Brent’s upward momentum persists. The analysis also outlines the movements of EUR, GBP, JPY, CHF, AUD, Gold, and the S&P 500 index.

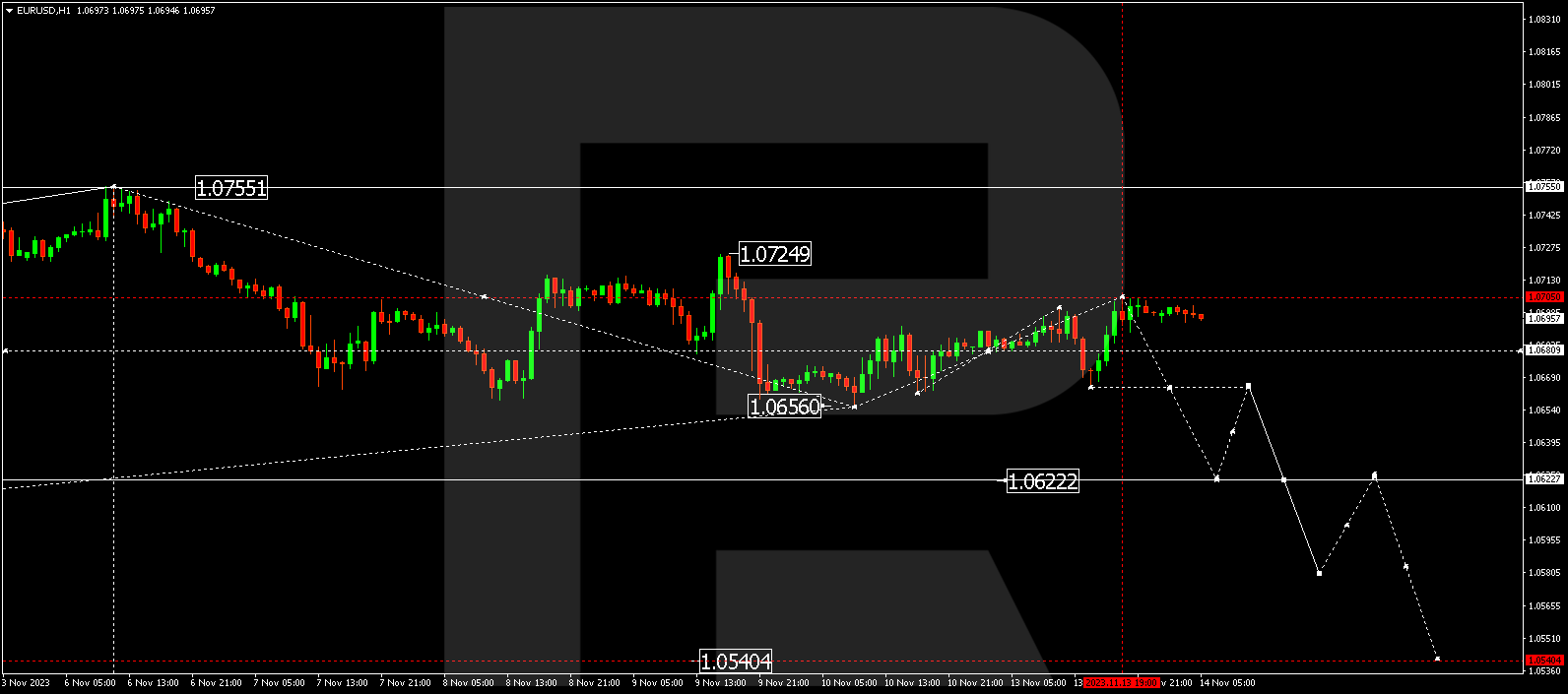

EUR/USD (Euro vs US Dollar)

EUR/USD is currently consolidating within the range of 1.0680. An extension to 1.0705 is plausible. Subsequently, a decline to 1.0640 may follow. A breakout below this level could lead to a drop to 1.0622, initiating a potential trend continuation to 1.0540, representing a local target.

