EUR continues its correction. In this overview, we also delve into the dynamics of GBP, JPY, CHF, AUD, Brent, Gold, and the S&P 500 index.

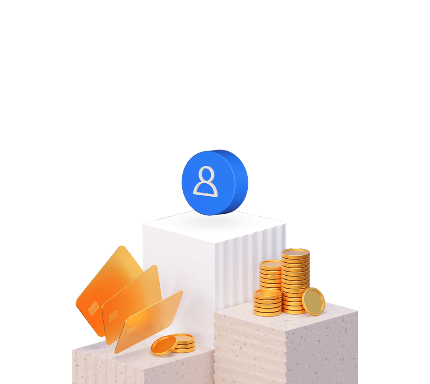

EUR/USD (Euro vs US Dollar)

EUR/USD found support at 1.0546 and completed an upward structure to 1.0585. Currently, a consolidation range has formed around this level. Breaking above this range, the price reached a local target of 1.0622. Today, we anticipate a correction to 1.0585 (with a test from above), followed by another correction to 1.0648. After reaching this level, another downward wave to 1.0515 is expected to commence.

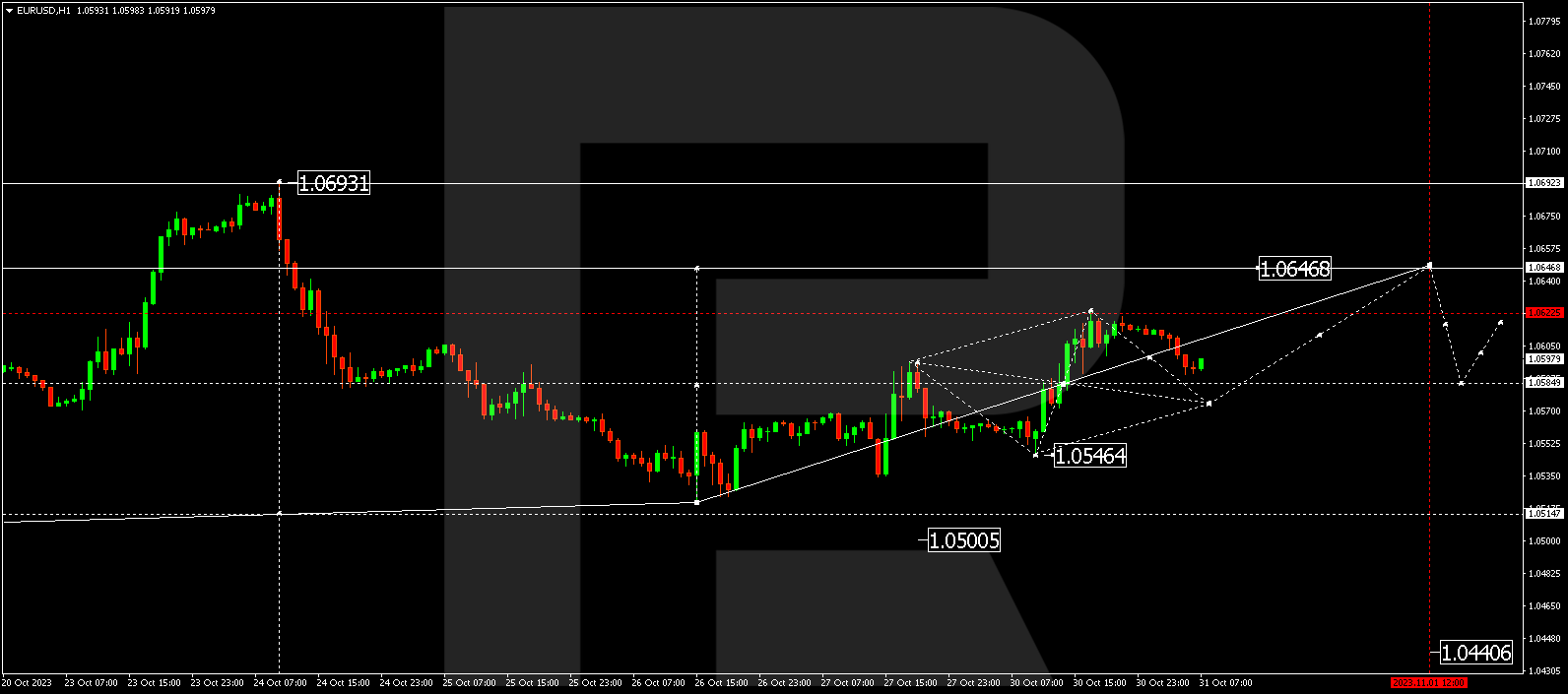

GBP/USD (Great Britain Pound vs US Dollar)

GBP/USD received support at 1.2090 and completed an upward structure to 1.2132. A consolidation range has now formed around this level. Breaking above this range, the price reached a local correction target of 1.2173. We expect a decline to 1.2132 (with a test from above) today, followed by another corrective structure to 1.2193. The next step is a downward wave to 1.2080.

