Brent Extends Uptrend: An overview of the dynamics of EUR, GBP, JPY, CHF, AUD, Gold, and the S&P 500 index is also included.

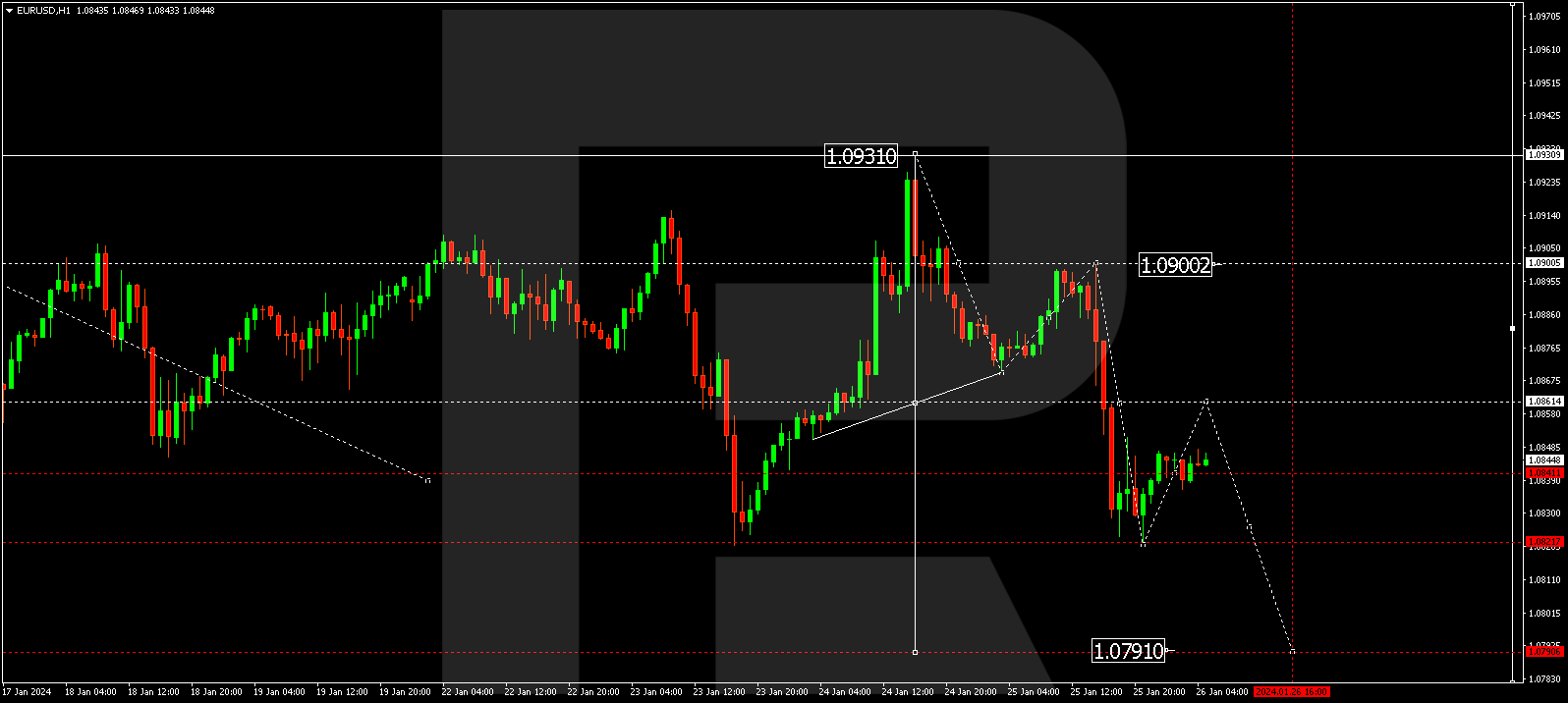

EUR/USD (Euro vs US Dollar)

EUR/USD has concluded a corrective wave at 1.0900, followed by a new downtrend to 1.0821. Today, there might be a correction of the previous downward wave with a target of 1.0860. Upon reaching this level, the next decline to 1.0790 could commence. This marks the initial target.

