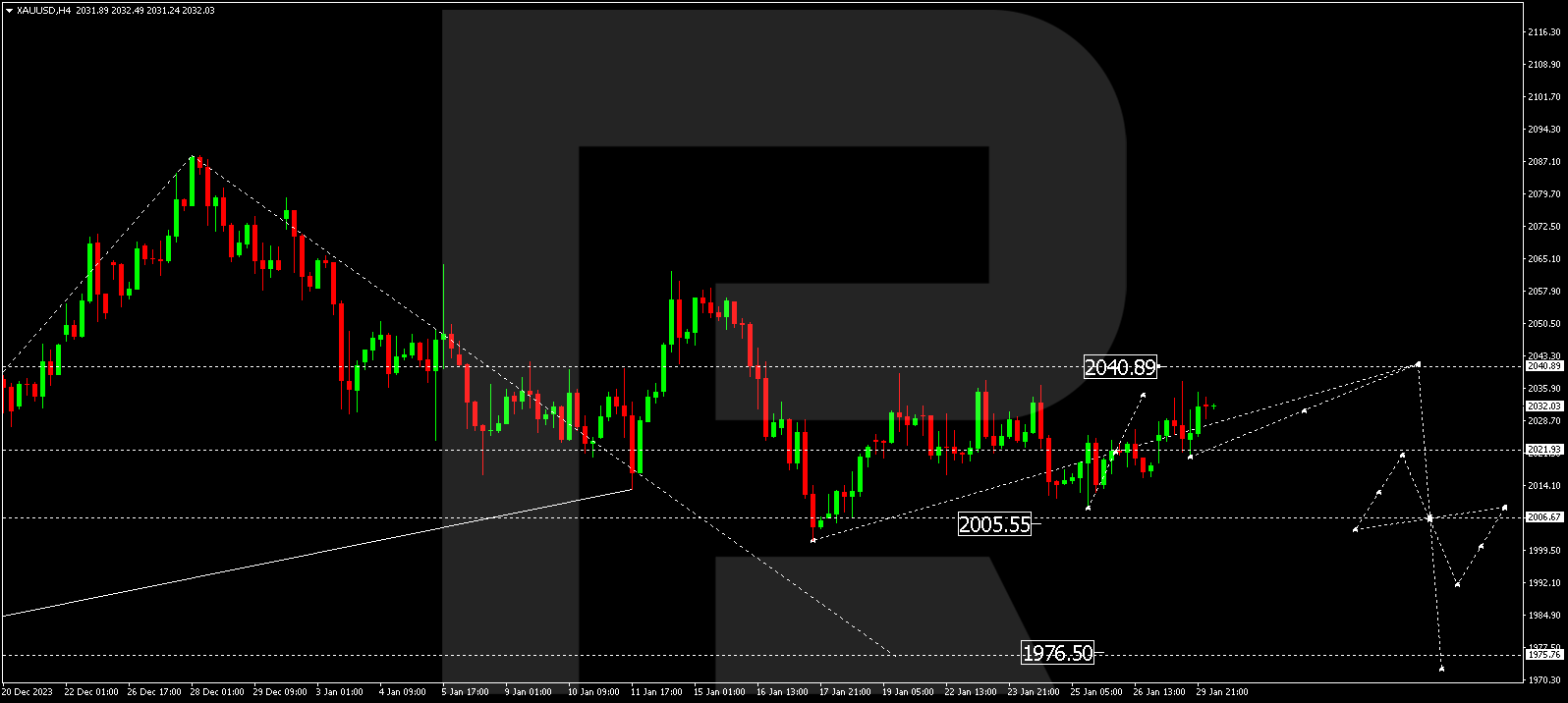

Gold appears to be consolidating before initiating a new downward trend. This overview encompasses the dynamics of various currencies, including EUR, GBP, JPY, CHF, AUD, commodities like Brent and Gold (XAU/USD), and the S&P 500 index.

