CHF Poised for a Potential New Low. This overview encompasses the dynamics of EUR, GBP, JPY, AUD, Brent, Gold, and the S&P 500 index.

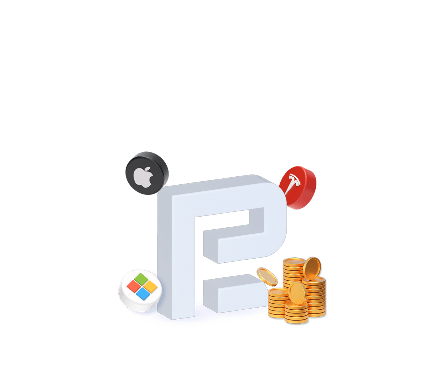

EUR/USD (Euro vs US Dollar)

EUR/USD is currently shaping a downward wave, targeting 1.0894 today. Following this level, a potential upward move to 1.0929 could unfold within a wide consolidation range. The market might attempt to expand the range to 1.0990 before retracing to its lower boundary at 1.0824. This sets the stage for the initial target.

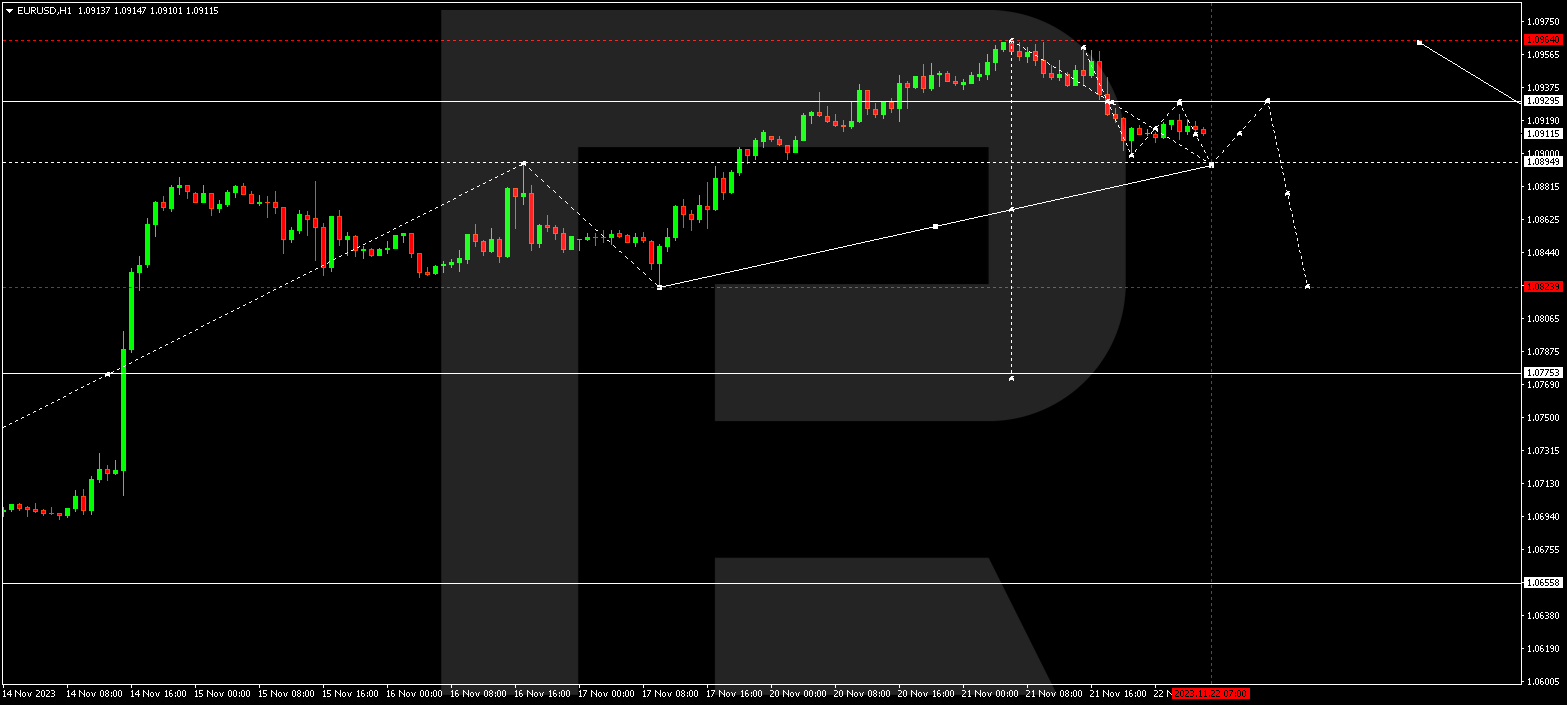

GBP/USD (Great Britain Pound vs US Dollar)

GBP/USD has expanded its consolidation range to 1.2555. Today, a decline to 1.2480 is anticipated, followed by a potential upswing to 1.2582. Upon reaching this level, a downward wave to 1.2374 might initiate, representing the first target.

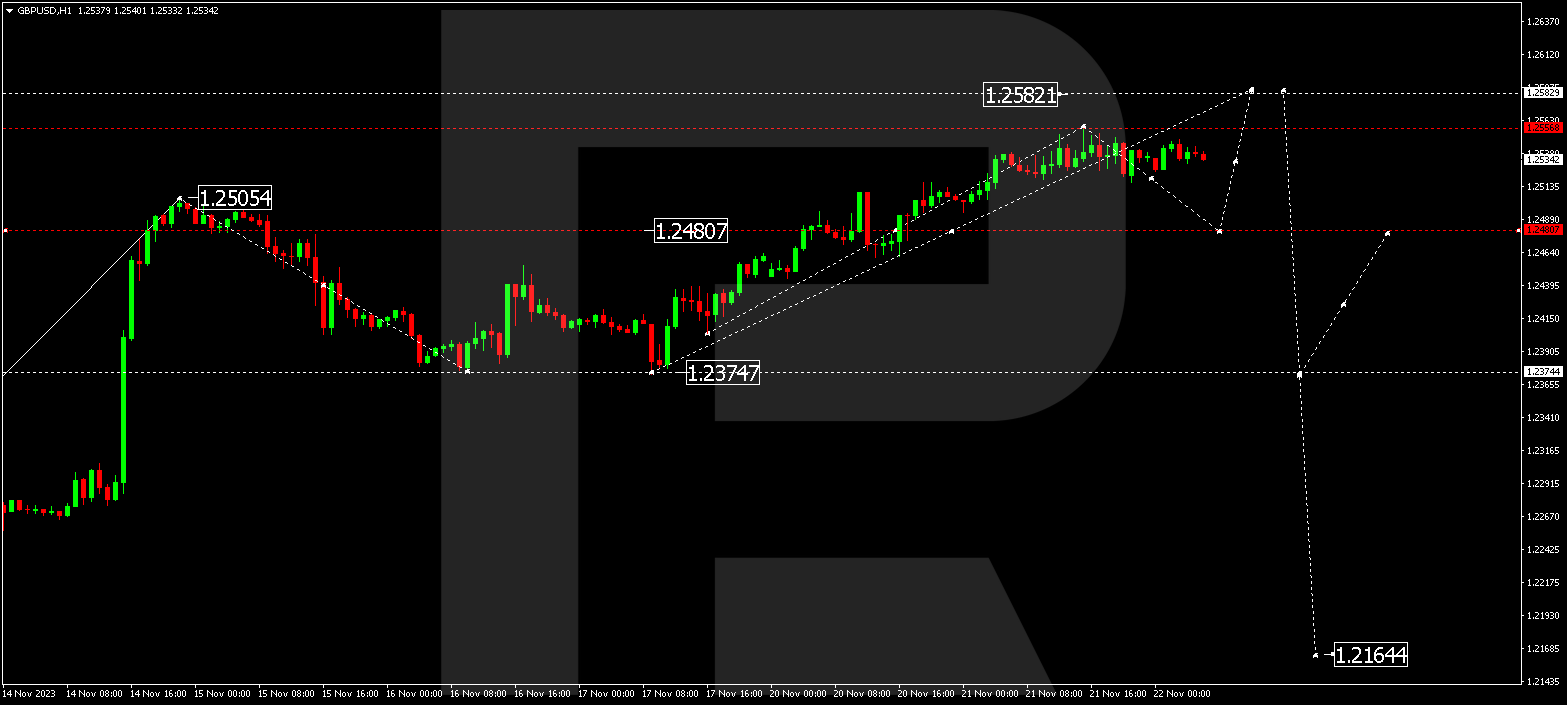

USD/JPY (US Dollar vs Japanese Yen)

