CHF Initiates a New Growth Phase. This overview also outlines the dynamics of EUR, GBP, JPY, AUD, Brent, Gold, and the S&P 500 index.

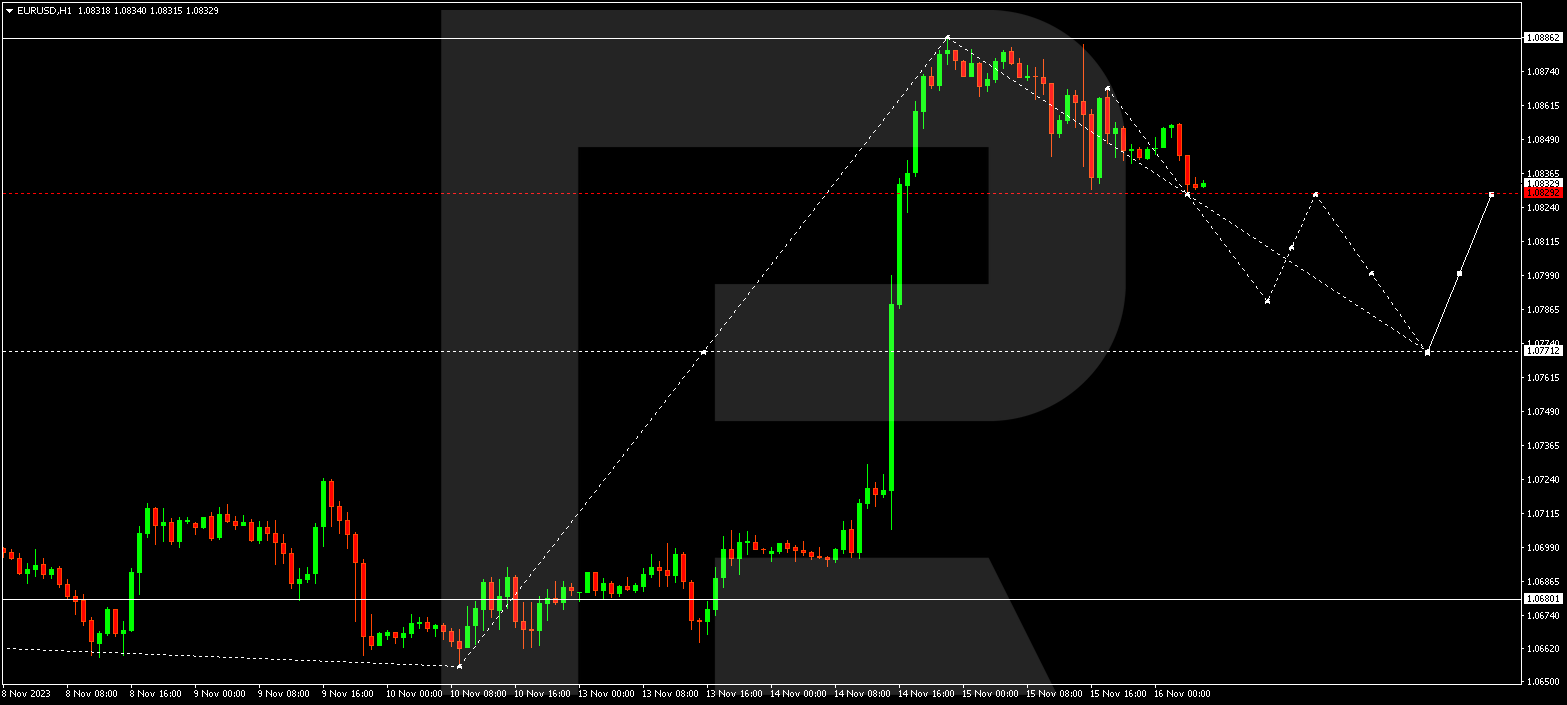

EUR/USD (Euro vs US Dollar)

The EUR/USD pair concluded a downward momentum at 1.0860, followed by a correction to 1.0868. Presently, the market is navigating within a descending wave towards 1.0790. Following this level, a potential upswing to 1.0829 is plausible (with a test from below). Subsequently, a decline to 1.0770 may ensue. This is the initial target.

