Gold Consolidates Ahead of Decline. The following also outlines the dynamics of EUR, GBP, JPY, CHF, AUD, Brent, and the S&P 500 index.

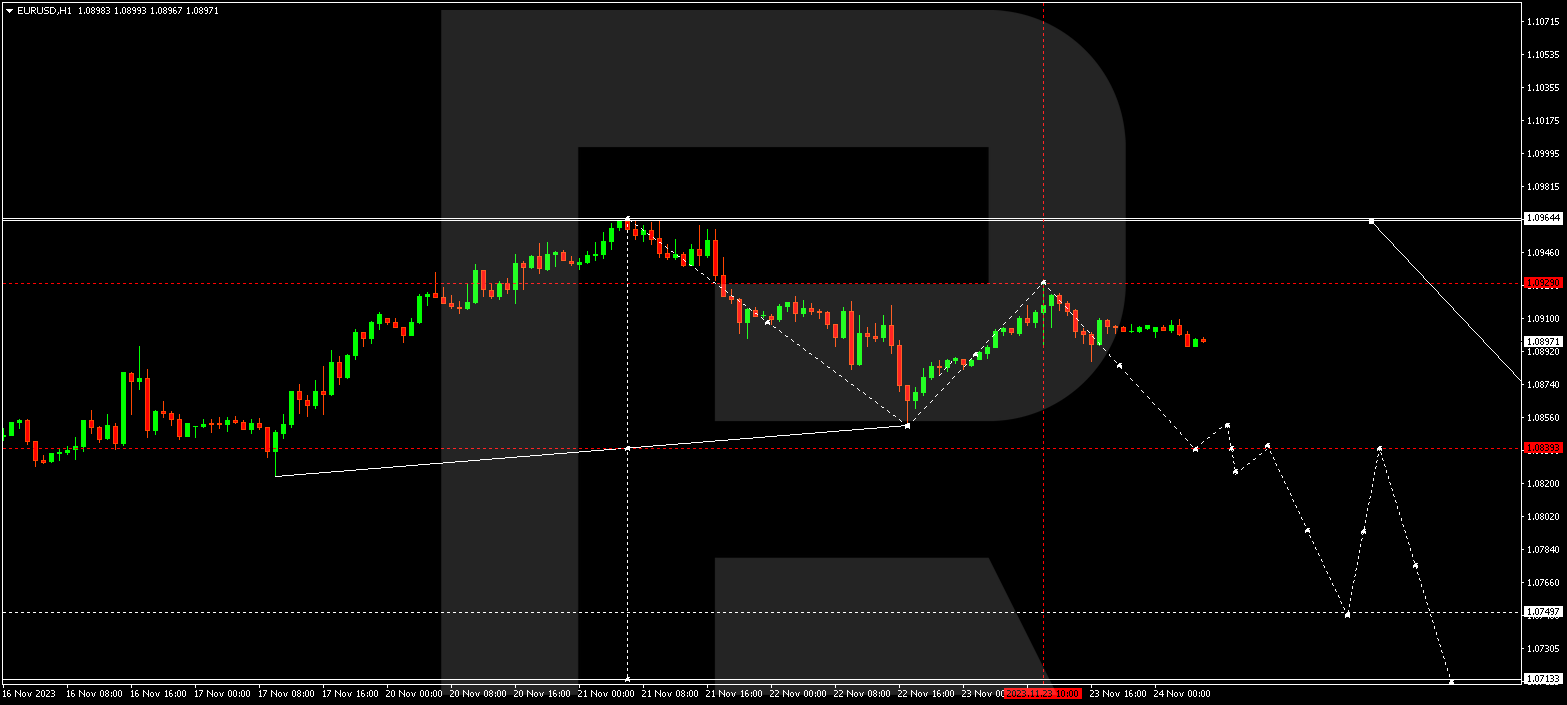

EUR/USD (Euro vs US Dollar)

EUR/USD concluded a corrective wave at 1.0929. Today, a downward trend to 1.0880 is emerging, forming a consolidation range around this level. A breakout downward could extend the decline to 1.0840, and if breached, open the potential for a wave to 1.0750. This is a local target.

