Gold Prepares for a Downturn: Insights into EUR, GBP, JPY, CHF, AUD, Brent, and S&P 500

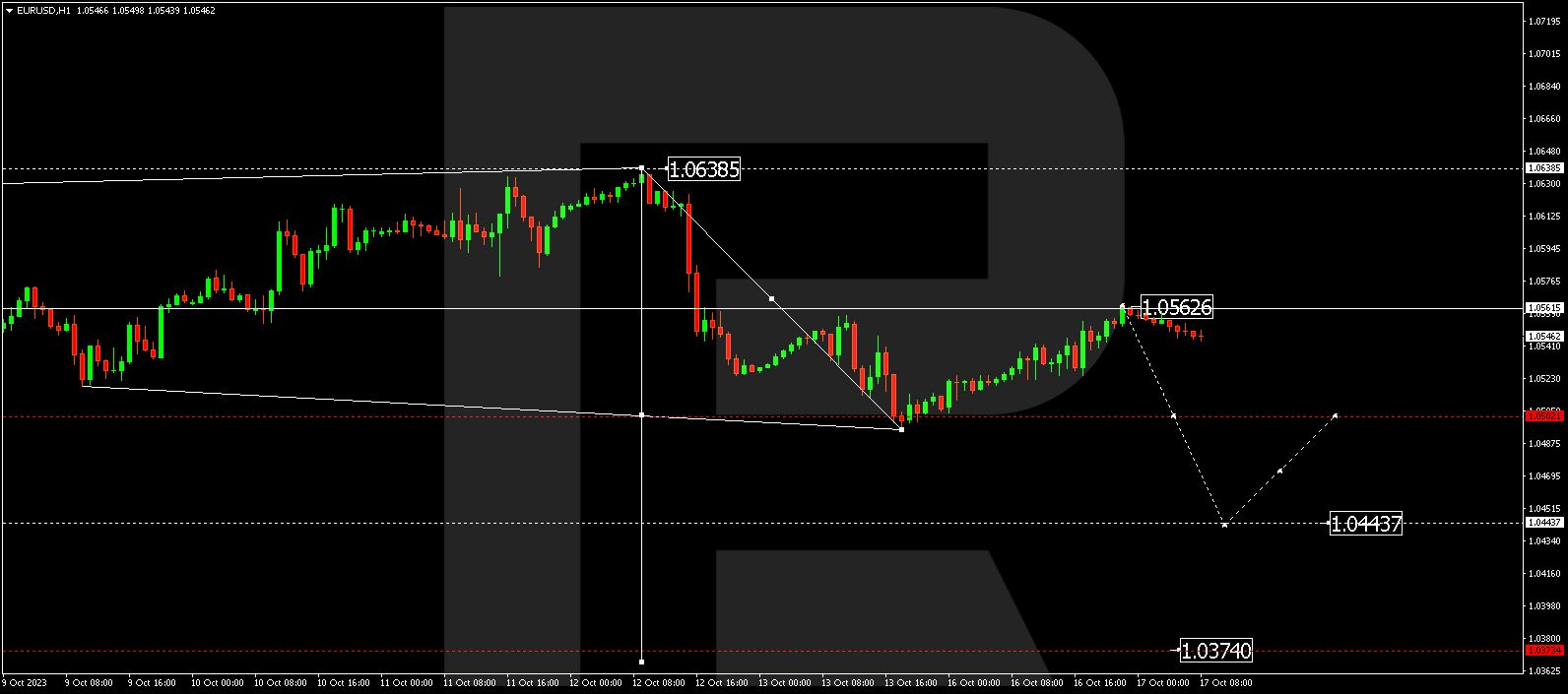

EUR/USD (Euro vs US Dollar)

EUR/USD recently wrapped up a corrective wave, reaching 1.0562. Today, the market is embarking on a downward trajectory to 1.0502. If this level is breached, a potential further dip to 1.0444 might occur. Following this, a correction to 1.0502 (likely tested from below) is plausible.