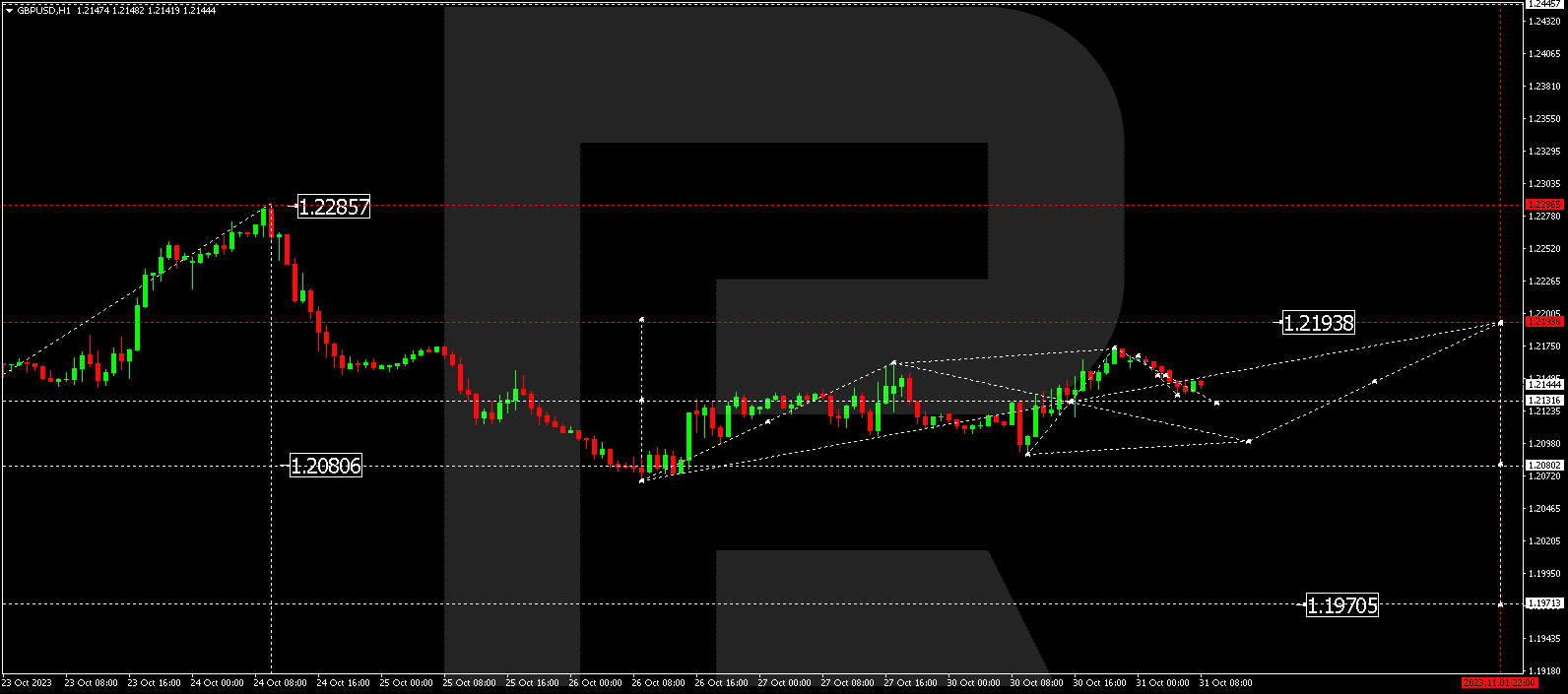

USD/JPY (US Dollar vs Japanese Yen)

USD/JPY has completed a downward wave to 148.80. The market is now forming an upward