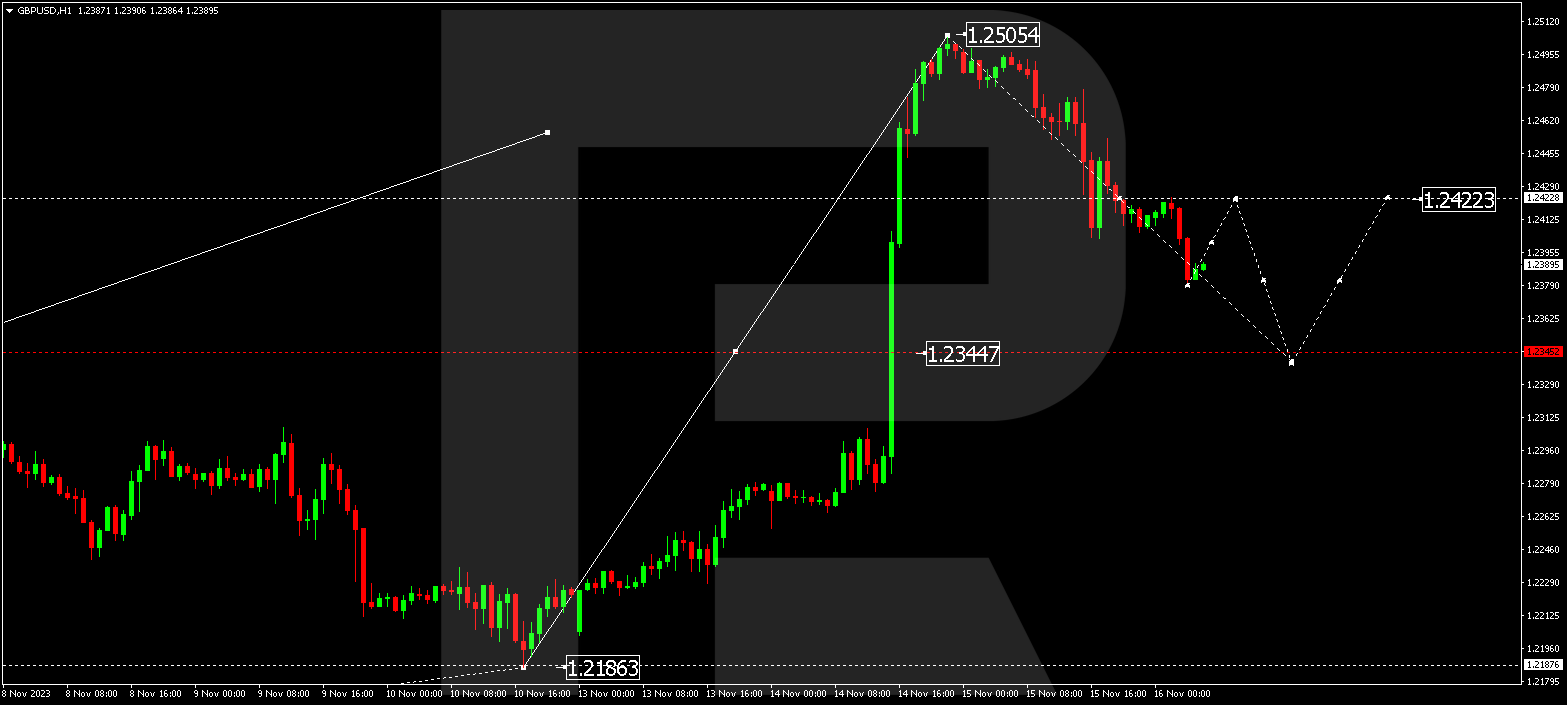

GBP/USD (Great Britain Pound vs US Dollar)

The GBP/USD pair wrapped up a declining momentum at 1.2424. Currently, a consolidation range has taken shape around this level. In the event of a downward breakout, the trend might extend to 1.2345. This is the preliminary target.

