Brent is currently in a consolidation phase. This overview also encompasses the dynamics of EUR, GBP, JPY, CHF, AUD, Gold, and the S&P 500 index.

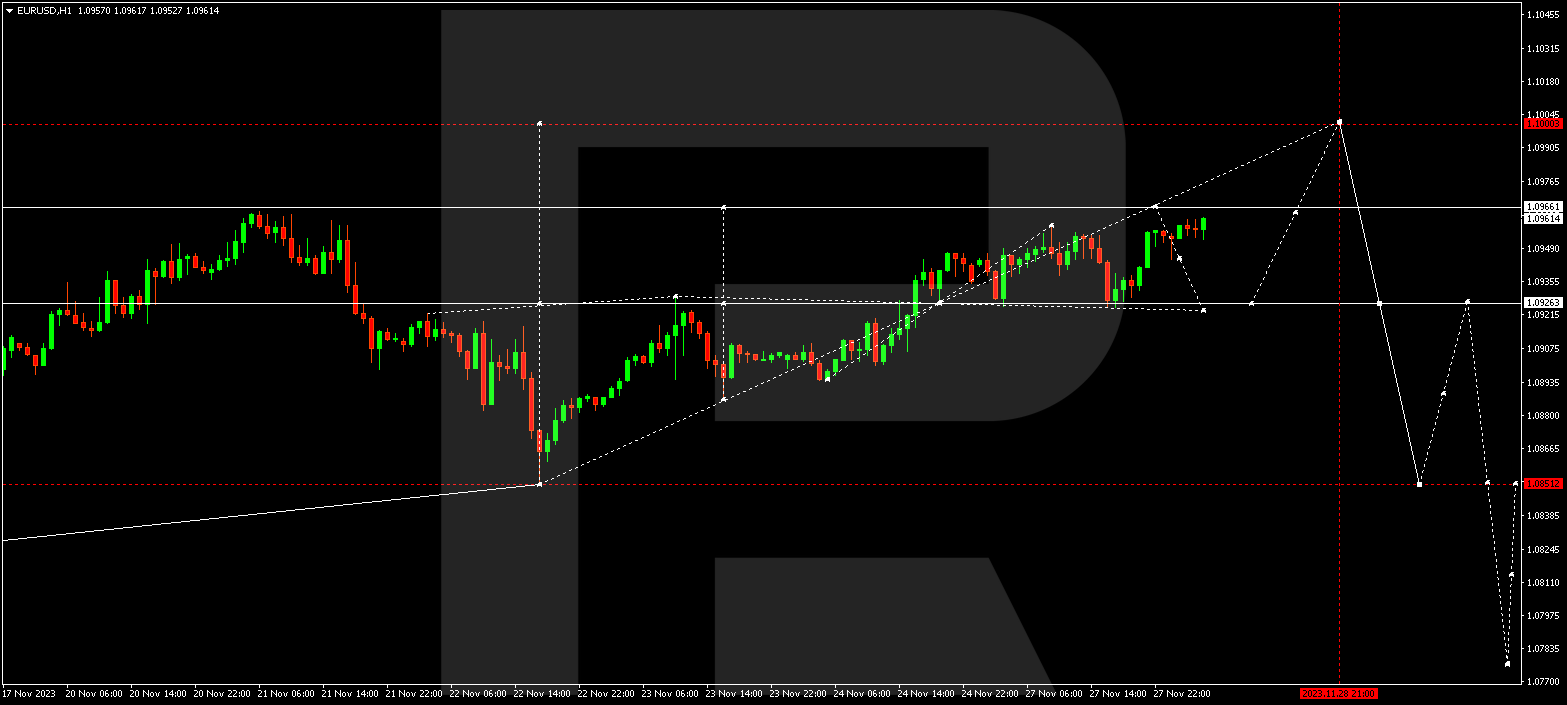

EUR/USD (Euro vs US Dollar)

EUR/USD is amidst a broad consolidation range around 1.0926. Today, the pair might experience an upswing to 1.0966. Following this, a decline wave to 1.0926 could commence (a test from above). Subsequently, the likelihood of a new upward movement to 1.1000 cannot be ruled out. Once this level is attained, a fresh decline to 1.0850 might initiate. This constitutes the first target.