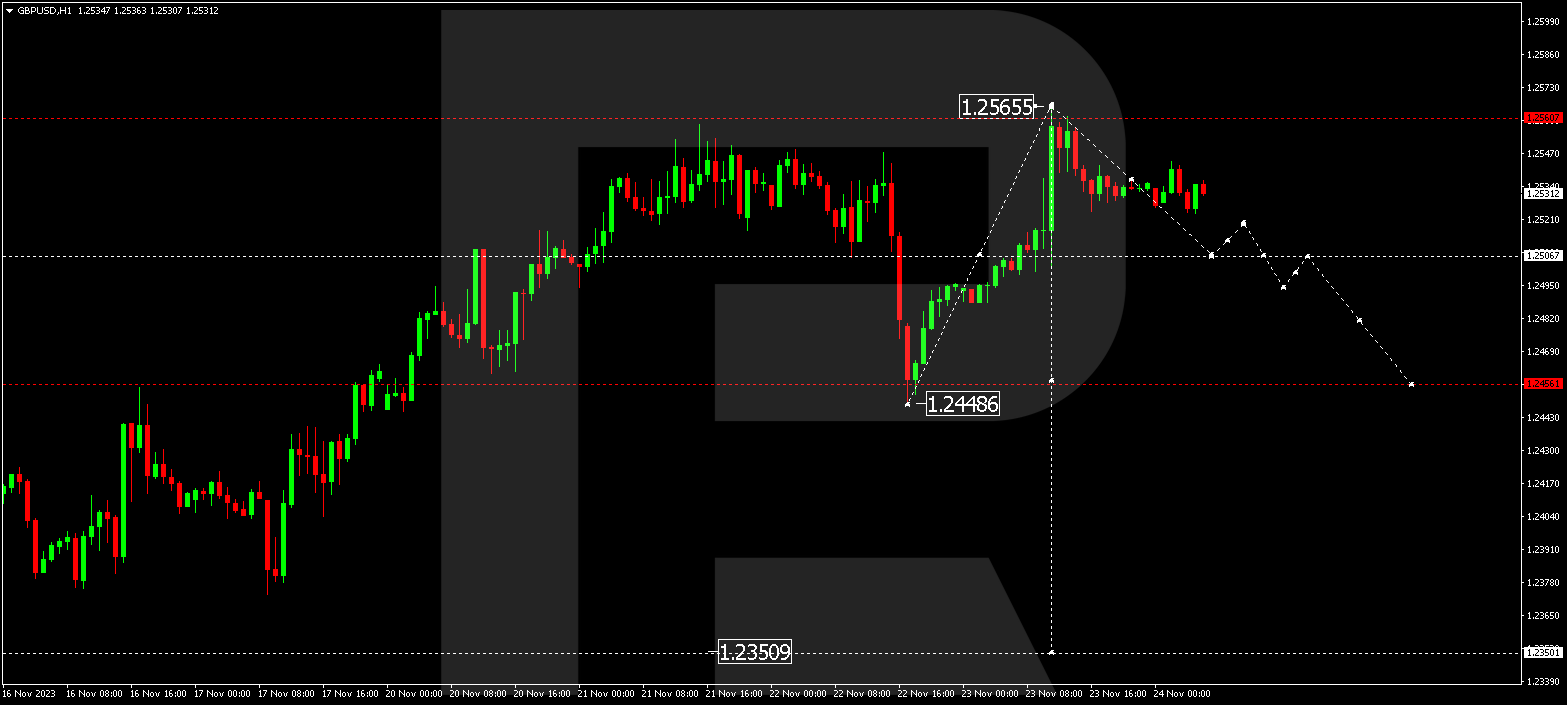

GBP/USD (Great Britain Pound vs US Dollar)

GBP/USD is in the process of forming an extensive consolidation range around 1.2505, currently extending to 1.2560. A downward structure is shaping up towards 1.2505. If the range breaks downward, the wave might continue to 1.2456. This is the first target.