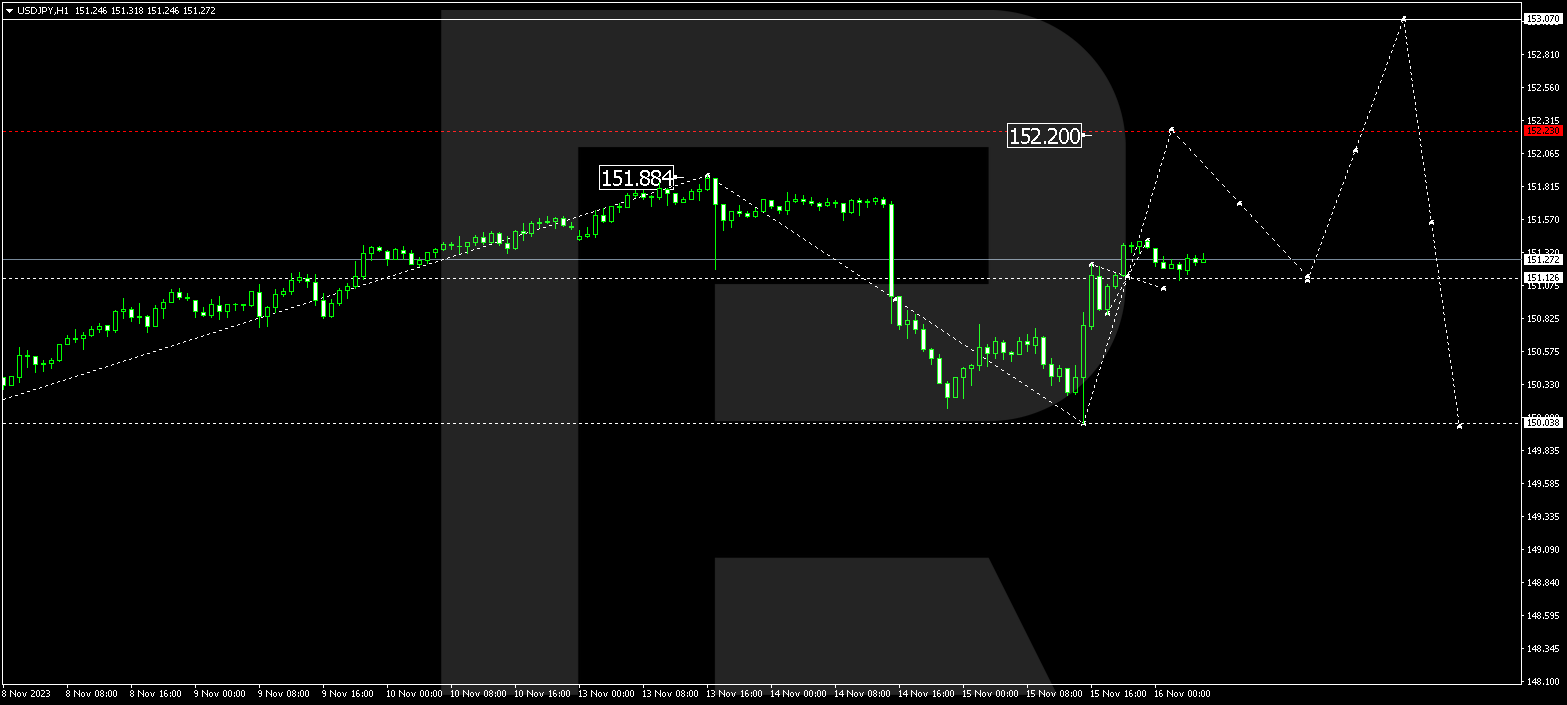

USD/JPY (US Dollar vs Japanese Yen)

USD/JPY completed a descending wave to 150.04, followed by an upward momentum to 151.23 today. At present, a consolidation range is shaping up around this level. A breakout to the upside could open the door to a rising wave towards 152.20.

