The Australian Dollar (AUD) Continues its Downward Trend: The overview also encompasses the performance of EUR, GBP, JPY, CHF, Brent, Gold, and the S&P 500 index.

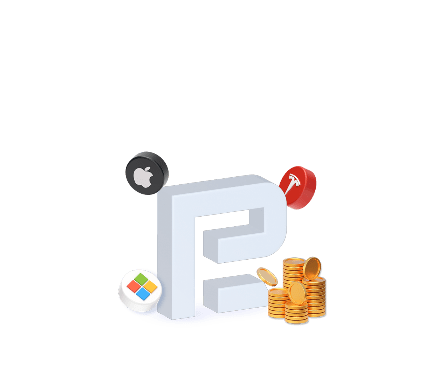

EUR/USD (Euro vs US Dollar)

EUR/USD has concluded a decline wave, reaching 1.0575. Today, a consolidation range may take shape above this level. A potential rise to 1.0616 (a test from below) cannot be ruled out, followed by a decline to 1.0556, potentially extending to 1.0550. This marks the initial target.

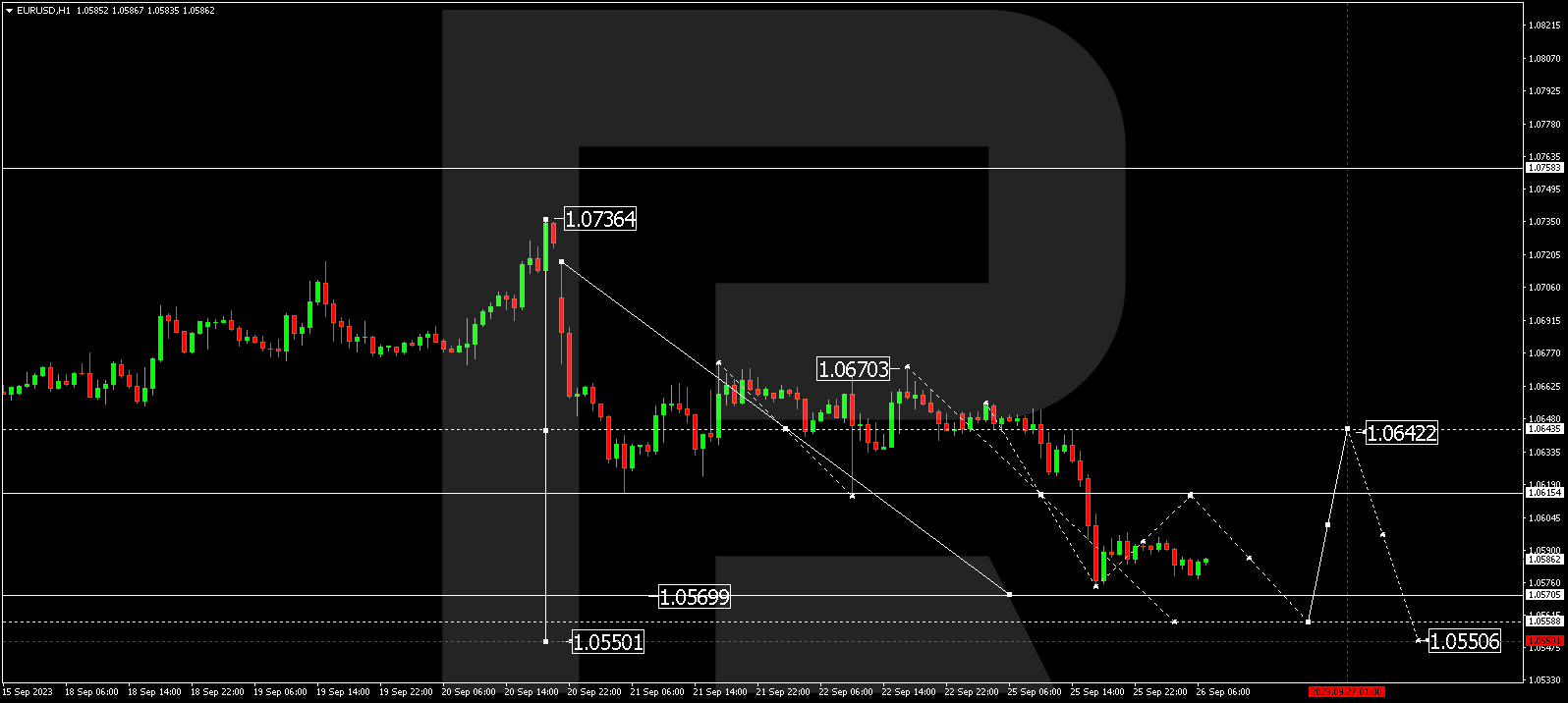

GBP/USD (Great Britain Pound vs US Dollar)

GBP/USD has concluded a decline wave, reaching 1.2194. Today, a consolidation range is expected to form above this level. If an upward breakout occurs, a corrective link to 1.2248 (a test from below) could manifest, followed by a decline to 1.2150. From there, the trend might continue to 1.2000.

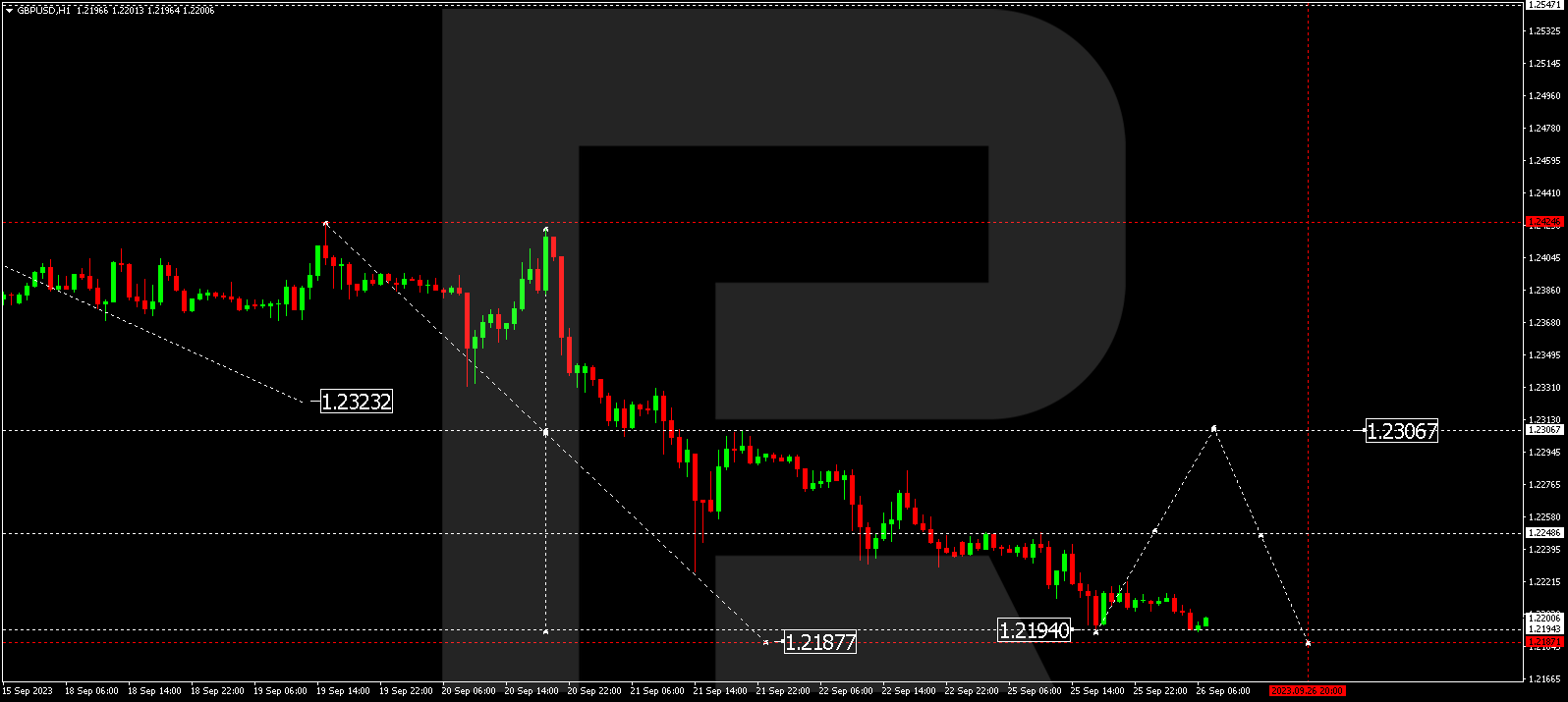

USD/JPY (US Dollar vs Japanese Yen)