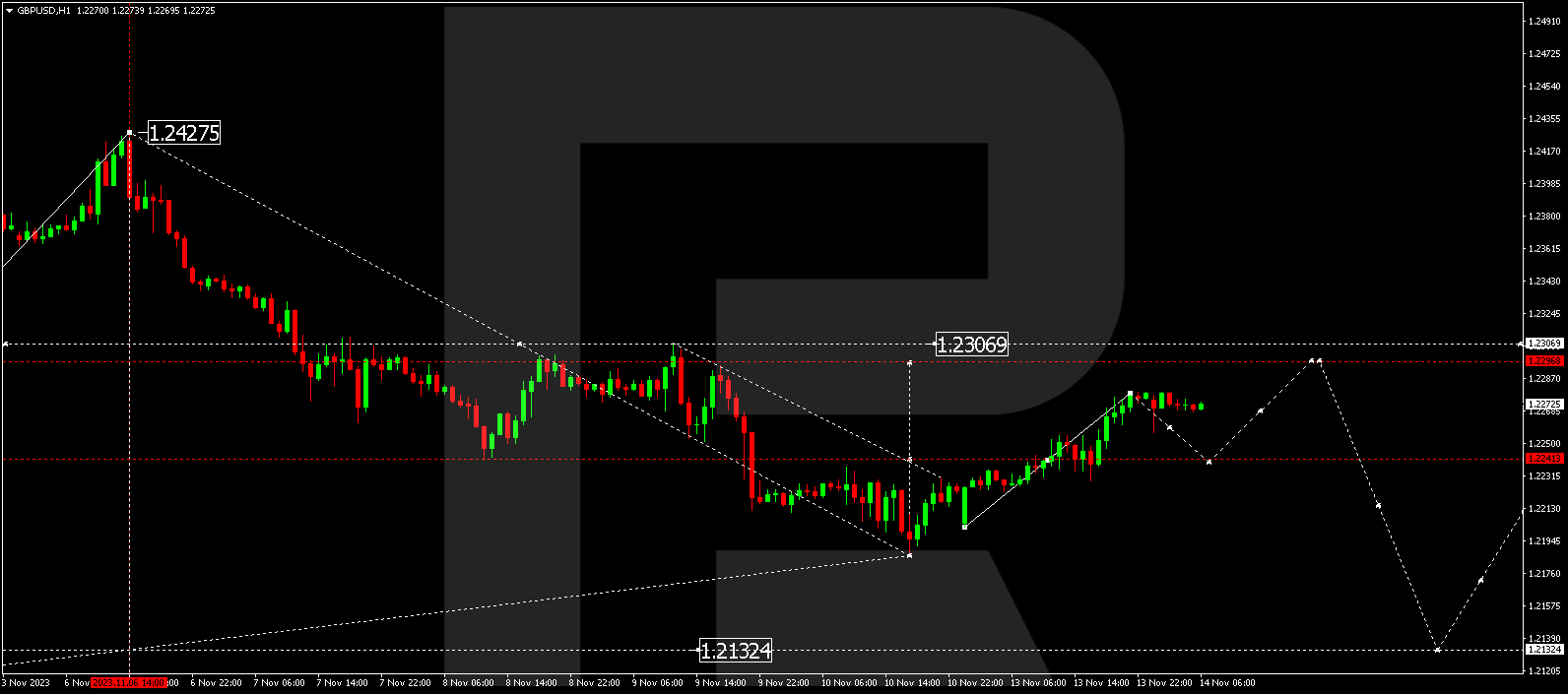

GBP/USD (Great Britain Pound vs US Dollar)

GBP/USD has established a consolidation range around 1.2242. Breaking above, the pair extends correction to 1.2297. Post-correction, a decline to 1.2133 might commence, marking a local target.