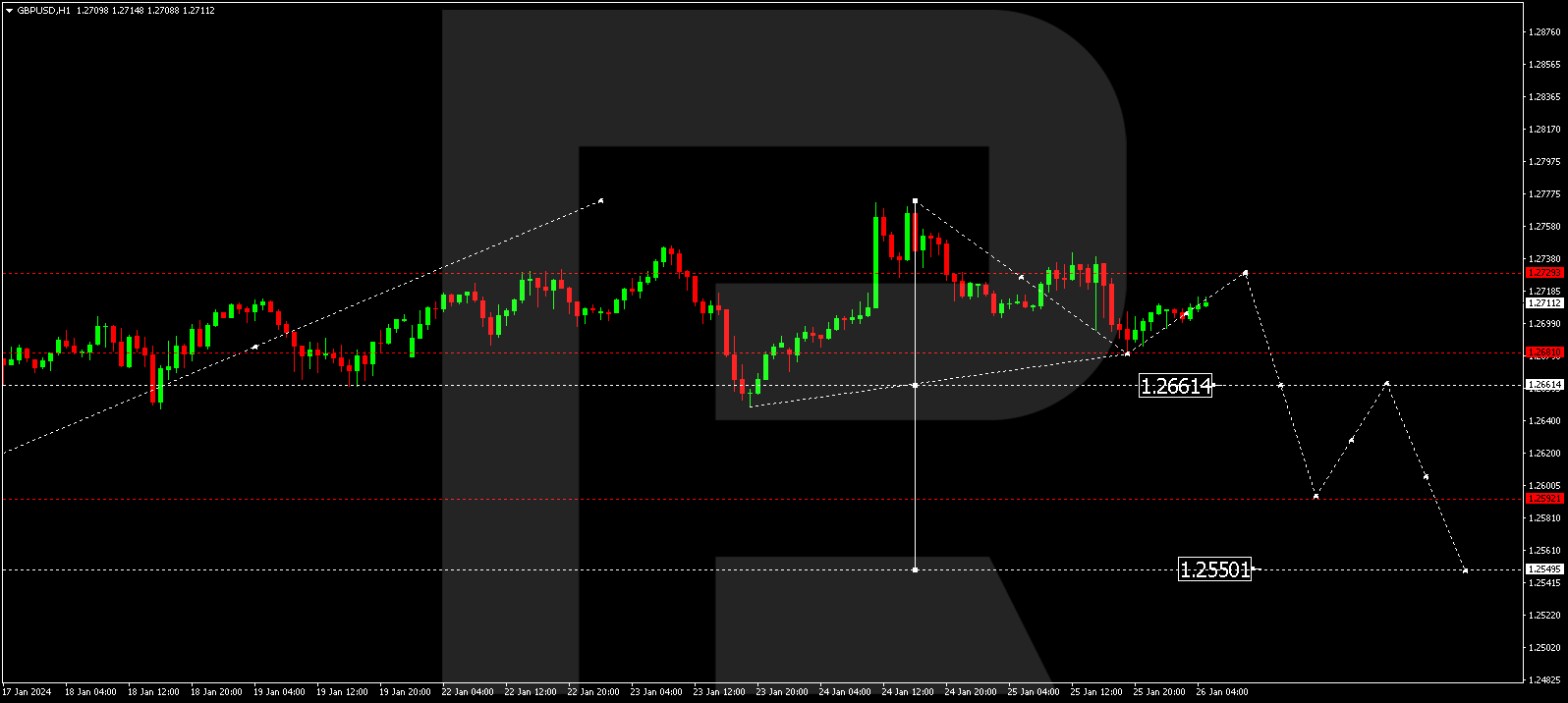

GBP/USD (Great Britain Pound vs US Dollar)

GBP/USD has wrapped up a decline wave at 1.2727 (tested from below). Once this correction concludes, a fresh downward wave to 1.2661 could initiate. Should this level break, the trend may persist towards 1.2600. This represents a local target.