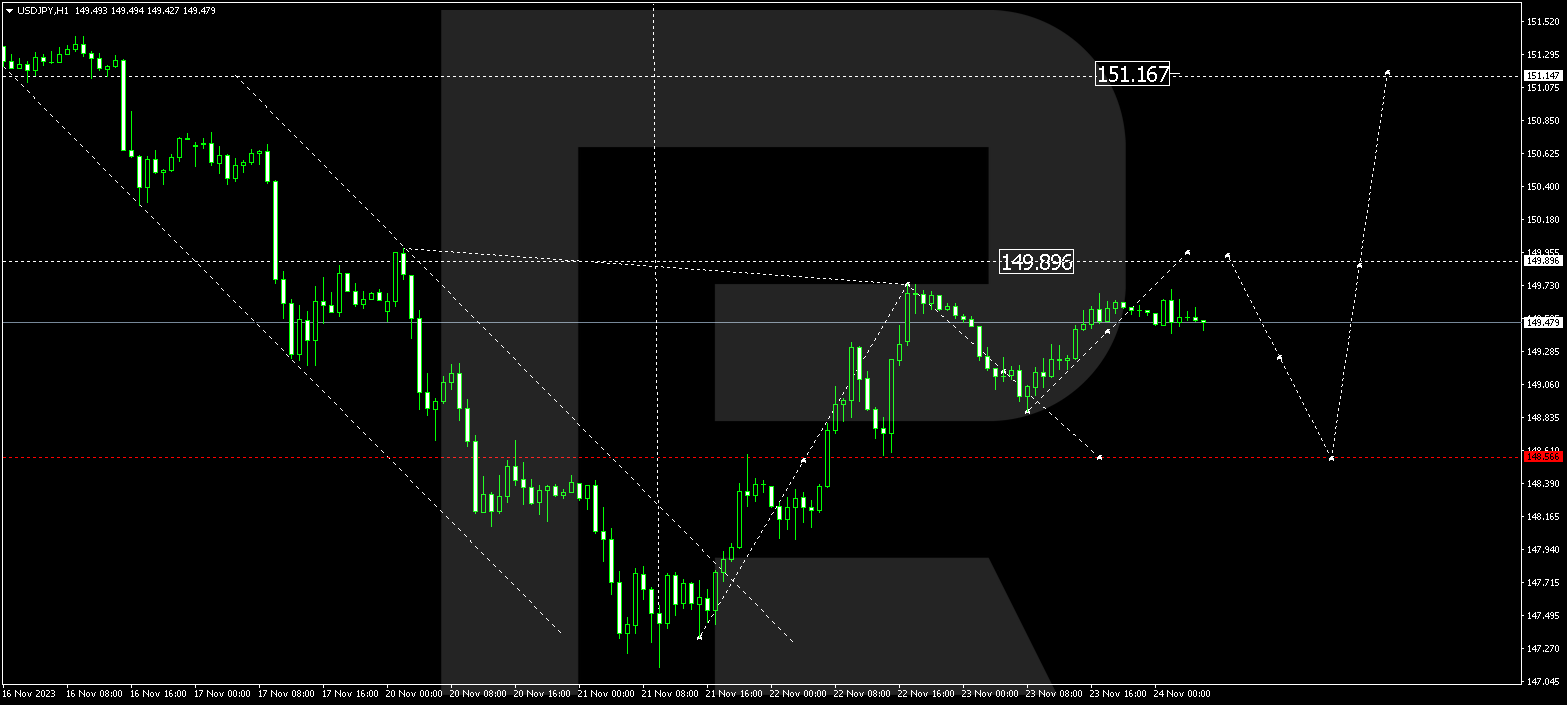

USD/JPY (US Dollar vs Japanese Yen)

USD/JPY is forming a consolidation range around 149.30. An escape downward may lead to a corrective link to 148.56, followed by a rise to 149.90. If there’s a breakout upward, the potential for a wave to 151.15 might open. This is a local target.

