The EUR is currently in a declining phase. This overview also covers the dynamics of GBP, JPY, CHF, AUD, Brent, Gold, and the S&P 500 index.

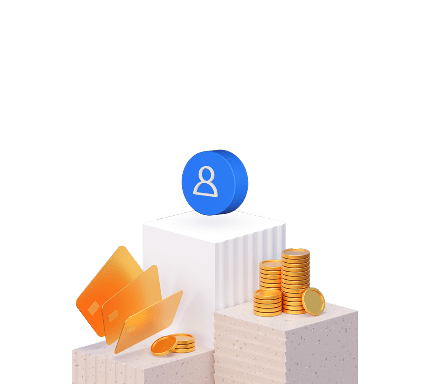

EUR/USD (Euro vs US Dollar)

The EUR/USD pair has concluded a correction wave reaching 1.0855. Today, the market is shaping a decline wave structure towards 1.0806. After reaching this level, a correction to 1.0825 is expected (a test from below), followed by a decline to 1.0790—a local target.

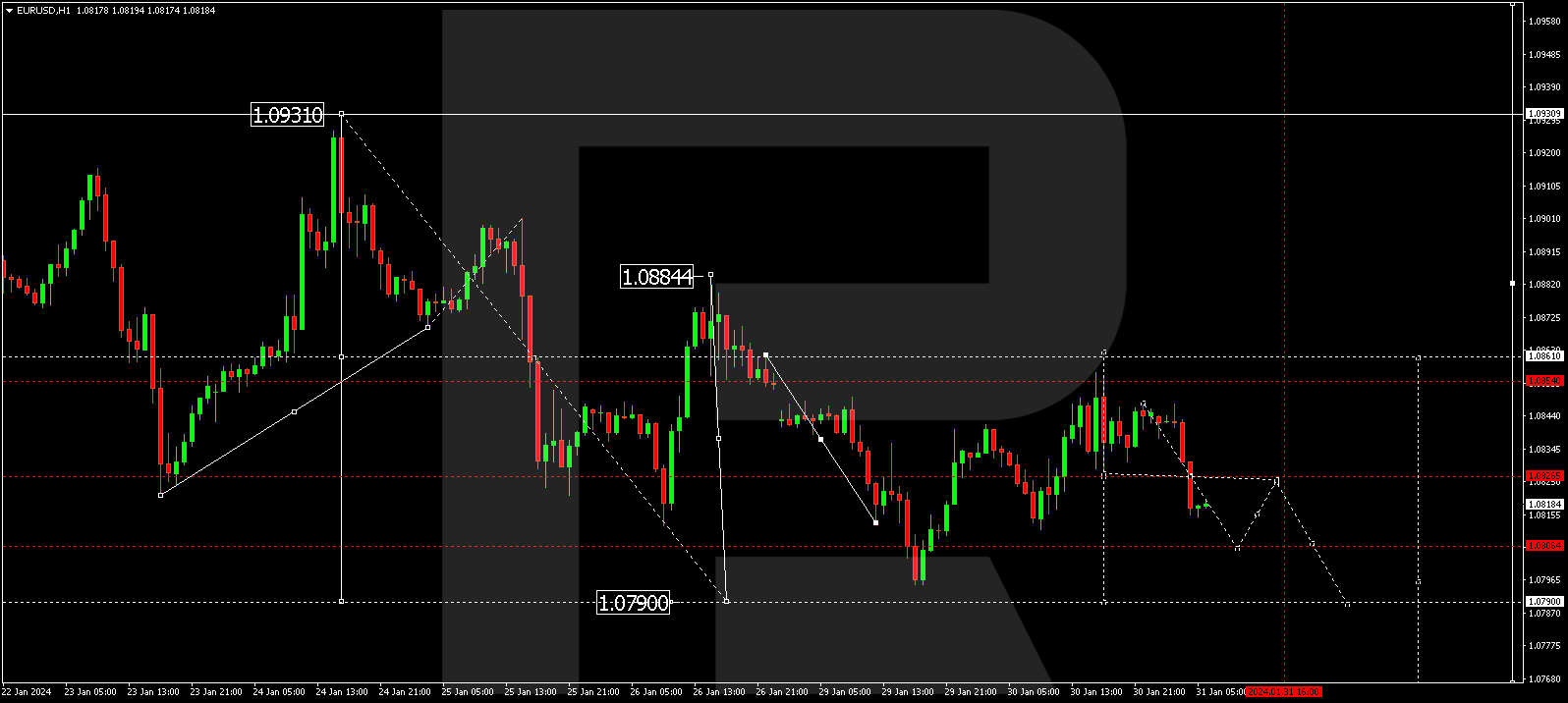

GBP/USD (Great Britain Pound vs US Dollar)

The GBP/USD pair has completed a decline wave to 1.2643. A correction to 1.2709 is possible today. After the correction, a new decline wave to 1.2585 may commence, potentially extending the trend to 1.2525.

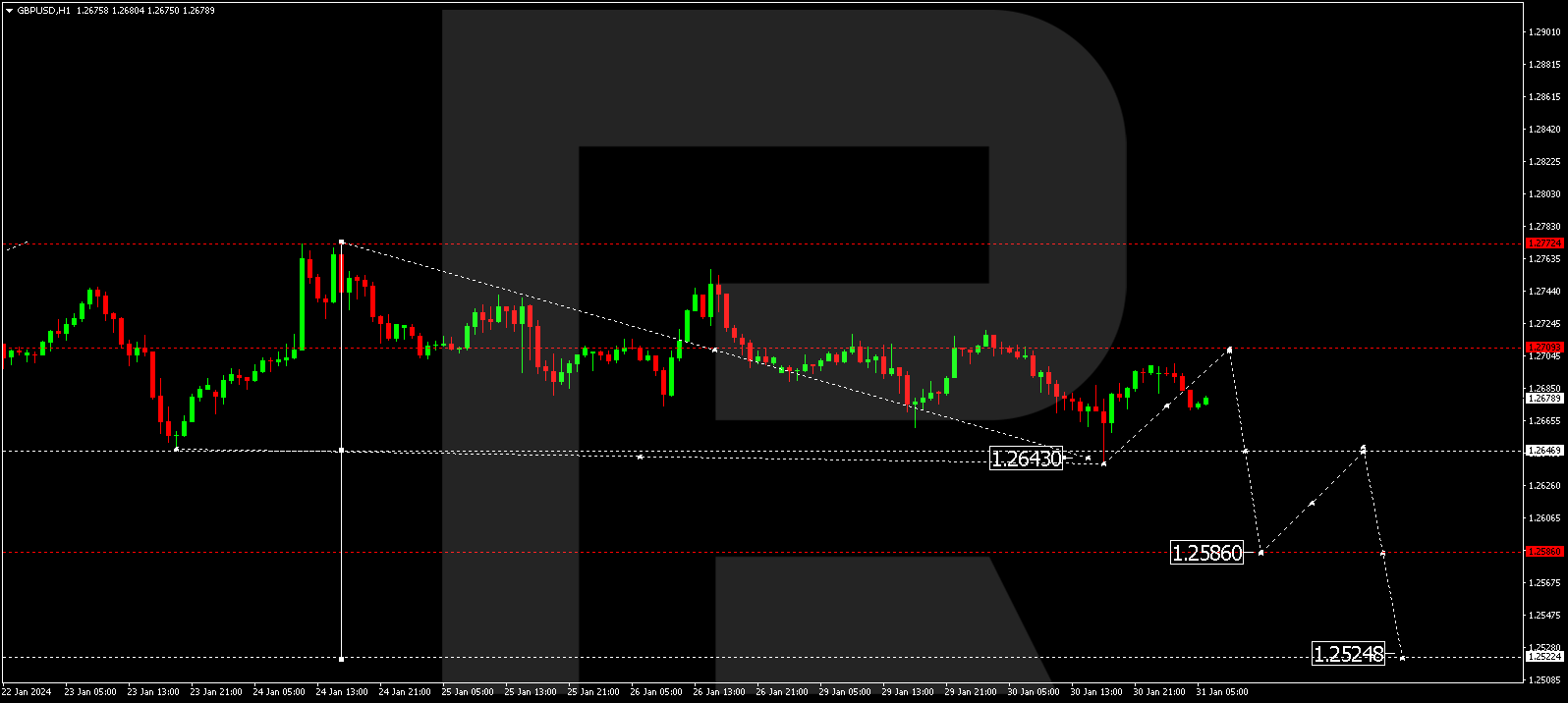

USD/JPY (US Dollar vs Japanese Yen)