wave to 150.55. Once the price reaches this level, it could decline to 149.69.

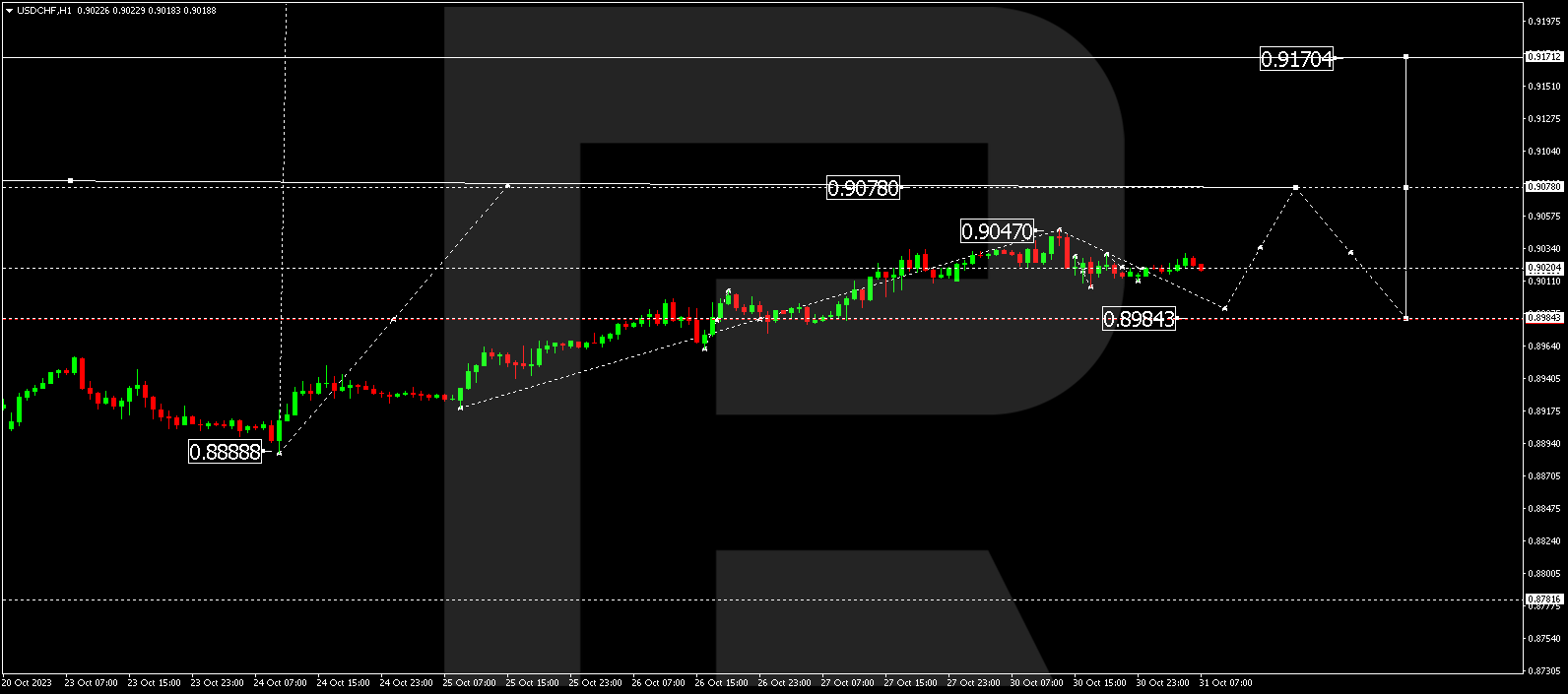

USD/CHF (US Dollar vs Swiss Franc)

