The S&P 500 index might experience further declines after a minor correction. In addition to this, we will delve into the dynamics of EUR, GBP, JPY, CHF, AUD, Brent, and Gold.

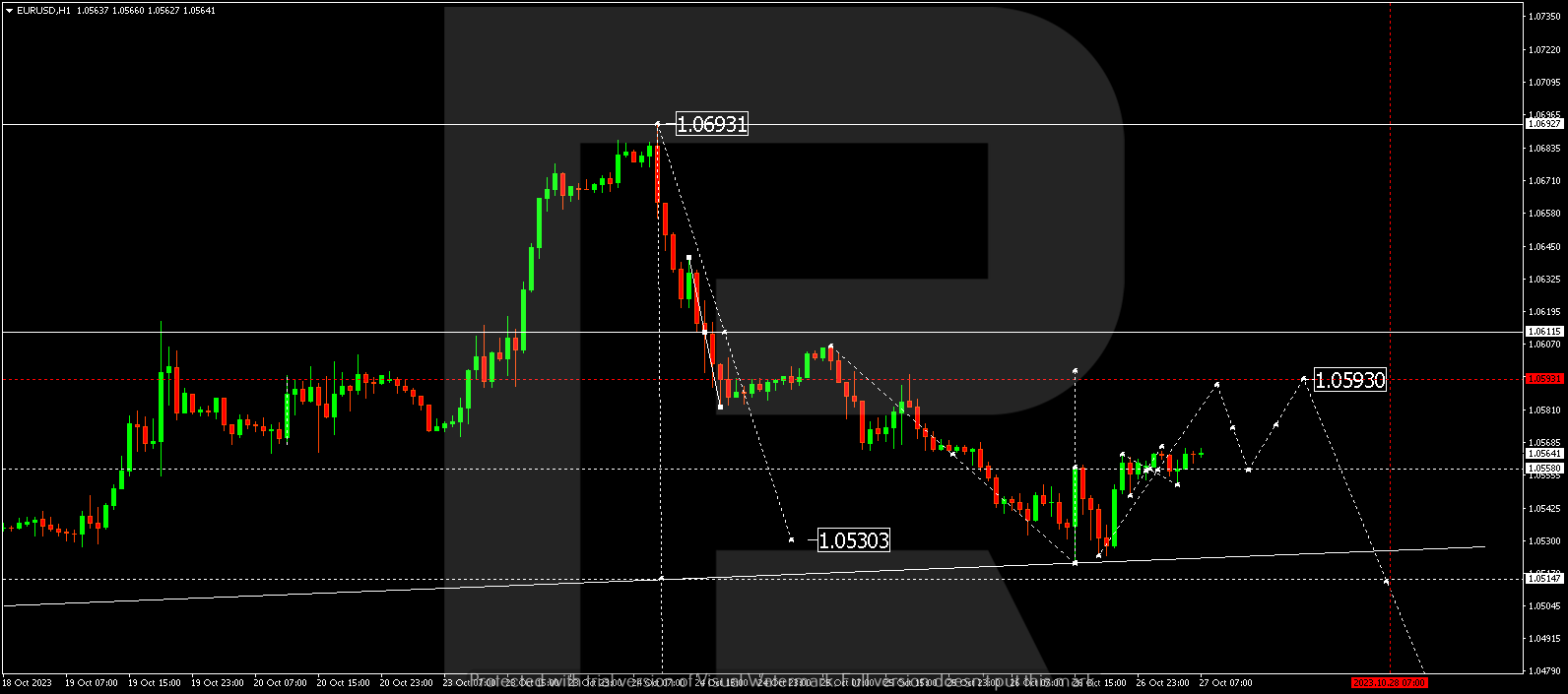

EUR/USD (Euro vs US Dollar)

EUR/USD has initiated a downward wave, reaching 1.0521. It’s possible that today, the quotes might correct to 1.0590. After reaching this level, a new wave of decline towards 1.0515 could commence. This marks the first target.

