JPY Sees Continued Ascent. This analysis also encompasses the movements of EUR, GBP, CHF, AUD, Brent, Gold, and the S&P 500 index.

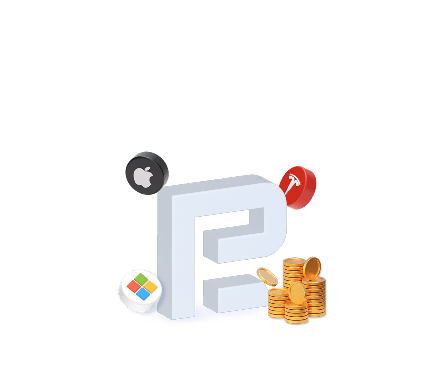

EUR/USD (Euro vs US Dollar)

EUR/USD persists in the development of a consolidation range around 1.0675. An extension of the range to 1.0695 is plausible. Following this, a descent to 1.0630 might unfold. A downside breakout of this range is anticipated to propel the trend toward 1.0540. This represents a nearby target.

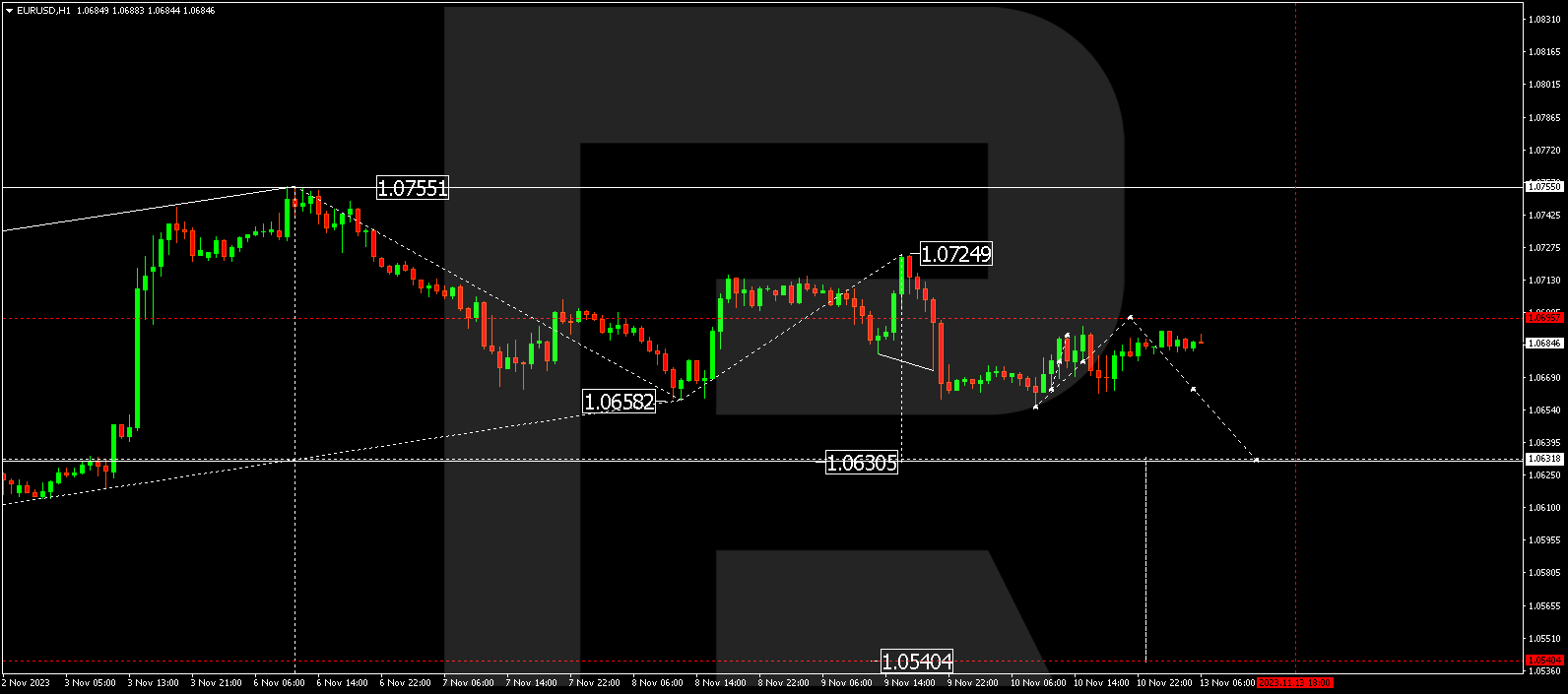

GBP/USD (Great Britain Pound vs US Dollar)

GBP/USD has concluded a downtrend wave at 1.2186. An upswing to 1.2247 is plausible. Subsequently, the trend might resume towards 1.2100. This is a local target.

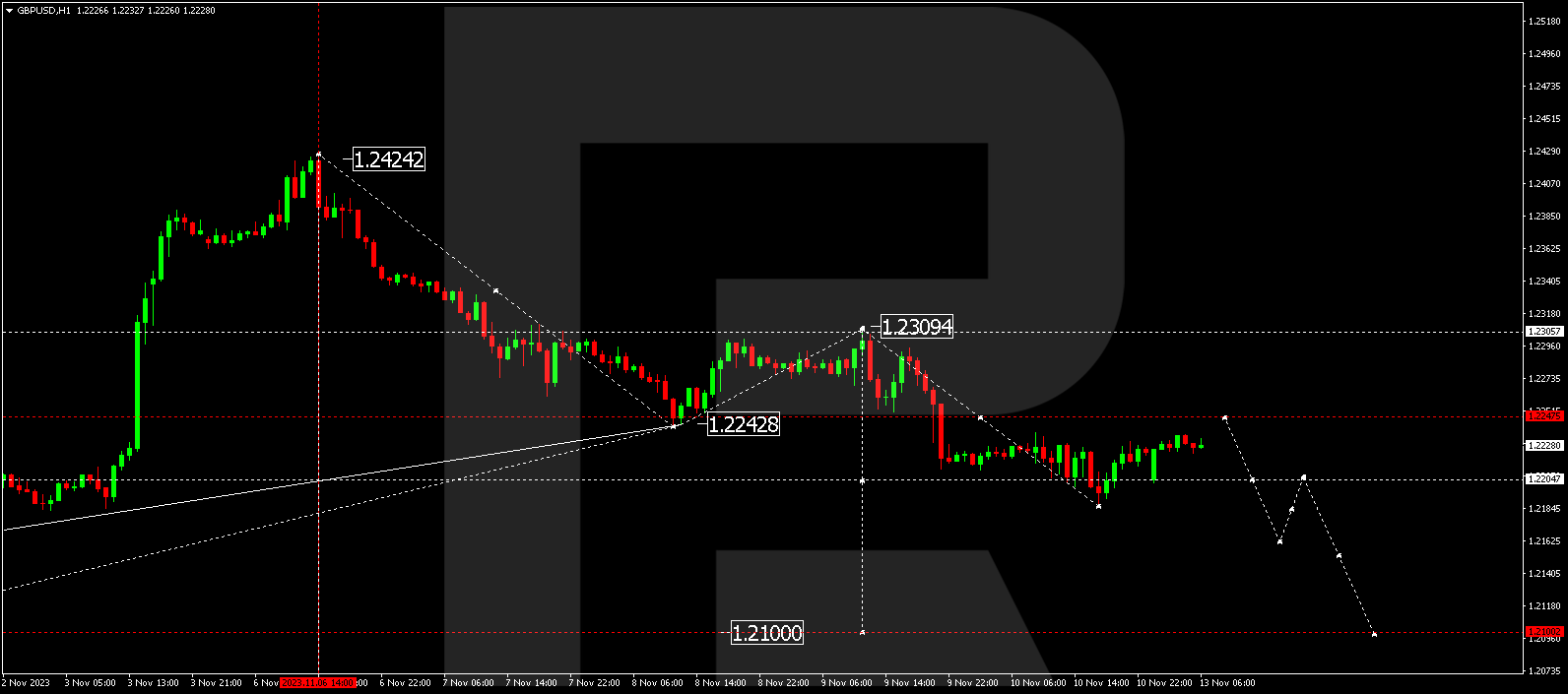

USD/JPY (US Dollar vs Japanese Yen)

