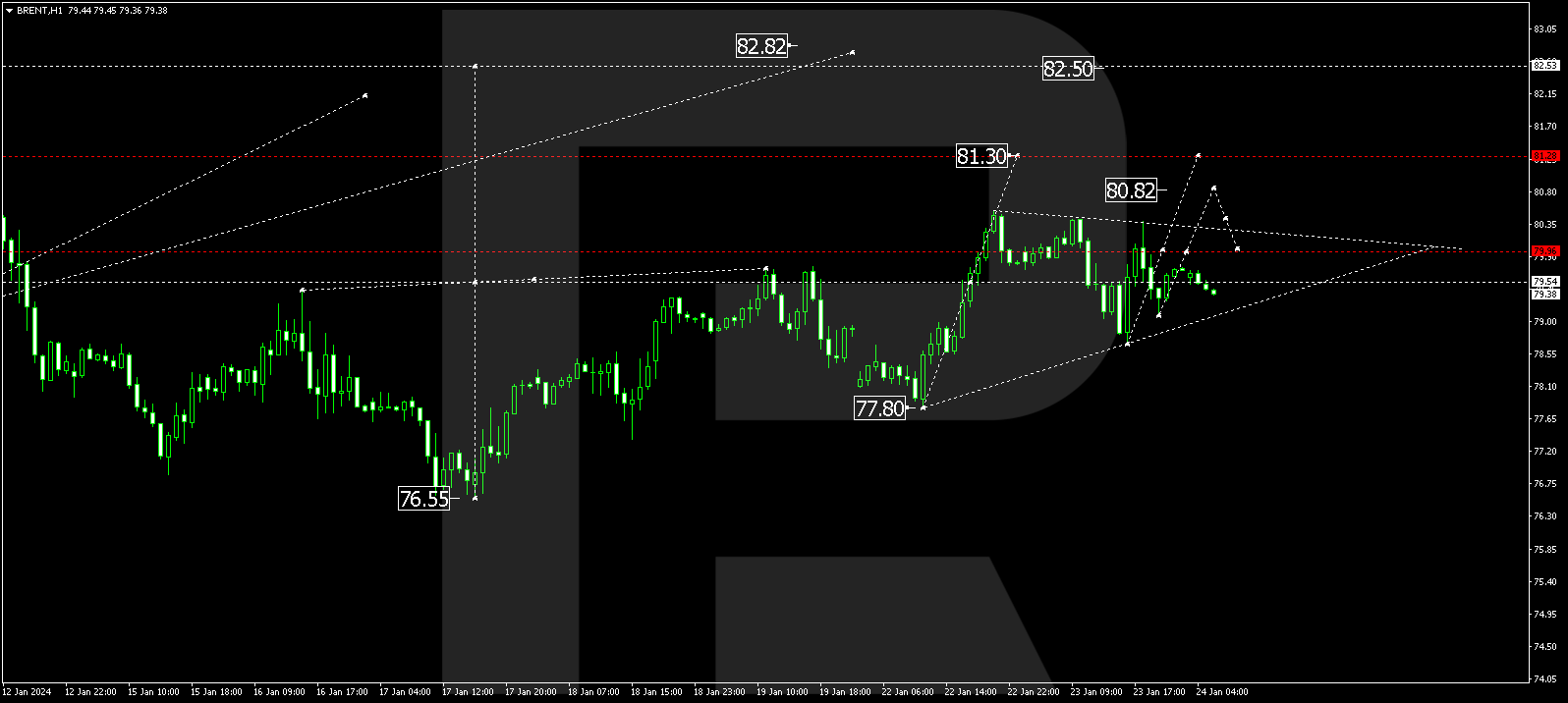

BRENT

Brent has undergone a correction to 79.55. The market now continues to develop a consolidation range around this level. With an upward breakout, another growth wave to 80.82 could develop, potentially extending to 81.30. This is a local target.