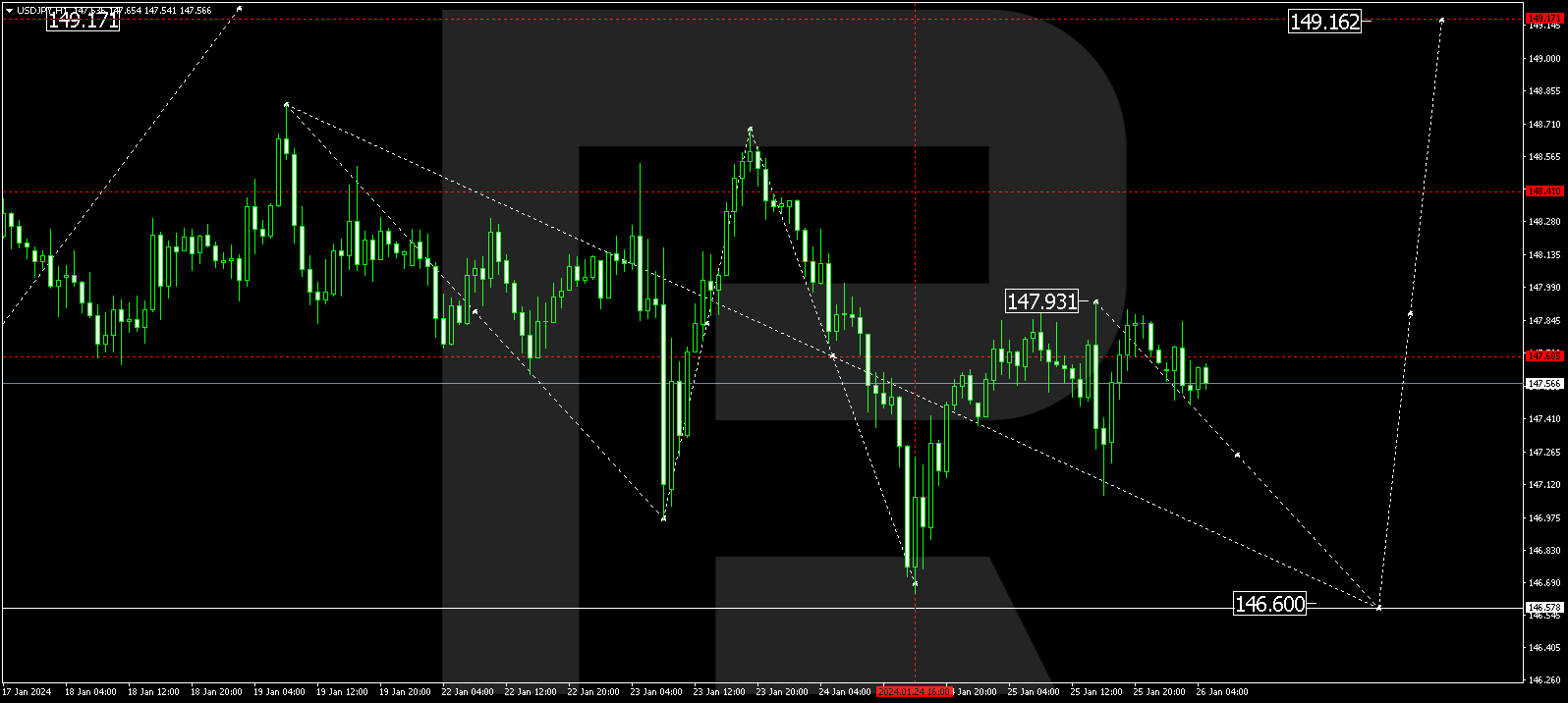

USD/JPY (US Dollar vs Japanese Yen)

USD/JPY is in the process of forming a consolidation range around 147.67 with no discernible trend. A breakout to the downside could extend the correction to 146.60, while an upward breakout might lead to a continuation of the growth wave to 149.16.