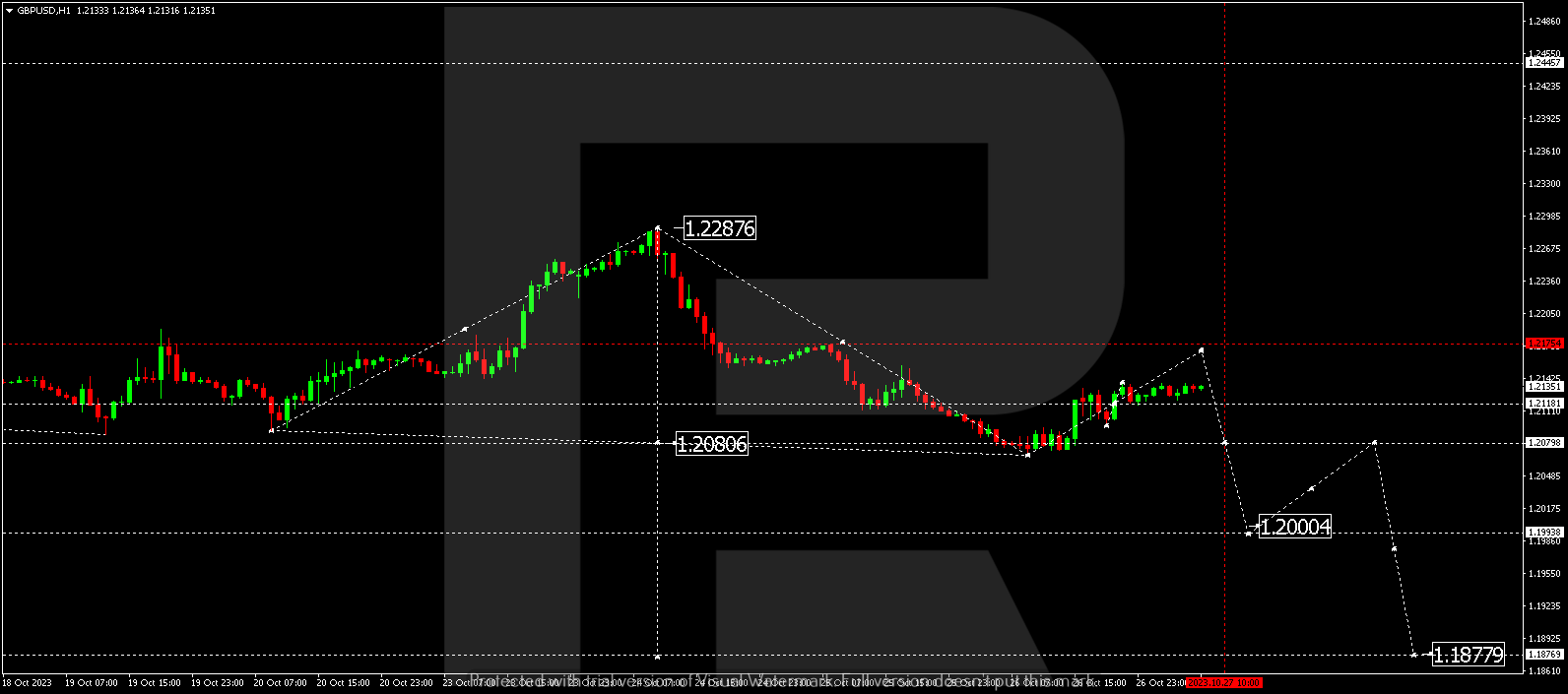

GBP/USD (Great Britain Pound vs US Dollar)

GBP/USD has completed a descending wave to 1.2068. Today, it could correct to 1.2170. Following this, the trend might continue to 1.2000, which represents a local target.

