JPY Consolidates at Decline Lows: Overview of EUR, GBP, CHF, AUD, Brent, Gold, and S&P 500

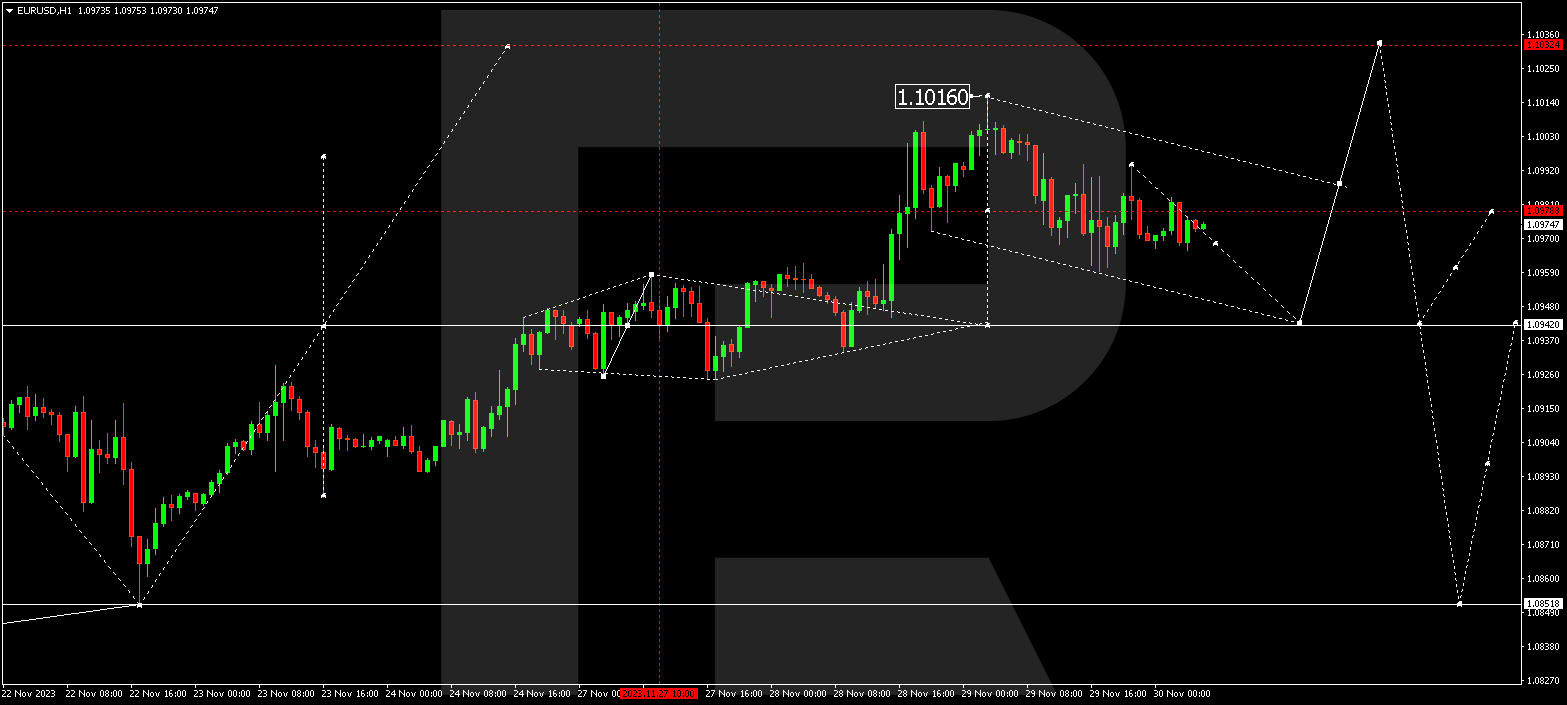

EUR/USD (Euro vs US Dollar)

EUR/USD is shaping a corrective structure to 1.0943. Following the correction, a new growth pattern to 1.1030 might unfold. Subsequently, a decline wave to 1.0850 could initiate. This is the initial target.