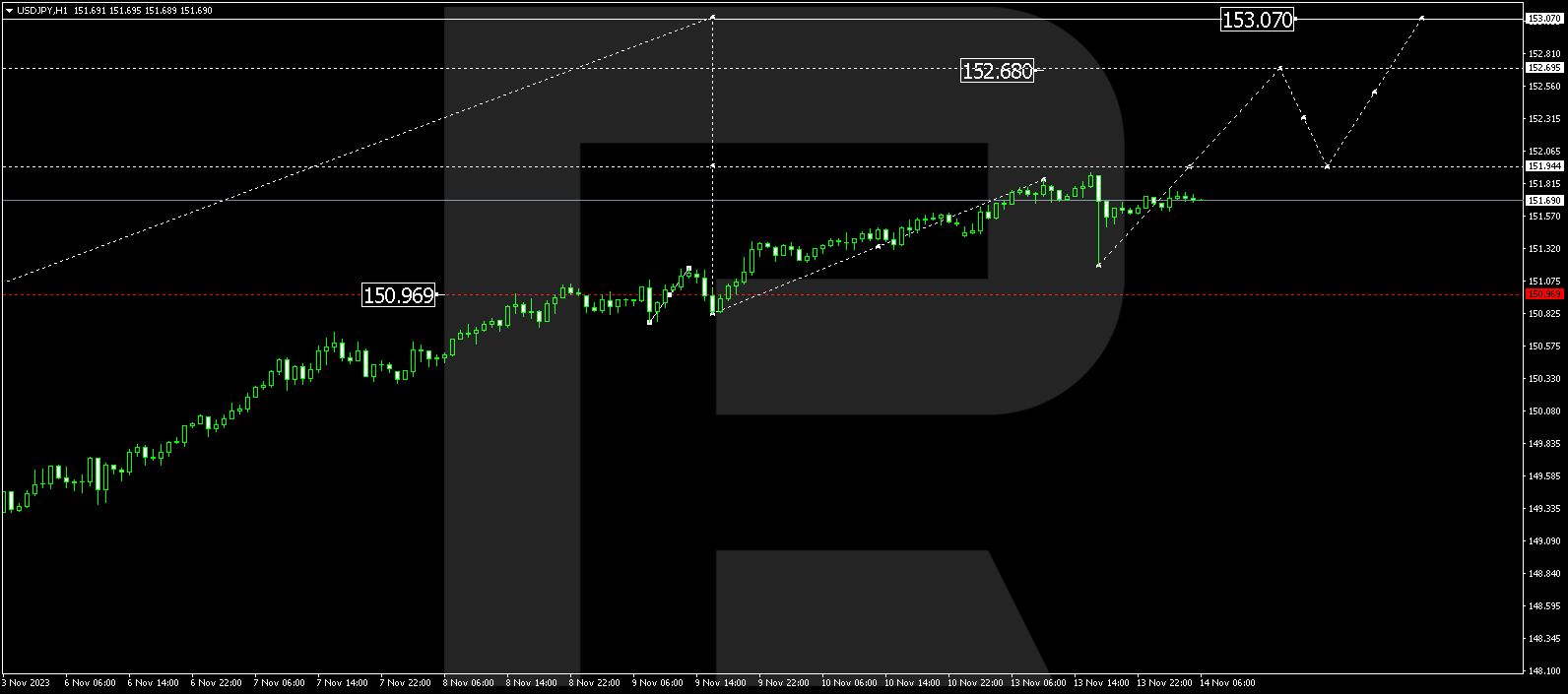

USD/JPY (US Dollar vs Japanese Yen)

USD/JPY completed a growth wave to 151.90 and a correction to 151.20. The market is currently in a rising movement to 151.95, potentially continuing to 152.69. After reaching this level, a corrective phase to 150.95 may ensue, followed by a rise to 153.07.