USD/JPY is progressing within an ascending wave towards 148.67. Subsequently, the quotes may dip to 148.02 before rebounding to 148.88, constituting the initial target. Following this, a corrective phase is expected, paving the way for an ascent to 150.40, marking a local target.

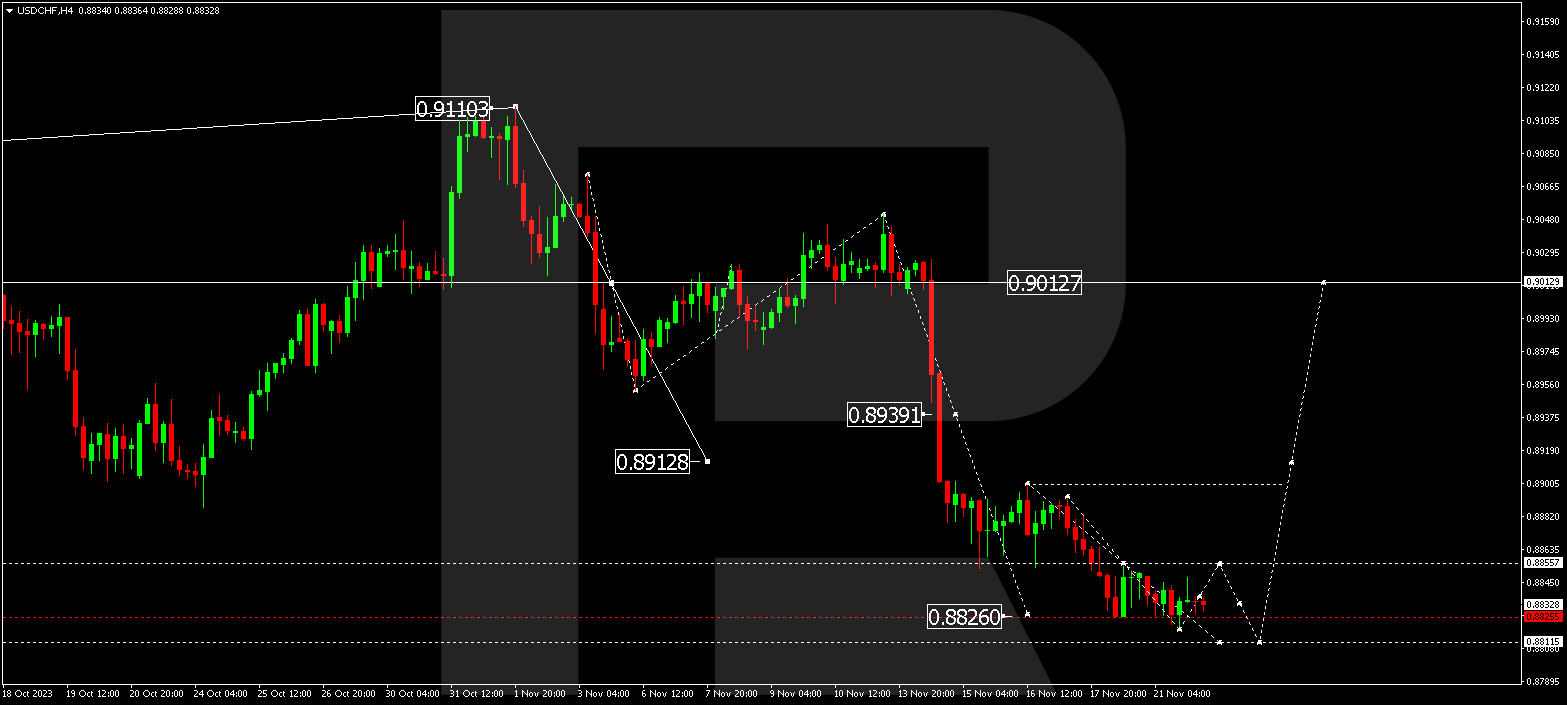

USD/CHF (US Dollar vs Swiss Franc)

USD/CHF has extended its consolidation range to the downside, reaching 0.8819. Anticipate an upswing to 0.8855 today, with the possibility of another downward link to 0.8811. Upon reaching this level, a growth wave to 0.8910 could commence, presenting the first target.