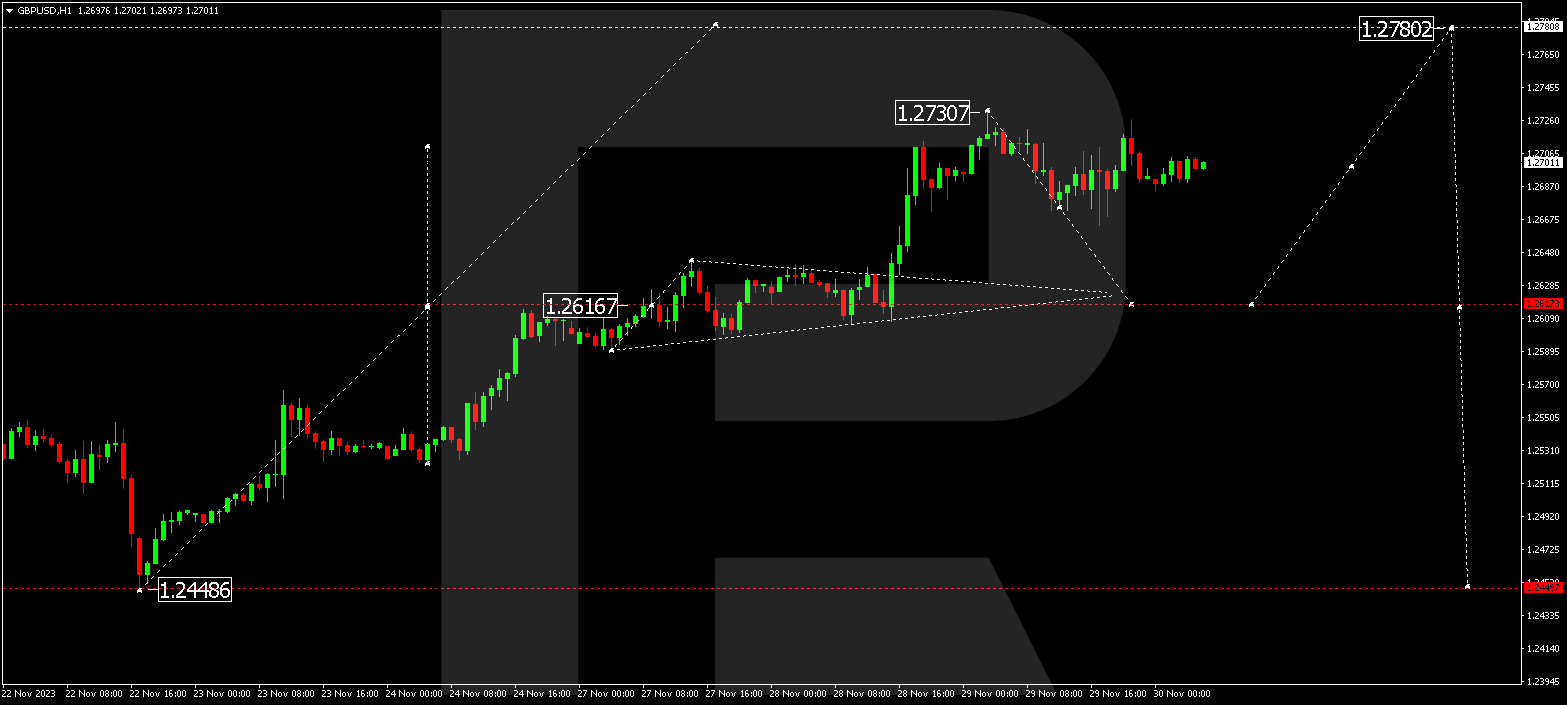

GBP/USD (Great Britain Pound vs US Dollar)

GBP/USD has concluded a decline phase at 1.2664 and ascended to 1.2726. The pair might dip to 1.2620 today. Post this level, an upswing to 1.2780 could follow. Then, a descent to 1.2615 might commence, potentially continuing the trend to 1.2450. This is the primary target.