USD/CHF has completed an upward wave, reaching 0.9047. Today, we expect a downward structure to 0.8985, followed by an upward move to 0.9078. This is the first target.

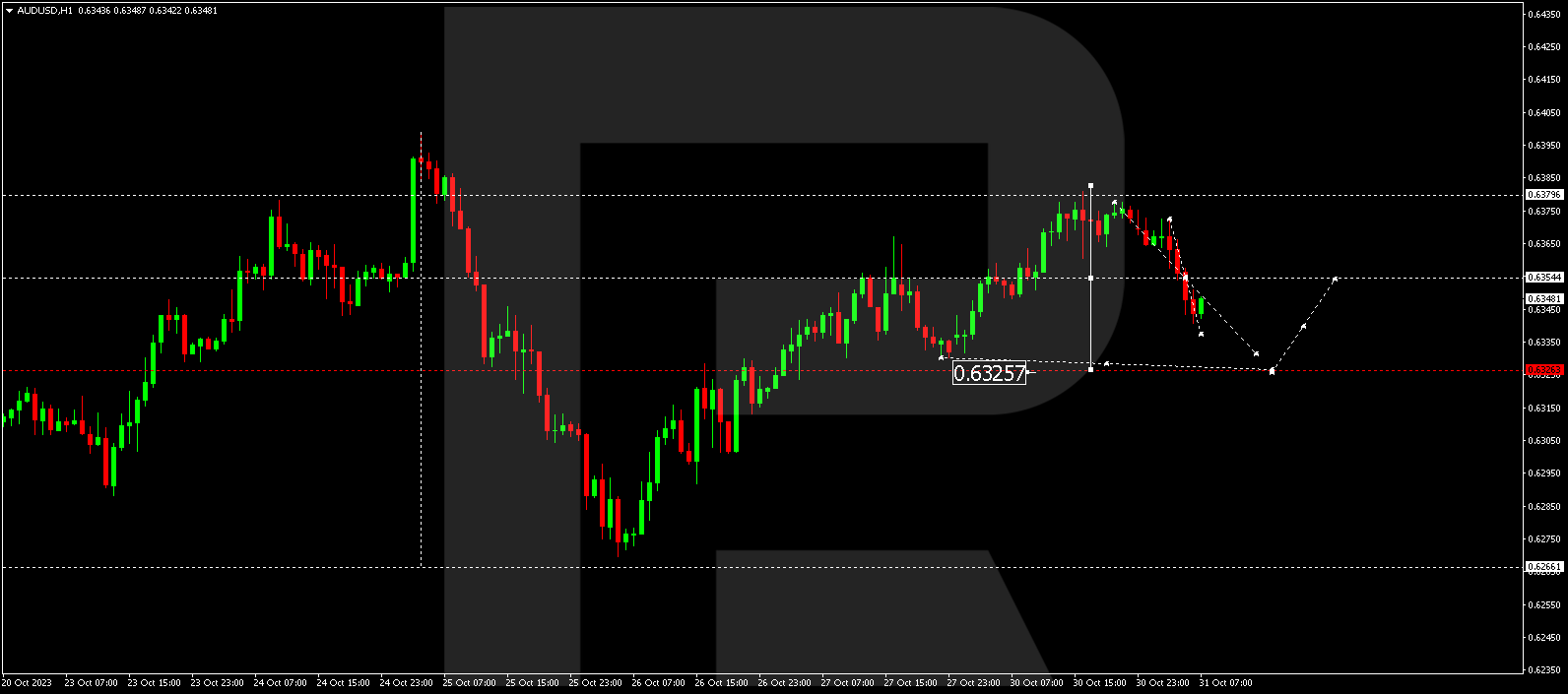

AUD/USD (Australian Dollar vs US Dollar)

AUD/USD has formed a consolidation range around 0.6355, which the market expanded to 0.6383. Today, we anticipate a decline to 0.6326, followed by a rise to 0.6355.