USD/JPY has completed a growth wave, reaching 148.95. Today, an expansion in the growth structure to 149.05 is anticipated. Following this, a consolidation range might develop below this level. A downward breakout could lead to a corrective link to 148.14. Conversely, an upward breakout could steer the trend towards 149.94. This represents a local target.

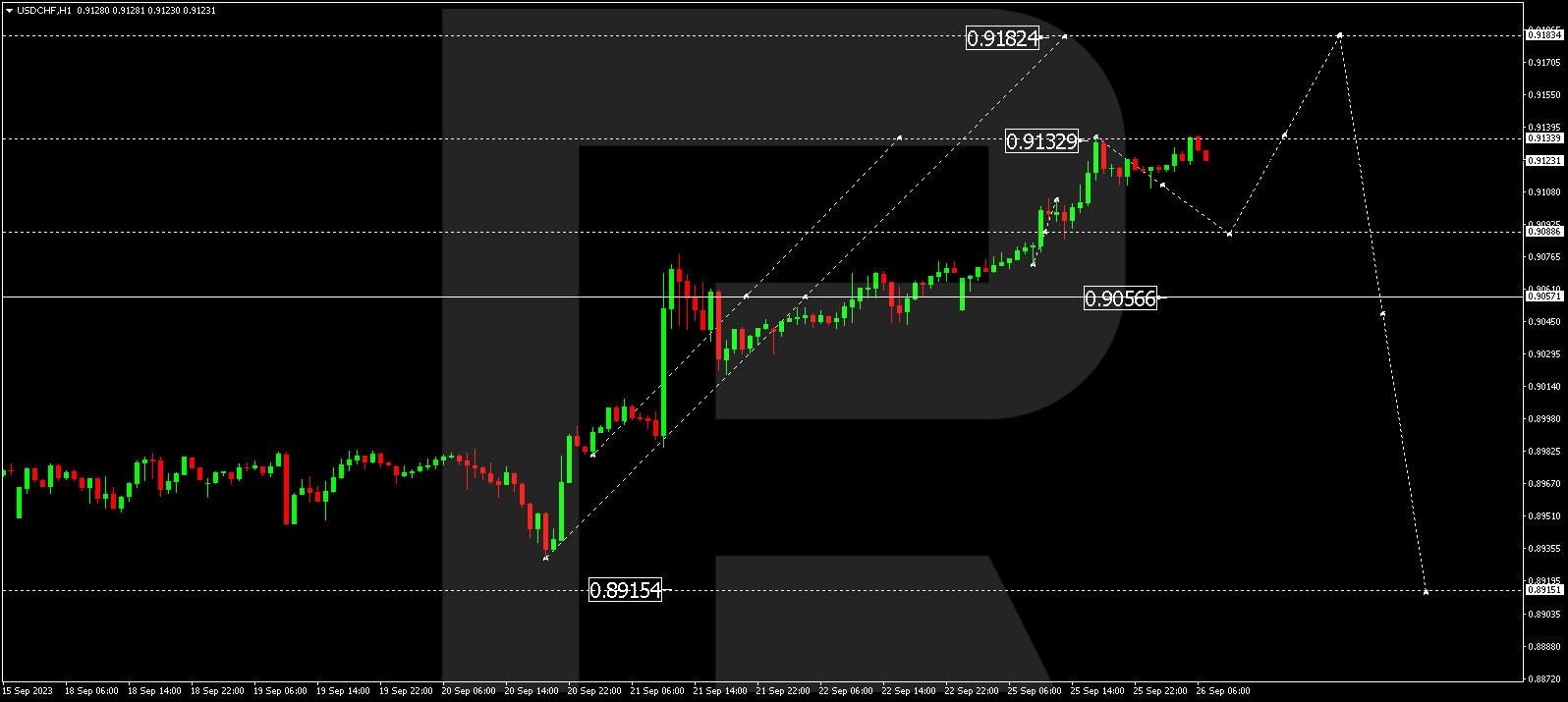

USD/CHF (US Dollar vs Swiss Franc)