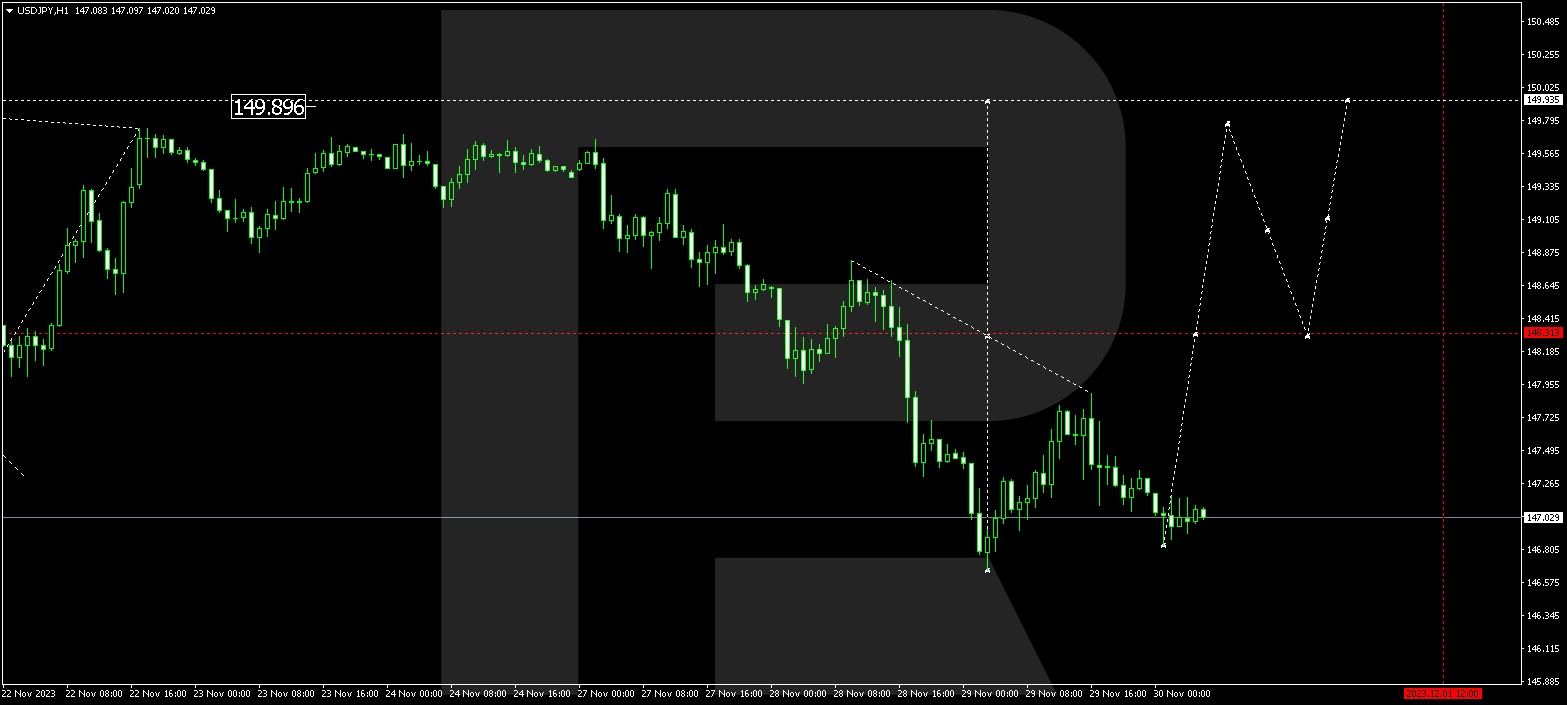

USD/JPY (US Dollar vs Japanese Yen)

USD/JPY has concluded an upward structure at 147.89. A downward structure to 146.66 is taking shape today. Practically, a consolidation range is emerging at the lows of this descent wave. If an upward breakout occurs, a correction to 149.30 might begin.

