The AUD is experiencing a decline. Explore the dynamics of other currencies such as EUR, GBP, JPY, CHF, along with Brent, Gold, and the S&P 500 index.

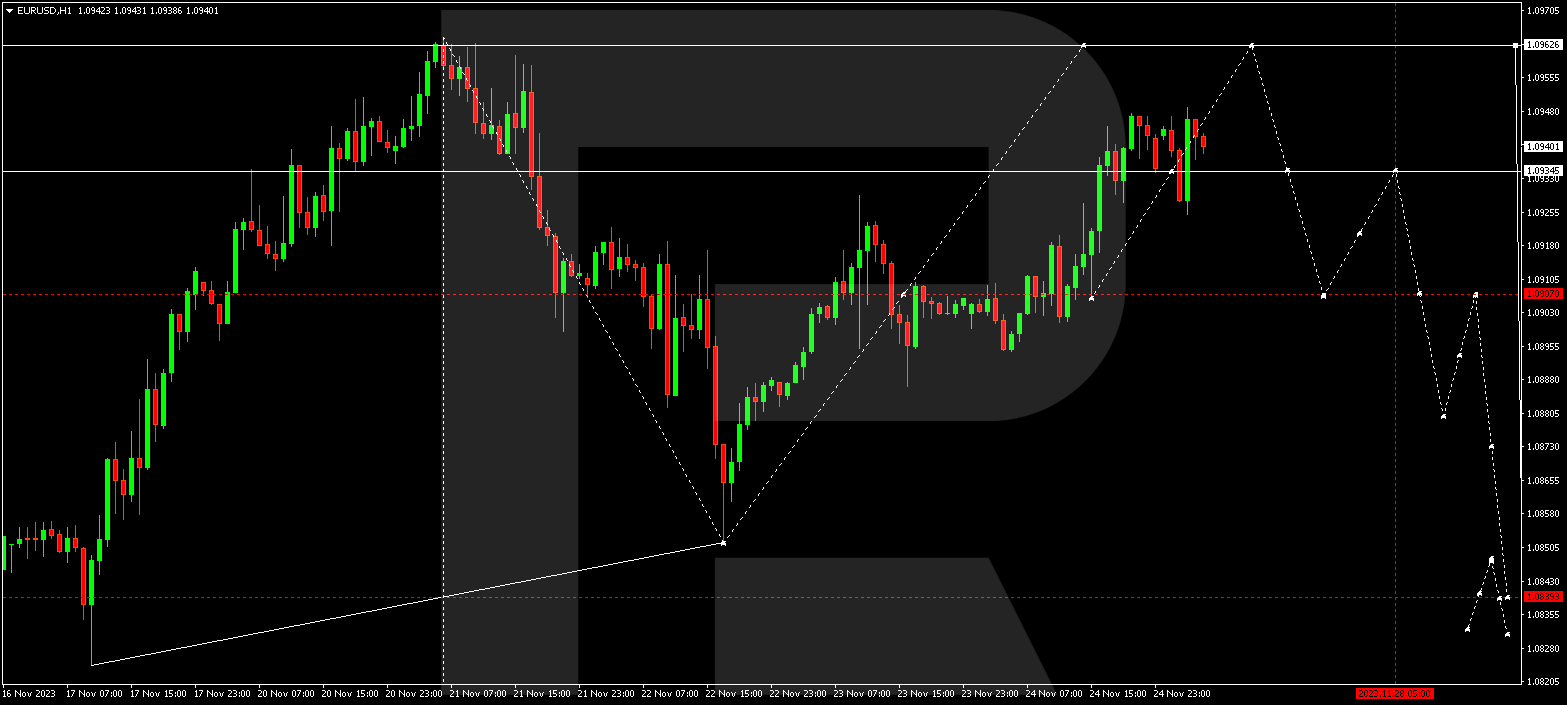

EUR/USD (Euro vs US Dollar)

EUR/USD is currently within a broad consolidation range around 1.0907. Today, the pair might reach the level of 1.0962. A subsequent decline wave to 1.0907 is anticipated, and from there, the trend could extend to 1.0840. This represents the initial target.