USD/JPY is currently forming a consolidation range around 147.62. Another decline structure to 146.96 is plausible, followed by a rise to 148.82. This represents a local target.

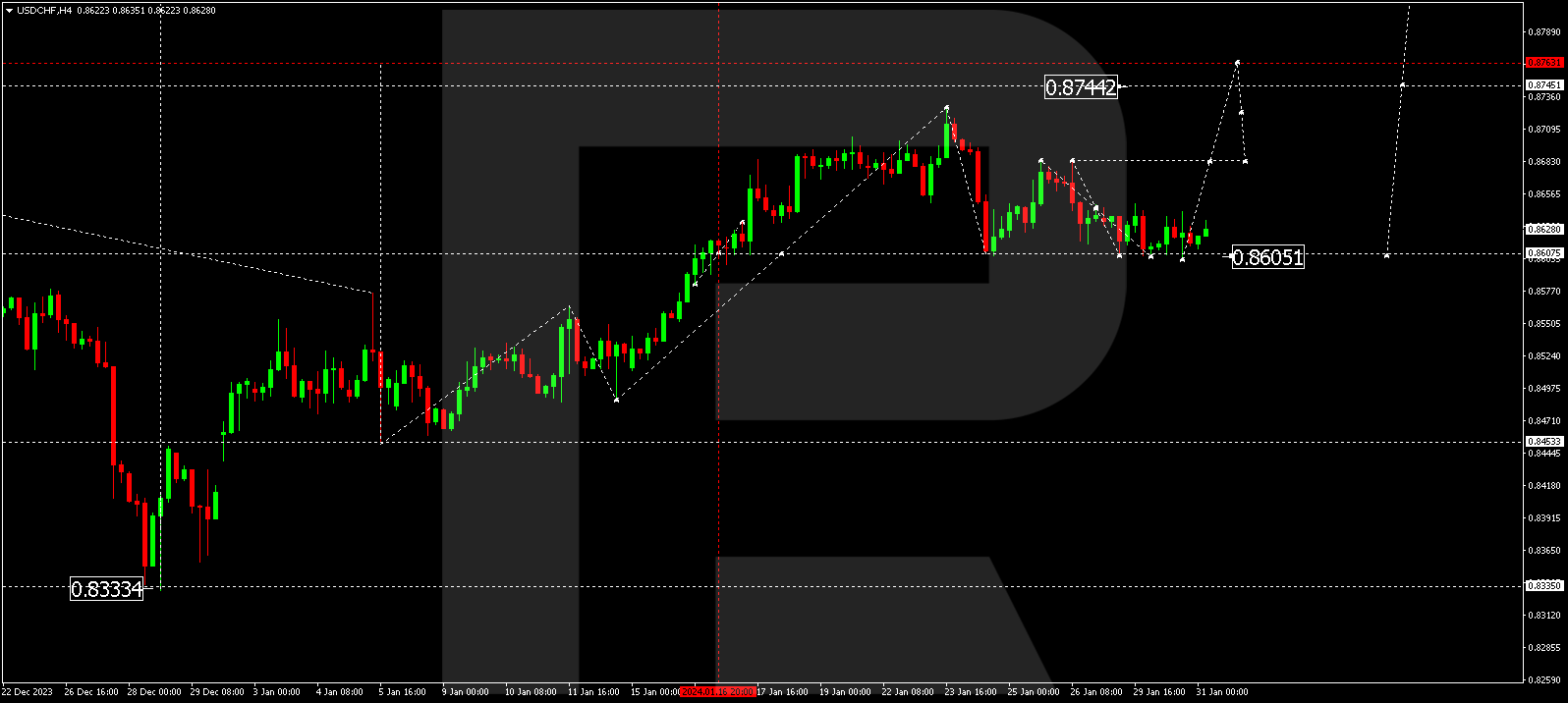

USD/CHF (US Dollar vs Swiss Franc)

USD/CHF is in a consolidation range above the 0.8605 level without a distinct trend. A potential upward movement to 0.8680 is possible today. If this level is breached, the potential for a wave to 0.8760 might emerge—a local target.