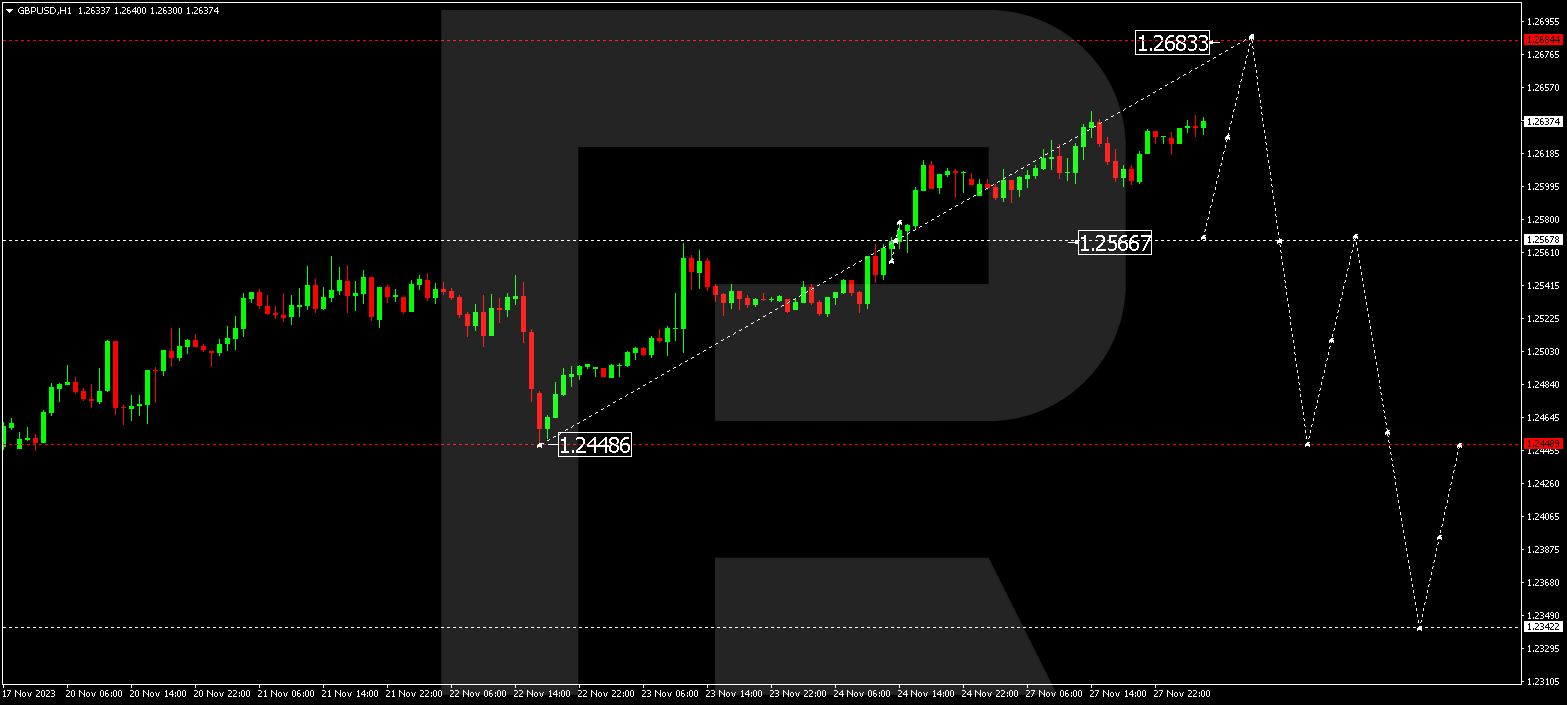

GBP/USD (Great Britain Pound vs US Dollar)

GBP/USD has established a narrow consolidation range around 1.2570. Presently, this range has expanded to 1.2640. A corrective phase to 1.2570 is conceivable (a test from above). After the correction concludes, an upward move to 1.2684 is plausible. Next, an anticipated decline wave to 1.2450 is expected to ensue. This represents the first target.