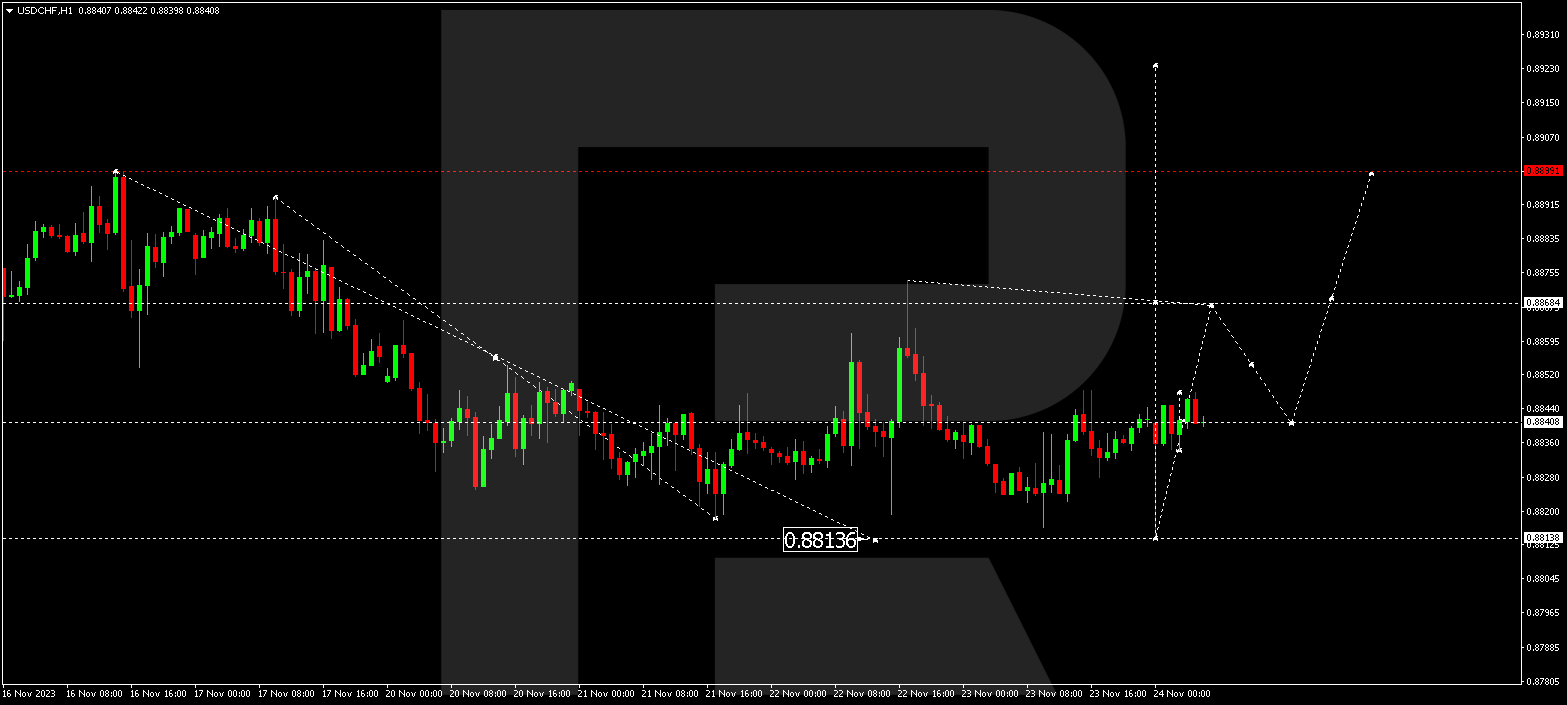

USD/CHF (US Dollar vs Swiss Franc)

USD/CHF is consolidating around 0.8841 without a clear trend. A decline to 0.8810 is plausible. Upon reaching this level, a new growth wave to 0.8868 is anticipated. This is the first target.