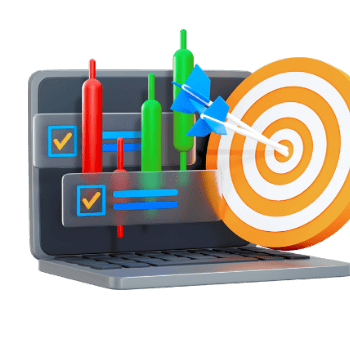

EUR/USD (Euro vs US Dollar)

The EUR/USD pair has completed a downward wave to 1.0795. Today, the market is undergoing a correction wave towards 1.0850. Once this level is reached, an anticipated continuation of the downward wave to 1.0790 is expected—a local target.

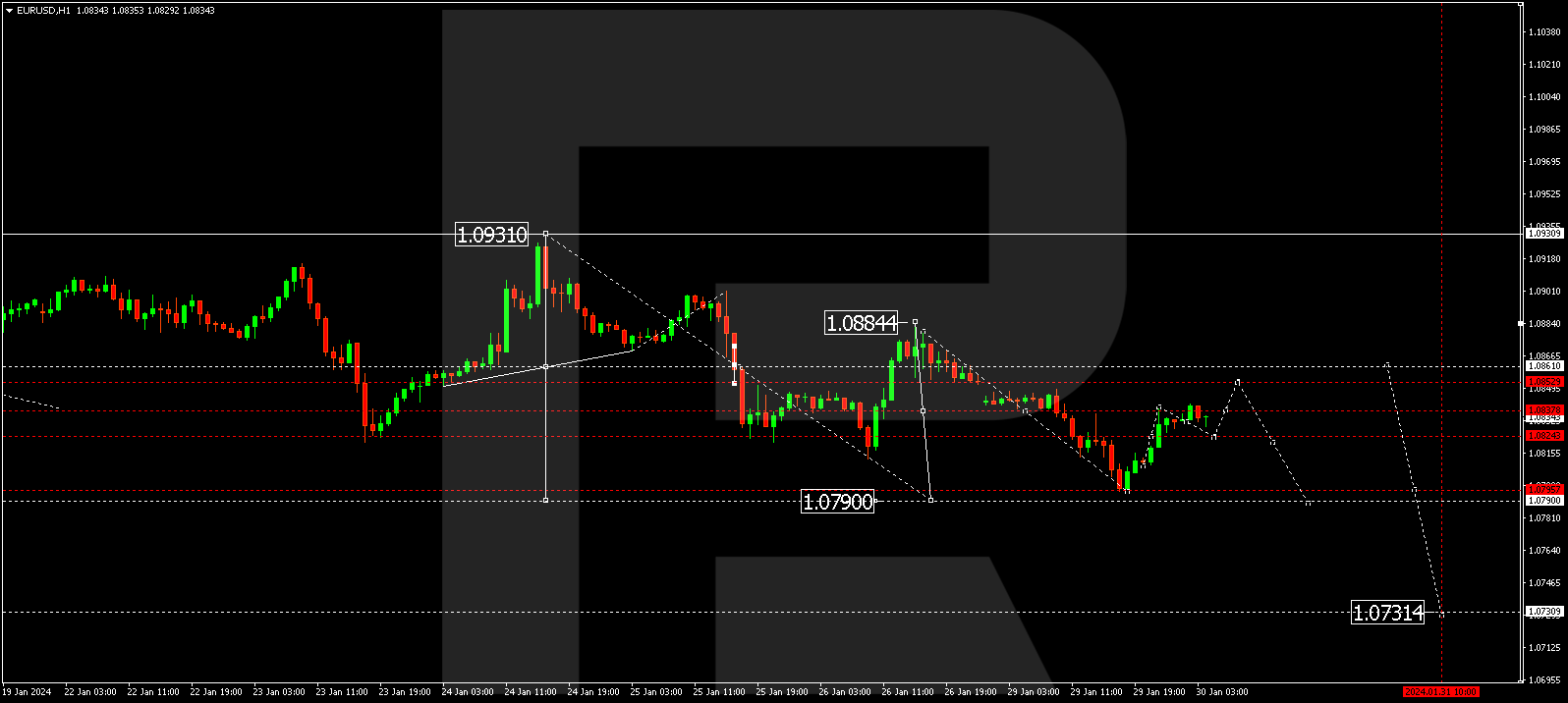

GBP/USD (Great Britain Pound vs US Dollar)

GBP/USD has concluded a downward wave to 1.2662. A correction to 1.2730 is currently forming. Following the correction, a new downward wave to 1.2650 is anticipated, potentially extending the trend to 1.2575.