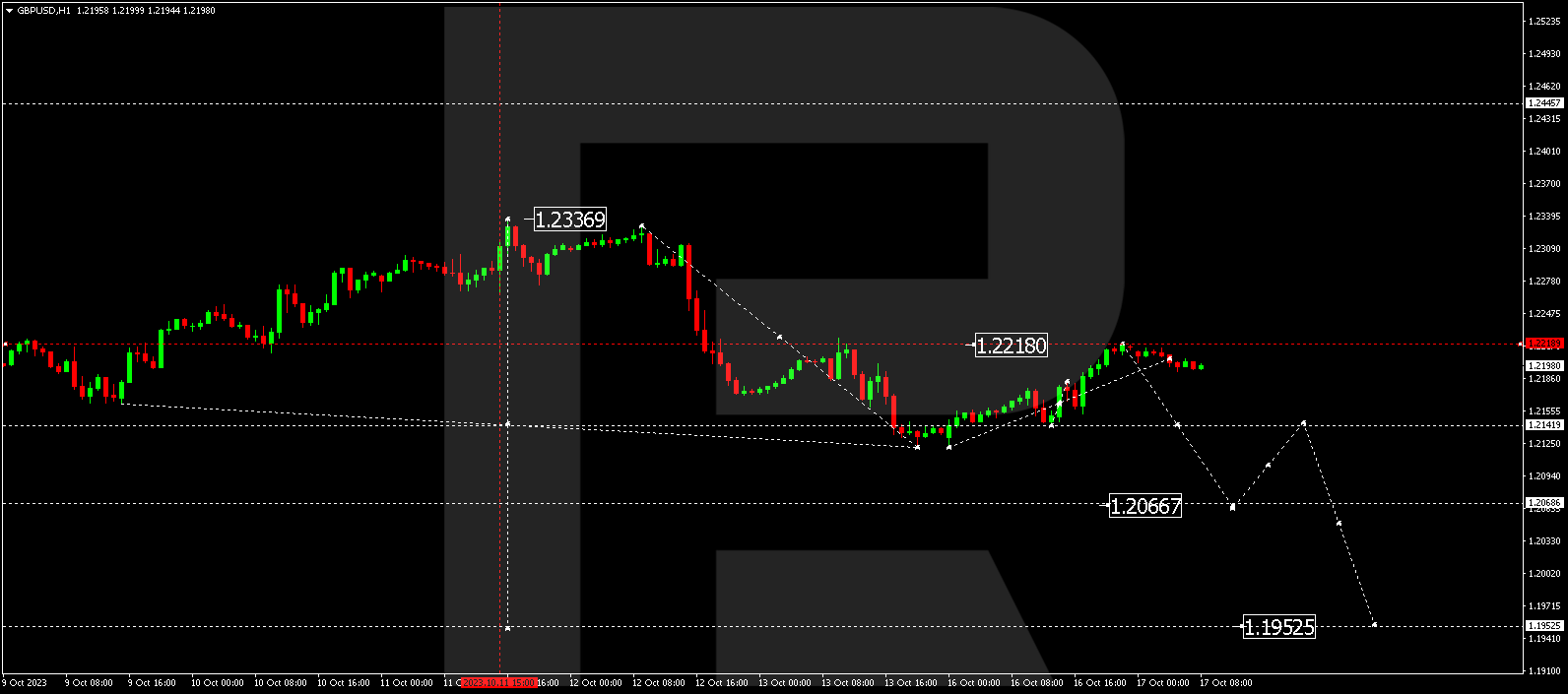

GBP/USD (Great Britain Pound vs US Dollar)

GBP/USD concluded a corrective wave at 1.2218. It is now tracing a downward movement to 1.2141. If this level is breached, a path to 1.2066 might unfold. Upon reaching this level, an upswing to 1.2141 (probably tested from below) is anticipated, followed by an anticipated decline to 1.1953.