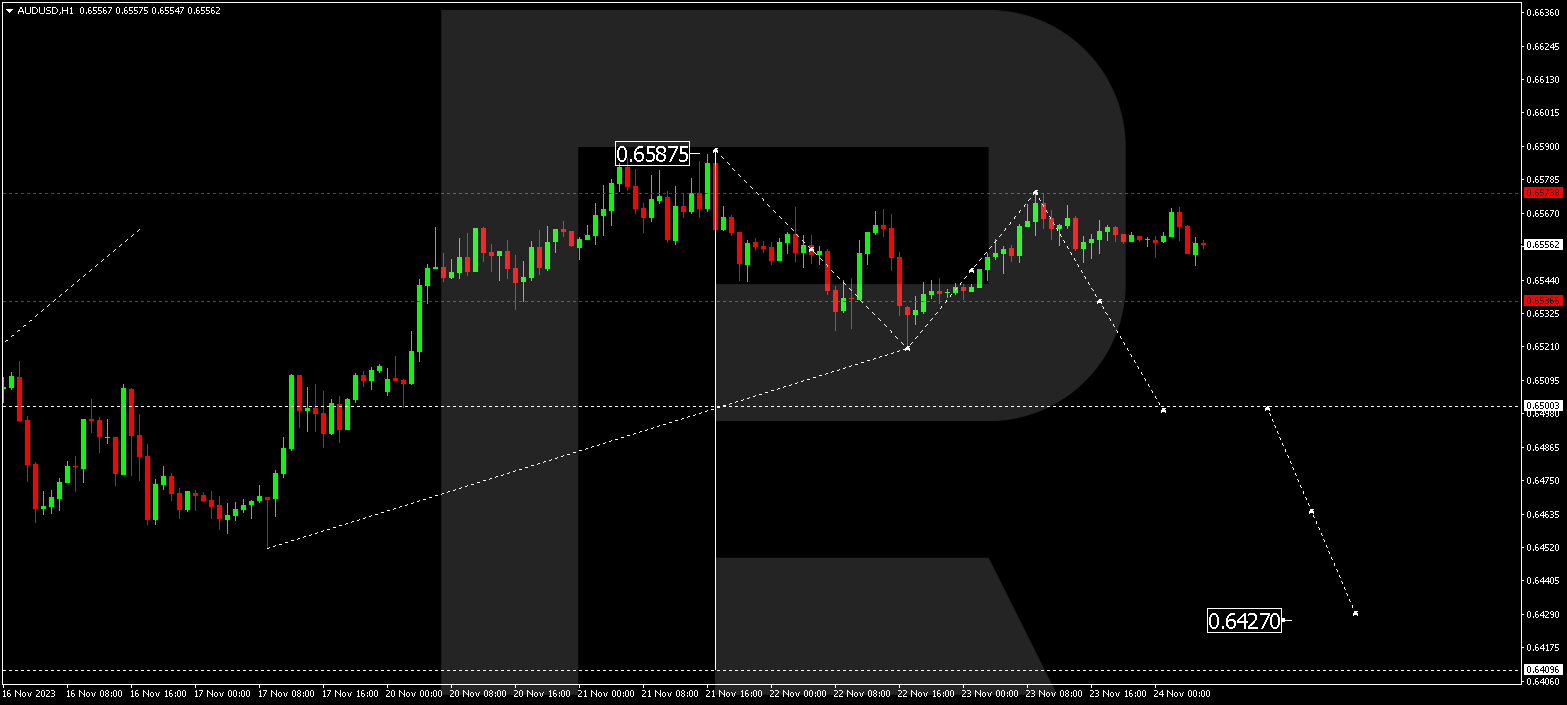

AUD/USD (Australian Dollar vs US Dollar)

AUD/USD is within a consolidation range around 0.6547. An expected decline to 0.6500 might occur today. If this level is breached, the potential for a wave to 0.6430 could open. This is a local target.