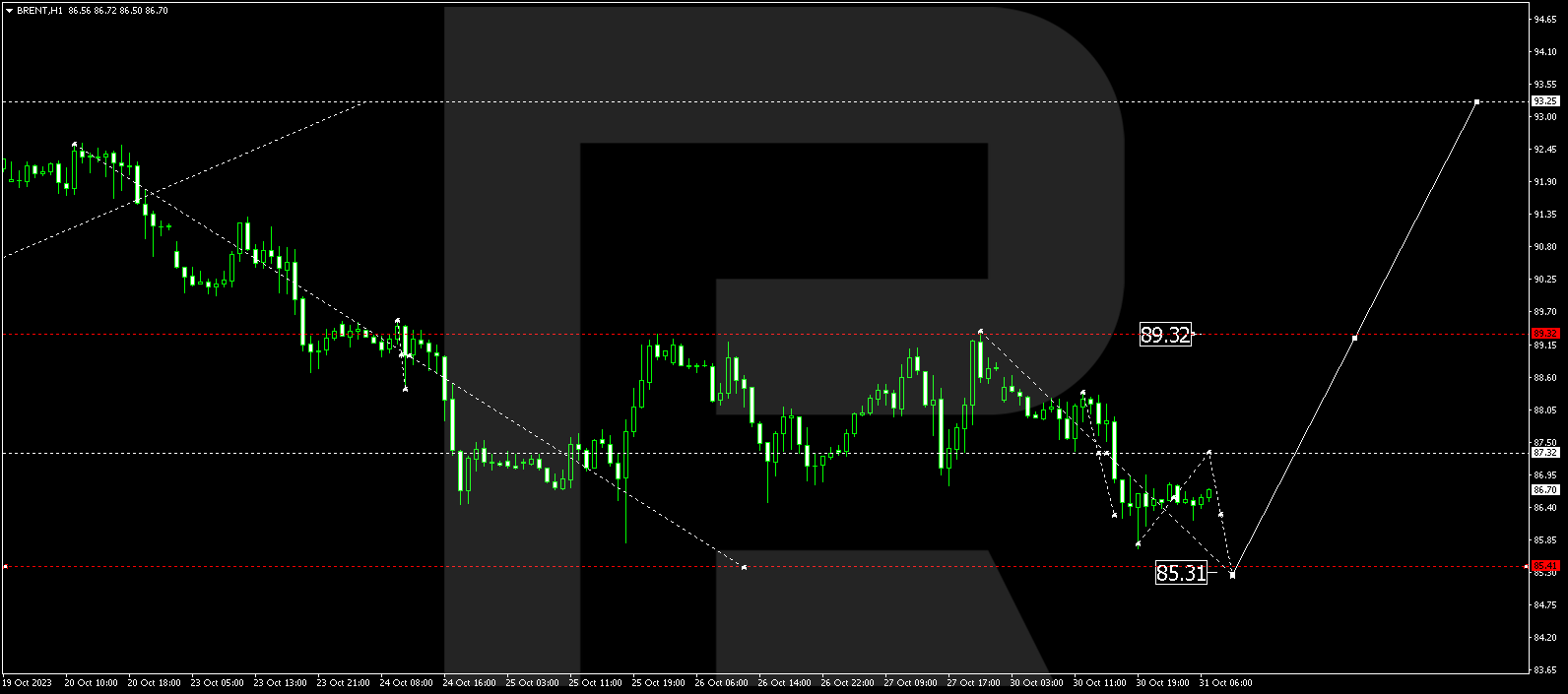

BRENT

Brent has corrected to 85.71. Today, we expect an upward move to 87.32, followed by a decline to 85.33. Afterward, a new upward trend to 89.32 could commence. This is the first target.