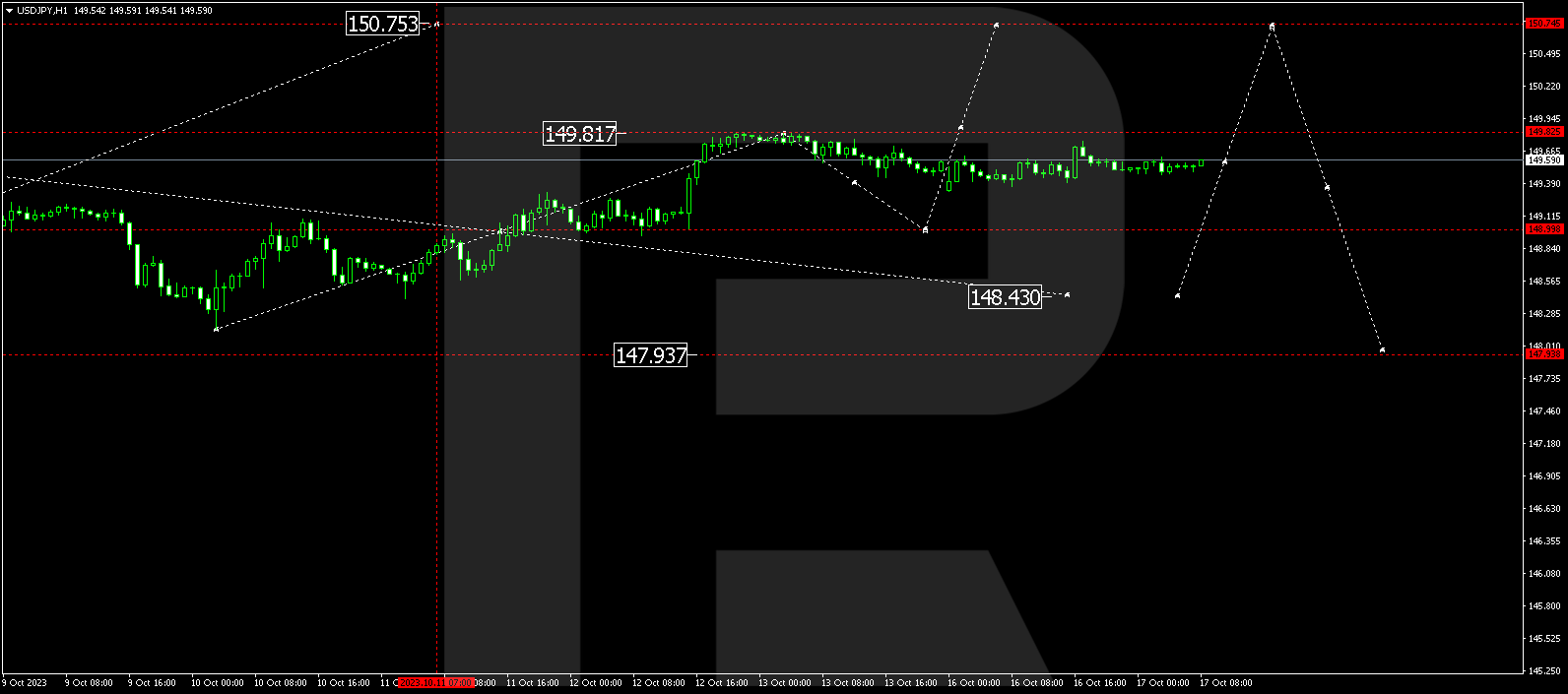

USD/JPY (US Dollar vs Japanese Yen)

USD/JPY remains in a consolidation range near 149.49, lacking a strong trend. An escape from this range downwards might prompt a correction to 148.98. Conversely, an upward breakout could lead to a rise to 150.75.