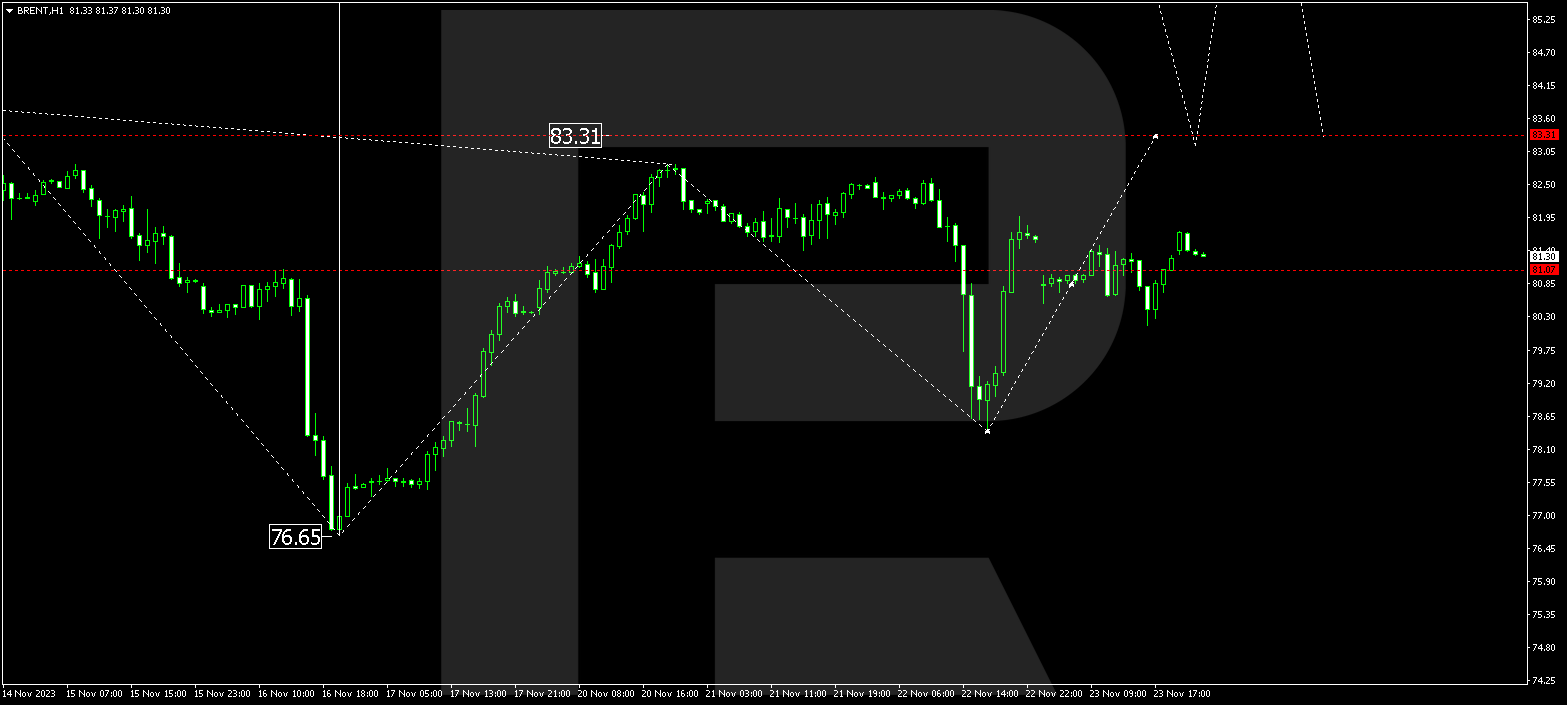

BRENT

Brent is forming a consolidation range around 81.10. A potential upward trend to 83.33 might follow. If this range is broken upwards, the wave could extend to 88.10. This is a local target.