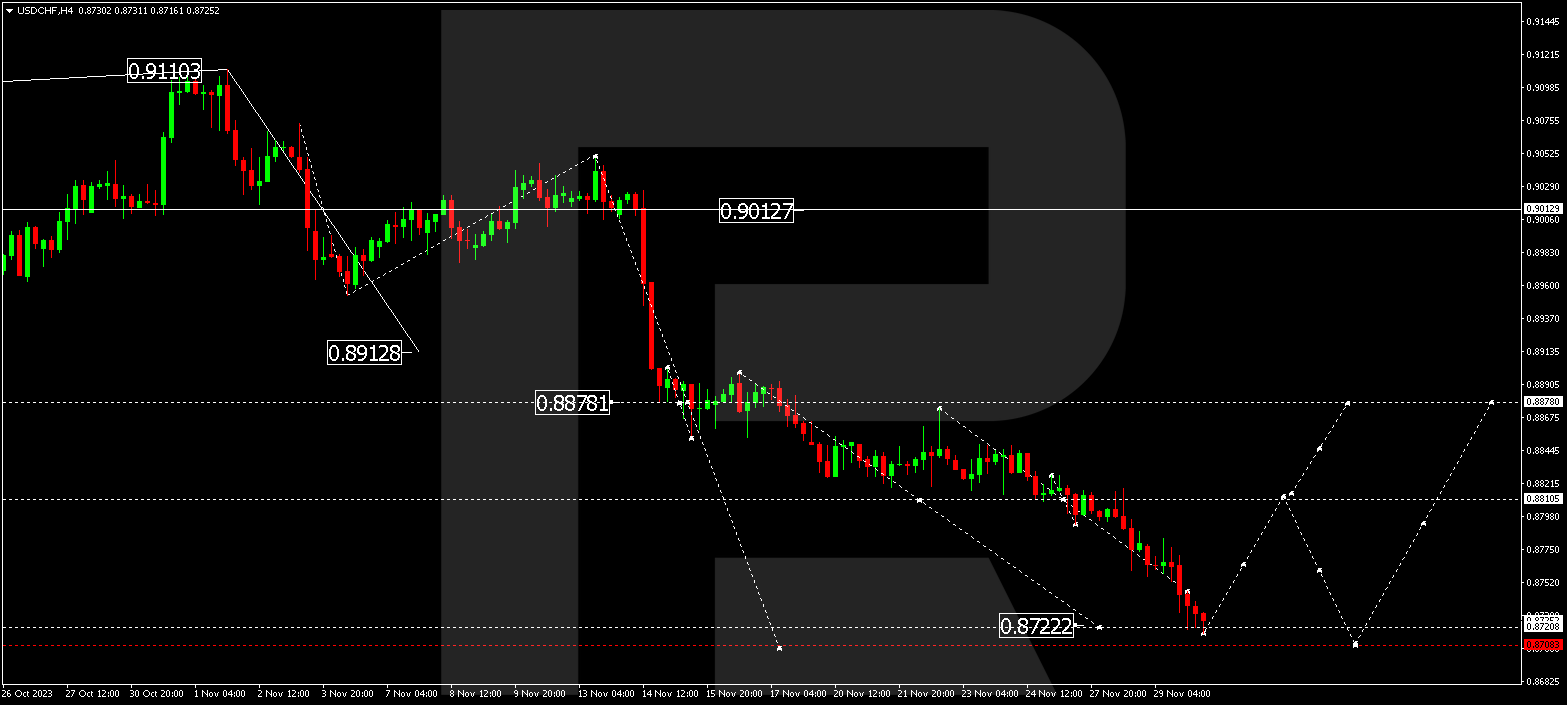

USD/CHF (US Dollar vs Swiss Franc)

USD/CHF has achieved the target of the decline wave extension at 0.8722. A rise to 0.8815 could transpire today. This is the initial target. Post reaching this level, a corrective phase to 0.8755 is not excluded.