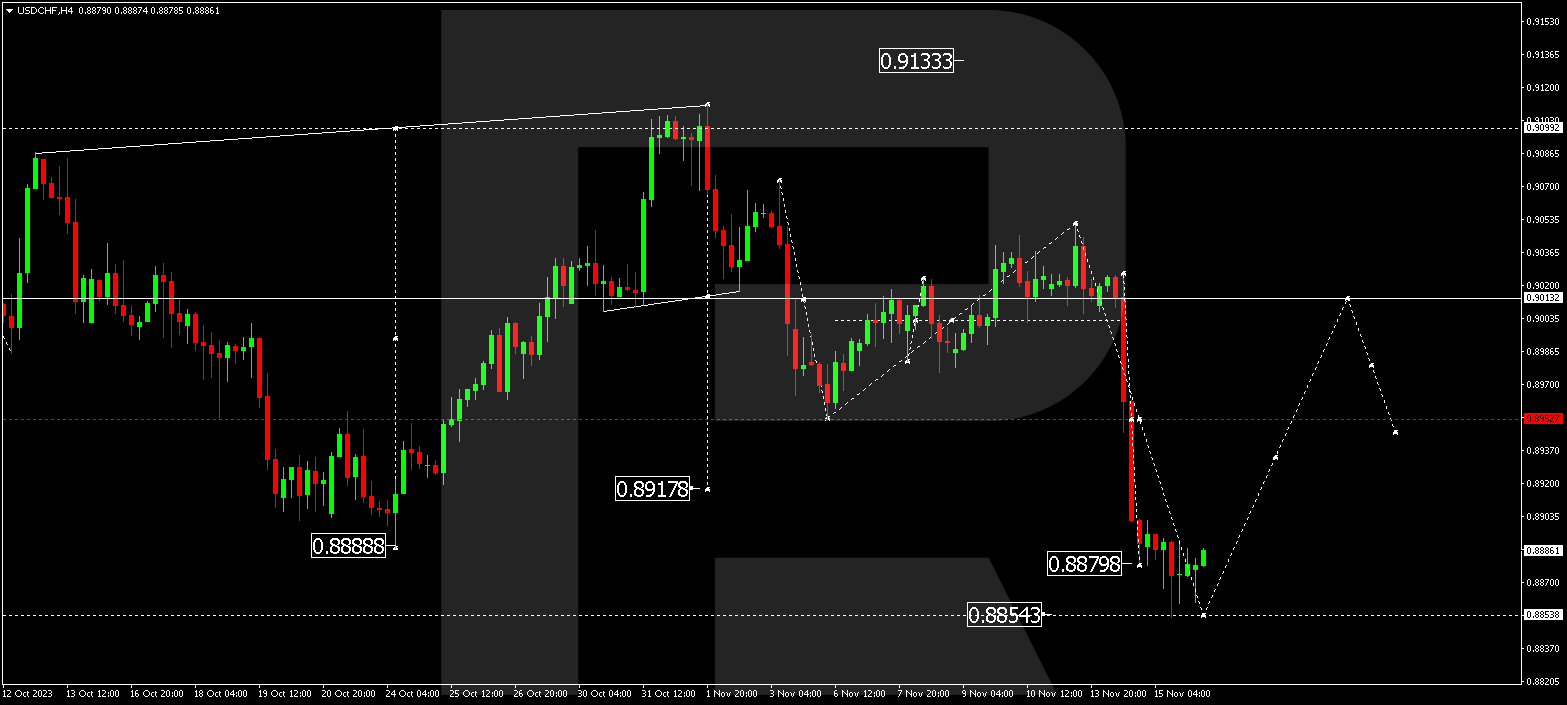

USD/CHF (US Dollar vs Swiss Franc)

USD/CHF concluded a downward wave at 0.8855. Presently, the market is establishing a consolidation range above this level. An upward breakout from the range, extending the wave to 0.9013, is anticipated. This marks the first target.