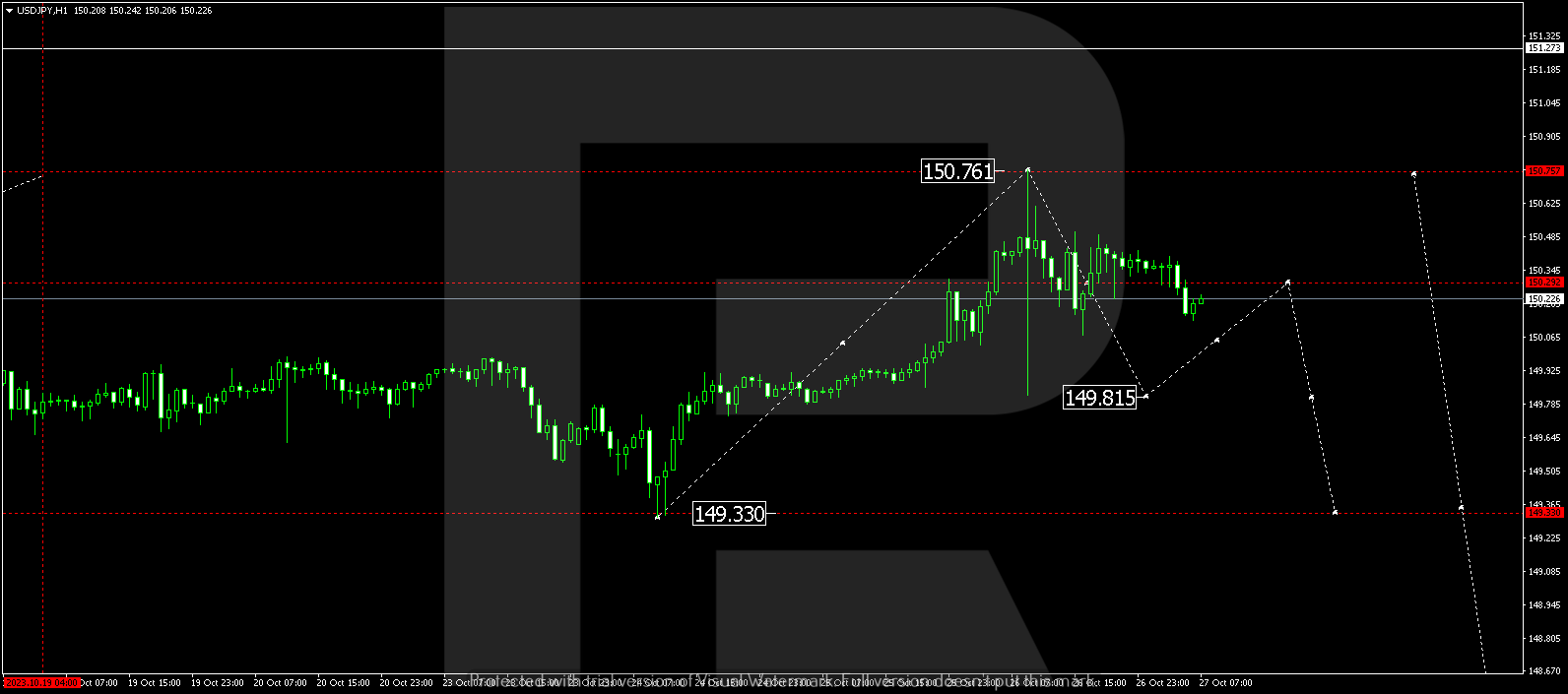

USD/JPY (US Dollar vs Japanese Yen)

USD/JPY has successfully executed a rising impulse to 150.75 and undergone a correction to 149.83. Today, the market is establishing a consolidation range around 150.30 and could decline to 149.80. Should this level be breached downwards, the potential for a decline to 149.33 may become apparent. This constitutes the first target.