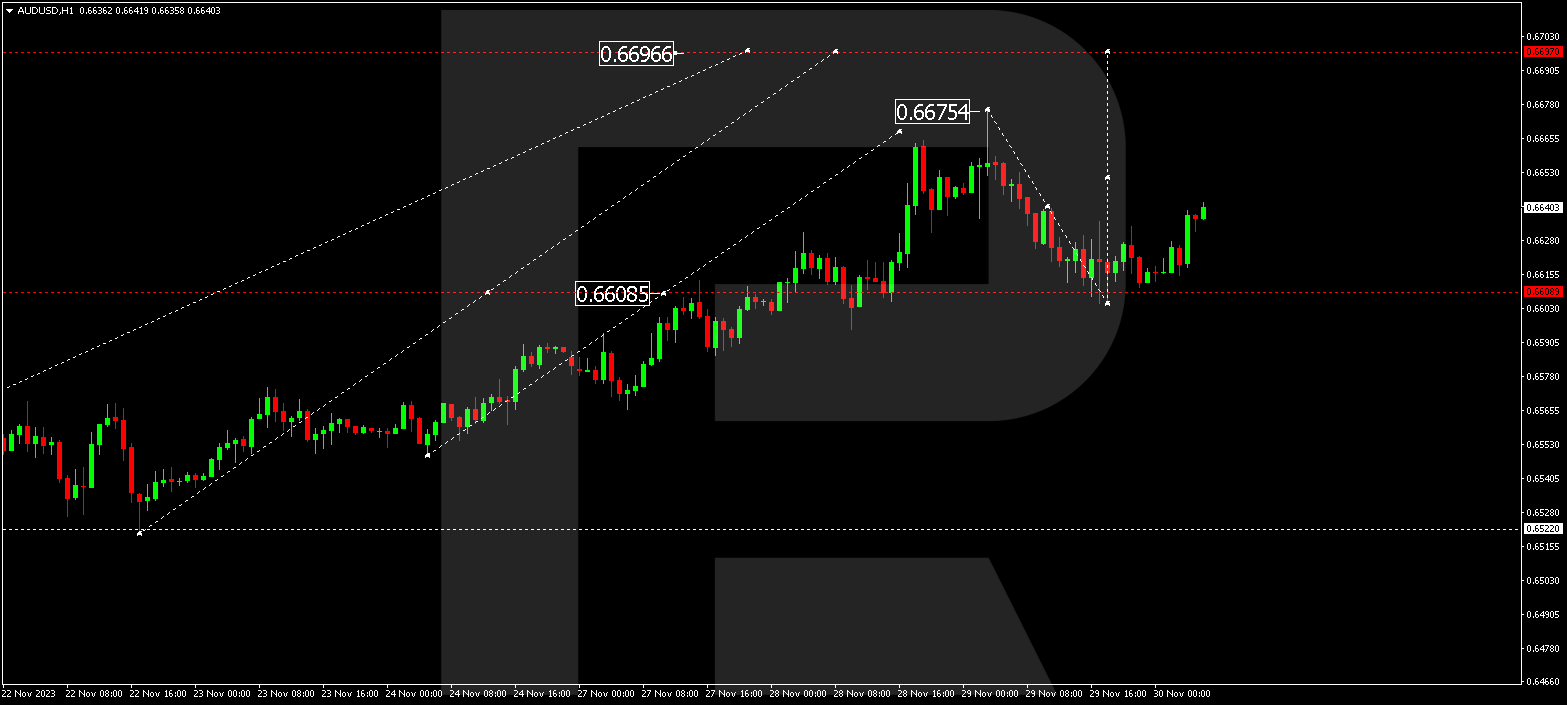

AUD/USD (Australian Dollar vs US Dollar)

AUD/USD has completed a decline wave to 0.6605 and a correction to 0.6647. Essentially, a consolidation range has materialized. With a downward breakout, the decline wave might persist to 0.6522. An upward breakout could lead to a growth phase to 0.6697. Next, a descent to 0.6522 is anticipated.