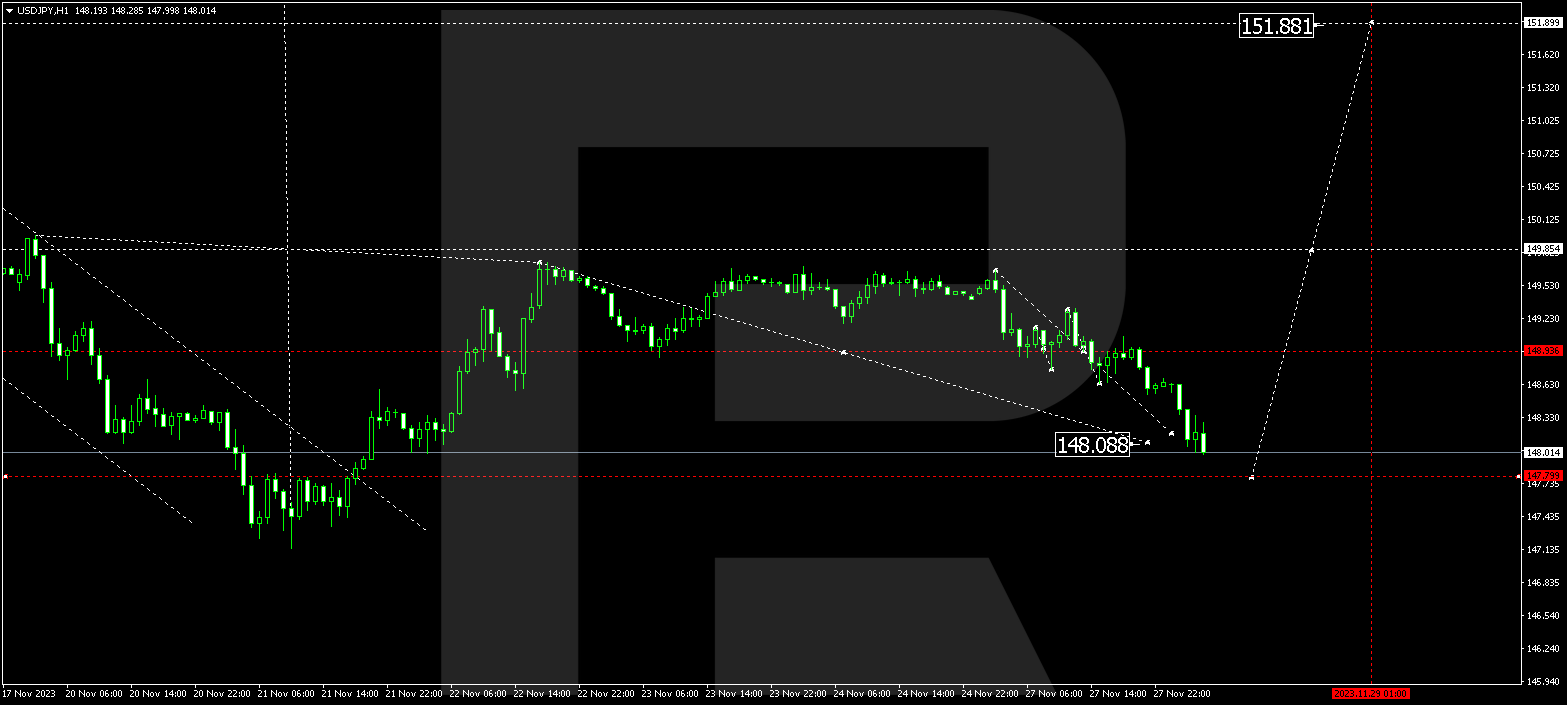

USD/JPY (US Dollar vs Japanese Yen)

USD/JPY has successfully completed a corrective wave to 148.08. Today, a consolidation range is foreseen at the current lows. It is probable that the range could extend to 147.77. Subsequently, an ascent to 148.80 might occur, and if this level is surpassed, the potential for growth to 151.88 could emerge. This is a local target.