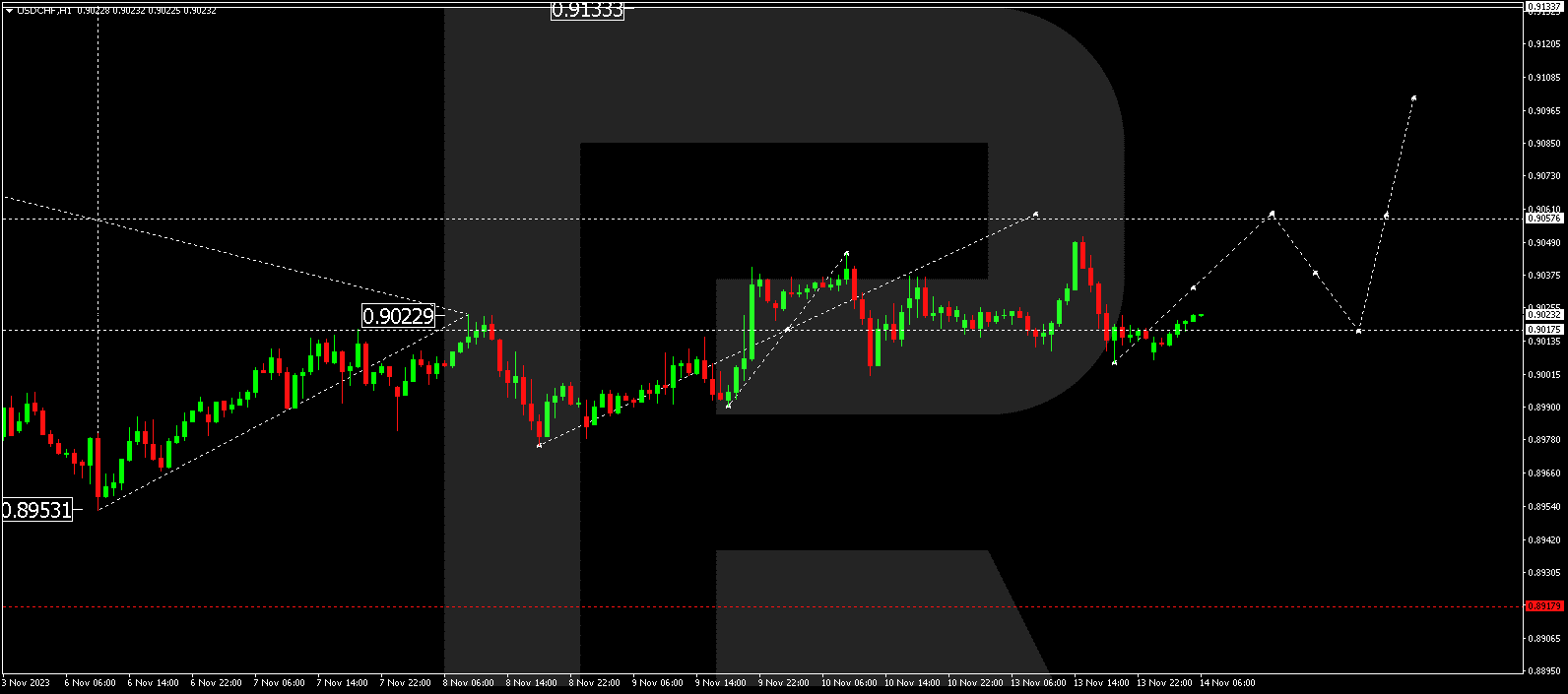

USD/CHF (US Dollar vs Swiss Franc)

USD/CHF is consolidating around 0.9017 without a strong trend. A potential extension to 0.9057 is possible today. A breakout upward may open the path for a rise to 0.9100, representing a local target.