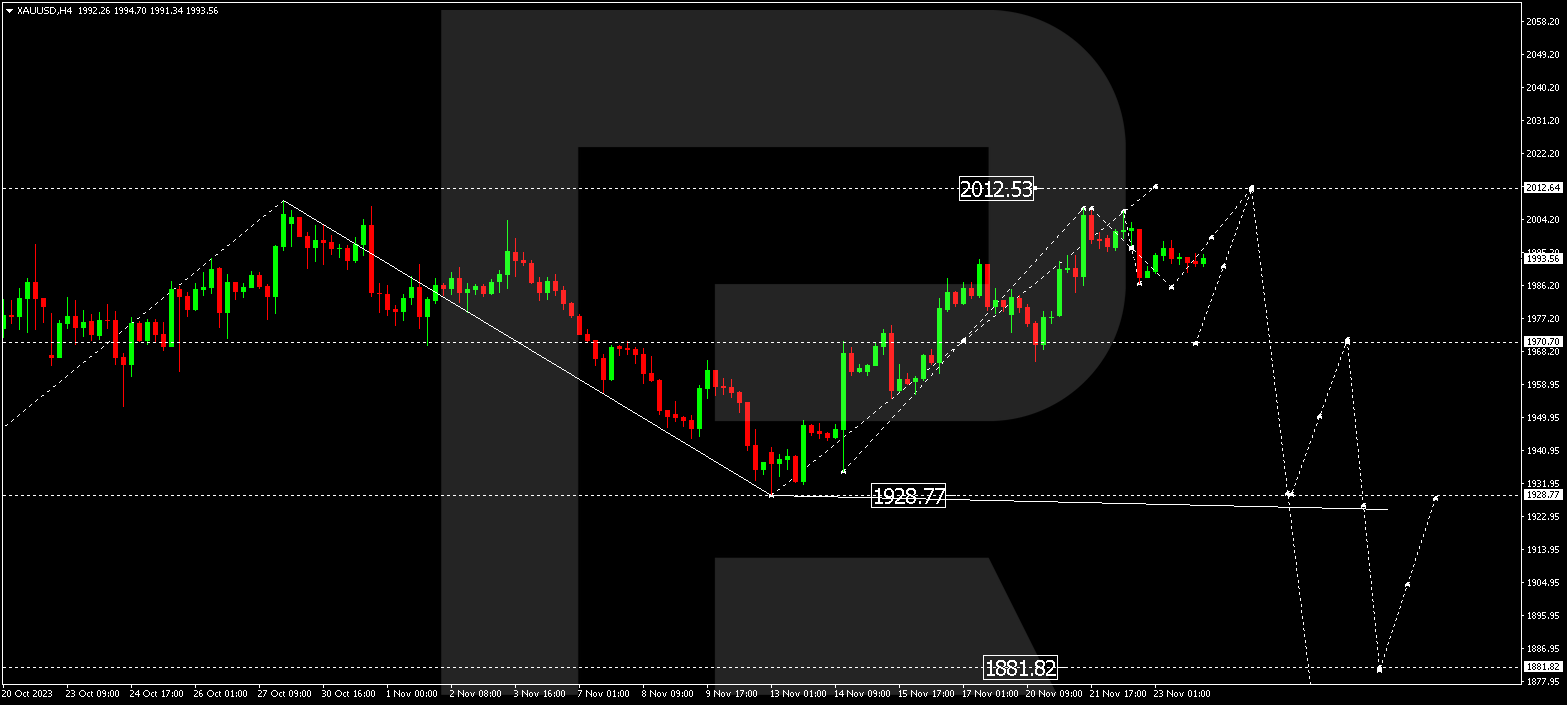

XAU/USD (Gold vs US Dollar)

Gold is continuing to form a wide consolidation range around 1970.70, extending at one point to 2007.20. A decline structure to 1970.70 is forming today. Another potential growth link to 2012.60 is not excluded. Following this, a decline wave to 1930.00 might begin. This is the first target.