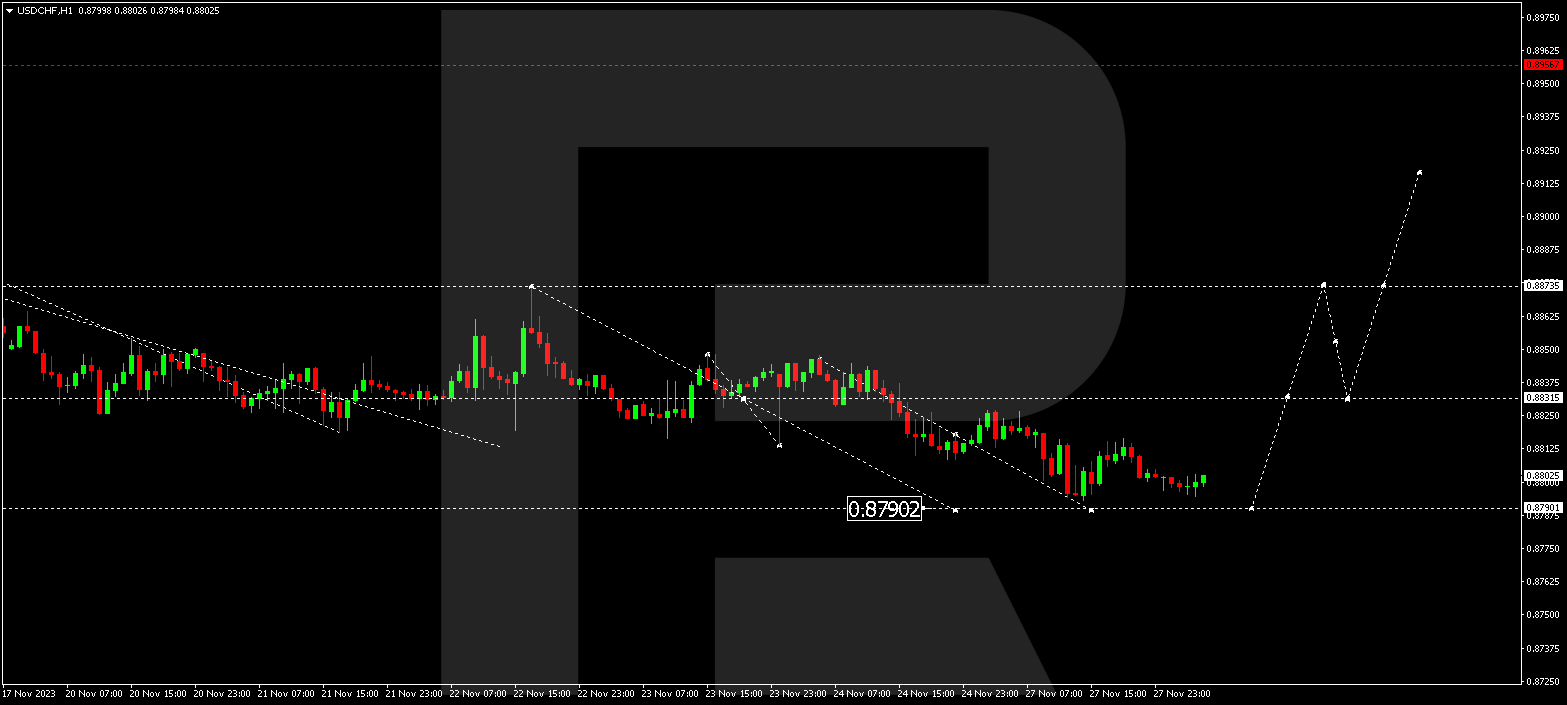

USD/CHF (US Dollar vs Swiss Franc)

USD/CHF is in the process of forming a consolidation range around 0.8840, which has now extended to 0.8805. A new, narrow consolidation range has formed above this level today. There is a possibility of a new decline to 0.8790. Following this, a new upswing to 0.8875 may commence. This constitutes the first target.