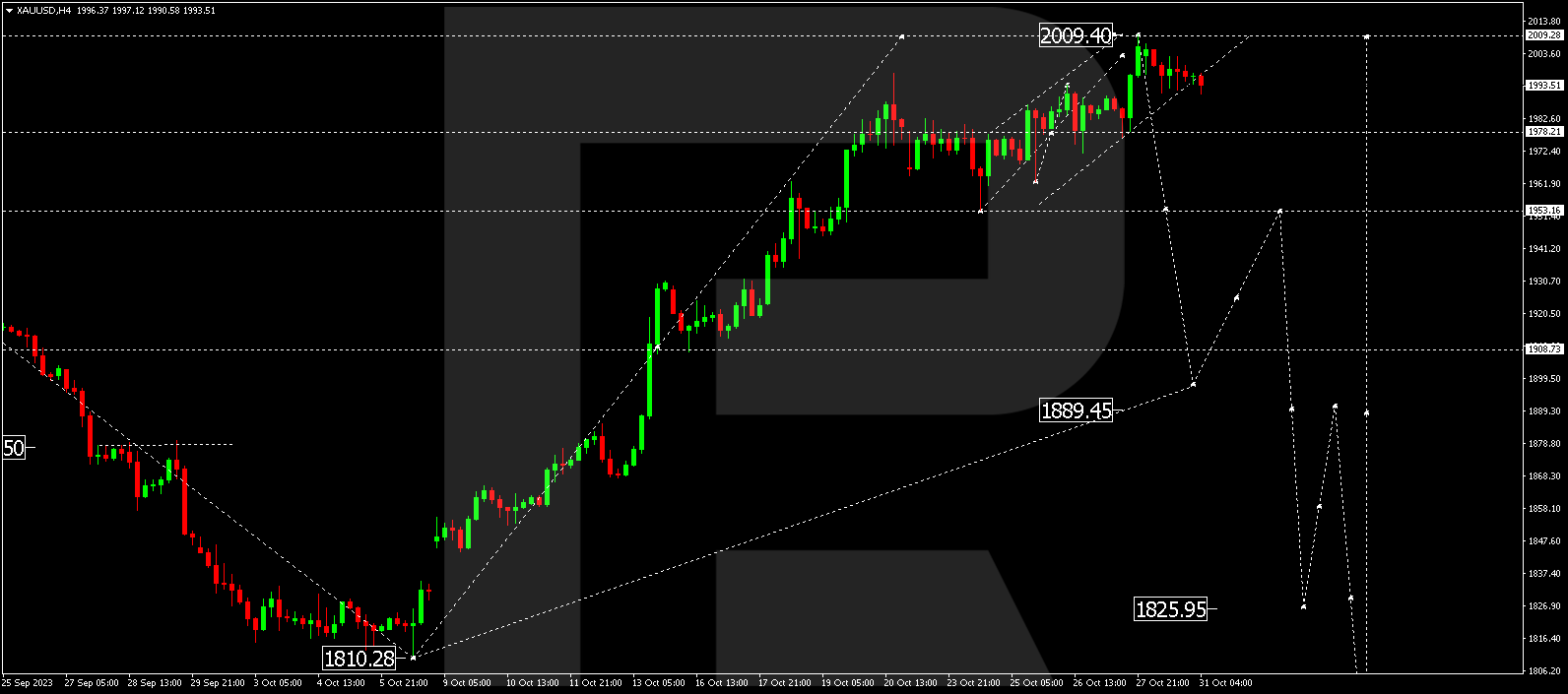

XAU/USD (Gold vs US Dollar)

Gold continues its downward movement to 1978.22. After reaching this level, the price could rise to 1993.15. Currently, a wide consolidation range is forming around 1978.22. A breakout below the range will open the potential for a decline to 1900.00.