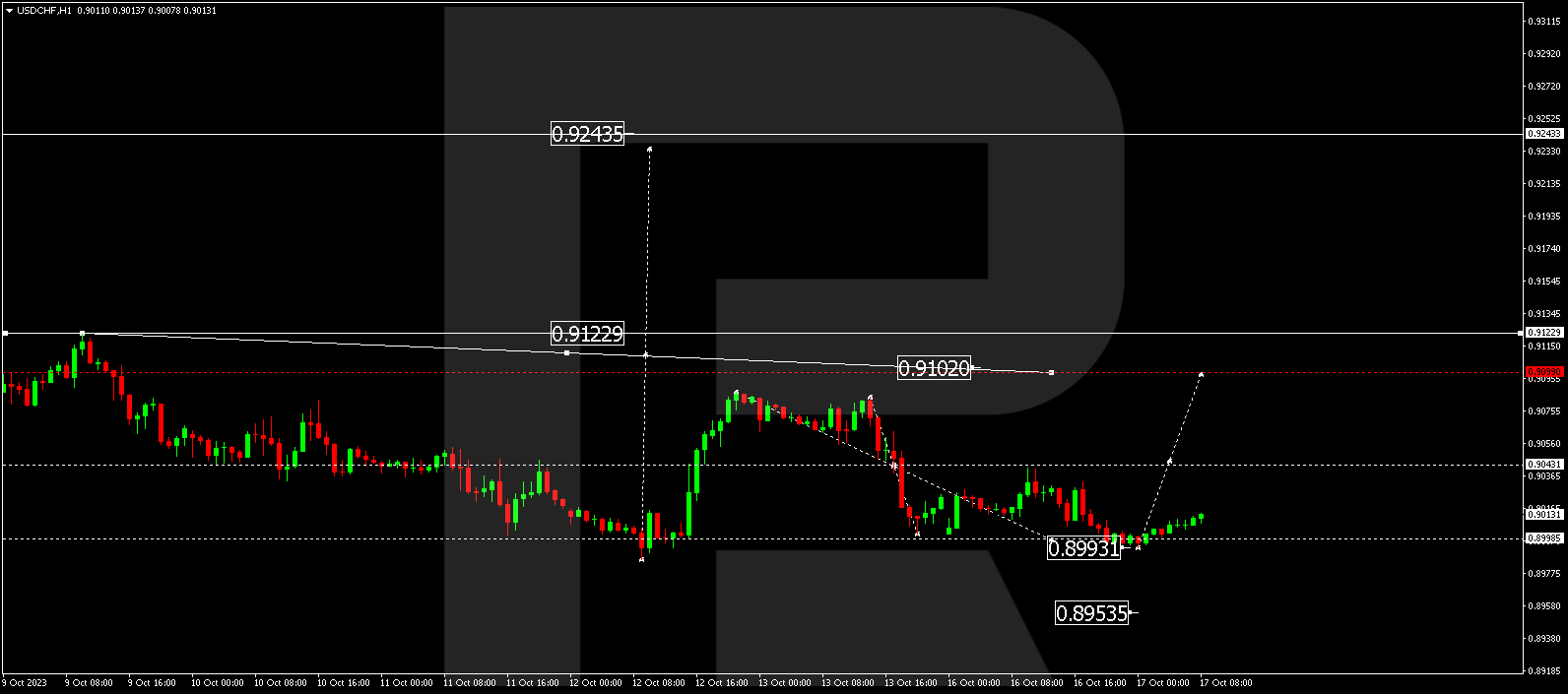

USD/CHF (US Dollar vs Swiss Franc)

USD/CHF has successfully corrected to 0.8993. Presently, the market is initiating an upward trajectory to 0.9044. A breach of this level could set the stage for a growth wave to 0.9090, constituting the first target. Subsequently, a decline to 0.9044 (likely tested from above) may precede a rise to 0.9244.