USD/JPY has completed an upward wave to 151.61. The market presently forms a consolidation range around this level. An upward breakout could sustain the growth wave to 152.35, extending further to 152.65. A downward breakout might result in a corrective phase to 150.96, followed by a rise to 152.65.

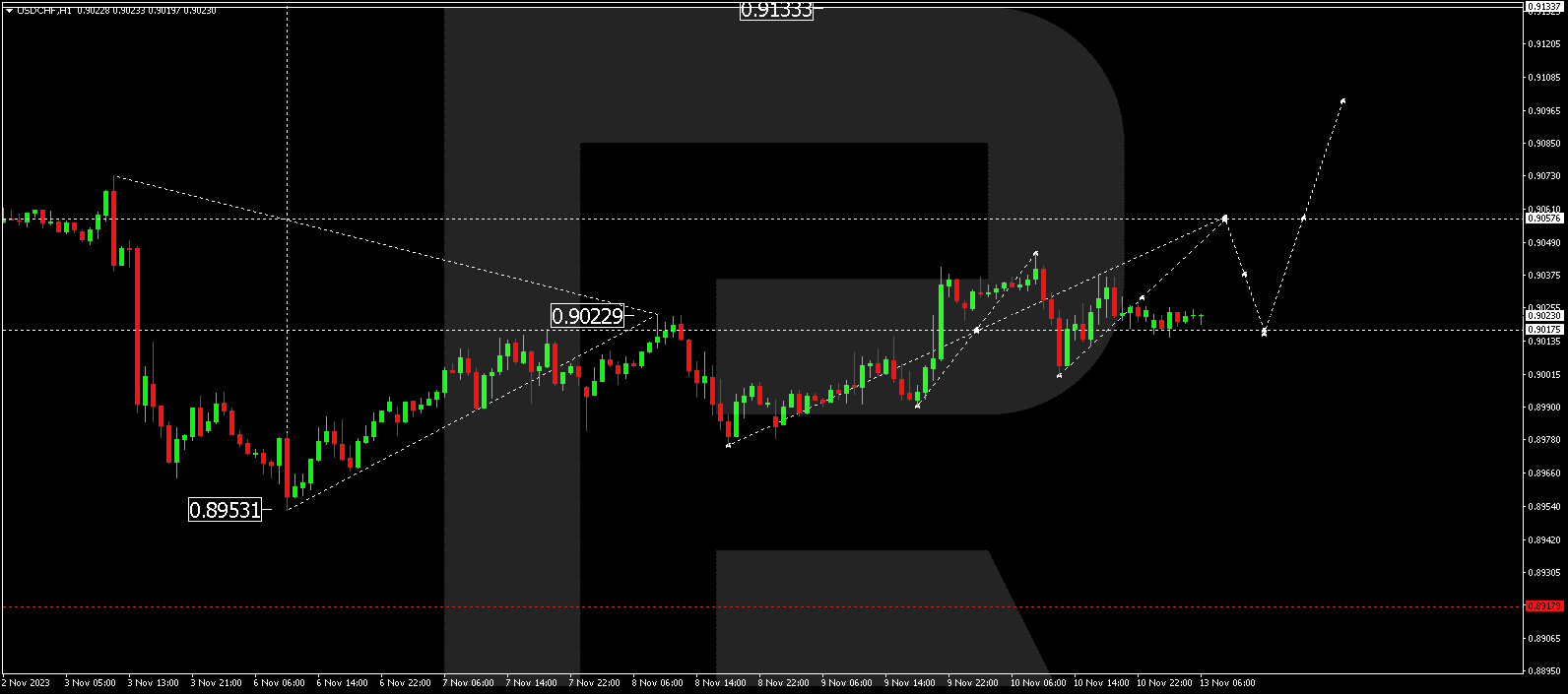

USD/CHF (US Dollar vs Swiss Franc)

USD/CHF continues consolidating within the range around 0.9017. The range might extend to 0.9057 today. A breakout above this level could set the stage for an ascent to 0.9095. This is a nearby target.