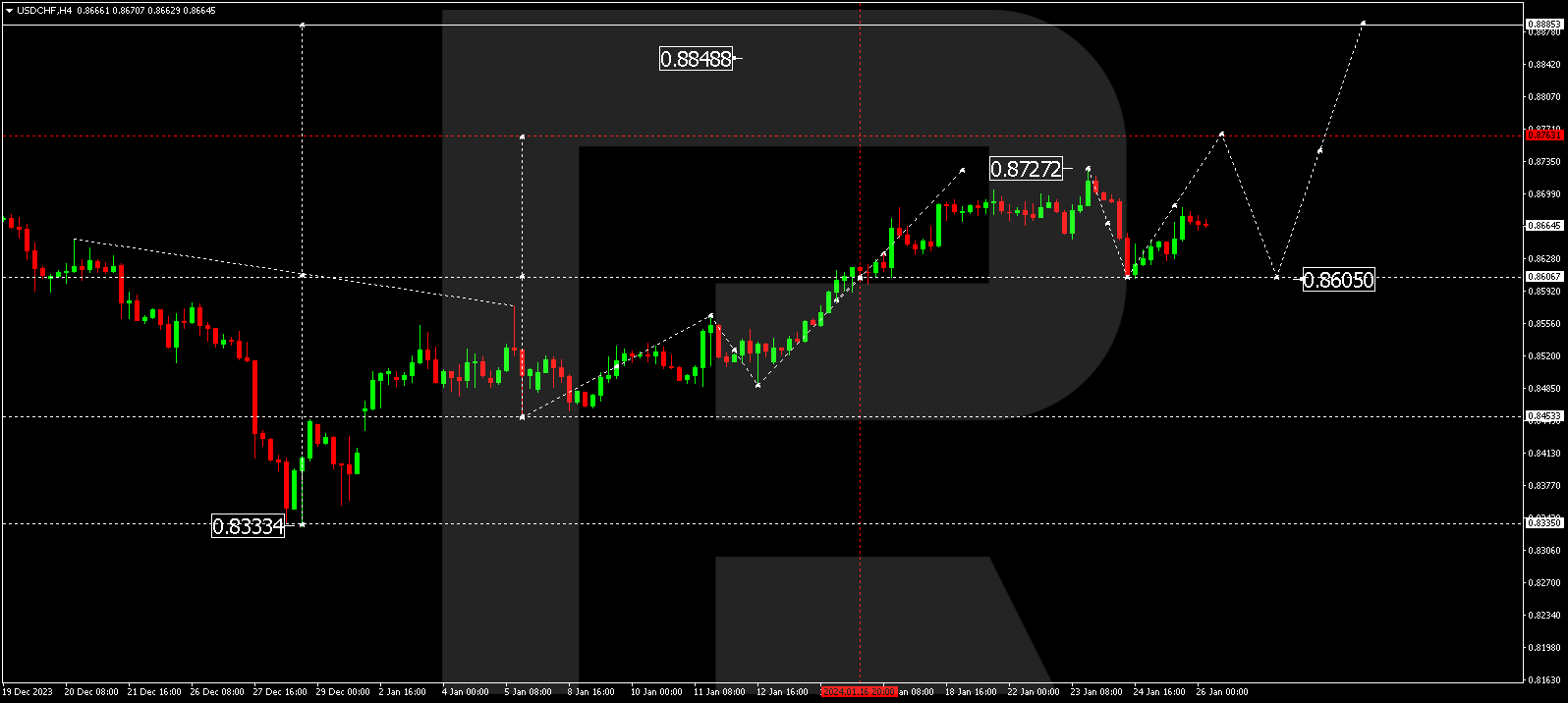

USD/CHF (US Dollar vs Swiss Franc)

USD/CHF has finished a growth wave at 0.8683. Today, the market could undergo a corrective phase to 0.8655. Following this correction, an anticipated resumption of the growth wave to 0.8717 is expected, with potential extension to 0.8766.