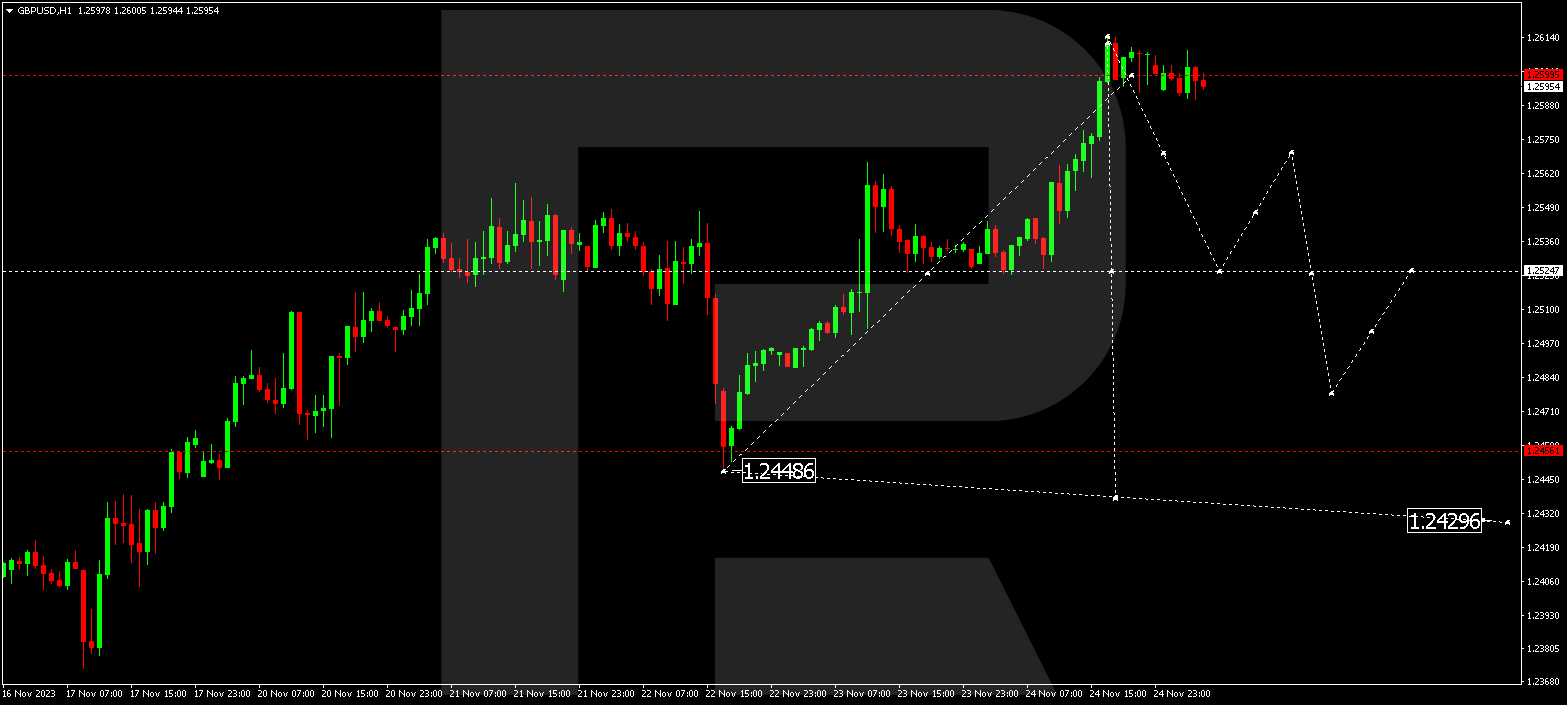

GBP/USD (Great Britain Pound vs US Dollar)

GBP/USD is in the midst of a wide consolidation range around 1.2525. Recently, the pair extended this range to 1.2614. There is a possibility of the price dropping to 1.2525 today. If this level is breached, the potential for a downward wave to 1.2455 might emerge. This is the first target.