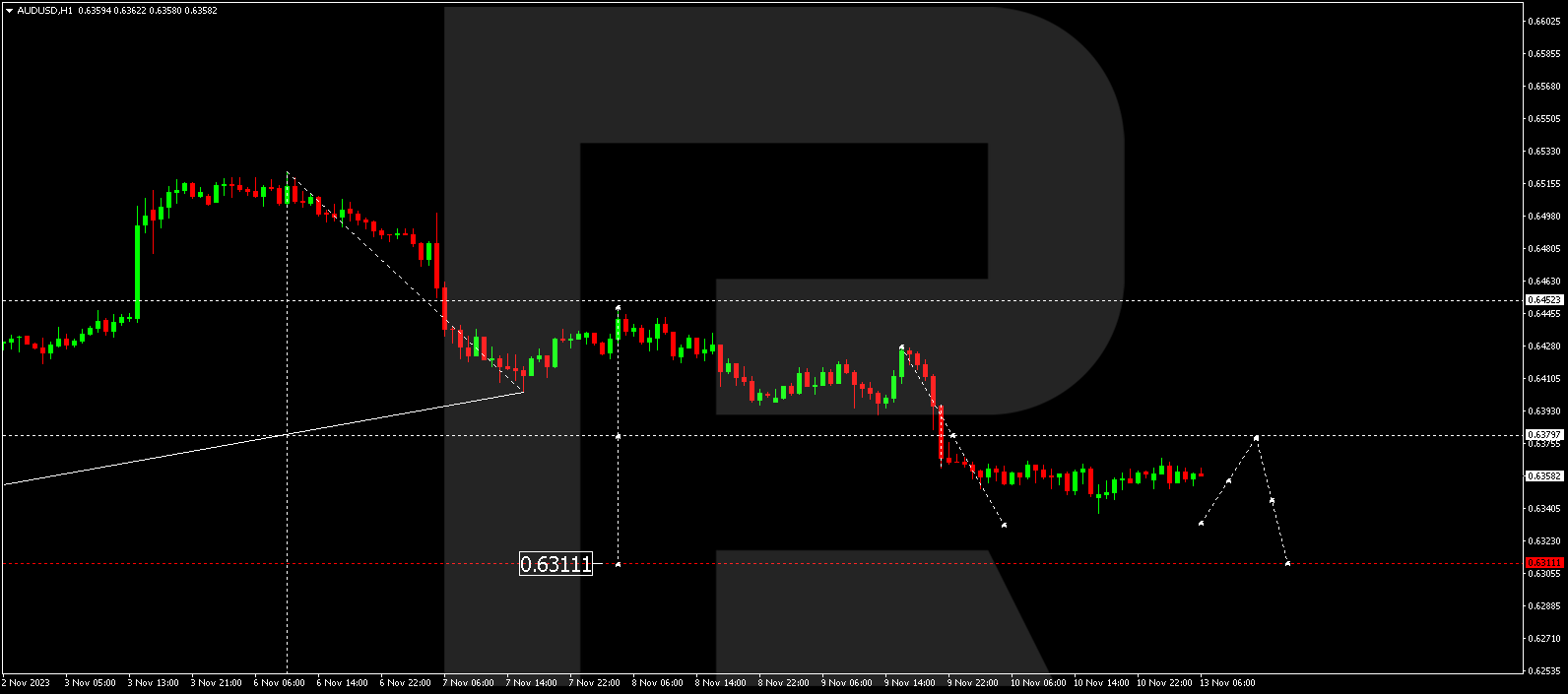

AUD/USD (Australian Dollar vs US Dollar)

AUD/USD is in the process of developing a declining wave to 0.6333. Following this, an upswing to 0.6380 is plausible, possibly with a test from below. Subsequently, a descent to 0.6311 might follow. This represents a local target.