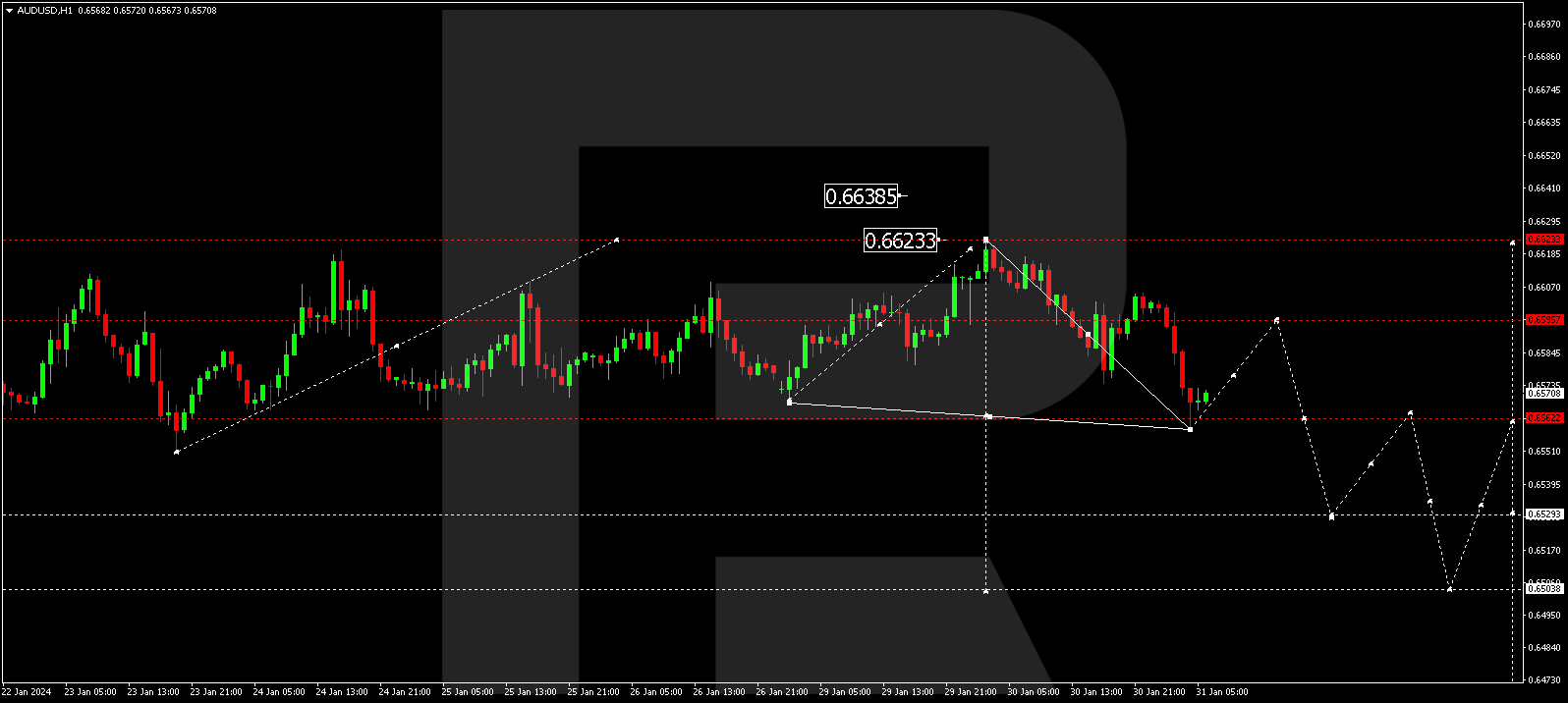

AUD/USD (Australian Dollar vs US Dollar)

The AUD/USD pair has concluded a decline wave to 1.6562. A consolidation range is currently forming above this level. An upward escape from the range could lead to a correction to 0.6595. Conversely, a downward escape might continue the decline wave to 0.6530—a local target.