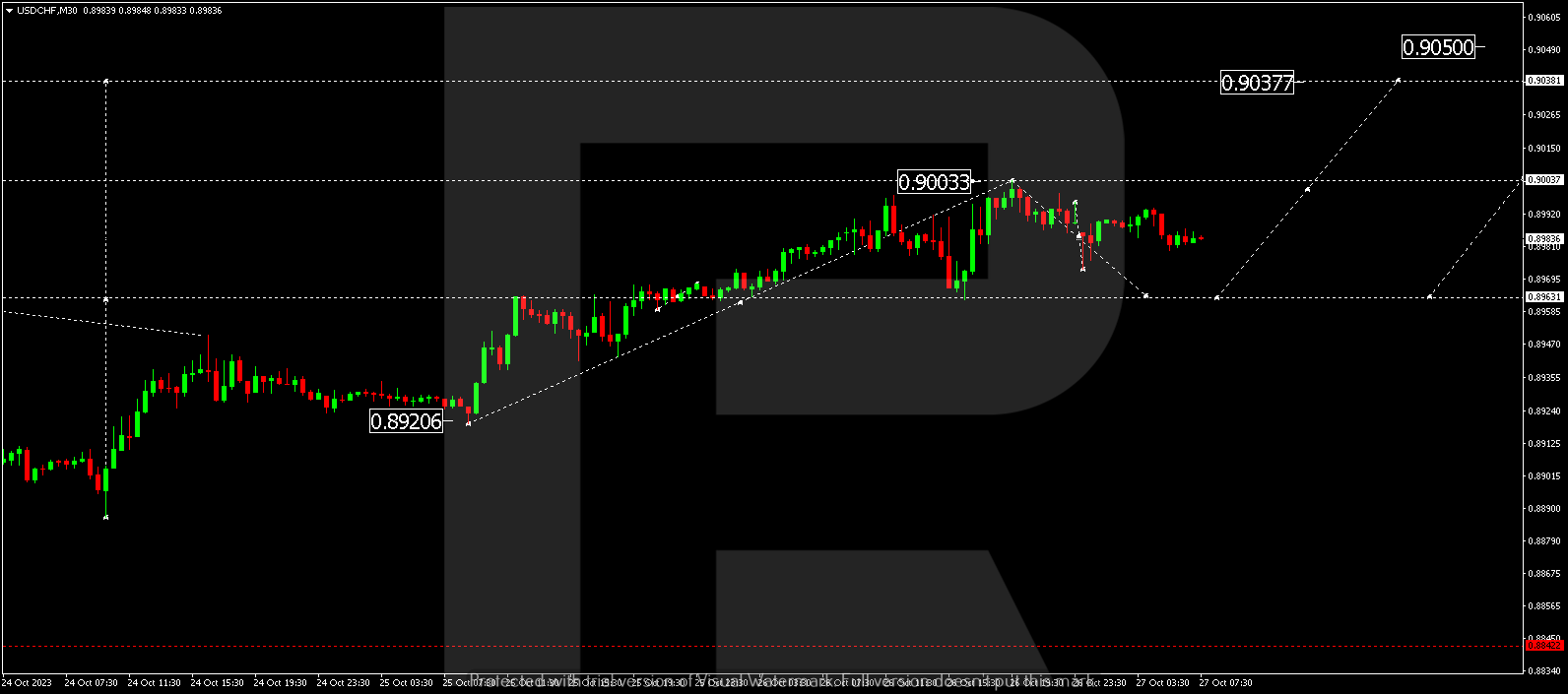

USD/CHF (US Dollar vs Swiss Franc)

USD/CHF has reached the local target of the downward wave at 0.9003. Today, the quotes might correct to 0.8965 (with a test from above). Subsequently, a new upward movement to 0.9040 might commence. This is the first target.