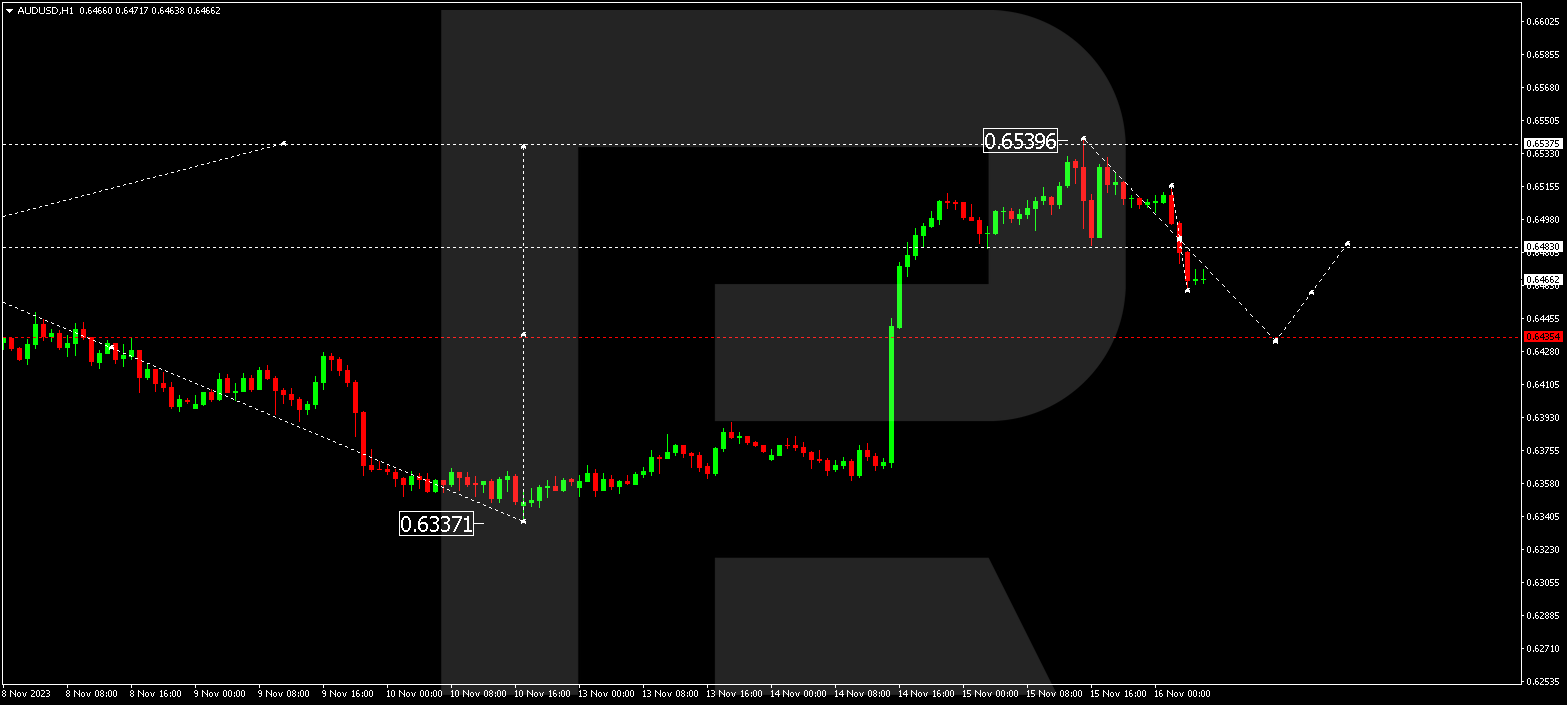

AUD/USD (Australian Dollar vs US Dollar)

AUD/USD completed a downward momentum to 0.6484 and a correction to 0.6530. Today, the market is extending the descending wave to 0.6433. Subsequently, a corrective phase to 0.6480 is plausible.