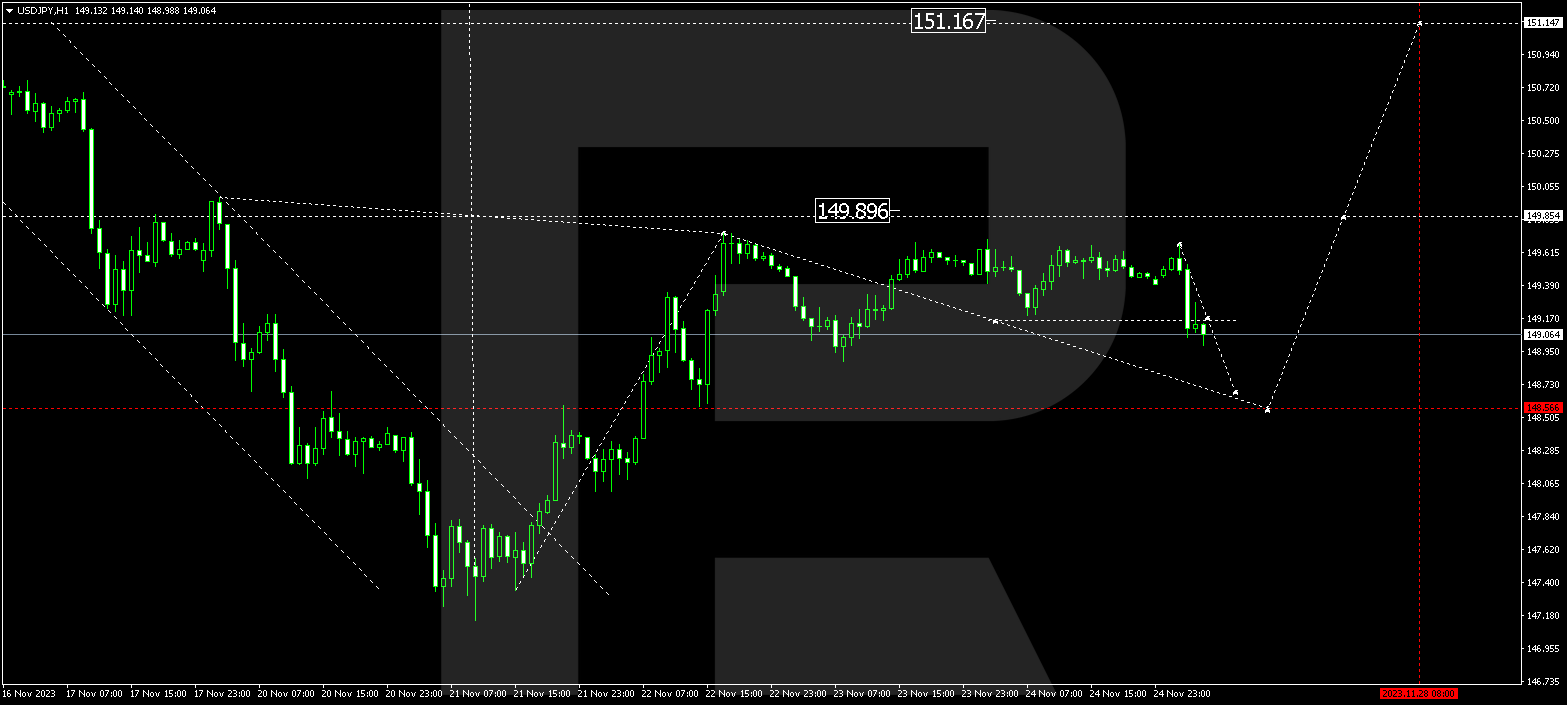

USD/JPY (US Dollar vs Japanese Yen)

USD/JPY is shaping a consolidation range around 149.30. In the event of a breakout downwards, the correction could persist to 148.56. Following this, an ascent to 149.90 is expected. A breakout upwards from this level could signify the potential for an upward wave to 151.15. This represents a local target.