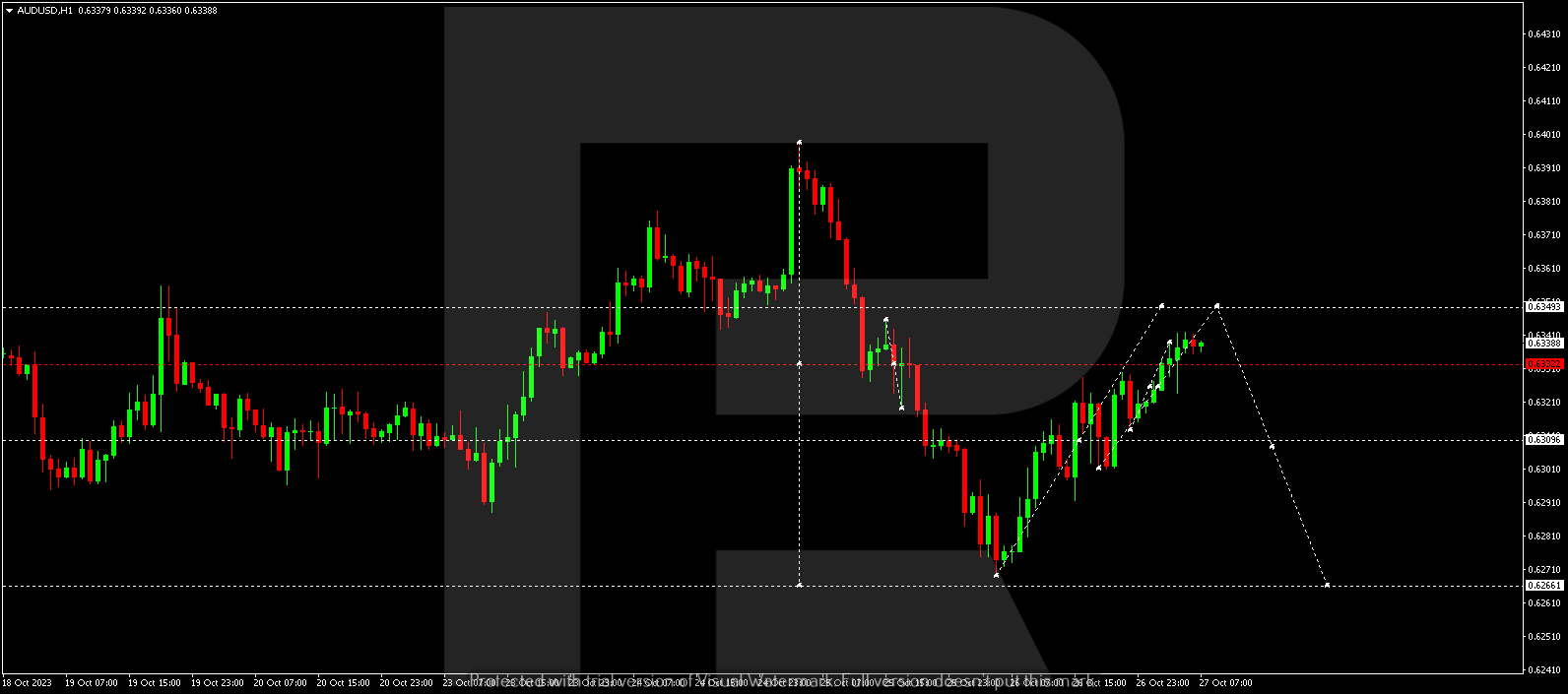

AUD/USD (Australian Dollar vs US Dollar)

AUD/USD has formed a consolidation range around 0.6310 and, if it escapes upwards, could extend the correction to 0.6350. Upon completing this correction, a decline is anticipated, with the target being 0.6266 – this is the first target.