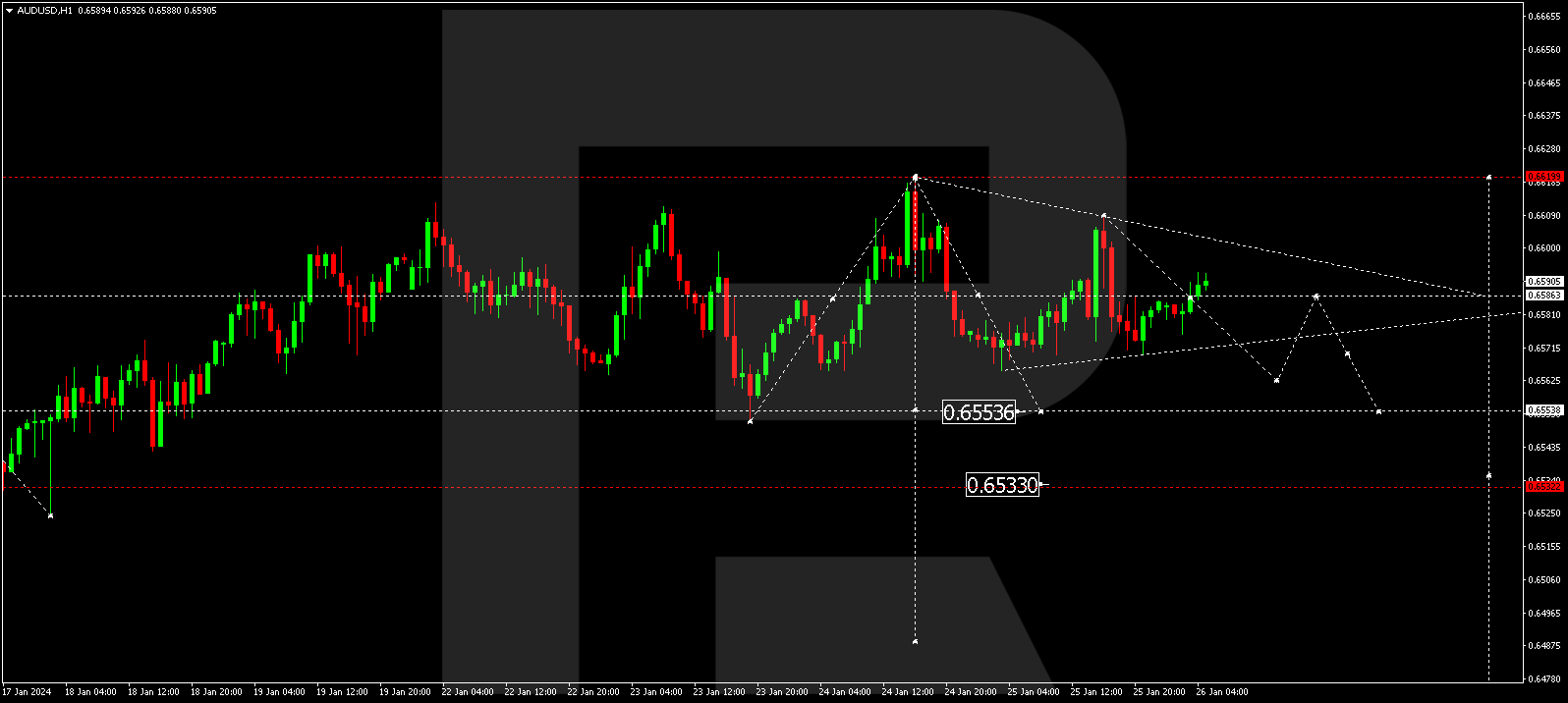

AUD/USD (Australian Dollar vs US Dollar)

AUD/USD is persisting in forming a consolidation range around 0.6585. An escape to the downside could open the potential for a wave to 0.6555, constituting the first target. Upon reaching this level, a rebound to 0.6585 (tested from below) is conceivable, followed by a decline to 0.6533. This represents a local target.