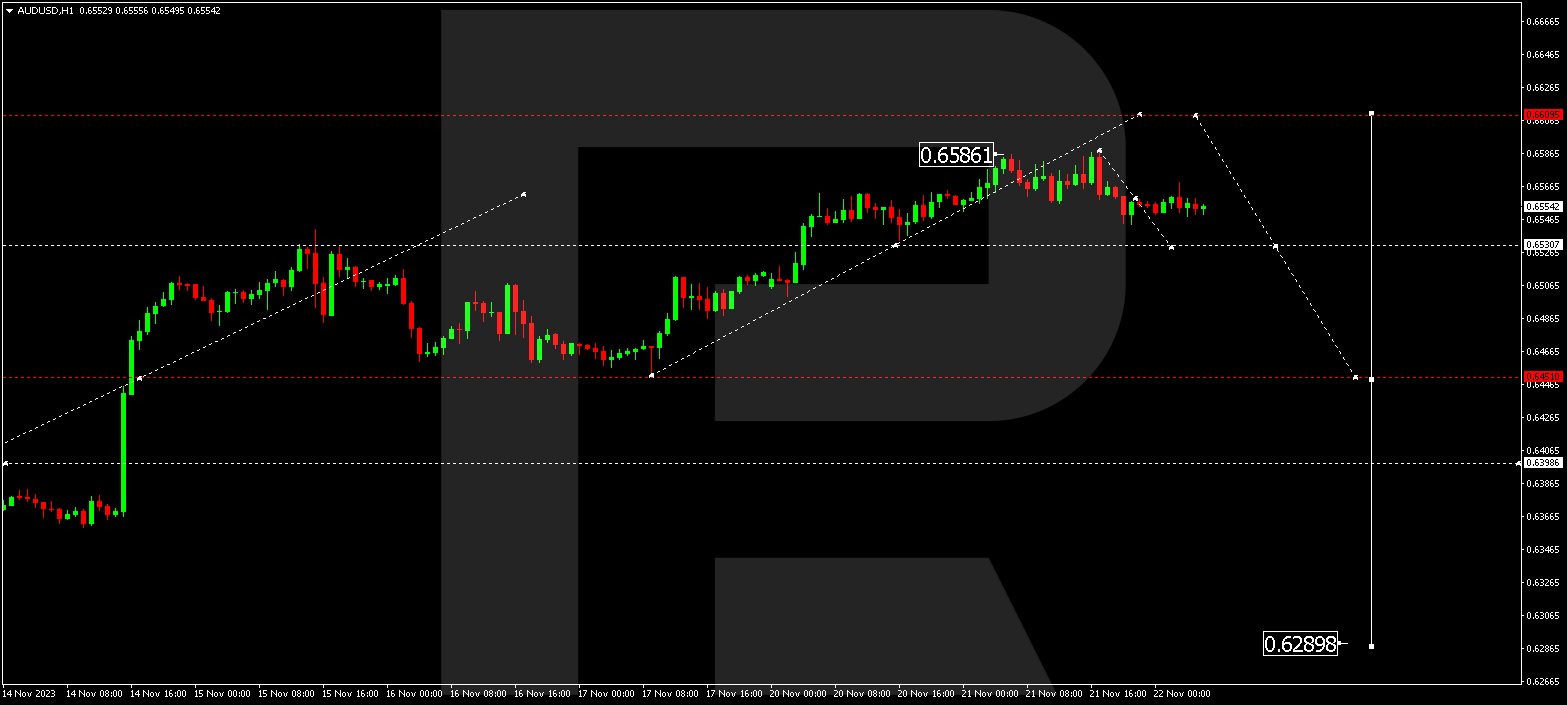

AUD/USD (Australian Dollar vs US Dollar)

AUD/USD is tracing a descent to 0.6530, followed by a potential surge surpassing the current peak of 0.6609. After reaching this level, a new downward wave to 0.6530 is expected. A break below this level opens the potential for a decline to 0.6450, signifying the initial target.