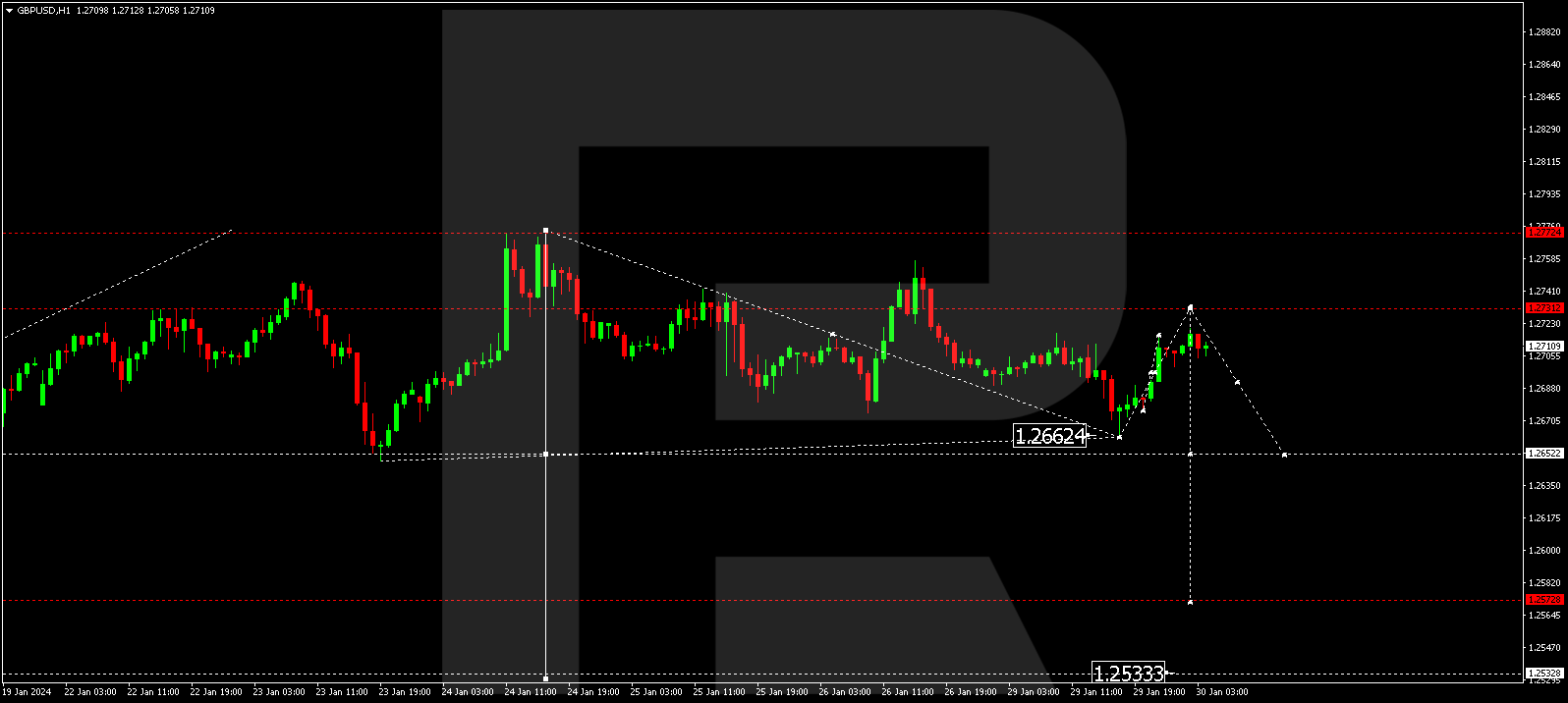

USD/JPY (US Dollar vs Japanese Yen)

The USD/JPY pair has corrected to 147.65. A consolidation range has formed around this level, and another potential downward structure to 146.96 is not excluded. Subsequently, a rise to 148.82 is expected—a local target.