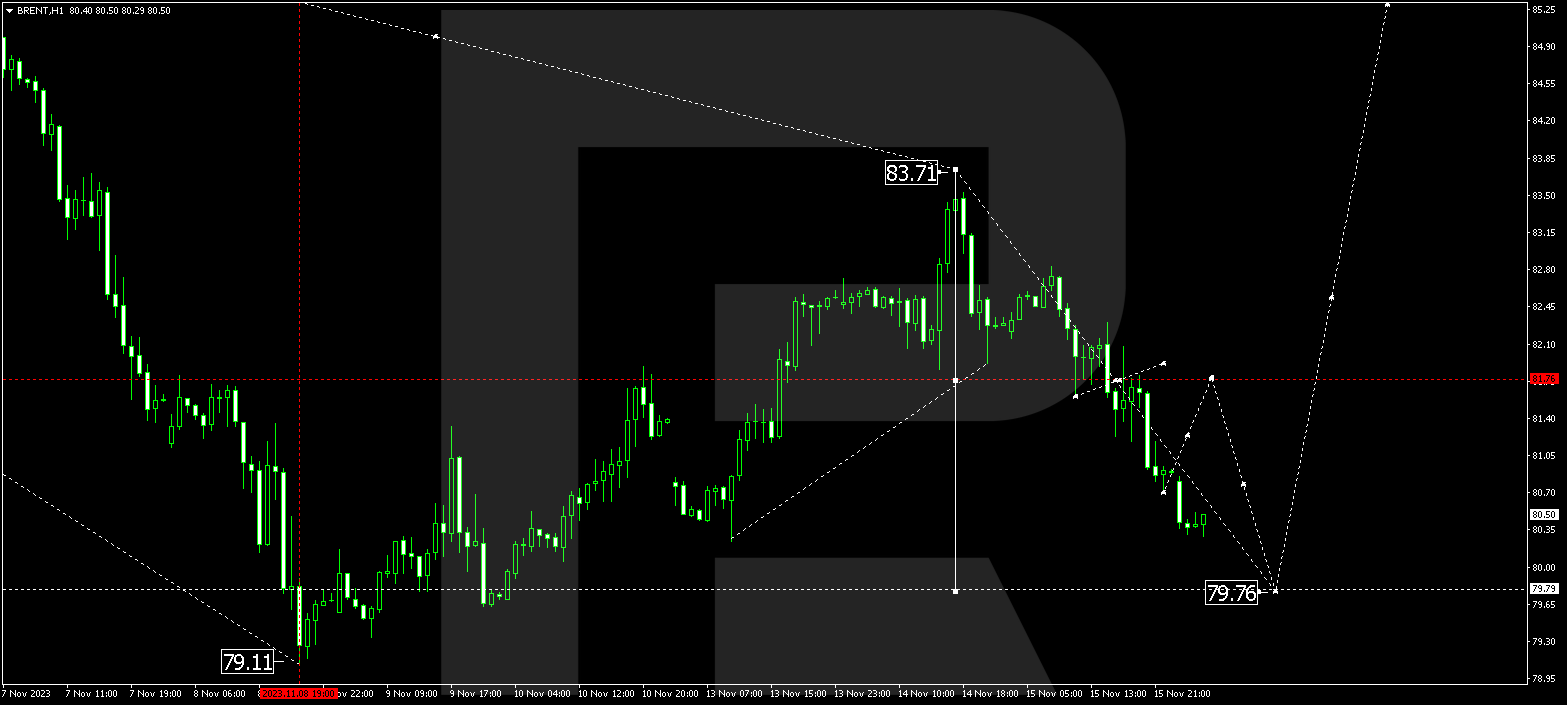

BRENT

Brent finalized a consolidation range around 81.77 and is extending a downward wave to 79.79 with a breakout from the range downwards. After reaching this level, a new upward wave to 83.70 may commence, leading to a potential continuation to 85.33. This is a local target.