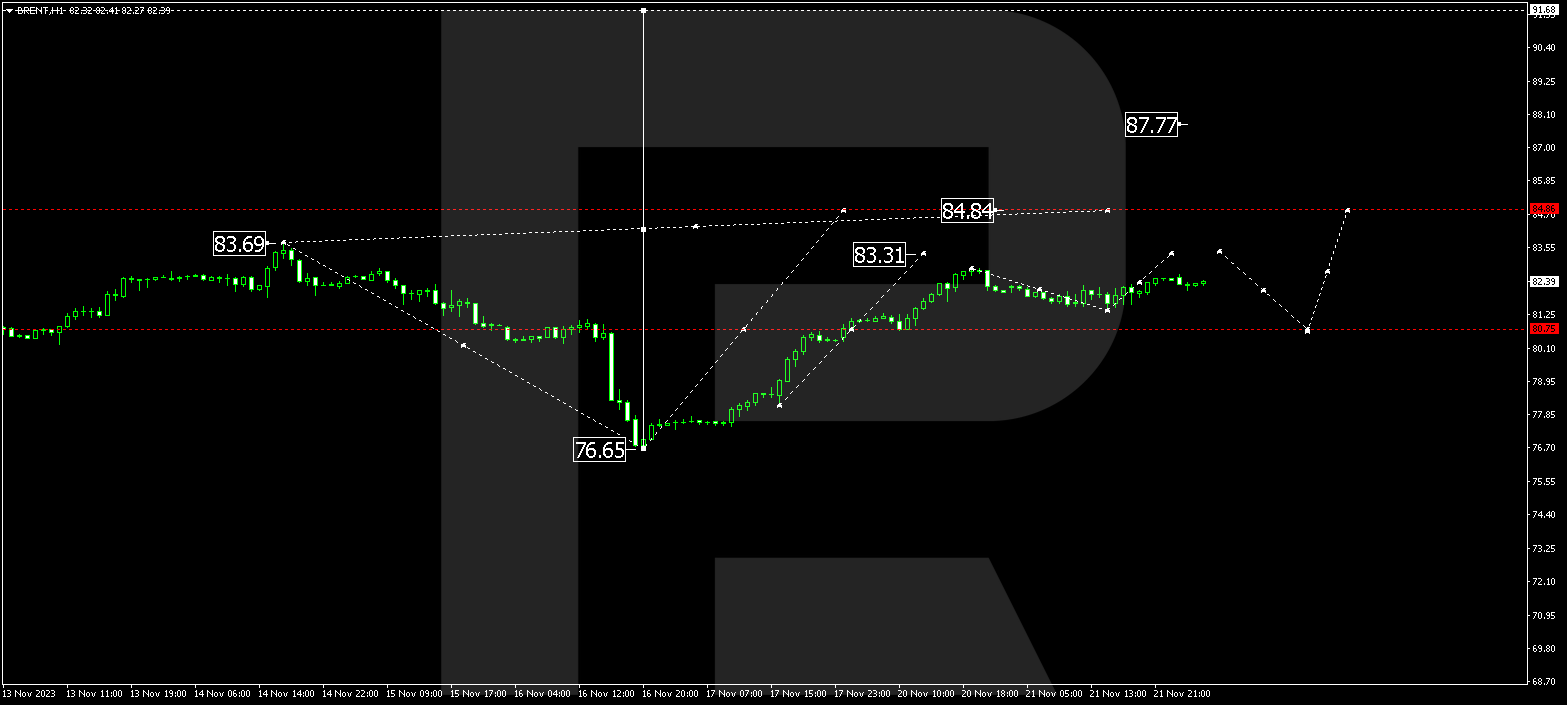

BRENT

Brent has undergone a correction to 81.41. Today, the market is generating an upward wave to 83.33, with further momentum to 84.84 expected. This marks the first target. Another correction to 80.75 is plausible. After this correction concludes, a fresh upward wave to 87.77 might commence, representing a local target.