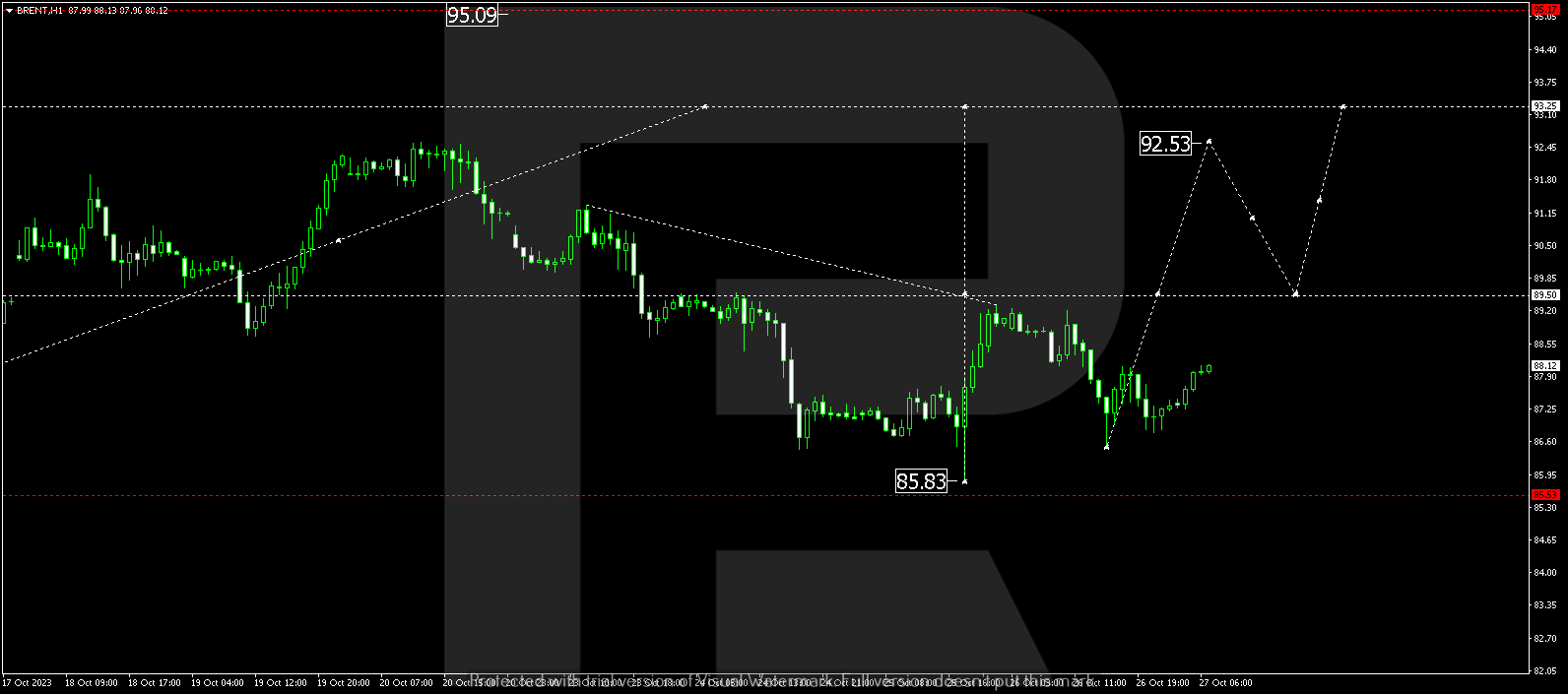

BRENT

Brent has successfully completed a correction wave at 86.50. Today, the market may rise to 89.50, and upon breaking this level upwards, it might open the potential for a new upward wave to 93.25, from which the trend could continue to 95.00. This represents a local target.

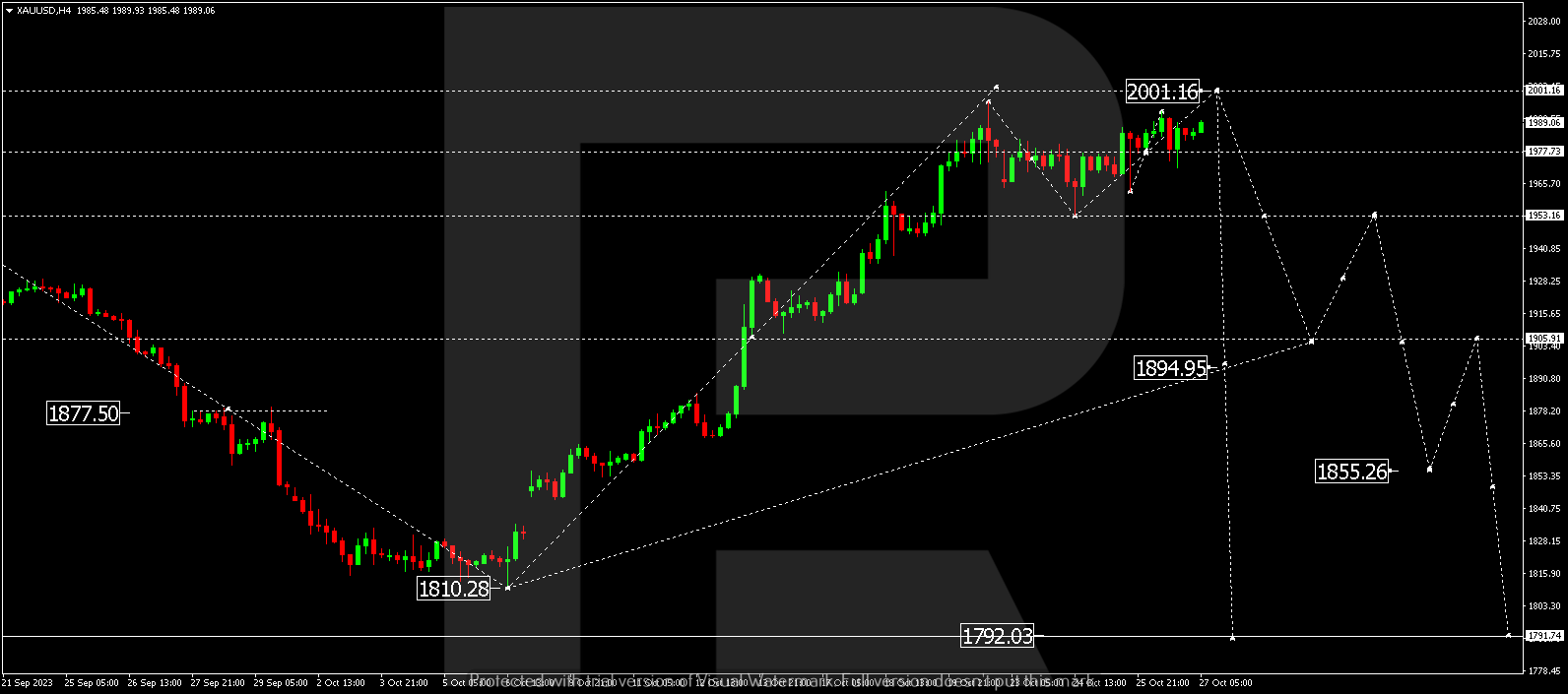

XAU/USD (Gold vs US Dollar)

Gold continues to consolidate within the range around 1977.00. Today, the range may expand to 2001.11. Following this expansion, a decline to 1952.00 is expected. In the event of a breakout below this level, the potential for a decline towards 1905.00 may be realized – this is the first target.