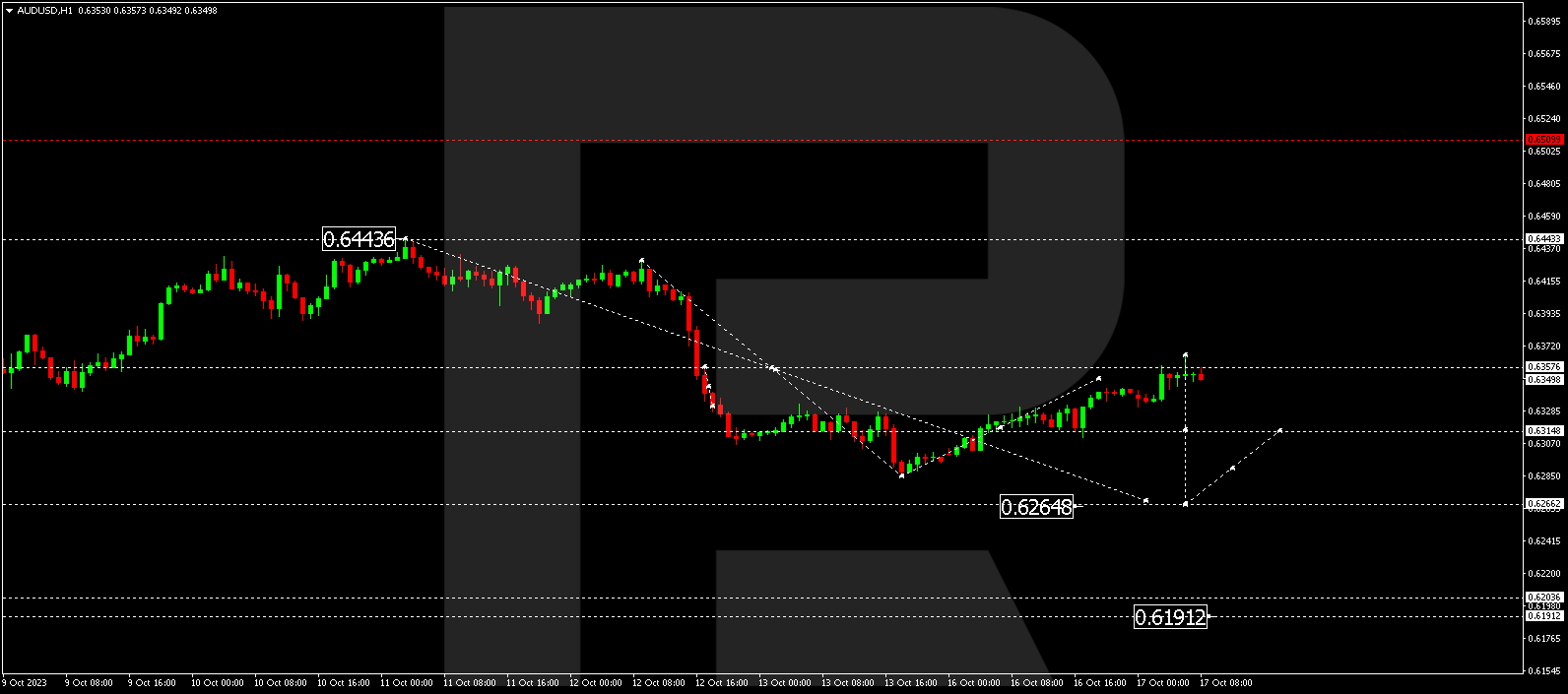

AUD/USD (Australian Dollar vs US Dollar)

AUD/USD concluded a corrective wave at 0.6366. An impending decline to 0.6315 is anticipated. Should this level be surpassed, a potential downswing to 0.6265 might manifest. A subsequent correction to 0.6315 (probably tested from below) is projected, followed by a decline to 0.6191.