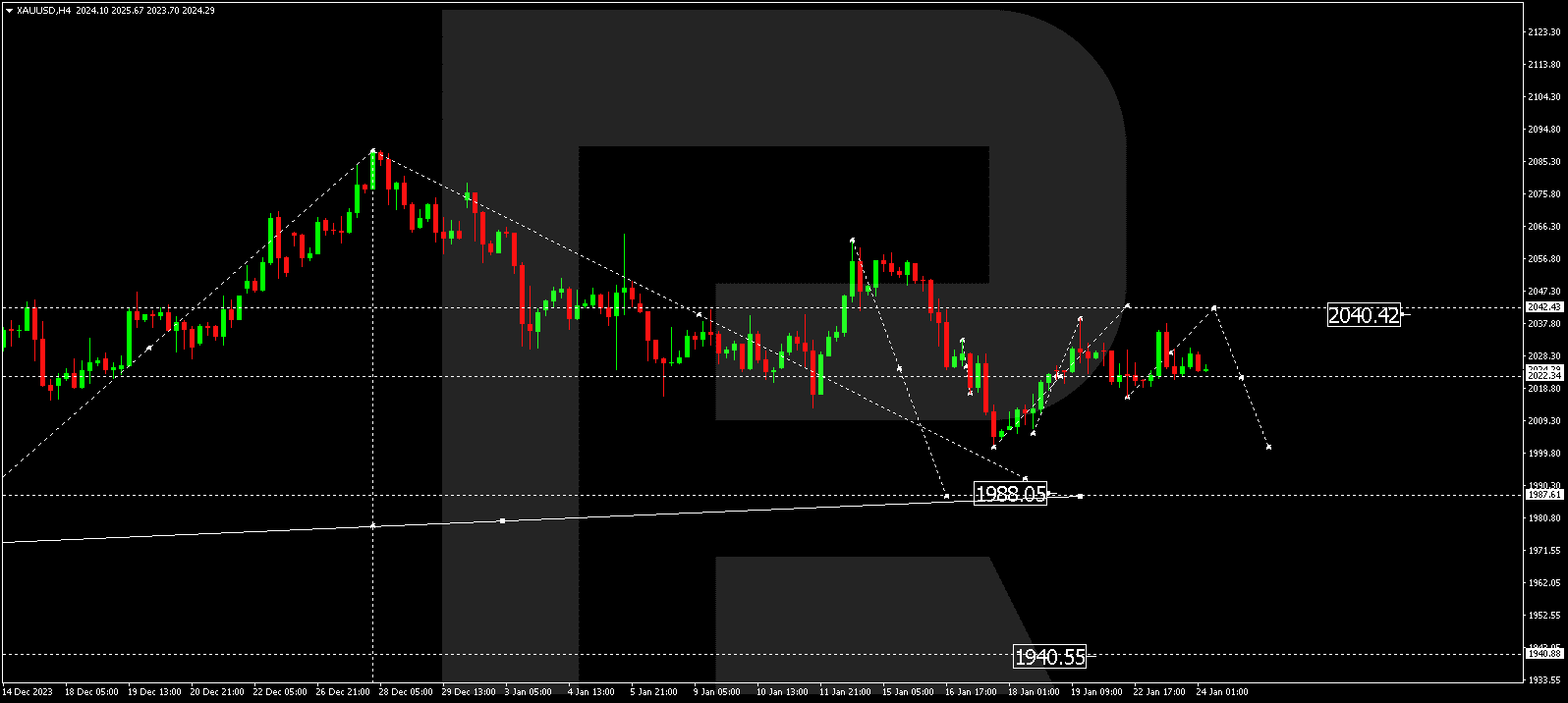

XAU/USD (Gold vs US Dollar)

Gold is presently in a consolidation phase around 2022.22 without any clear trend. Today the range could expand to 2040.40. Subsequently, a new decline structure could form, targeting 1988.00. This is the first target.