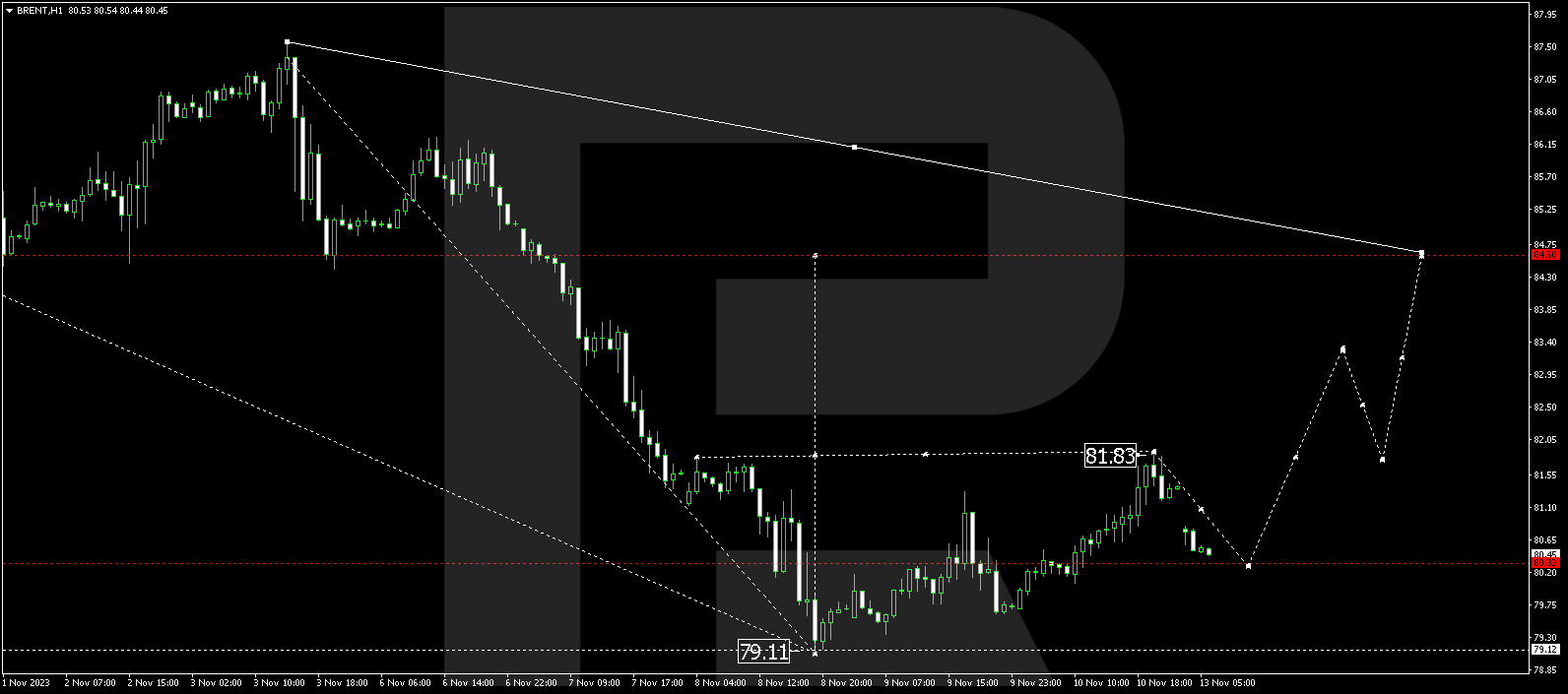

BRENT

Brent has concluded an upward wave at 81.89. A correction to 80.33 is underway today. Following this correction, a new upward wave to 83.40 is anticipated, with the potential for the trend to extend to 84.60. This is the initial target.