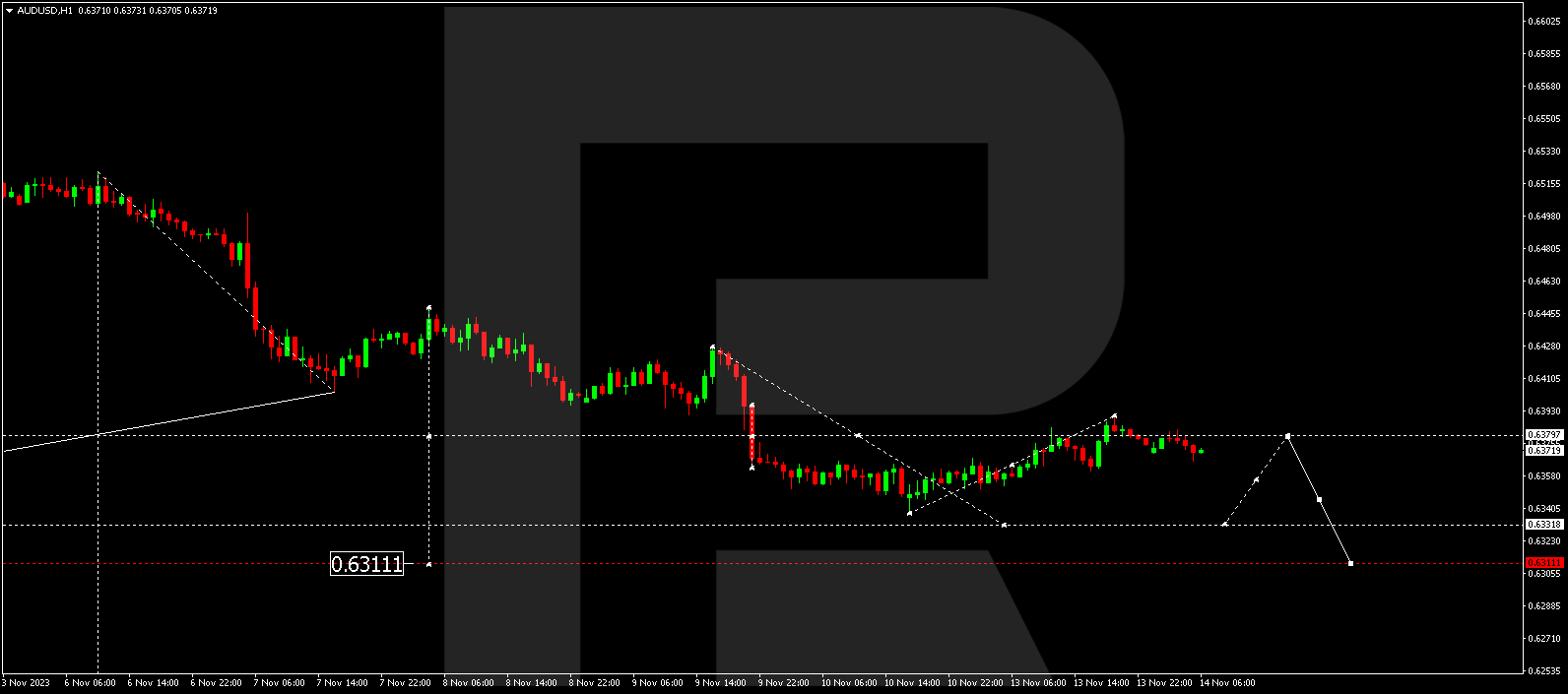

AUD/USD (Australian Dollar vs US Dollar)

AUD/USD has concluded a correction to 0.6390. Anticipate a new decline wave to 0.6332 today, with the potential for extension to 0.6311 as a local target.