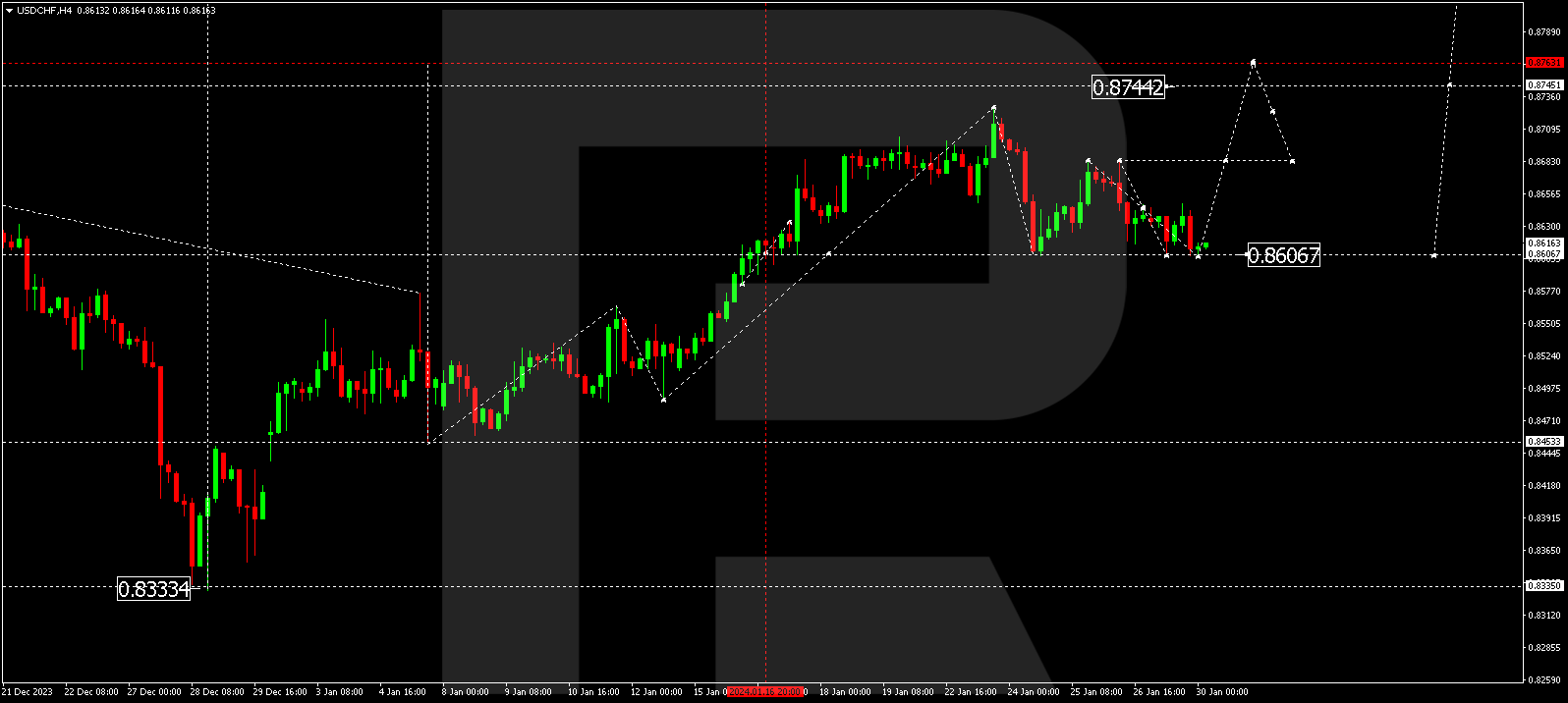

USD/CHF (US Dollar vs Swiss Franc)

USD/CHF is in the process of developing a consolidation range above 0.8607. A potential upward movement to 0.8690 might occur today. If this level is breached, there is potential for a growth wave to 0.8760—a local target.