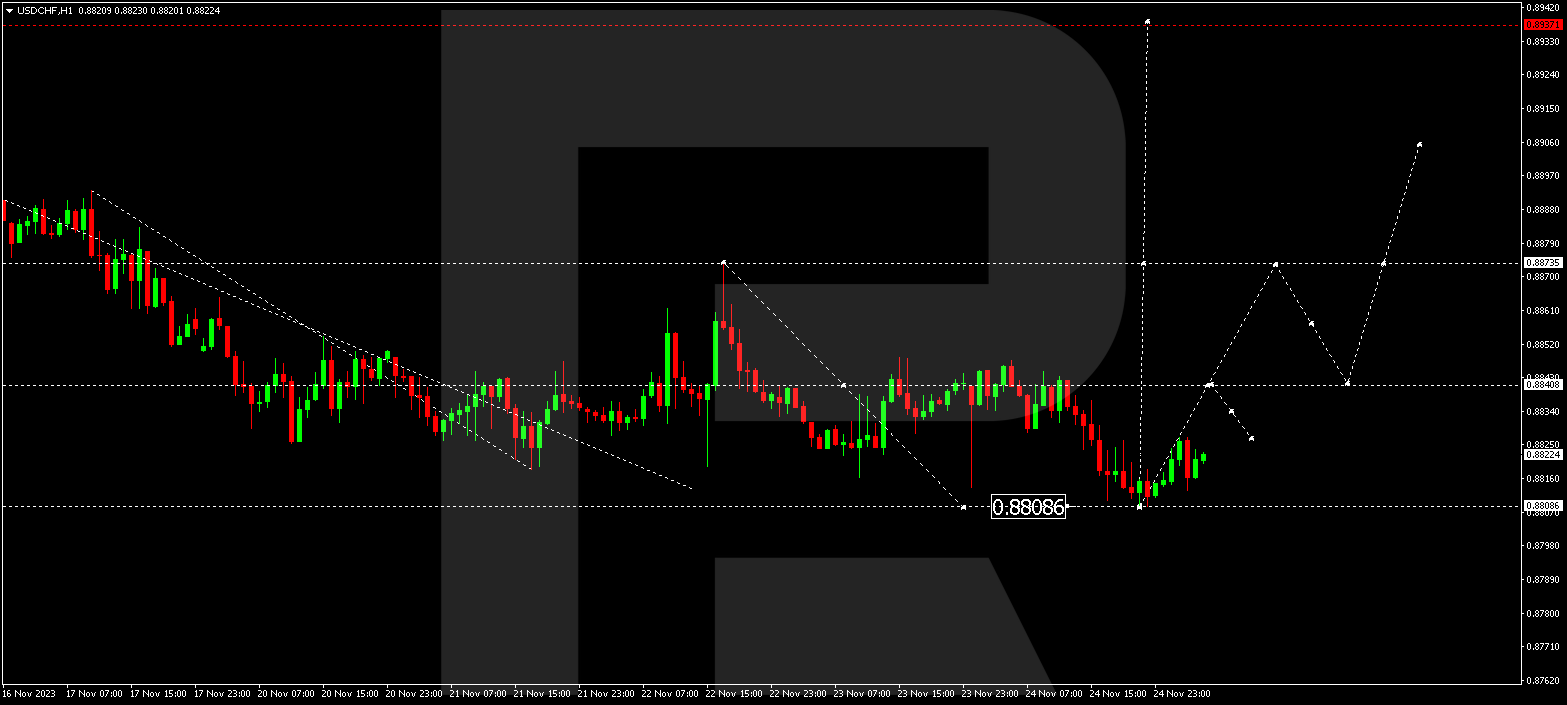

USD/CHF (US Dollar vs Swiss Franc)

USD/CHF is continuing to form a consolidation range around 0.8841. Recently, the market extended the range to 0.8808. Today, a consolidation range has formed above this level. An upward breakout and the development of a wave to 0.8875 are anticipated. This is the initial target.