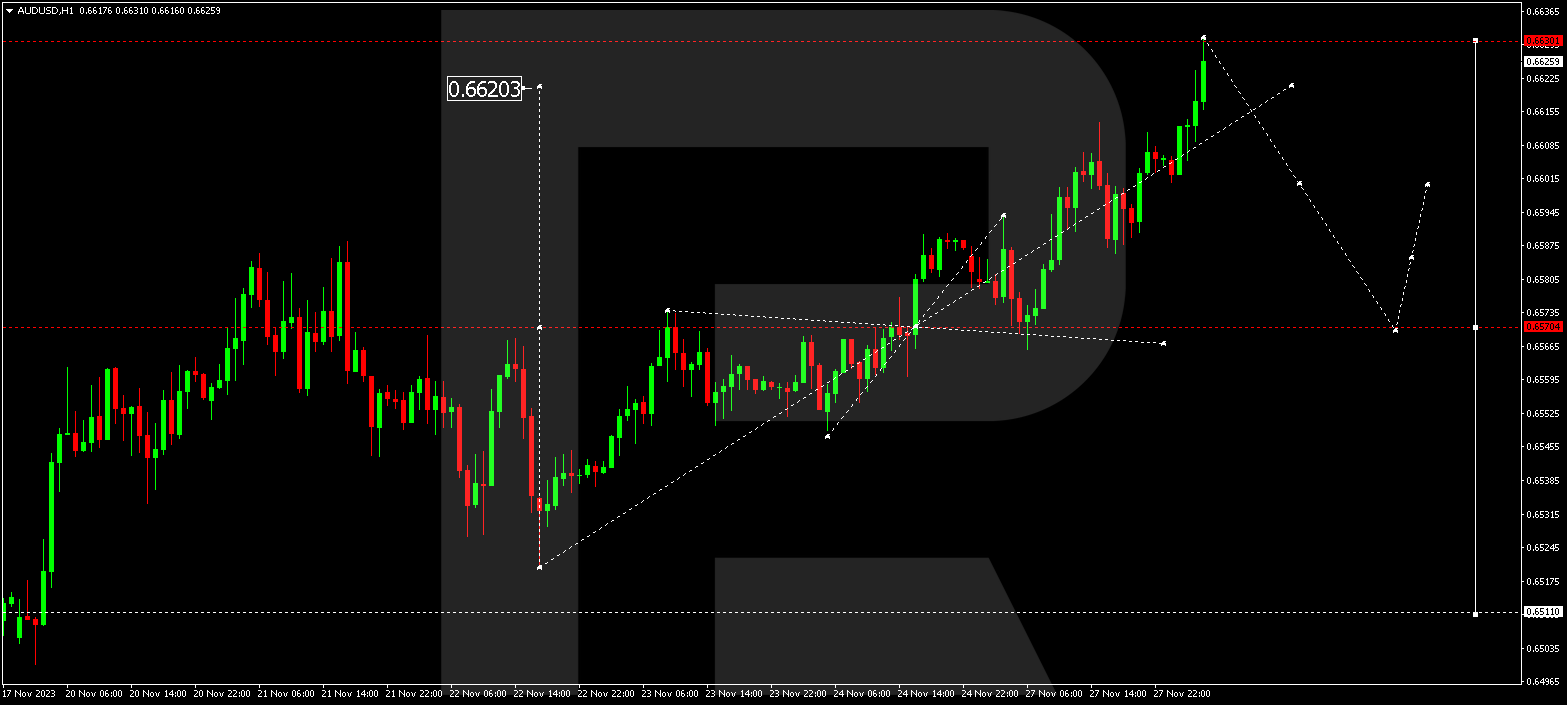

AUD/USD (Australian Dollar vs US Dollar)

AUD/USD continues to mold a consolidation range around 0.6570, recently extending to 0.6630. Presently, the market is shaping a new narrow consolidation range below this level. An anticipated escape from the range downwards might result in the development of a decline structure to 0.6570. This marks the first target.