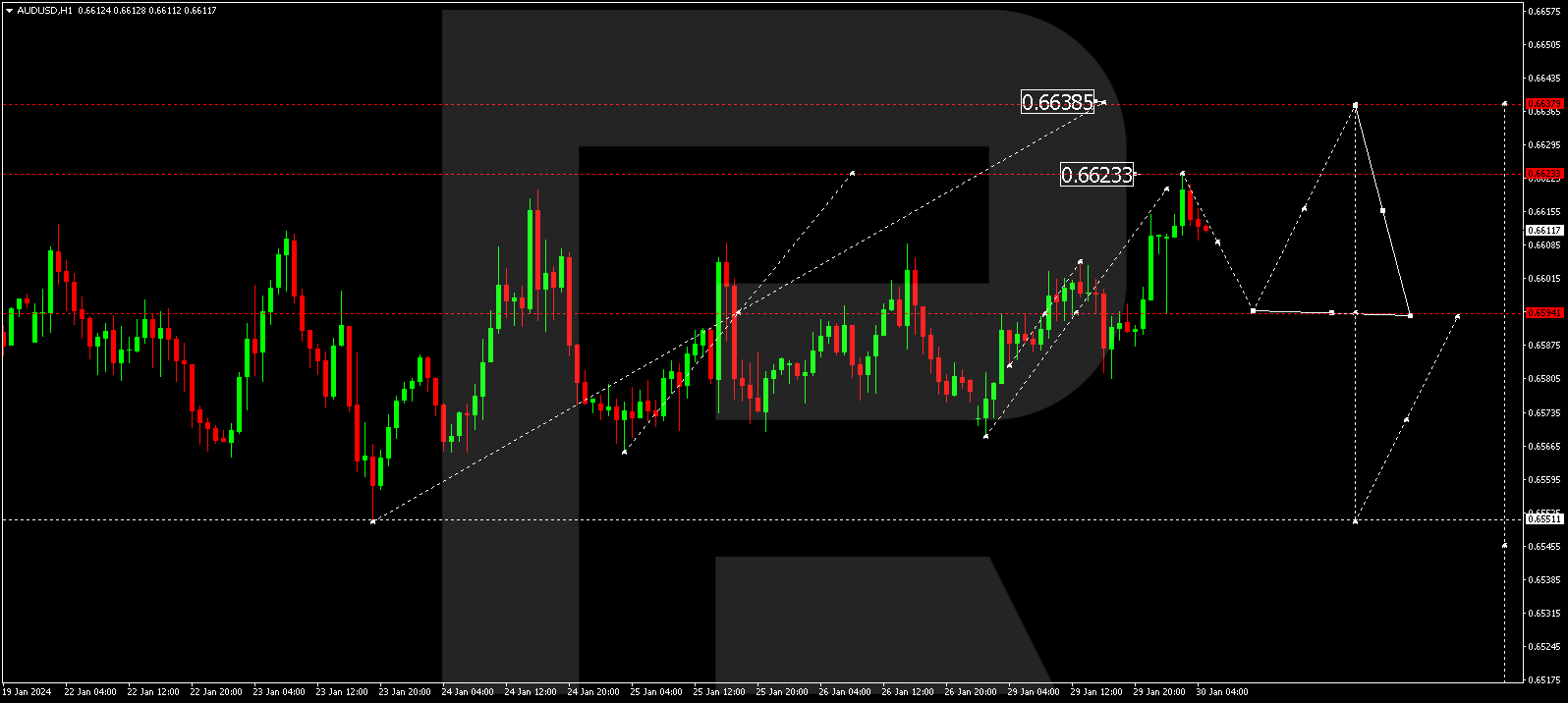

AUD/USD (Australian Dollar vs US Dollar)

The AUD/USD pair is currently forming a consolidation range around 0.6594. The market has extended the range upwards to 0.6623. A potential downward movement to 0.6594 could follow today. Next, a new correction wave to 0.6636 is not excluded, with a possible decline to 0.6555—a local target.