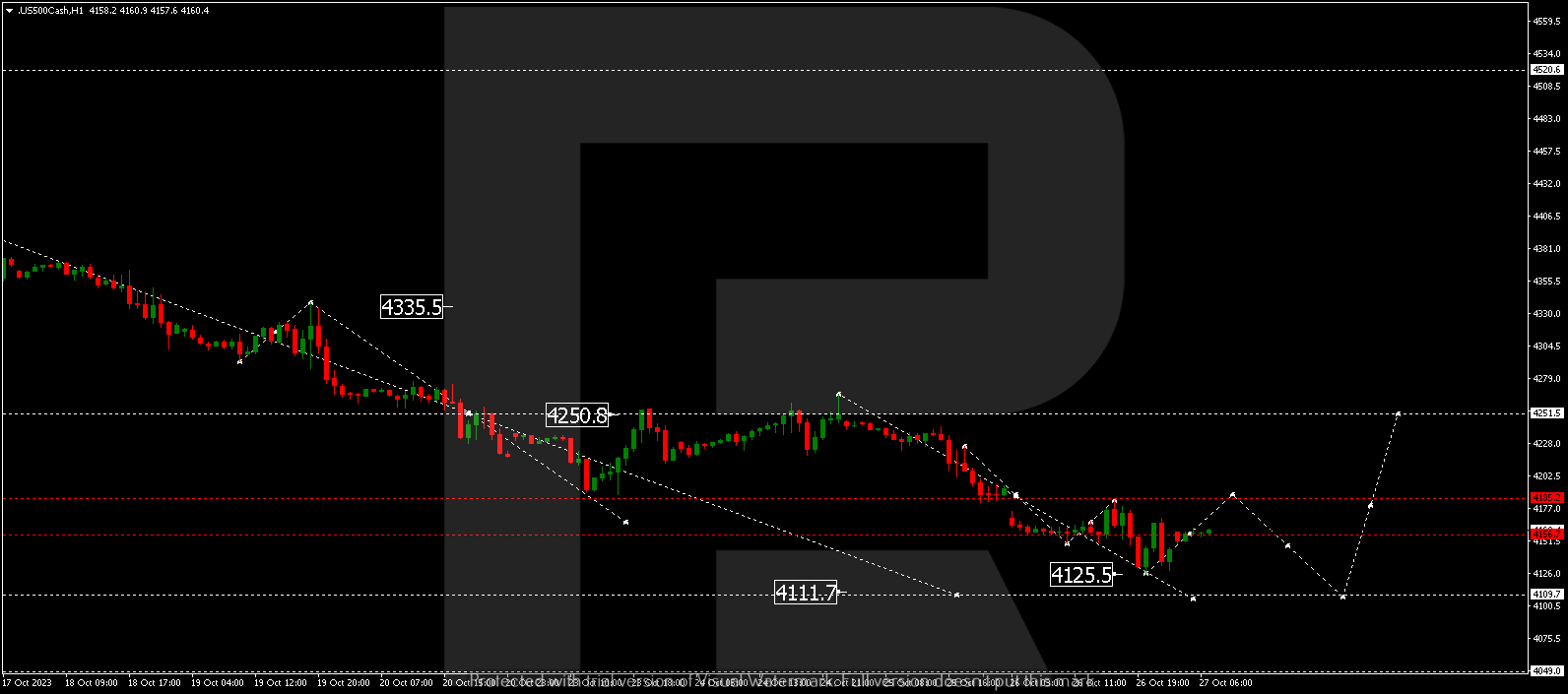

S&P 500

The stock index has completed a declining wave to 4125.5. A correction to 4185.0 could potentially occur today, marked by a test from below. After the correction, a decline to 4111.1 is expected – this is the first target.

The post Technical Analysis & Forecast October 27, 2023 appeared first at R Blog – RoboForex.