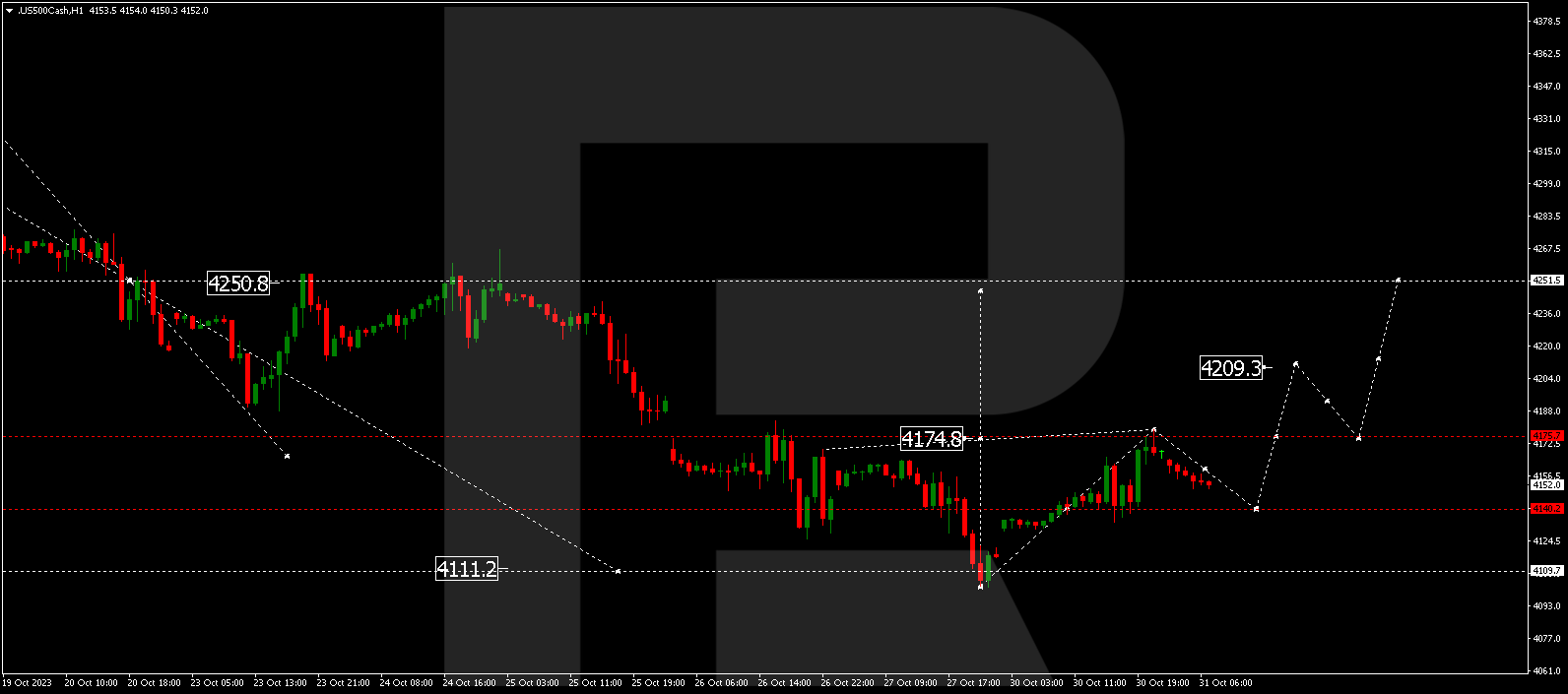

S&P 500

The stock index has completed an upward wave, reaching 4179.0. Today, the market is forming a downward structure to 4140.0. After reaching this level, it could maintain its upward trajectory to 4251.5.

The post Technical Analysis & Forecast October 31, 2023 appeared first at R Blog – RoboForex.