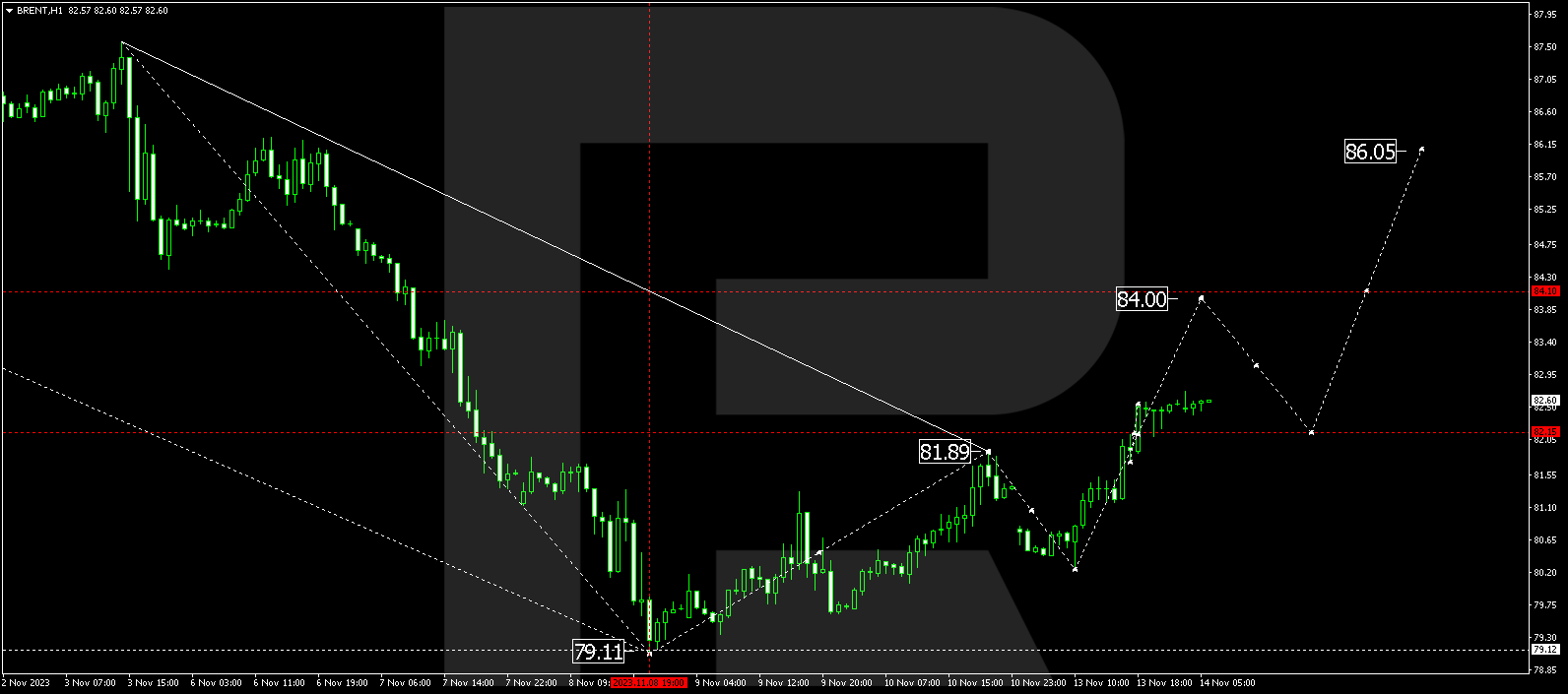

BRENT

Brent completed a growth wave to 82.15. Currently in a consolidation range, an upward breakout may lead to a rising wave to 84.10, and further to 86.05 as a local target.

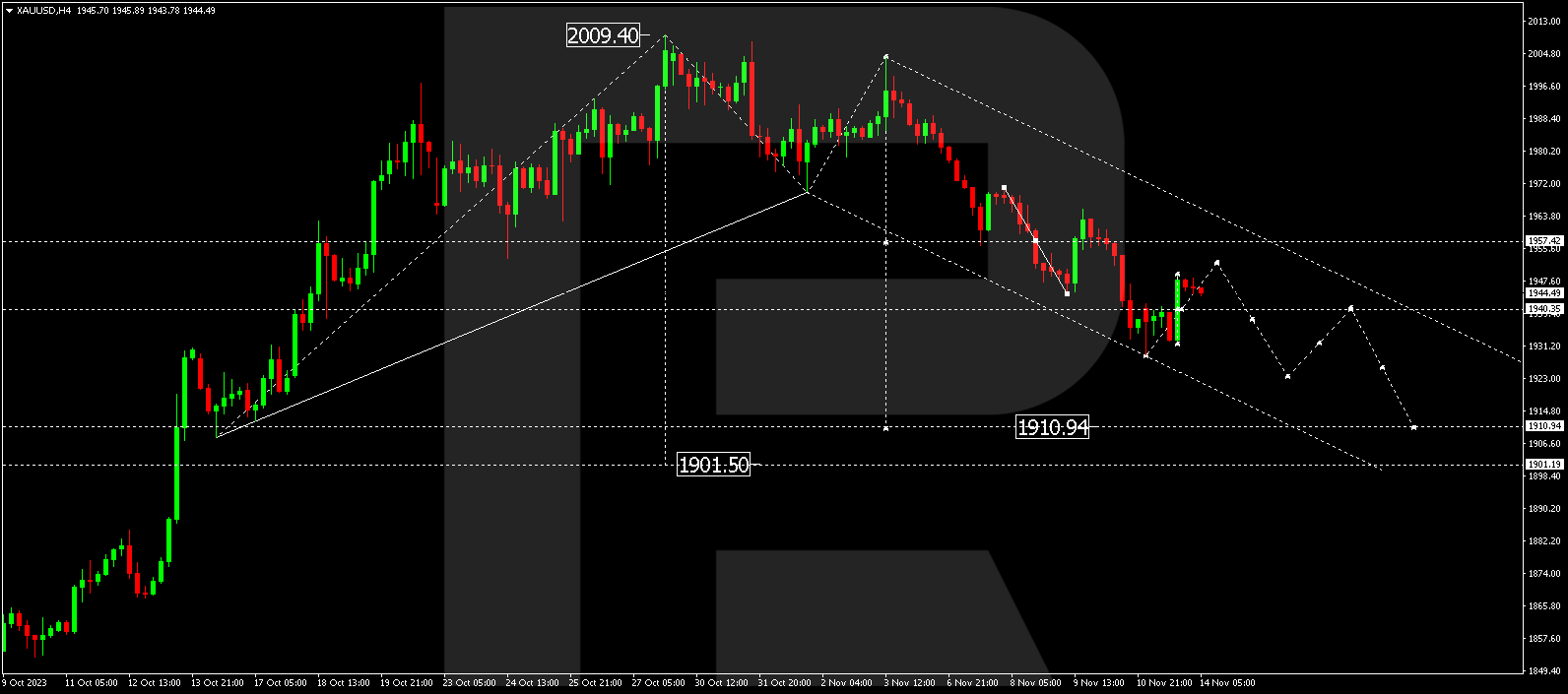

XAU/USD (Gold vs US Dollar)

Gold is within a consolidation range around 1940.35. A potential extension to 1951.88 exists. Subsequently, a decline to 1924.00 may occur, continuing to 1910.90 as a local target.