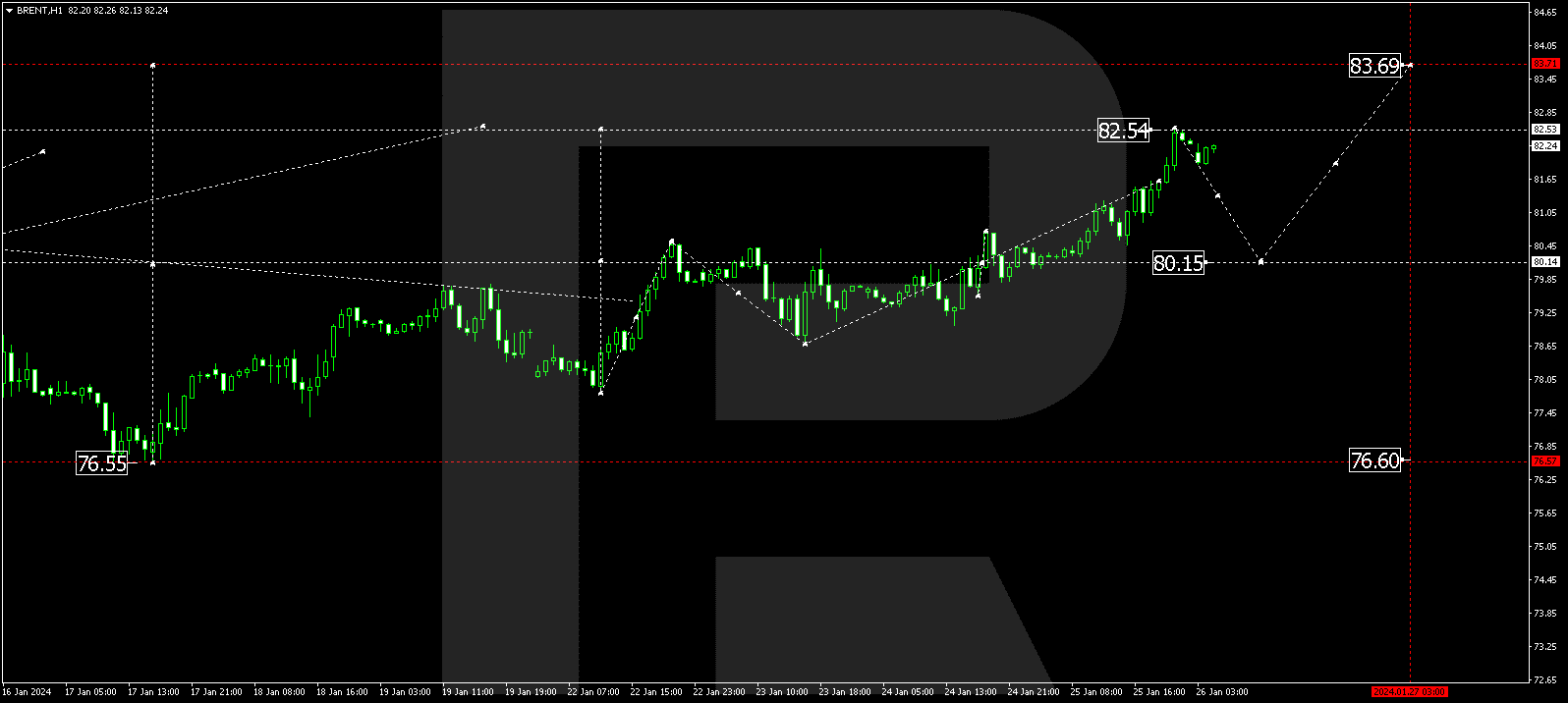

BRENT

Brent has completed a growth structure to 82.54. Today, the market has corrected to 81.92. Currently, a consolidation range is shaping up above this level. An upward breakout and extension of the wave to 83.00 are anticipated, from where the trend might progress to 83.35. Conversely, a downward breakout could extend the correction to 81.00, with the subsequent likelihood of the growth wave continuing to 83.35. This marks a local target.