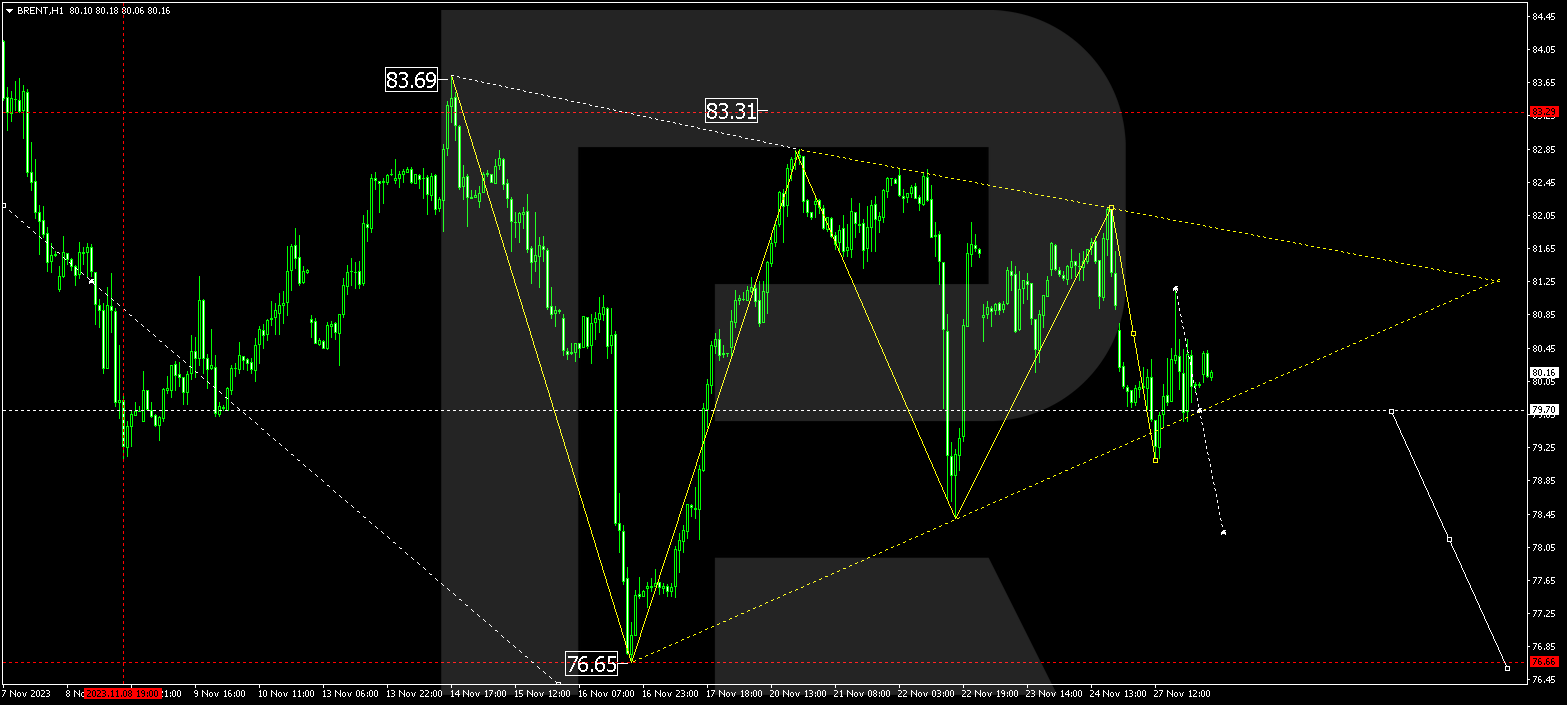

BRENT

Brent has formed an expansive consolidation range around 80.50, taking on the characteristics of a Triangle pattern. An escape from the range downward would interpret this pattern as a consolidation within a downtrend with a target at 70.00. Conversely, an upward breakout would signify a trend reversal pattern with a target at 89.89.