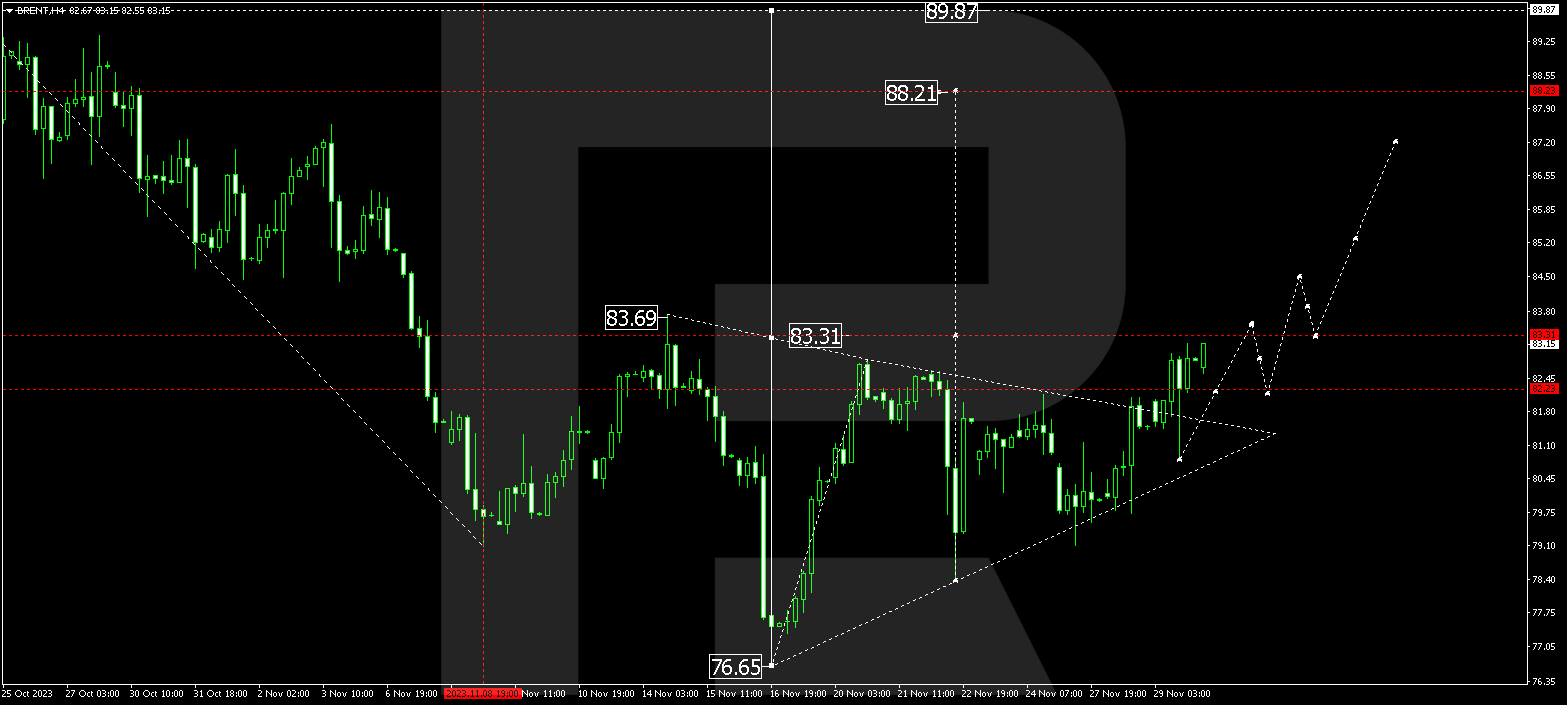

BRENT

Brent extends a growth wave to 83.33. Subsequently, a consolidation range might materialize around this level. An upward breakout from this range could open the potential for a wave to 88.23. This is a local target.