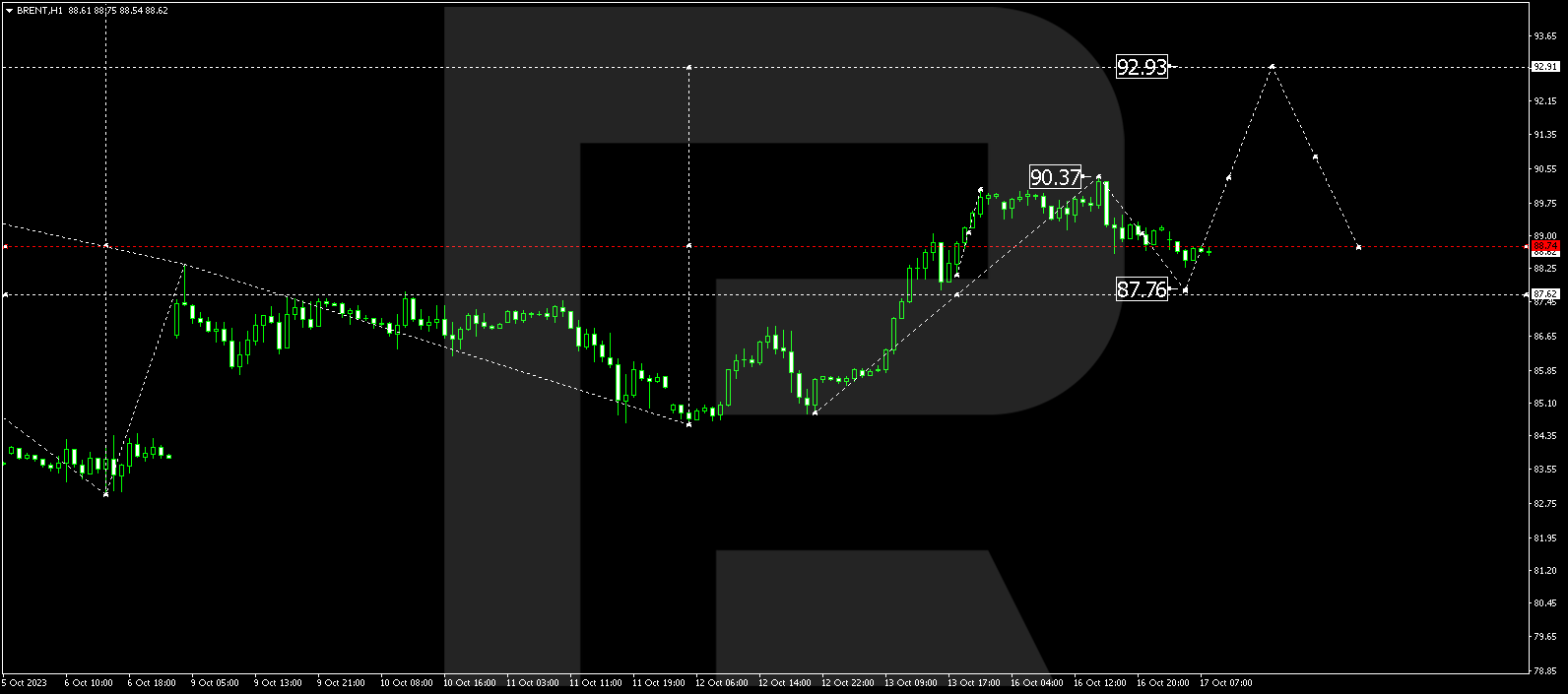

BRENT

Brent is consolidating around 89.10. A downward breakout may trigger a corrective move to 87.77. Conversely, an upward escape could extend the growth wave to 92.92, marking the initial target.

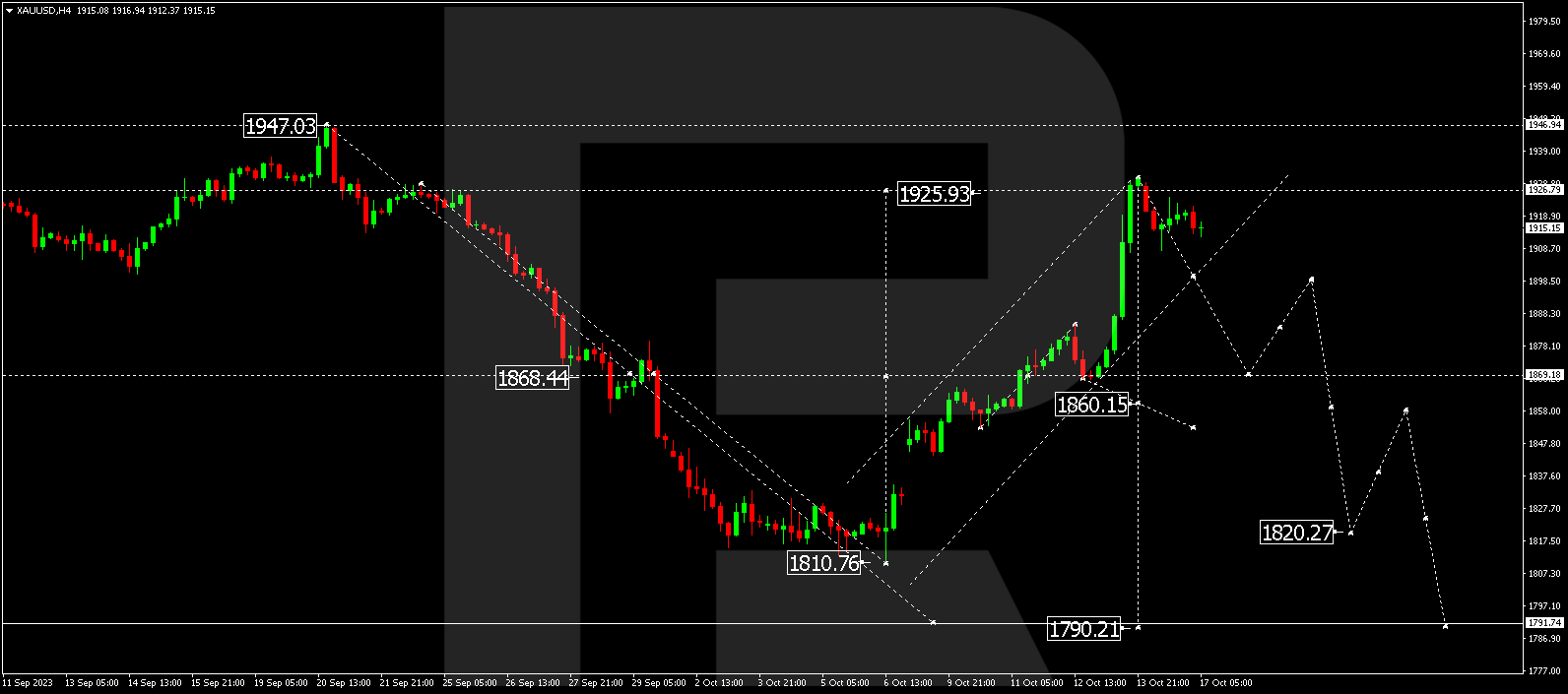

XAU/USD (Gold vs US Dollar)

Gold is establishing a consolidation range below 1927.00. A downside breakout might propel a decline to 1870.00. Upon reaching this level, an upswing to 1898.00 and a subsequent decline to 1820.30 might follow. These levels constitute local targets.