USD/CHF has concluded a growth wave, reaching 0.9133. Today, a consolidation range is anticipated below this level. A downward breakout may result in a corrective link to 0.9088. Conversely, an upward breakout might pave the way for the trend to extend to 0.9184.

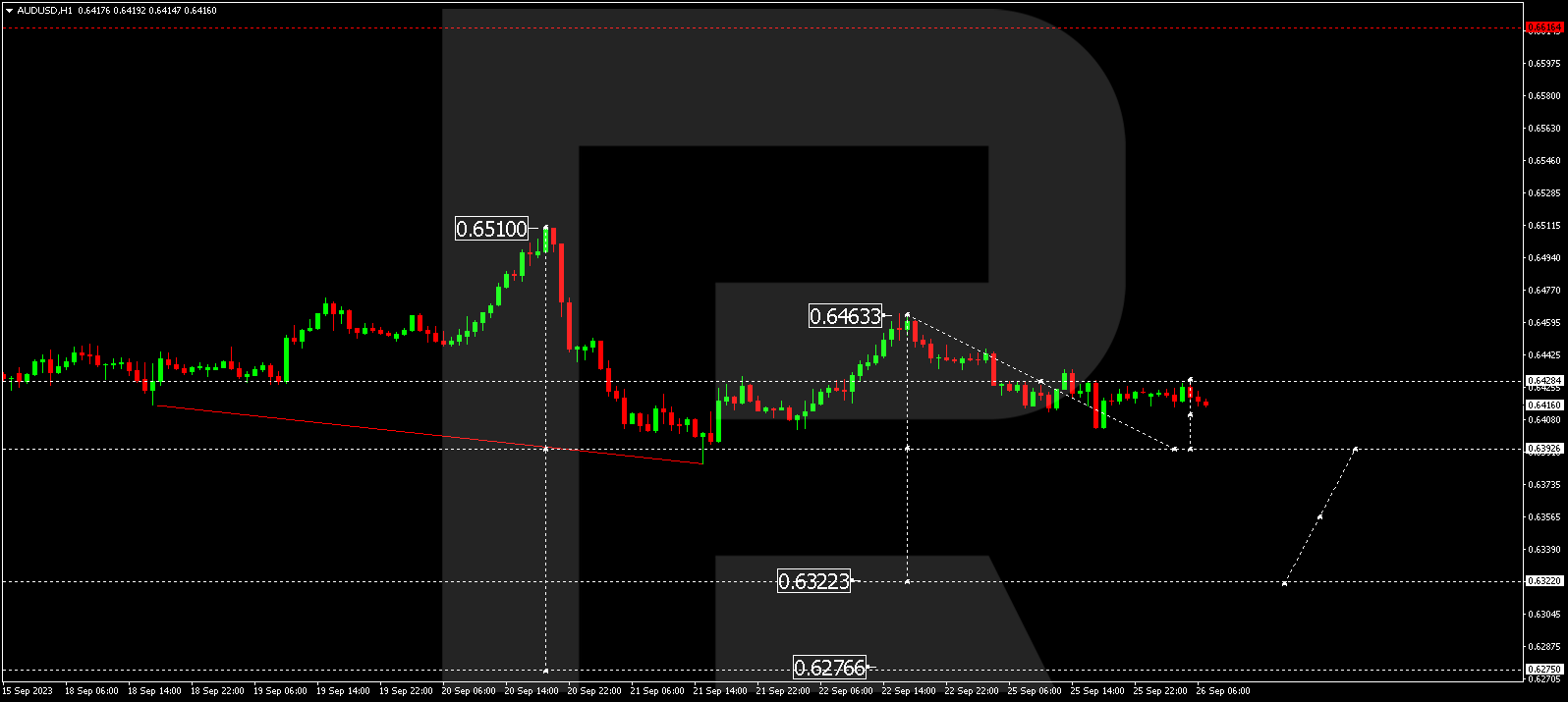

AUD/USD (Australian Dollar vs US Dollar)

AUD/USD is maintaining its downward trajectory towards 0.6393. After reaching this level, a corrective link to 0.6428 may emerge, followed by a decline to 0.6322. The trend could potentially develop to 0.6276.