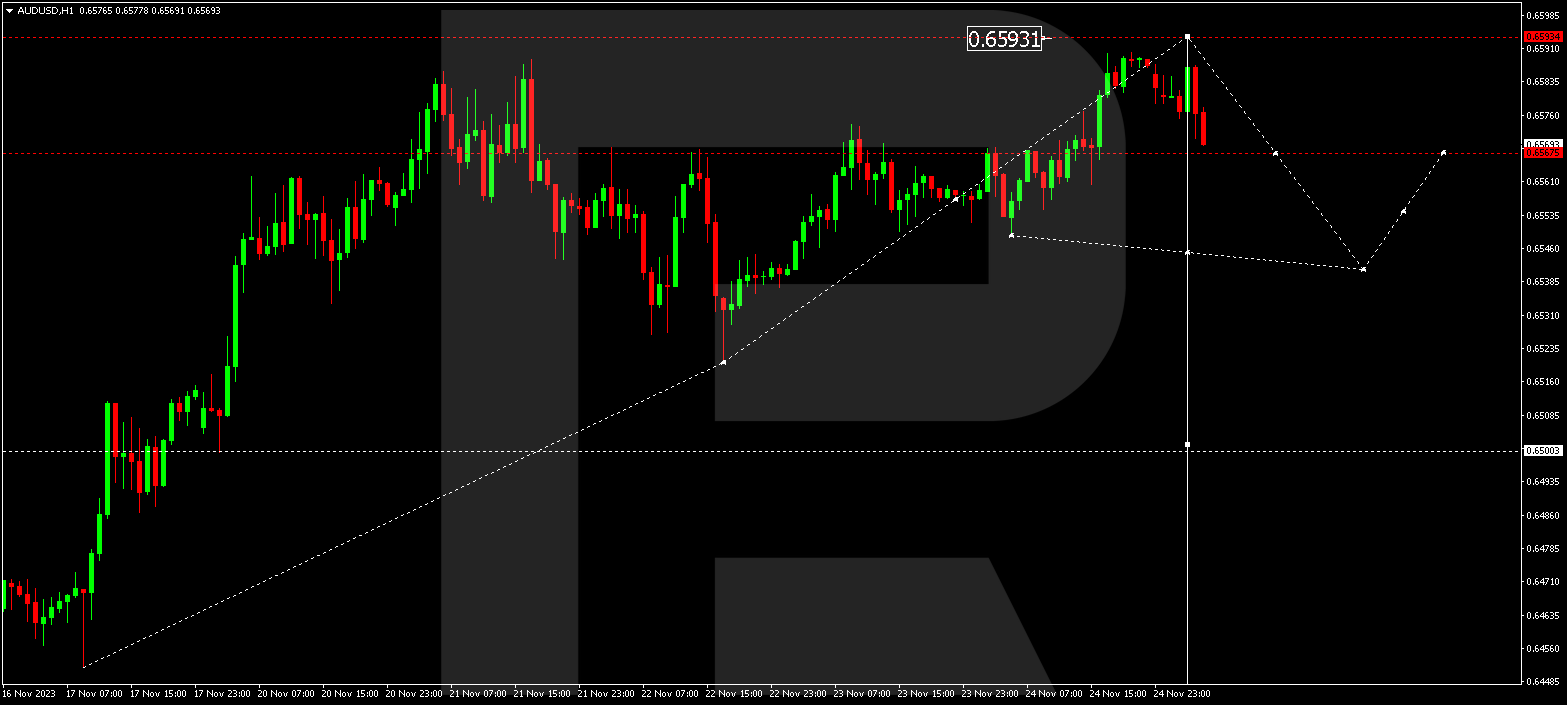

AUD/USD (Australian Dollar vs US Dollar)

AUD/USD is shaping a consolidation range around 0.6567, recently extending to 0.6590. The market is forming a decline structure to 0.6567 today. A breakout below this level could indicate the potential for a decline wave to 0.6540, continuing the trend to 0.6500. This represents the first target.