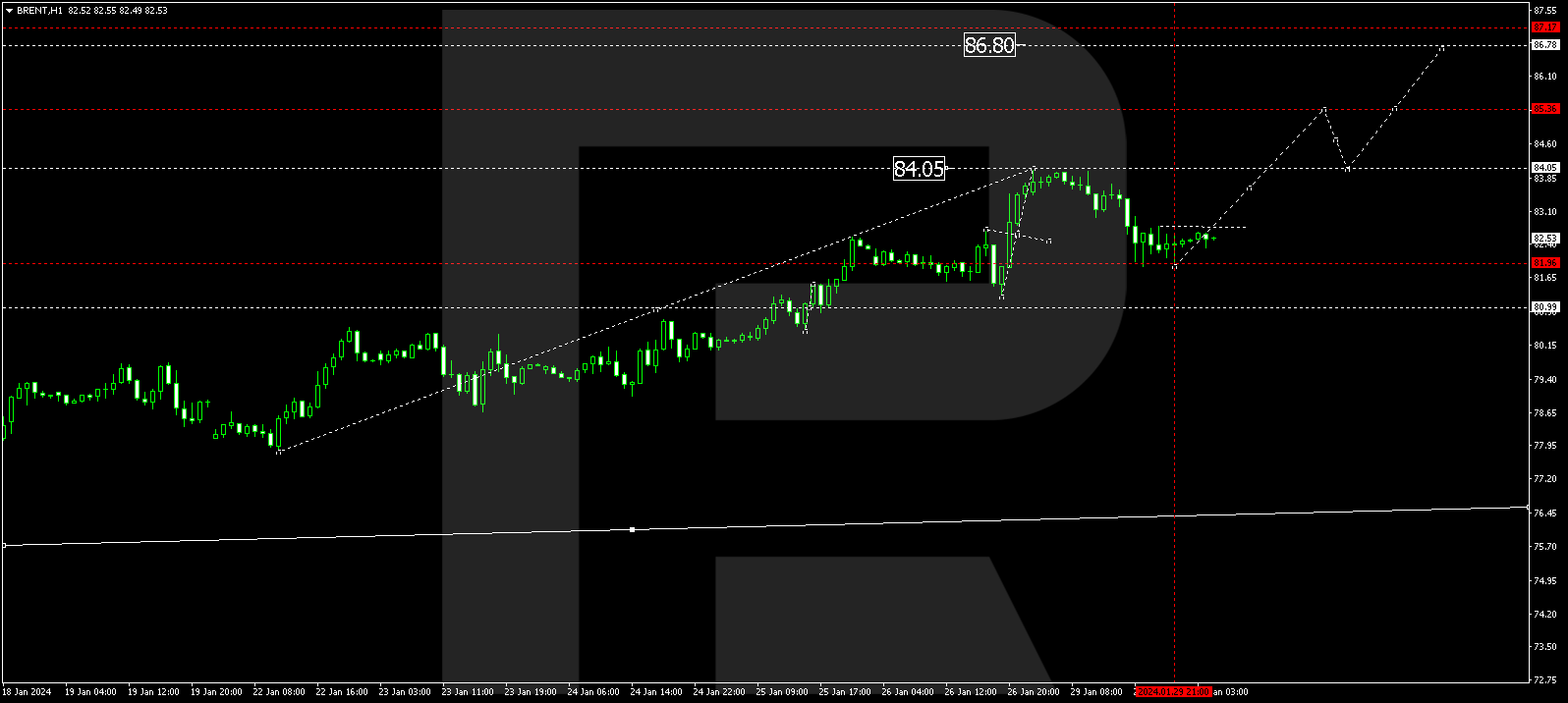

BRENT

Brent has completed a correction structure to 81.90. Currently, a consolidation range is forming above this level. A breakout from the range upwards might continue the growth wave to 84.22. Upon reaching this level, a potential correction to 83.40 is not excluded. Subsequently, the trend might extend to 85.55—a local target.

XAU/USD (Gold vs US Dollar)

Gold continues developing a consolidation range around 2022.22. A potential upward movement to 2040.90 might occur today, followed by a potential downward movement to 2005.55. After breaking below this level, a new downward structure to 1991.10 could follow, potentially extending the trend to 1976.50.