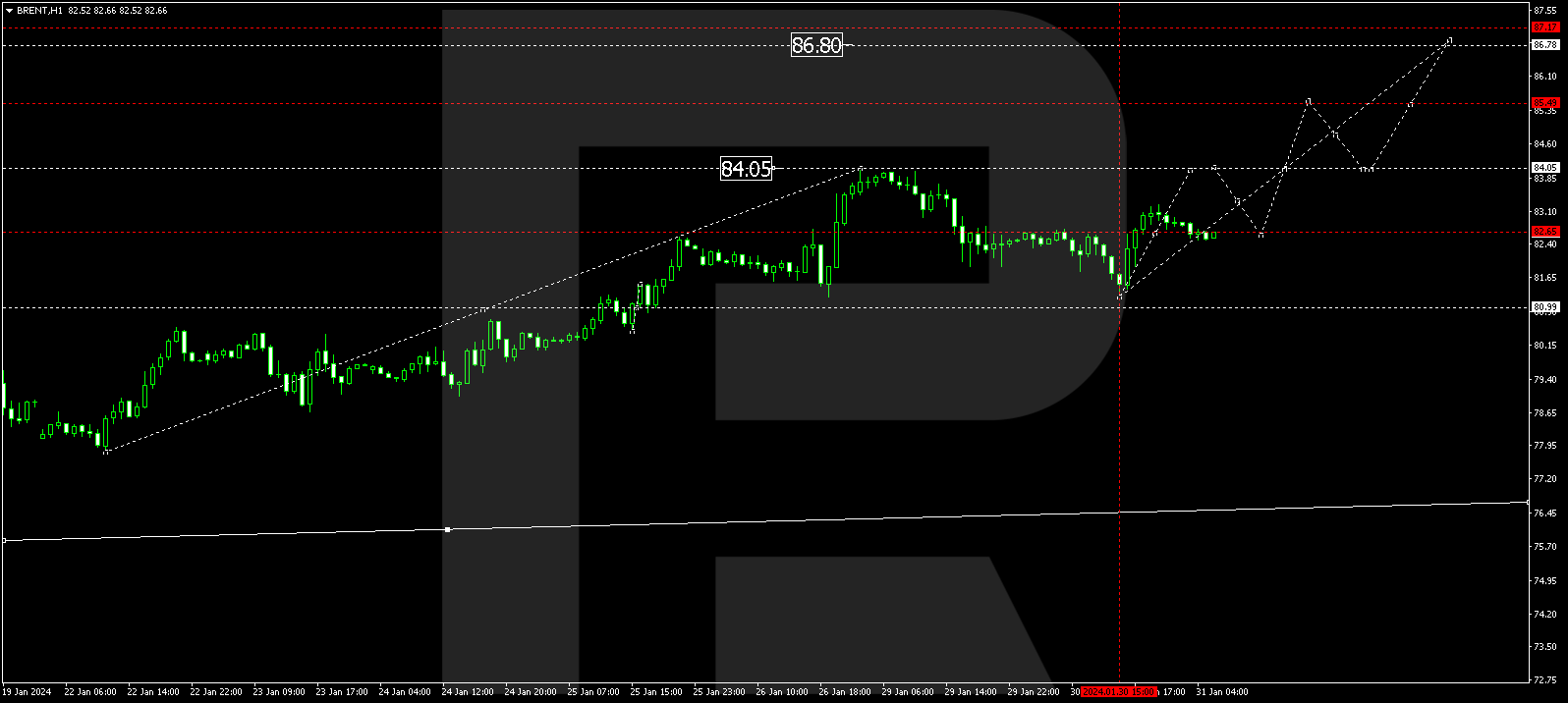

BRENT

Brent is developing a consolidation range around 82.65 without a pronounced trend. An upward escape from the range might lead to a growth link to 84.05, followed by a decline to 82.65 (a test from above). Next, a rise to 85.55 could occur, potentially extending the trend to 86.76. This is a local target.