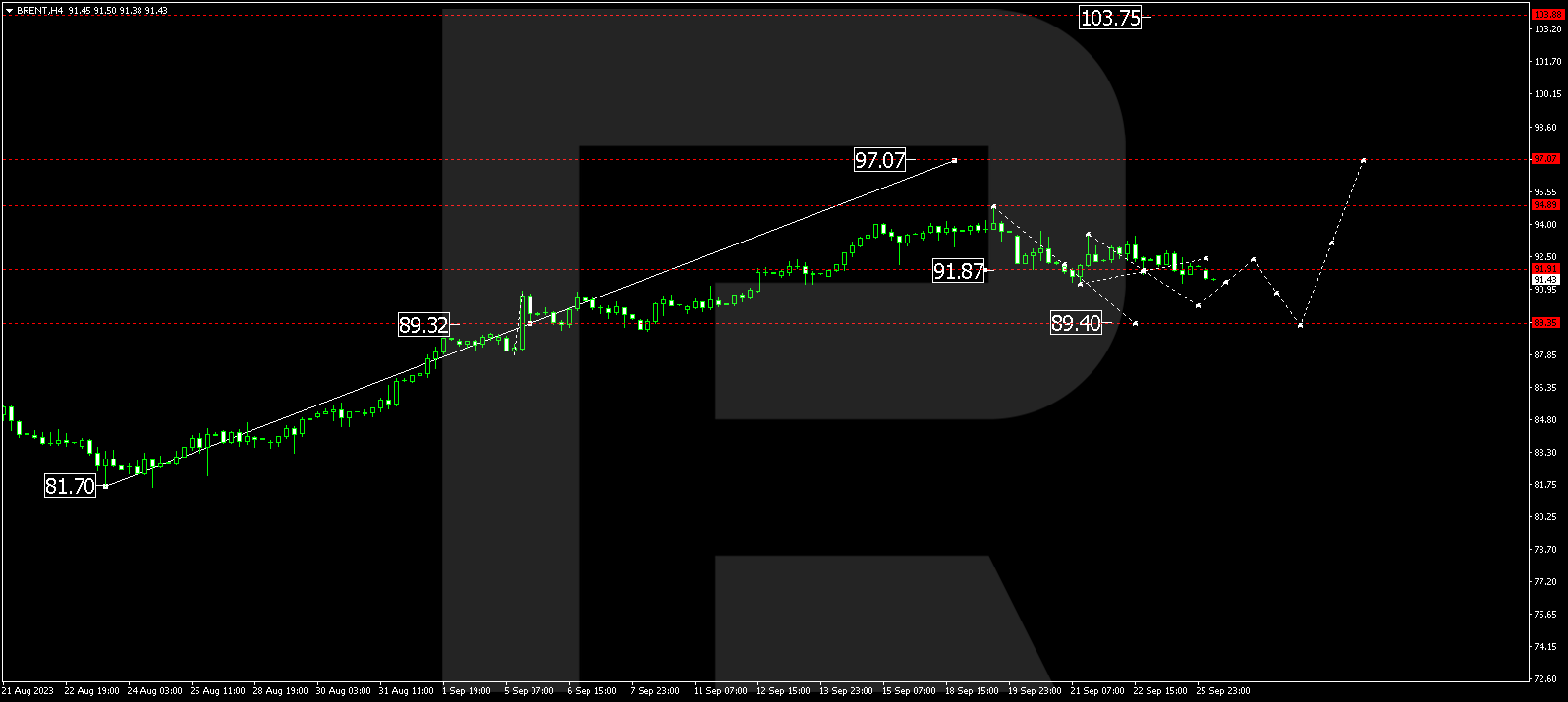

Brent

Brent is currently in a consolidation phase around 91.91. A correction might persist, targeting 89.40 today. Once this phase concludes, an upward movement to 97.07 is expected. This is considered a local target.