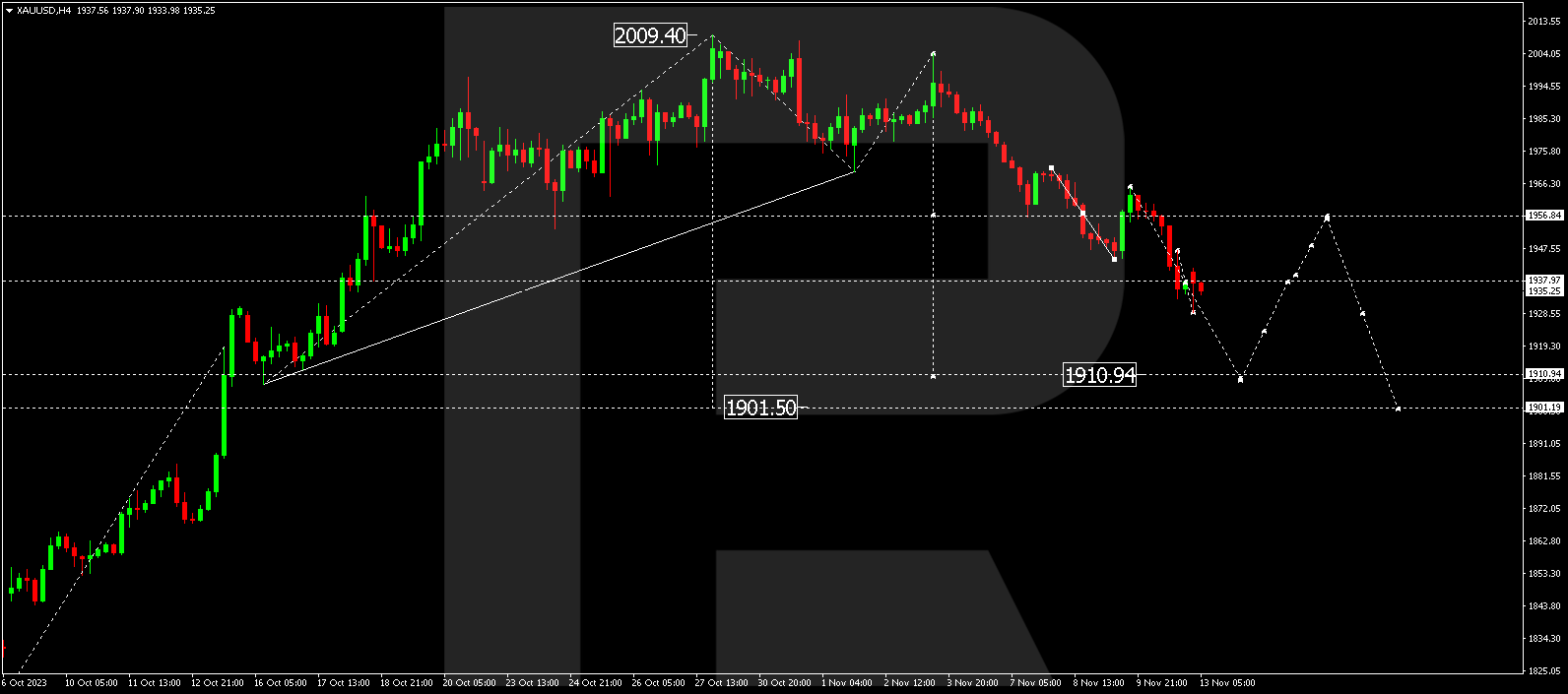

XAU/USD (Gold vs US Dollar)

Gold continues its descent wave to 1911.00. Following this, a correction to 1937.00 might commence, likely with a test from below. A subsequent downward wave to 1901.20 might ensue. This represents the first target.