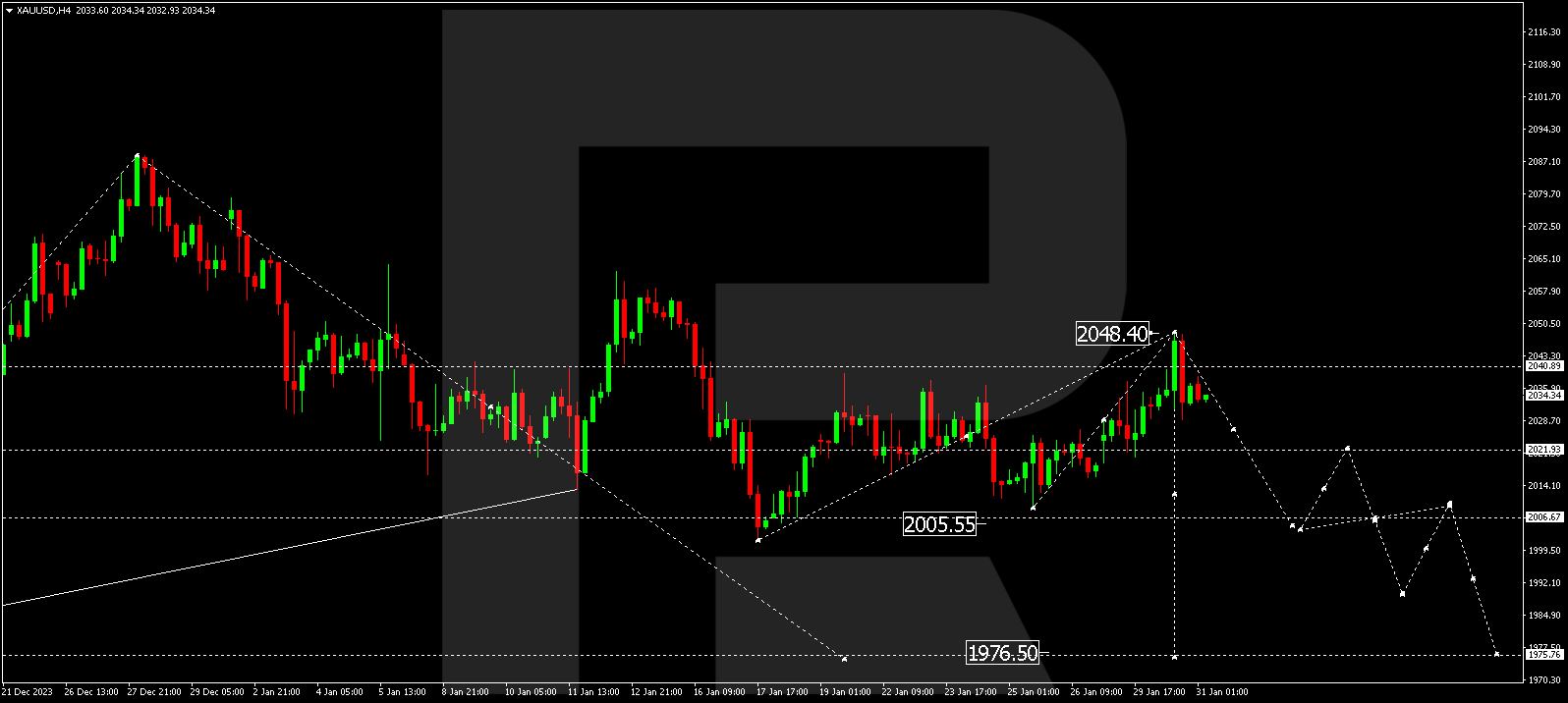

XAU/USD (Gold vs US Dollar)

Gold has completed a correction to 2048.40. Today, the market continues developing a new decline wave to 2021.00. If this level is breached, the potential for a decline wave to 2006.66 might open—a local target.