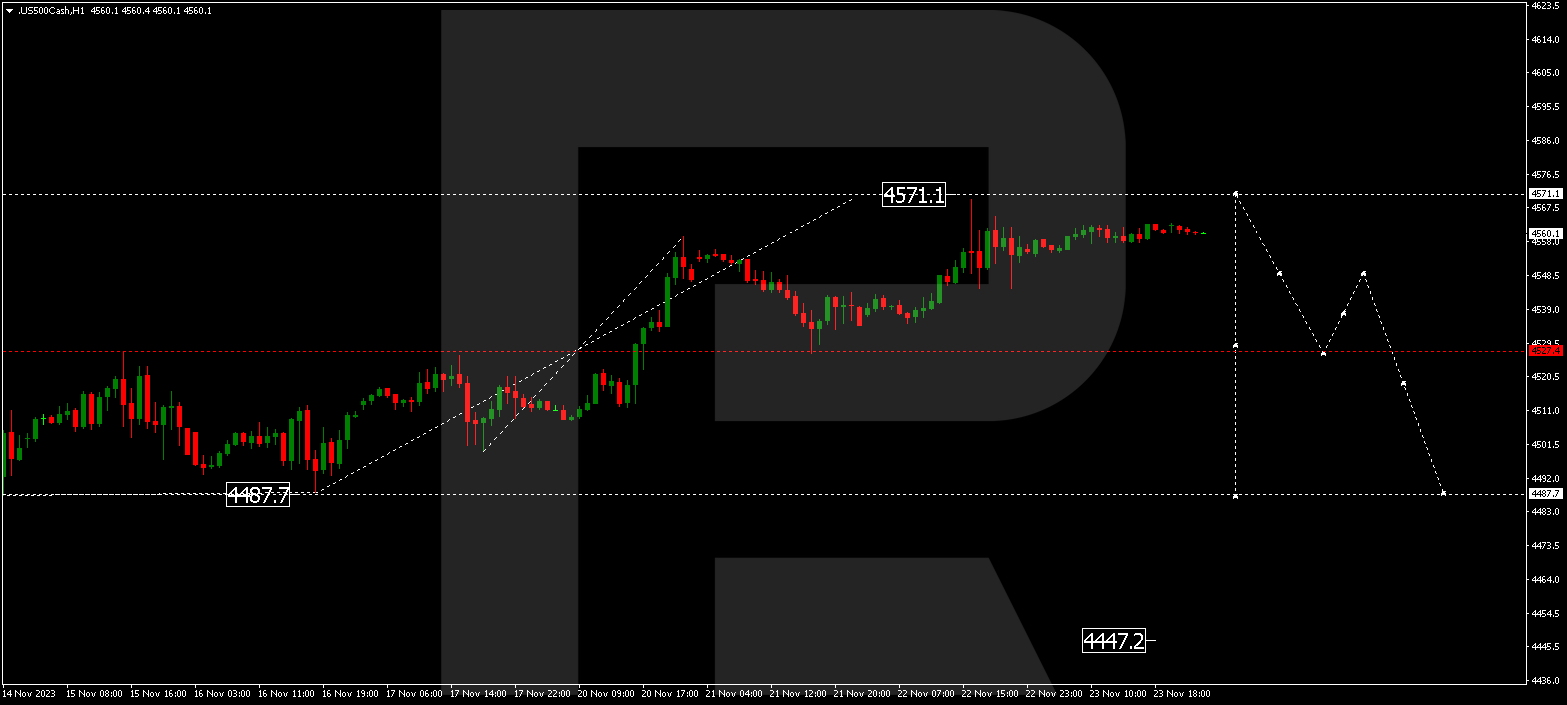

S&P 500

The stock index is in the process of developing a consolidation range around 4530.0. An upward link to 4571.0 is plausible today. A subsequent new decline wave to 4487.0 might commence. This is the first target.

The post Technical Analysis & Forecast November 24, 2023 appeared first at R Blog – RoboForex.