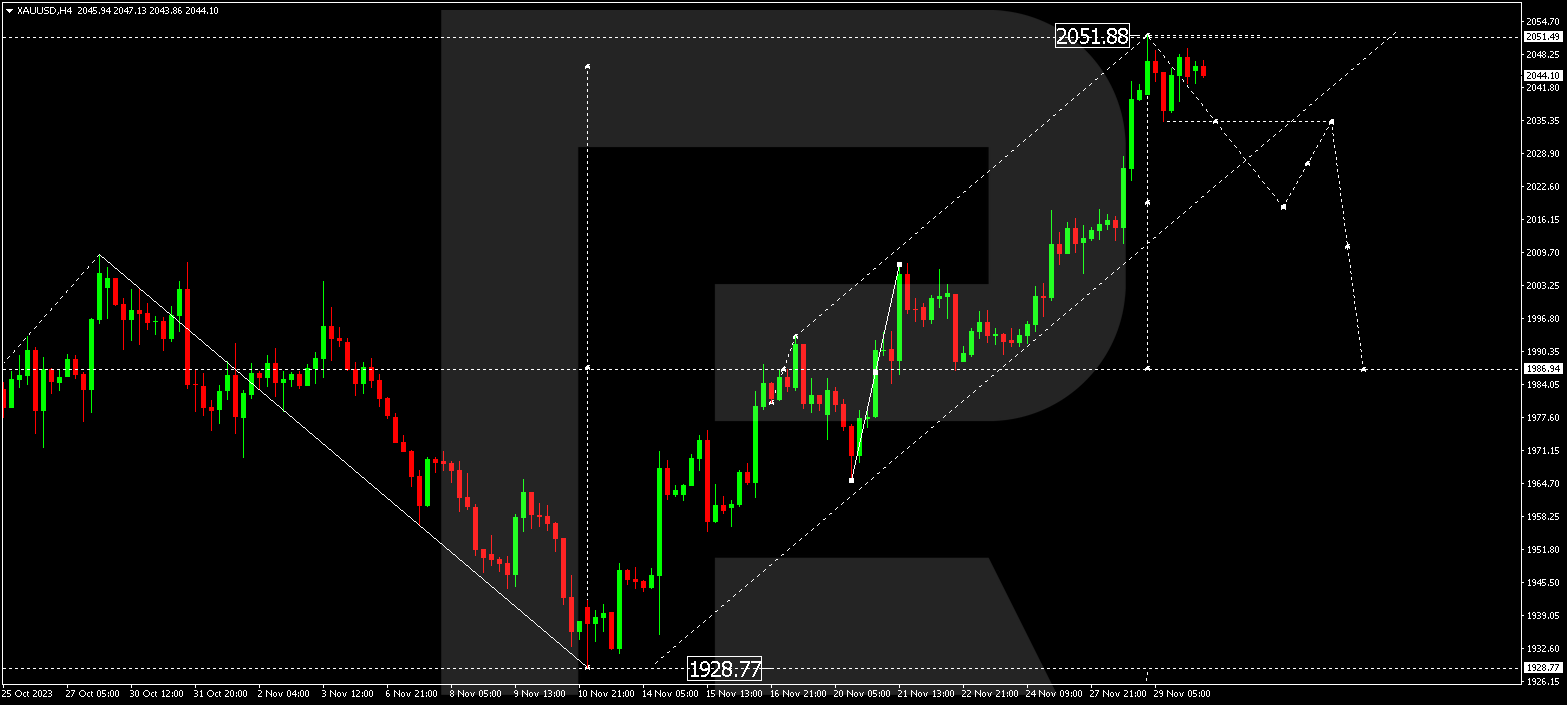

XAU/USD (Gold vs US Dollar)

Gold has completed a decline impulse to 2035.20 and a correction to 2049.50. A decline to 2018.38 seems plausible today. This is the initial target. Post reaching this level, a correction to 2030.00 is expected.