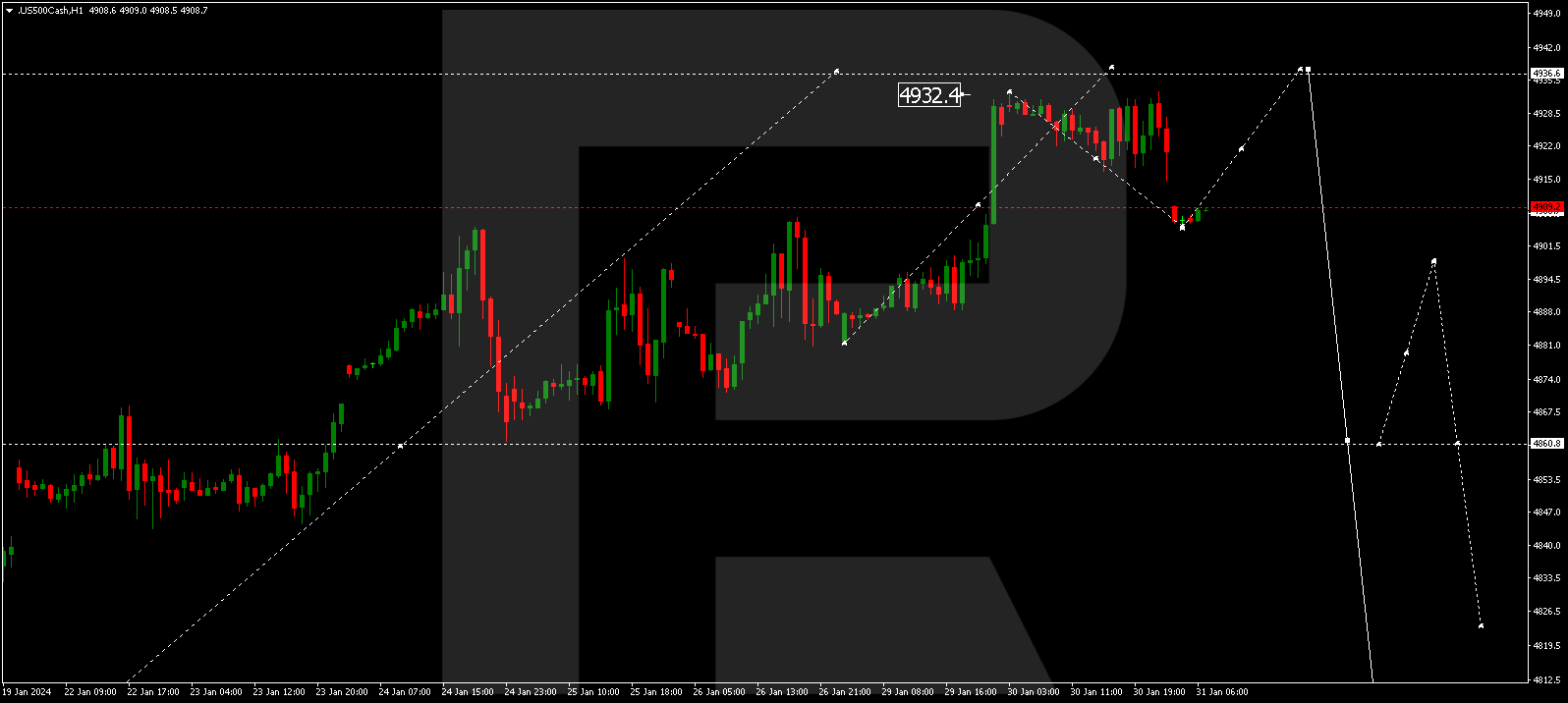

S&P 500

The stock index has completed a growth wave to 4932.9 and a correction to 4909.2. Currently, a consolidation range is forming around this level. A potential upward movement to 4936.6 is not ruled out, followed by a decline to 4860.8. This is the first target.

The post Technical Analysis & Forecast January 31, 2024 appeared first at R Blog – RoboForex.