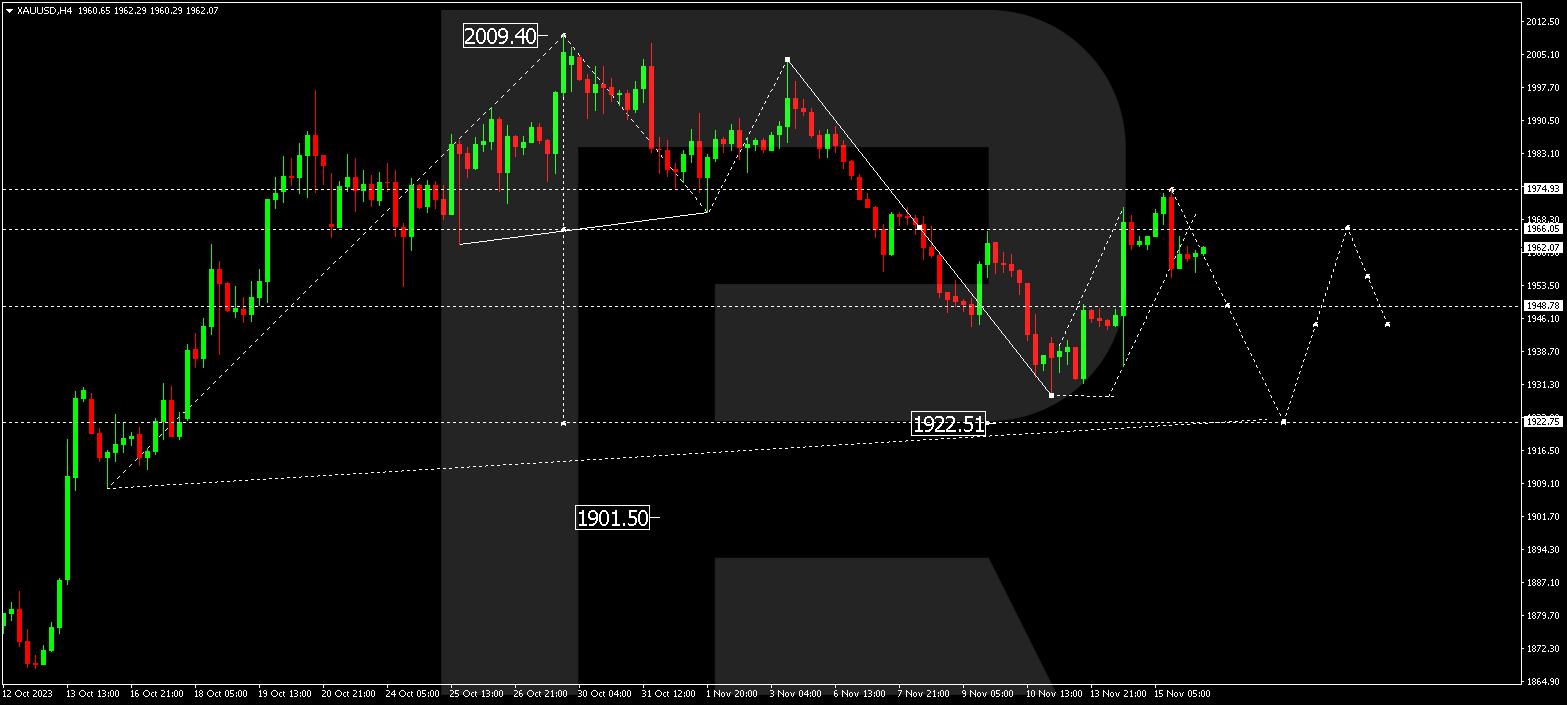

XAU/USD (Gold vs US Dollar)

Gold initiated a downward momentum to 1955.40. A correction to 1966.00 is plausible. Next, an anticipated downward wave to 1948.00 may occur, paving the way for a potential continuation to 1922.75.