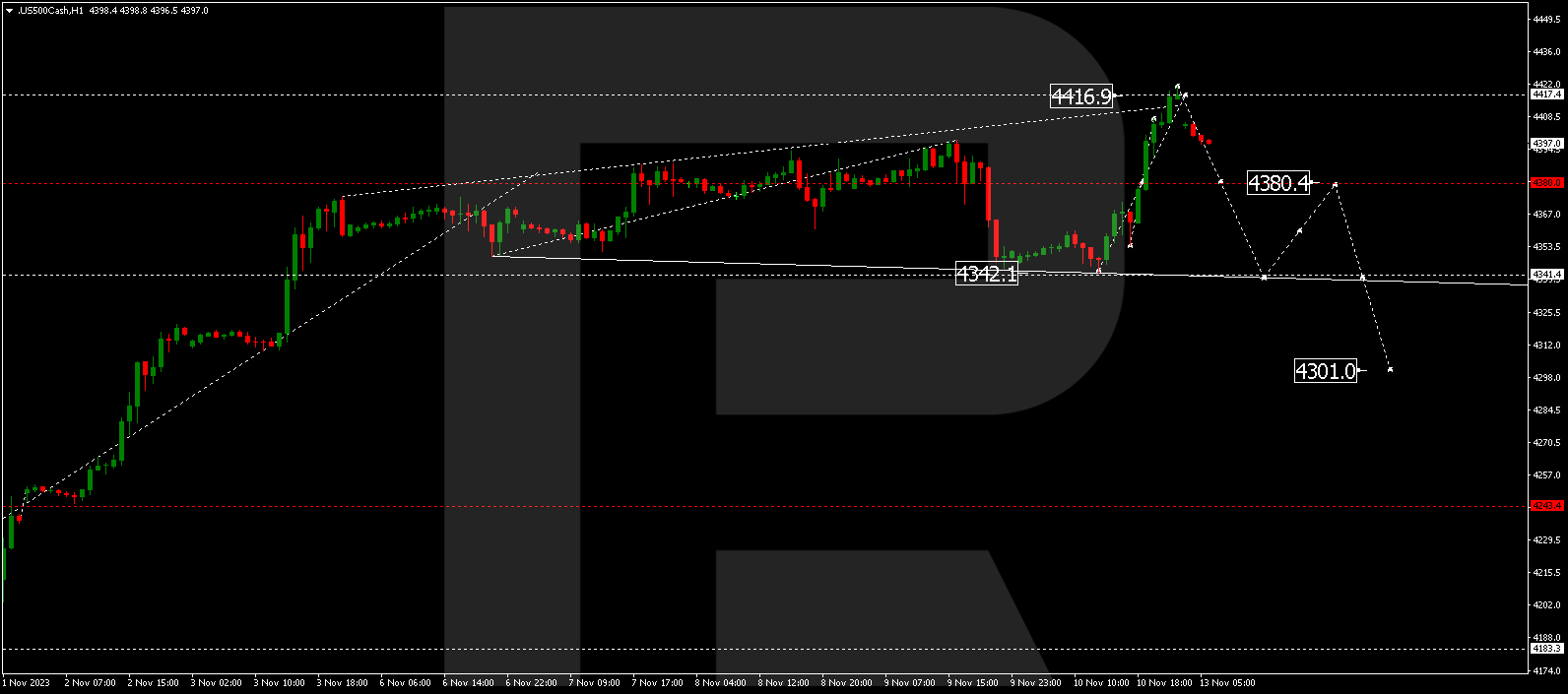

S&P 500

The stock index continues to configure a consolidation range around 4380.4. A potential drop to 4341.4 is foreseeable today. Following this, an upswing to 4380.4 is plausible, possibly with a test from below. Subsequently, a decline to 4301.0 is a local target.

The post Technical Analysis & Forecast November 13, 2023 appeared first at R Blog – RoboForex.