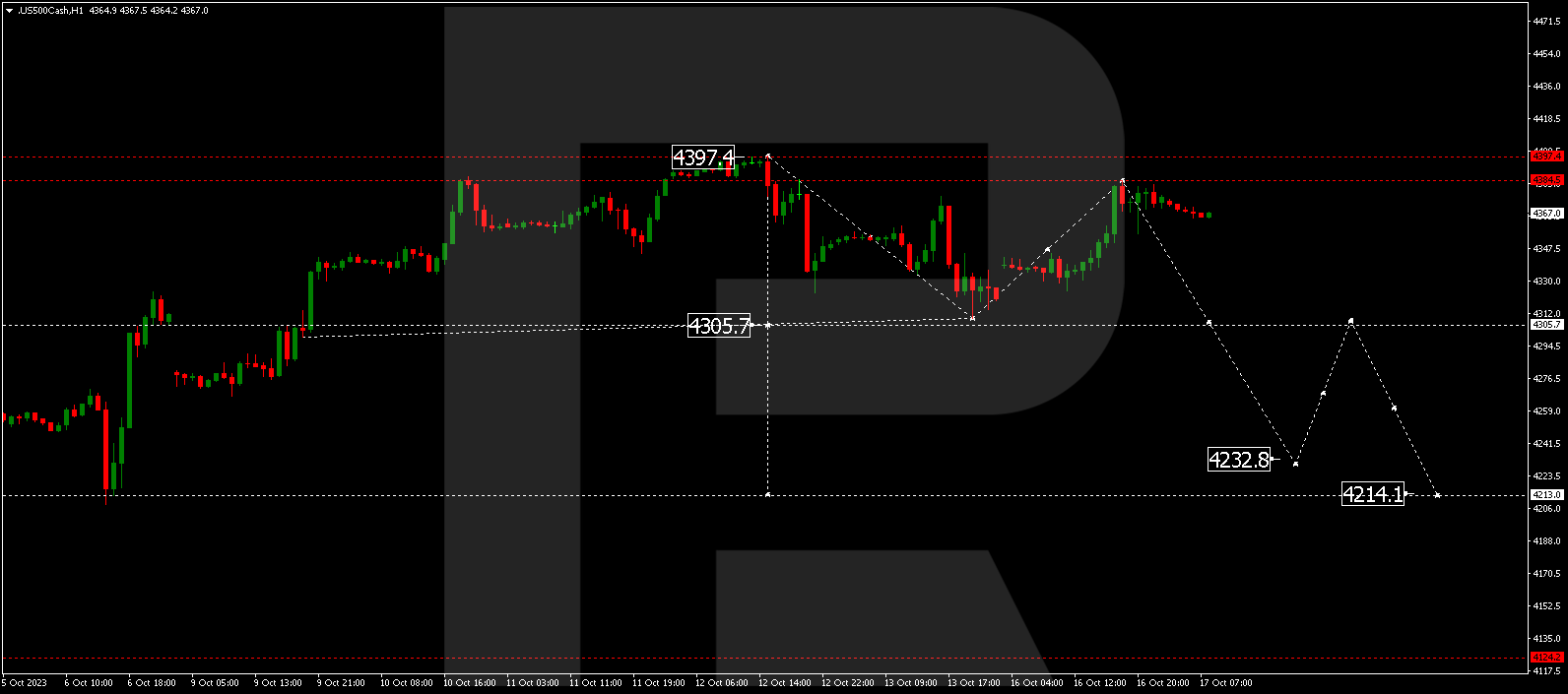

S&P 500

The stock index wrapped up a correction wave at 4384.5. An impending decline to 4343.0 is likely. A breach of this level could pave the way for a downturn to 4232.0, representing a local target.

The post Technical Analysis & Forecast October 17, 2023 appeared first at R Blog – RoboForex.