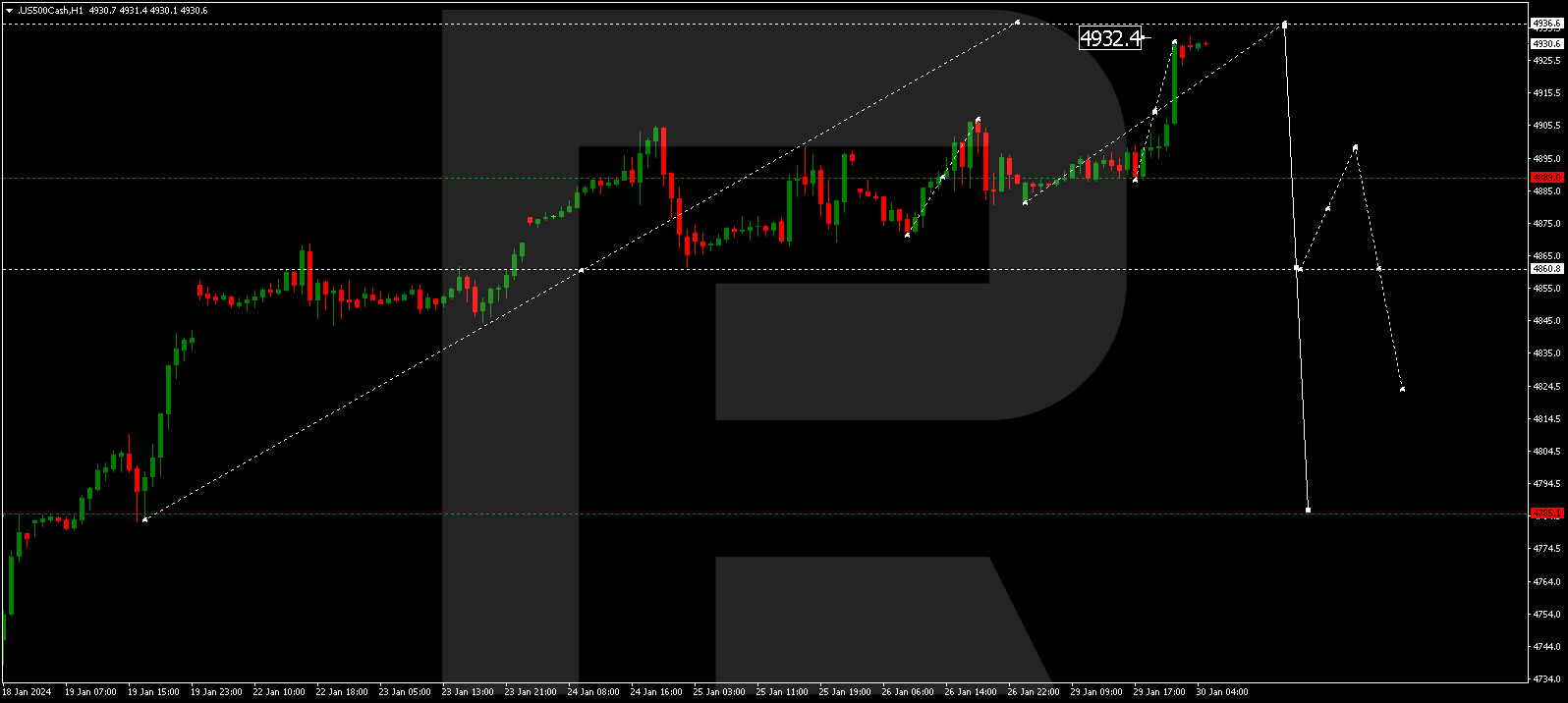

S&P 500

The stock index is in the process of developing a consolidation range around 4880.0. A breakout from the range upwards might extend the growth structure to 4936.6. Next, a potential downward wave to 4860.0 might begin. If this level is breached, there is potential for a wave to 4785.0—a first target.

The post Technical Analysis & Forecast January 30, 2024 appeared first at R Blog – RoboForex.