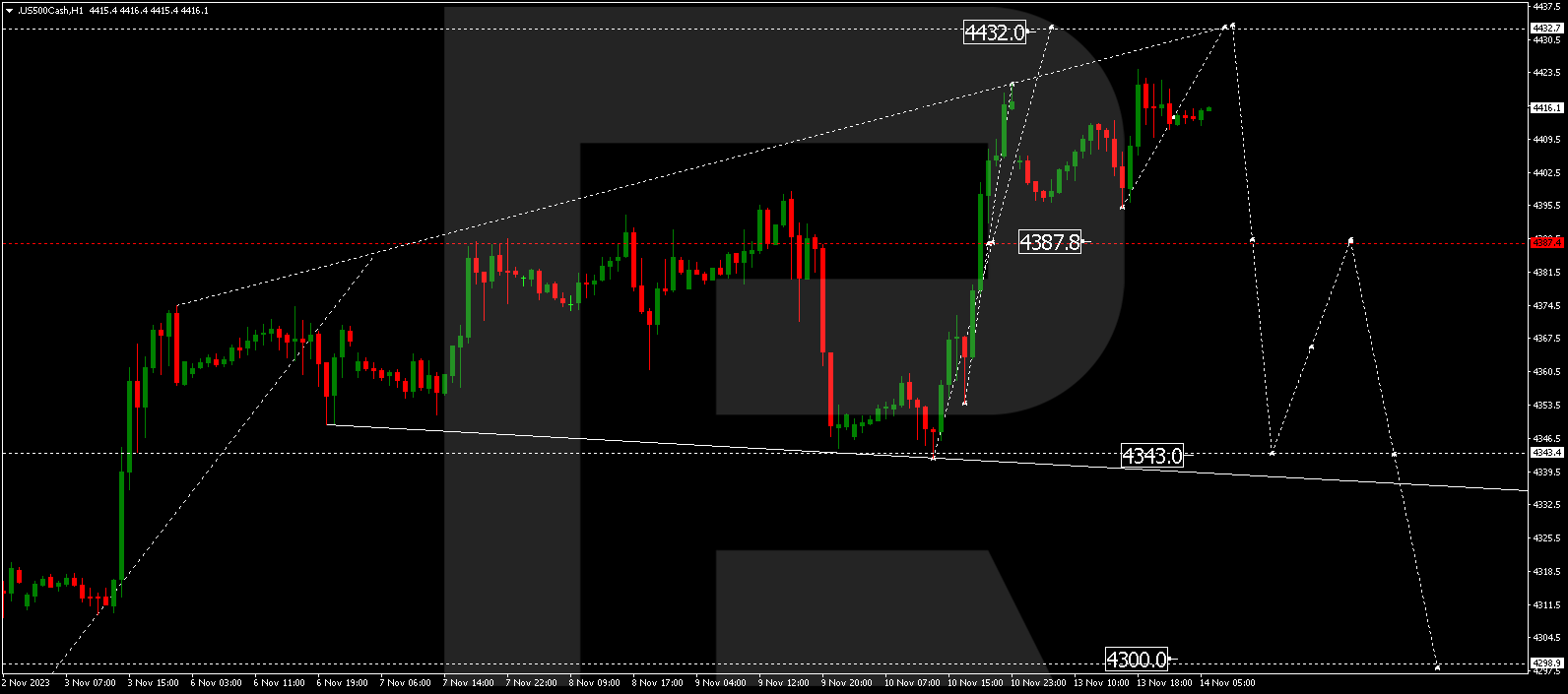

S&P 500

The stock index has formed a consolidation range around 4414.0. Potential extension to 4432.0 is on the horizon. After reaching this level, a declining wave to 4343.0 might commence, marking the first target.

The post Technical Analysis & Forecast November 14, 2023 appeared first at R Blog – RoboForex.