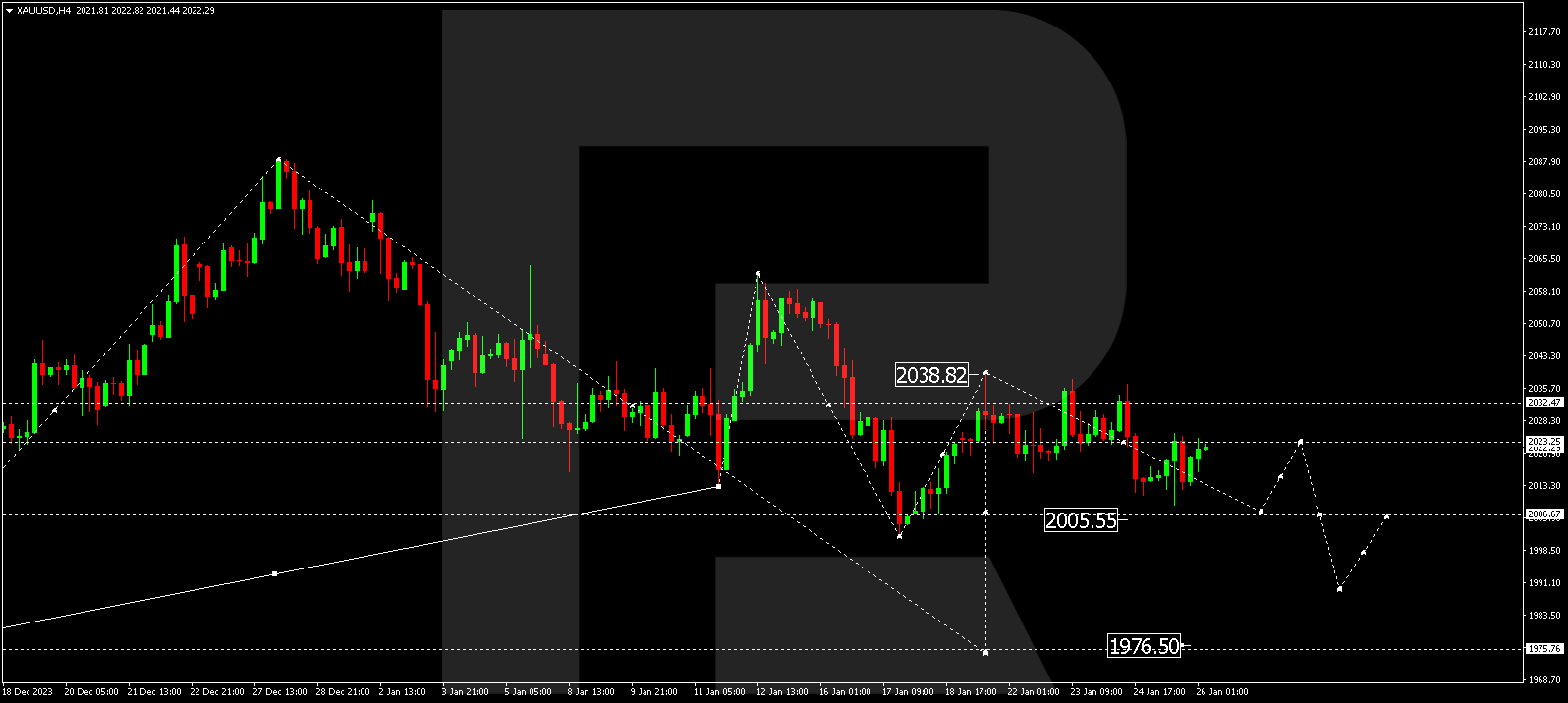

XAU/USD (Gold vs US Dollar)

Gold continues to develop a consolidation range below 2023.23. Today, the price might decline to 2005.55 before rising to 2023.00. Once this level is reached, a new downward wave to 1991.10 might follow, paving the way for the trend to continue to 1976.50.