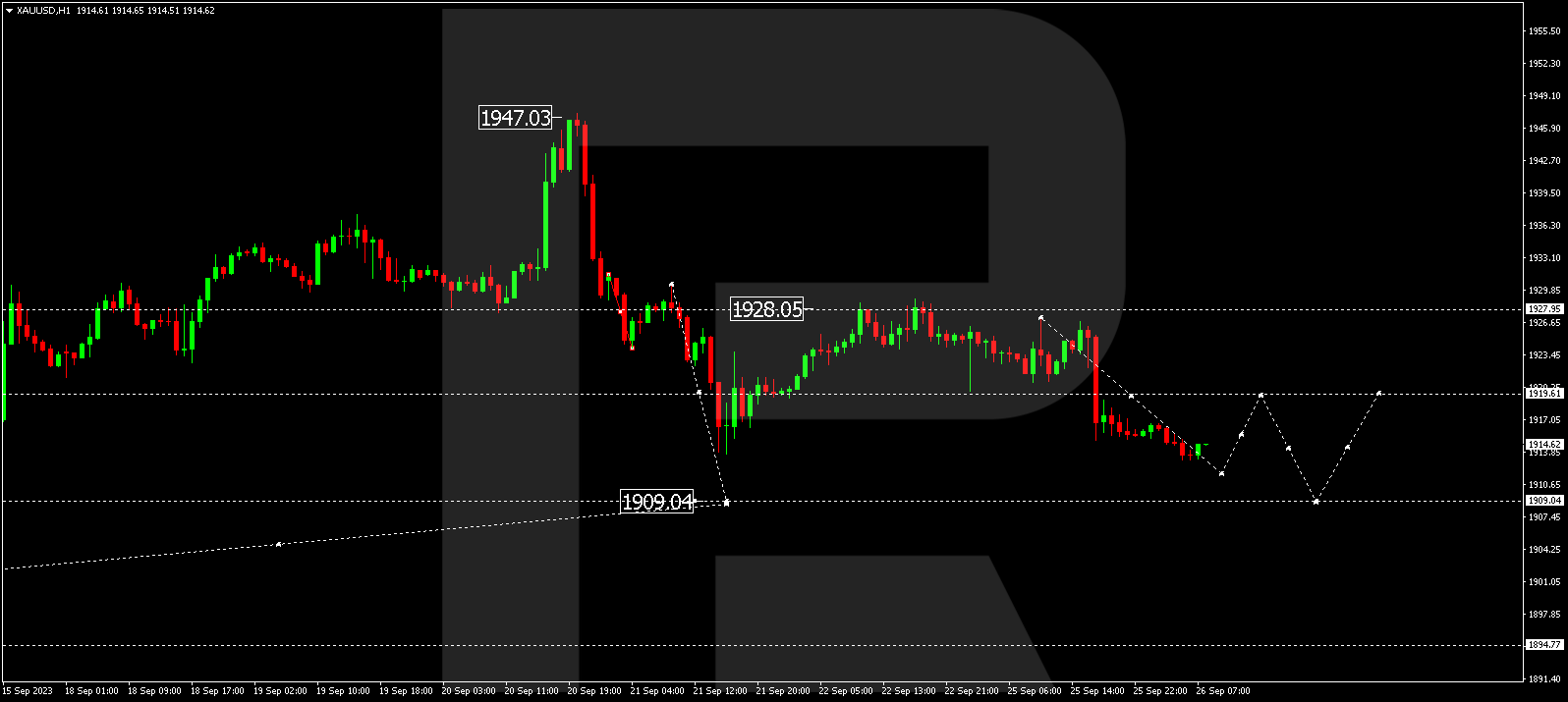

XAU/USD (Gold vs US Dollar)

Gold is in the process of a decline wave, heading towards 1911.11. After reaching this level, a potential rise to 1919.60 (a test from below) may ensue. Subsequently, a decline to 1909.00 could transpire, setting the stage for a trend towards 1894.77.