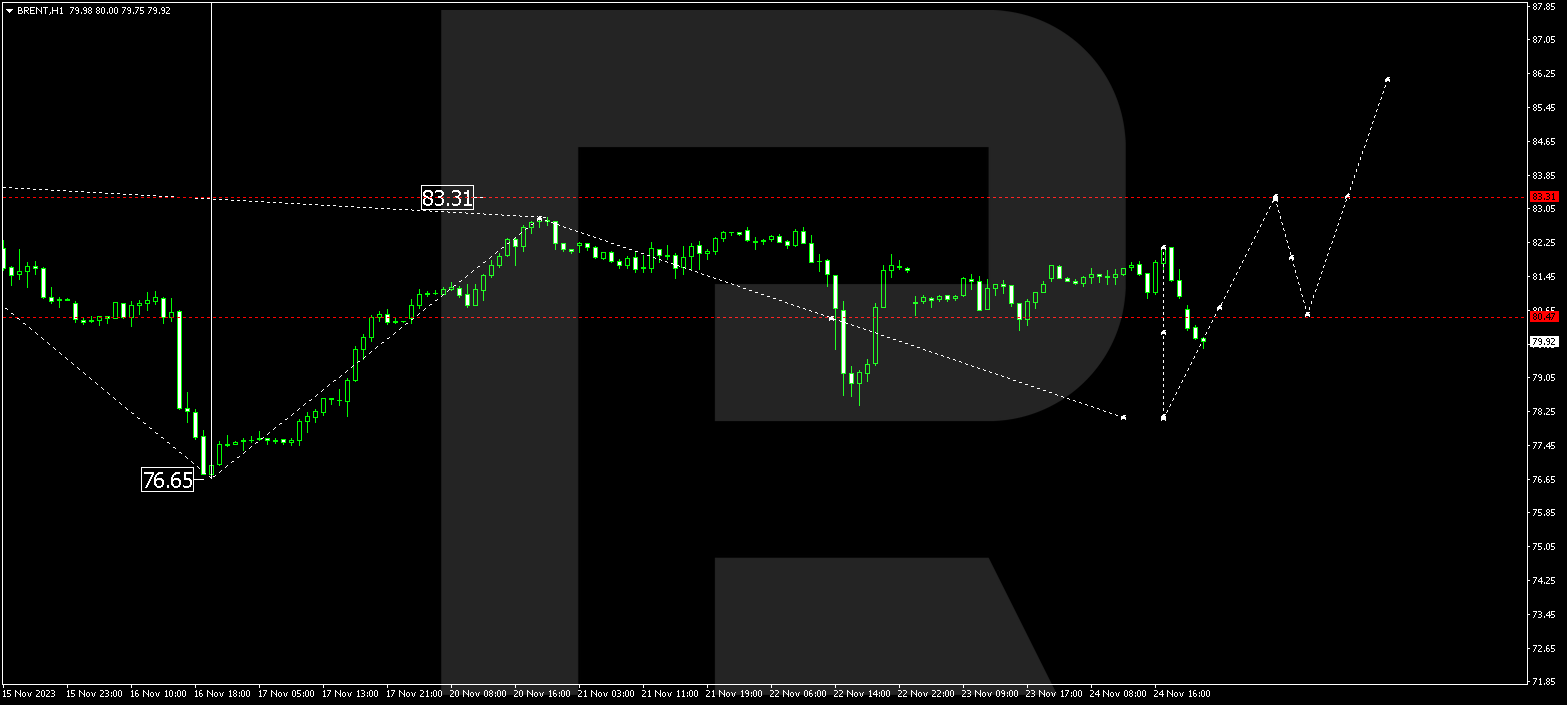

BRENT

Brent is currently developing a consolidation range around 80.47. A decline to 78.18 is possible today. Following this, a growth movement to 83.33 might follow. A breakout upwards from this level could suggest the potential for an upward wave to 86.25, continuing the trend to 88.45. This is a local target.