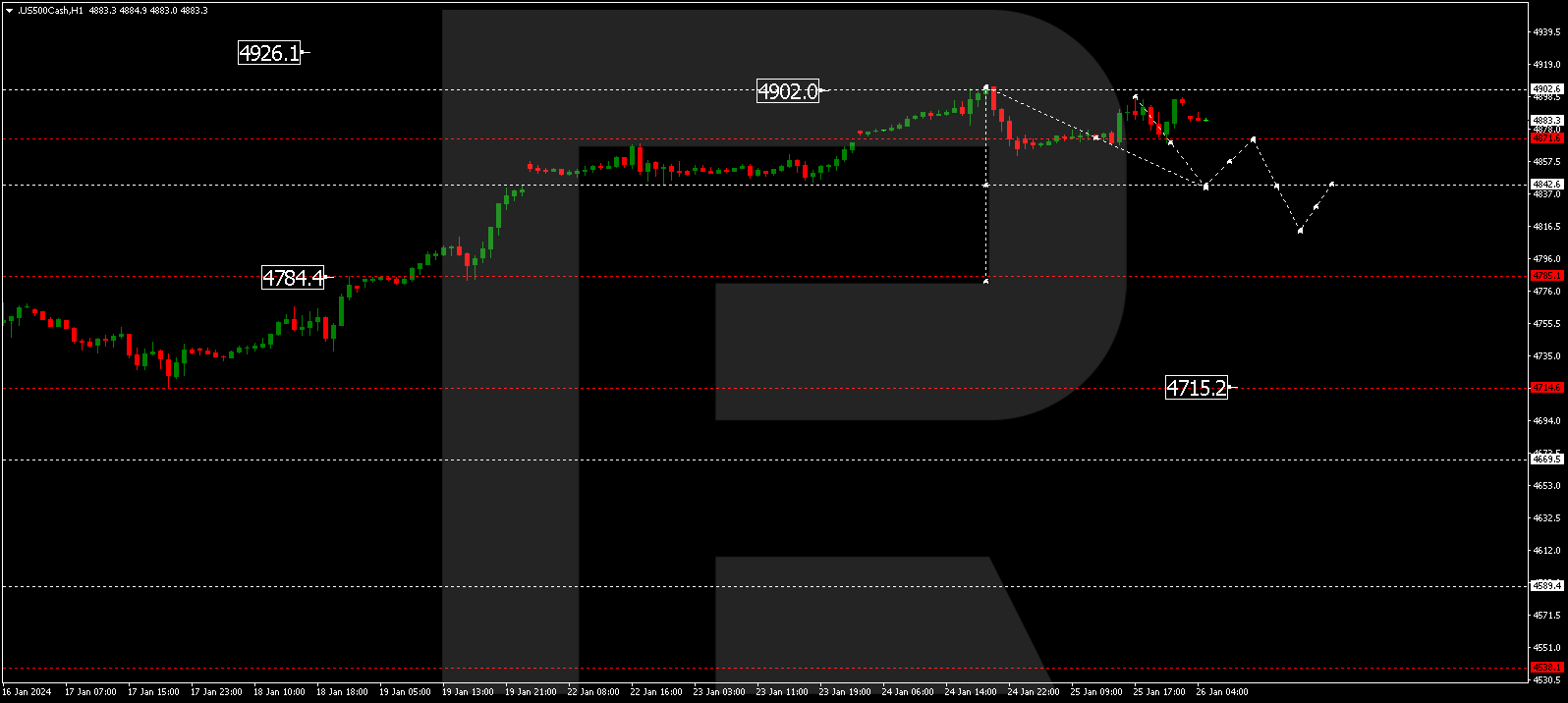

S&P 500

The stock index is currently unfolding a consolidation range around 4871.5. A breakout to the downside could initiate a decline wave to 4784.4. This marks the initial target.

The post Technical Analysis & Forecast January 26, 2024 appeared first at R Blog – RoboForex.