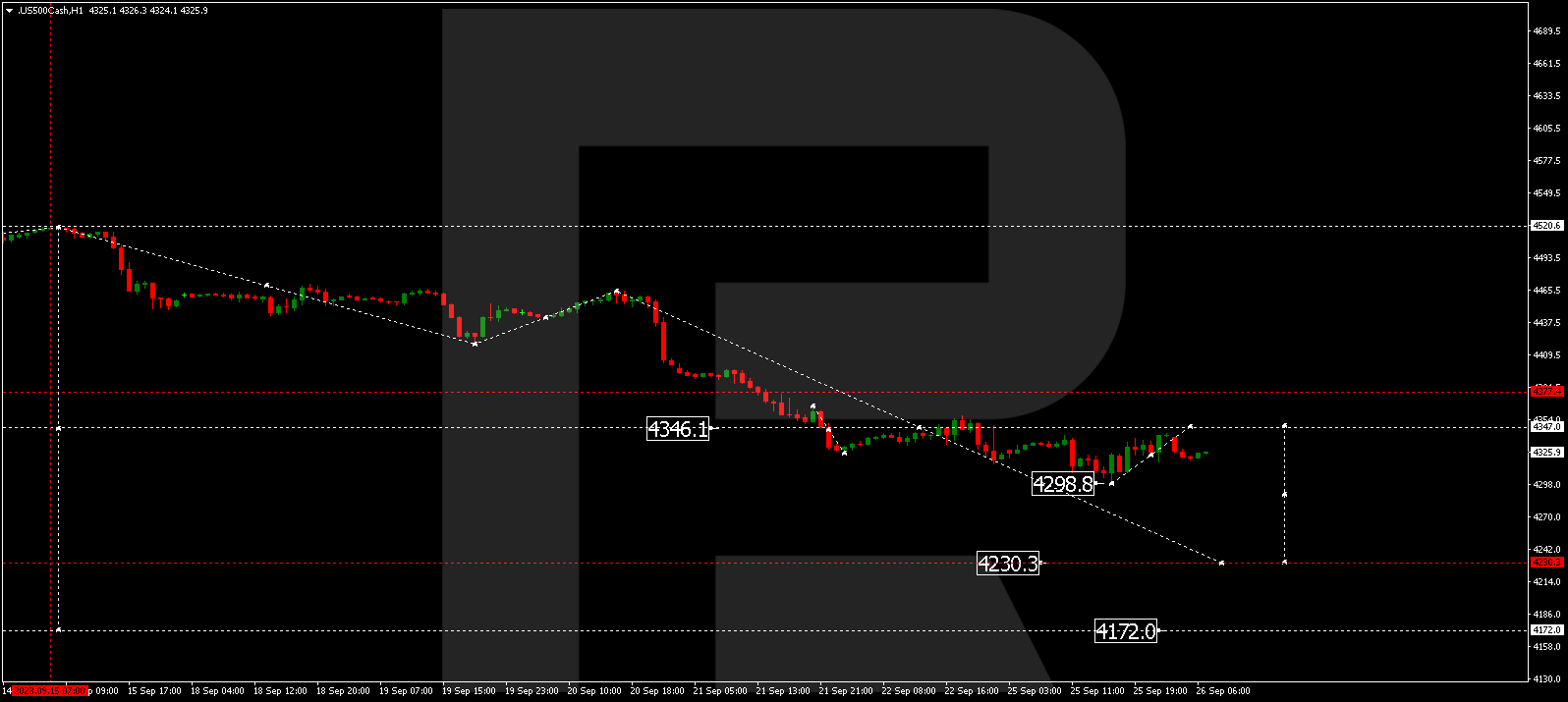

S&P 500

The stock index has completed a downward movement, reaching 4298.8. Today, a consolidation range might take shape above this level. In the event of an upward breakout, a corrective link to 4347.0 (a test from below) could manifest, followed by a decline to 4230.3. This represents a local target. Following this, the price might correct to 4298.0 before descending to 4172.0. This marks the initial target.

The post Technical Analysis & Forecast September 26, 2023 appeared first at R Blog – RoboForex.