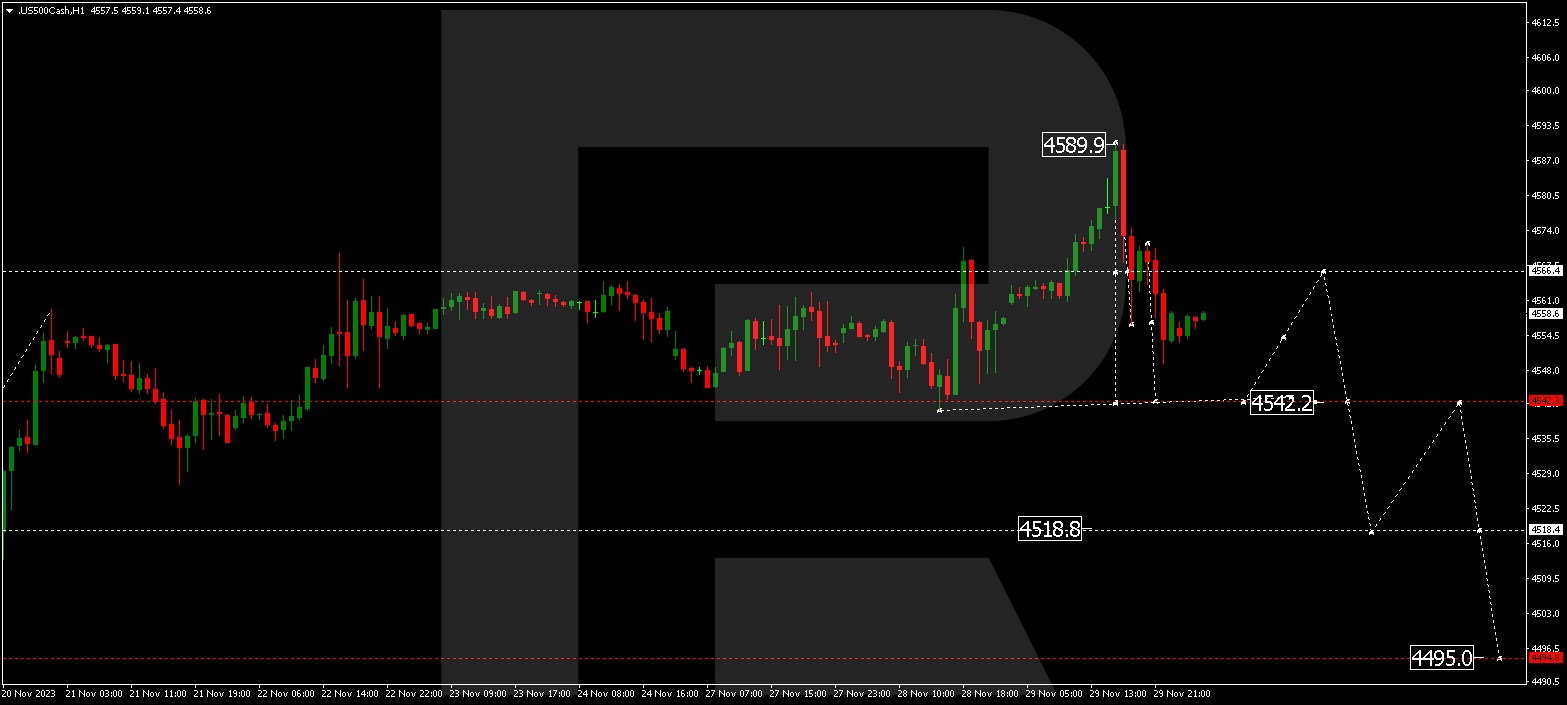

S&P 500

The stock index has completed a decline phase at 4566.0. Presently, a consolidation range has formed around this level. The impulse might persist to 4542.2. This is the initial target. After reaching this level, a correction to 4566.0 is not excluded (a test from below). Subsequently, a new decline wave to 4518.0 might commence. This is a local target.

The post Technical Analysis & Forecast November 30, 2023 appeared first at R Blog – RoboForex.