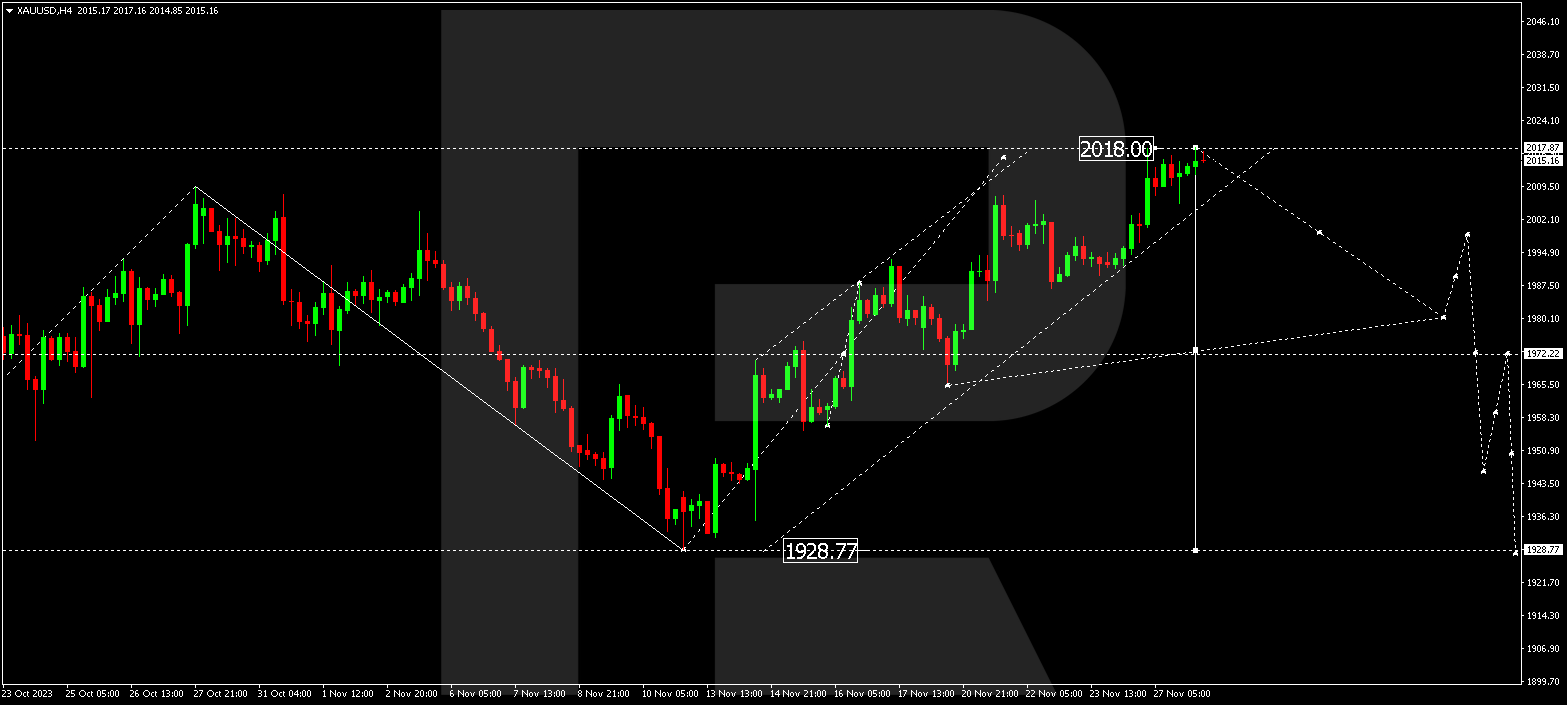

XAU/USD (Gold vs US Dollar)

Gold continues to craft a broad consolidation range around 1972.22, having now extended upwards to 2018.00. A narrow consolidation range might emerge under this level today. An anticipated breakout from the range downwards could initiate a decline structure to 1972.22. Further, if this level is breached, the wave might unfold to 1928.77. This stands as the first target.