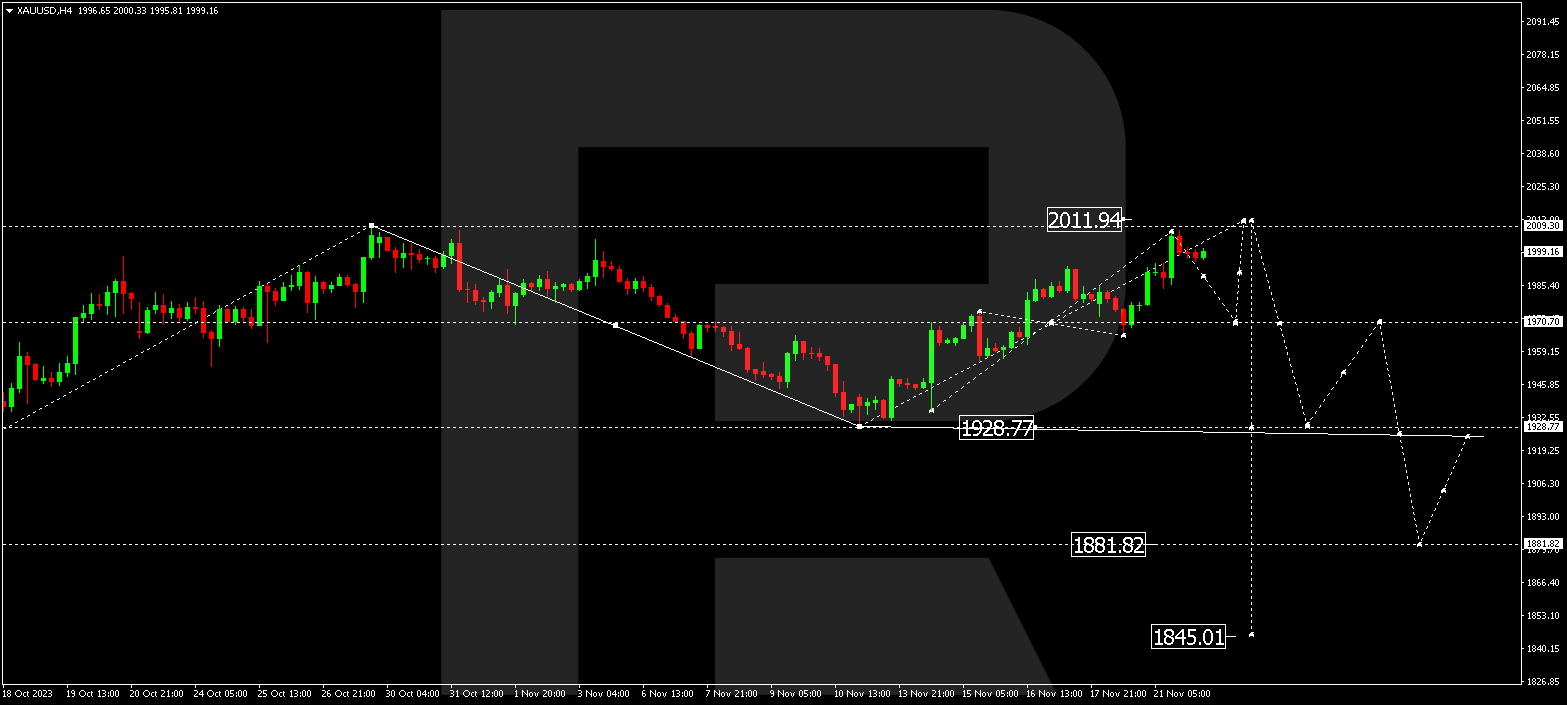

XAU/USD (Gold vs US Dollar)

Gold is ensconced in a broad consolidation range around 1970.00, recently expanding upwards to 2007.55. Today, a descent to 1970.00 is projected, followed by another upward move to 2012.00. Post this peak, a new downward wave to 1929.00 is envisaged, signifying the initial target.