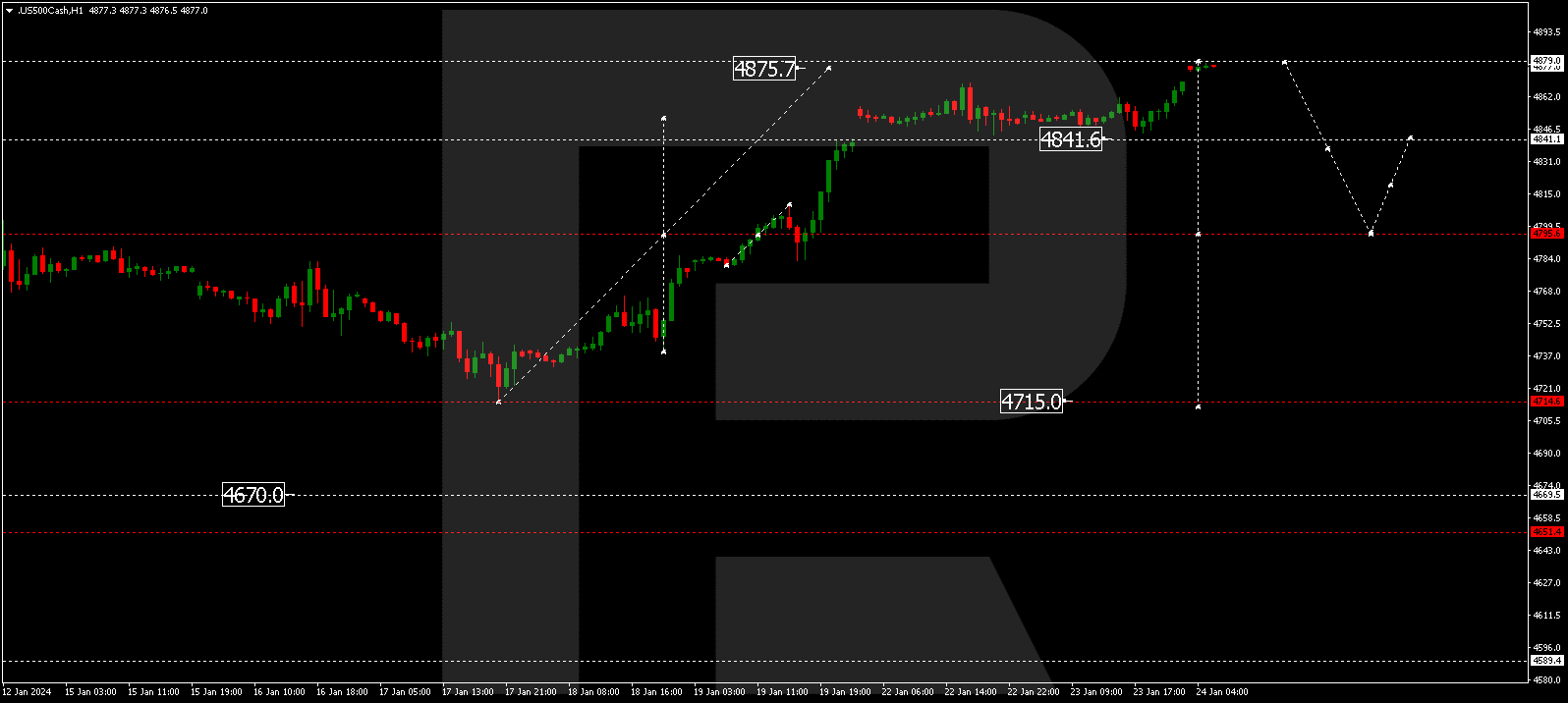

S&P 500

The stock index has expanded a consolidation range upwards, reaching 4879.0. Nearly the entire estimated potential for growth has been reached. A new consolidation range is expected to develop around this level. With an upward breakout, the wave could continue to 4900.0. With a downward breakout, a new decline wave to 4795.0 could commence. This is the first target.

The post Technical Analysis & Forecast January 24, 2024 appeared first at R Blog – RoboForex.