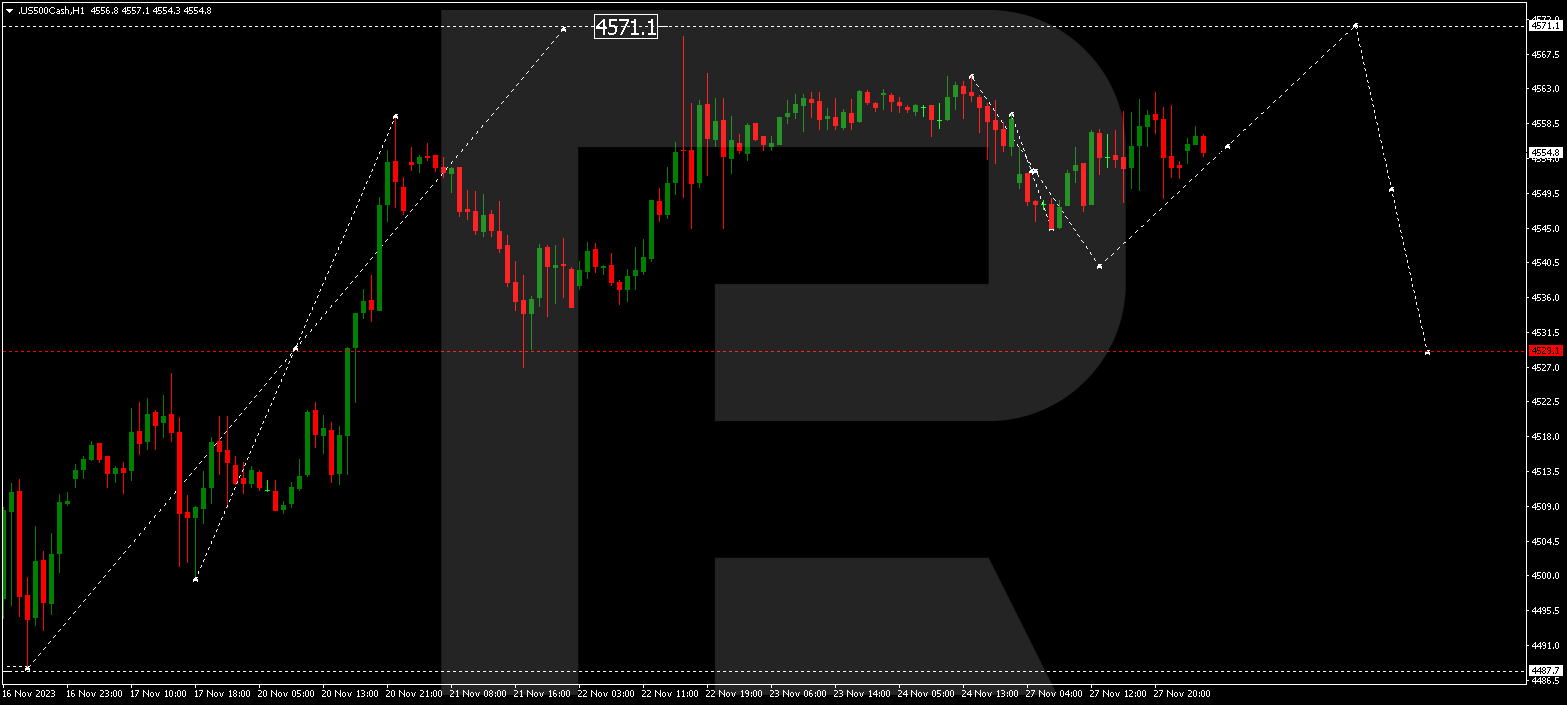

S&P 500

The stock index is currently in a consolidation phase around 4552.0 without any distinct trend. A decline to 4540.0 is anticipated today. Following this, an upward move to 4570.0 might materialize, succeeded by a decline to 4530.0. A breakout from this level downwards could signal the potential for a wave to 4500.0, from where the trend may continue to 4487.7. This forms the first target.

The post Technical Analysis & Forecast November 28, 2023 appeared first at R Blog – RoboForex.