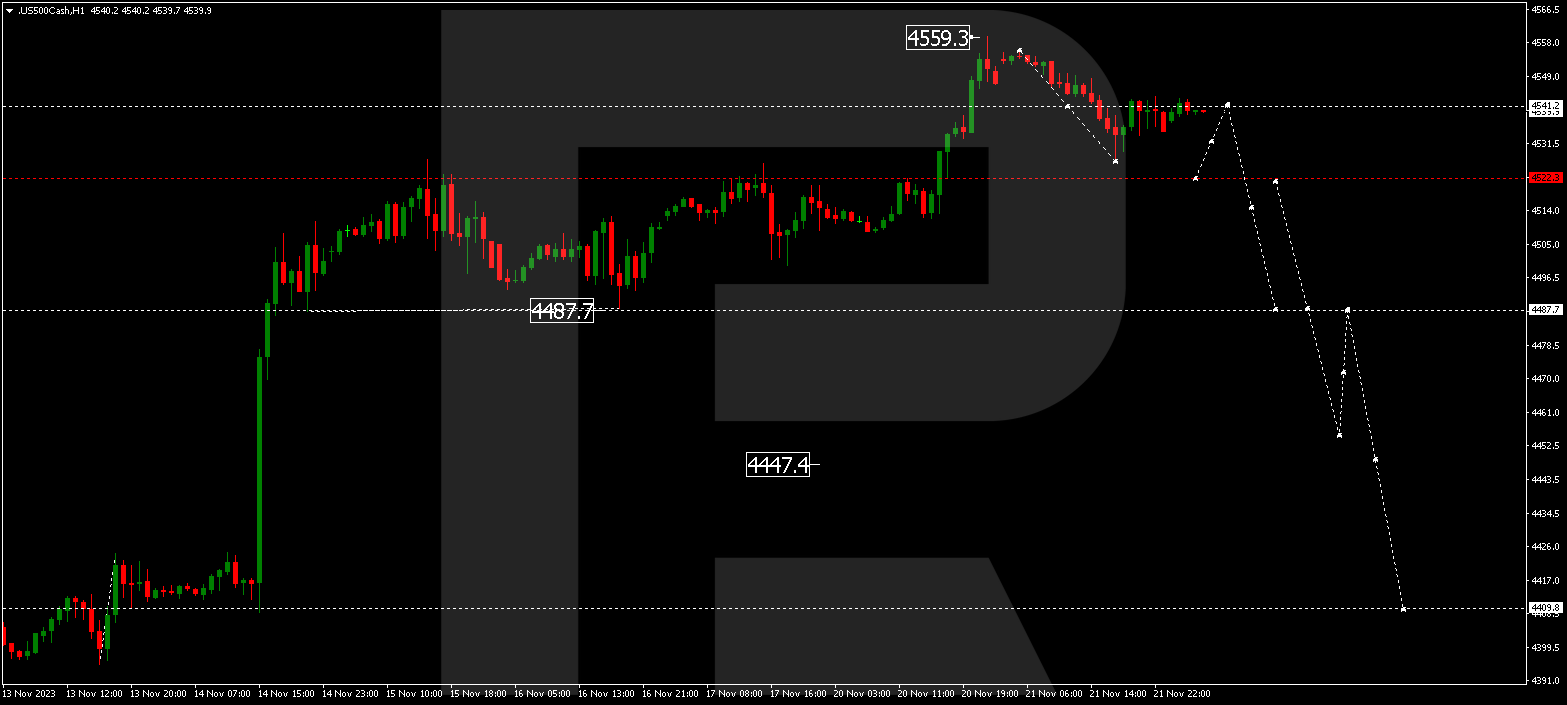

S&P 500

The stock index has reached the extension target within the range at 4559.4. Today, a descent to 4522.3 is in progress. Expect a rebound to 4541.0 (a test from below). A wide range is forming around 4541.0, with another upswing to 4560.0 plausible. Following this, a new downward wave to 4487.0 might commence, marking the initial target.

The post Technical Analysis & Forecast November 22, 2023 appeared first at R Blog – RoboForex.