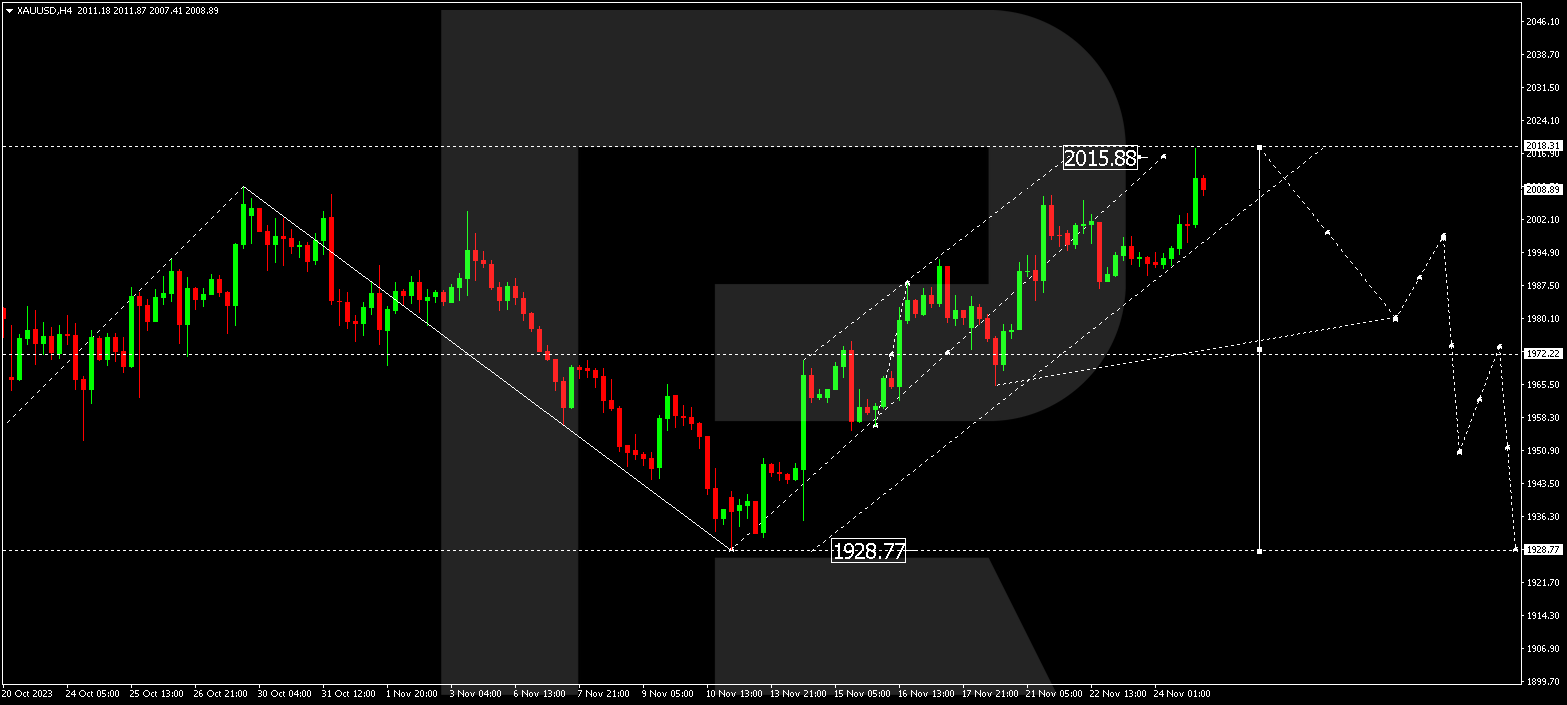

XAU/USD (Gold vs US Dollar)

Gold is continuing to form a wide consolidation range around 1972.22, recently extending upwards to 2015.88. Today, a decline structure to 1972.22 is expected. A breakout below this level might open the potential for a wave to 1928.77. This is the initial target.