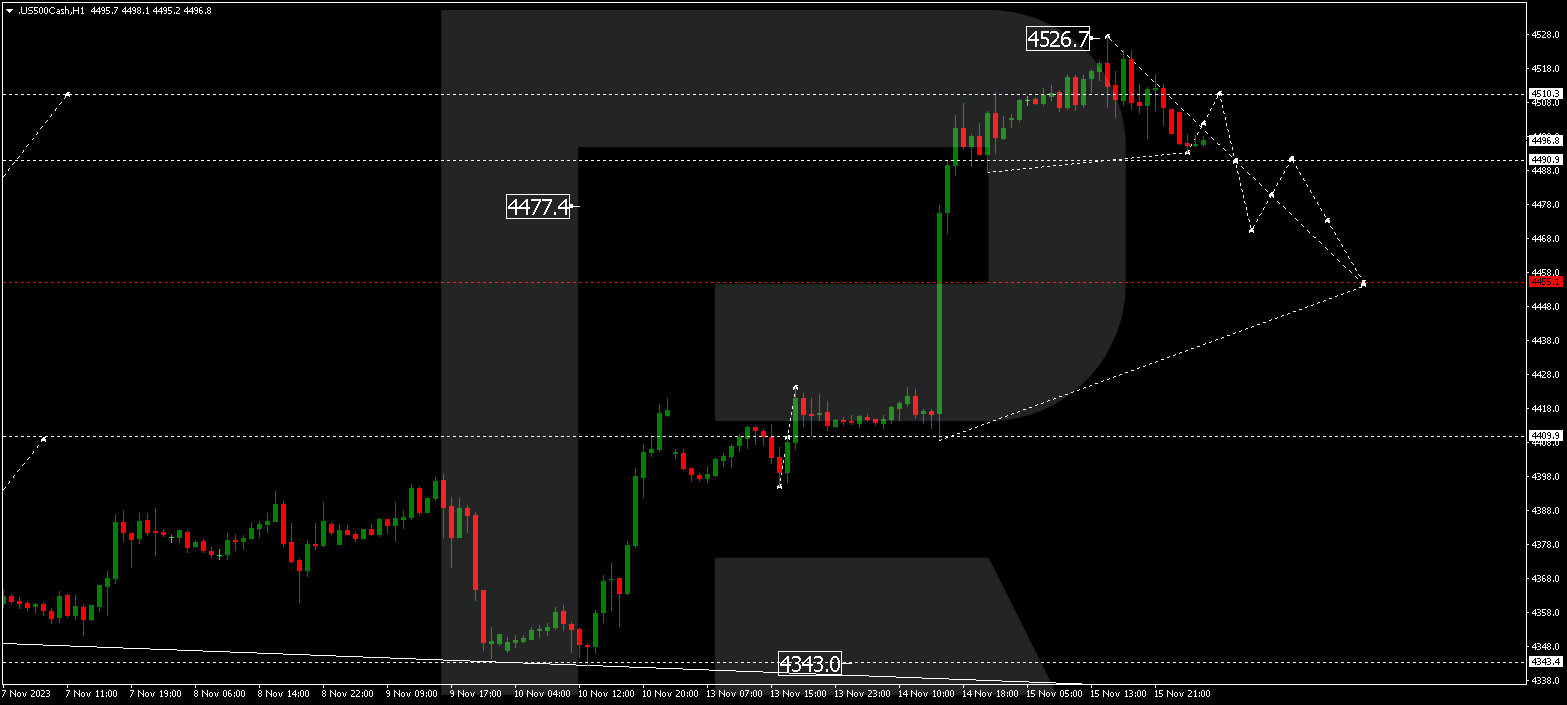

S&P 500

The stock index formed a downward momentum to 4499.0. Today, a corrective phase to 4510.0 is expected. Following this, a new downward movement to 4470.0 may transpire, setting the stage for a potential continuation to 4455.0. This represents the initial target.

The post Technical Analysis & Forecast November 16, 2023 appeared first at R Blog – RoboForex.