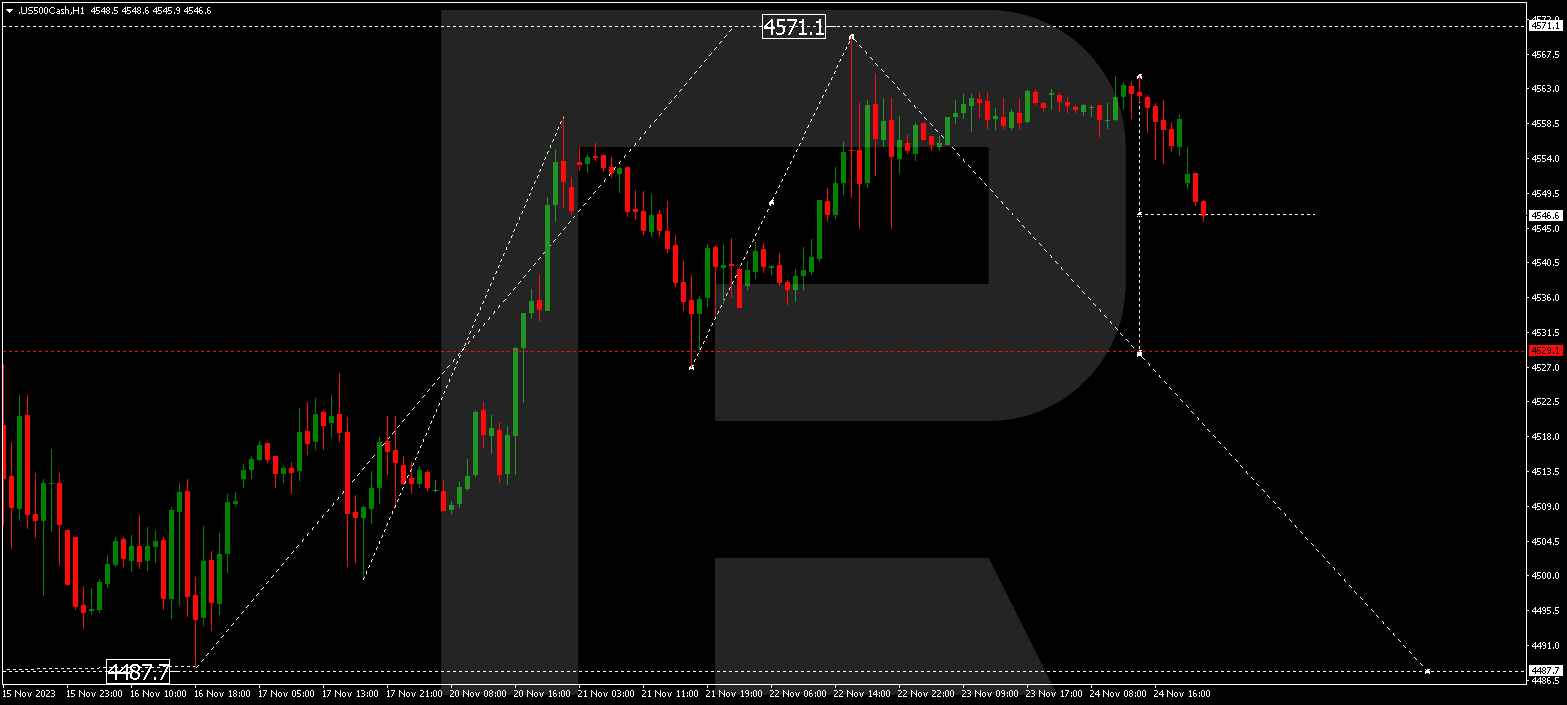

S&P 500

The stock index is continuing to develop a consolidation range around 4530.0, recently extending to 4564.0. A decline to 4530.0 is anticipated today. A breakout below this level could suggest the potential for a decline wave to 4500.0, continuing the trend to 4487.7. This is the first target.

The post Technical Analysis & Forecast November 27, 2023 appeared first at R Blog – RoboForex.