This article is about The NFT Gaming Company Inc. which develops video games and a platform for monetising them with NFT (non-fungible-token). It plans to go public on the NASDAQ exchange on 16 February, and the ticker of its stocks is NFTG.

We will take a closer look at the business model of The NFT Gaming Company Inc., the outlook for its addressable market, its main competitors, its financial situation, strengths and weaknesses, and the details of its forthcoming IPO.

What we know about the NFT Gaming Company

The NFT Gaming Company Inc. is working on the development of the Gaxos platform on which it plans to sell proprietary and third-party video games. The company was founded in 2021 in the US and is headquartered in New Jersey. The CEO is Vadim Mats, who was previously CFO at DatChat Inc.

The issuer plans for Gaxos to sell shooters, races, role-playing video games, and products from other genres. The games will feature various artefacts, heroes, weapons, equipment, and other attributes of the game world, which will be represented in the form of NFTs. The corporation creates these tokens through the Polygon blockchain technology.

Many of the issuer’s competitors use Ethereum blockchain in similar developments. Polygon benefits from faster transaction processing speeds and lower smart-contract costs on the Polygon Network. It is worth noting, however, that these blockchain technologies are compatible and interoperable.

As of 30 June 2022, the amount of investment raised by The NFT Gaming Company Inc. reached USD 2.2 million. The main investors are FortyNine Hulbert LLC, TIMB94 LLC, and Many Ads Inc.

The prospects of the NFT Gaming Company’s addressable market

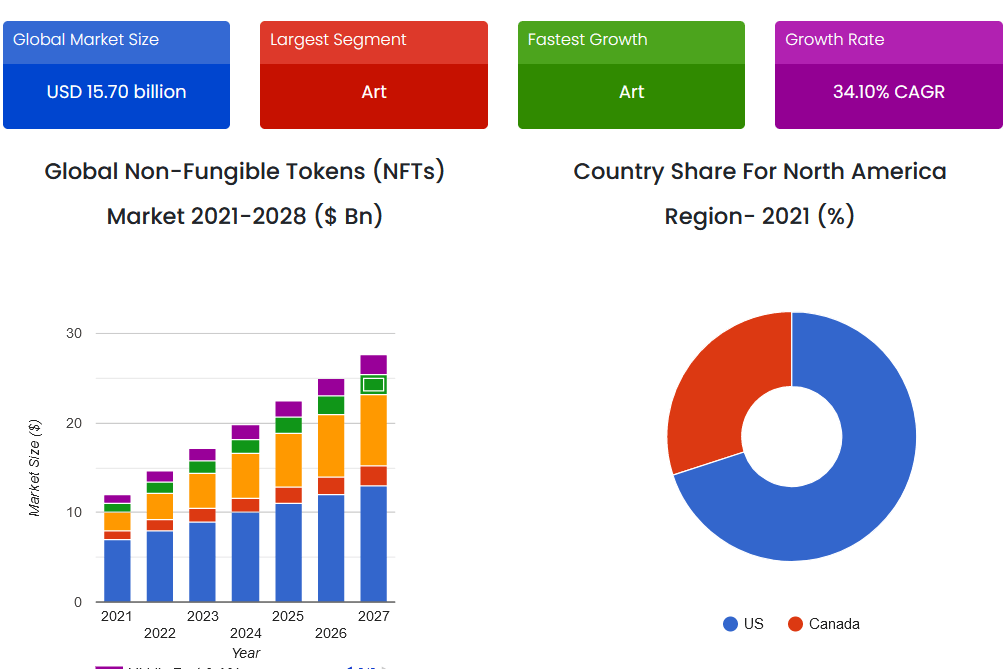

According to SkyQuest Technology, the global NFT market was valued at USD 15.7 billion in 2021. By 2028, the estimate is expected to reach USD 122.4 billion. The projected compound annual growth rate (CAGR) from 2022 to 2028 is 34.1%.

The main growth drivers for this market could be increased demand for digital artwork, greater integration of tokens into the entertainment industry, and the popularisation of crypto tools.

Main competitors:

- Coinbase Global, Inc.

- Ozone Networks, Inc.

- Larva Labs, LLC

- Cloudflare, Inc.

- Dapper Labs, Inc.

- Binance Holdings Ltd.

NFT Gaming Company’s financial performance

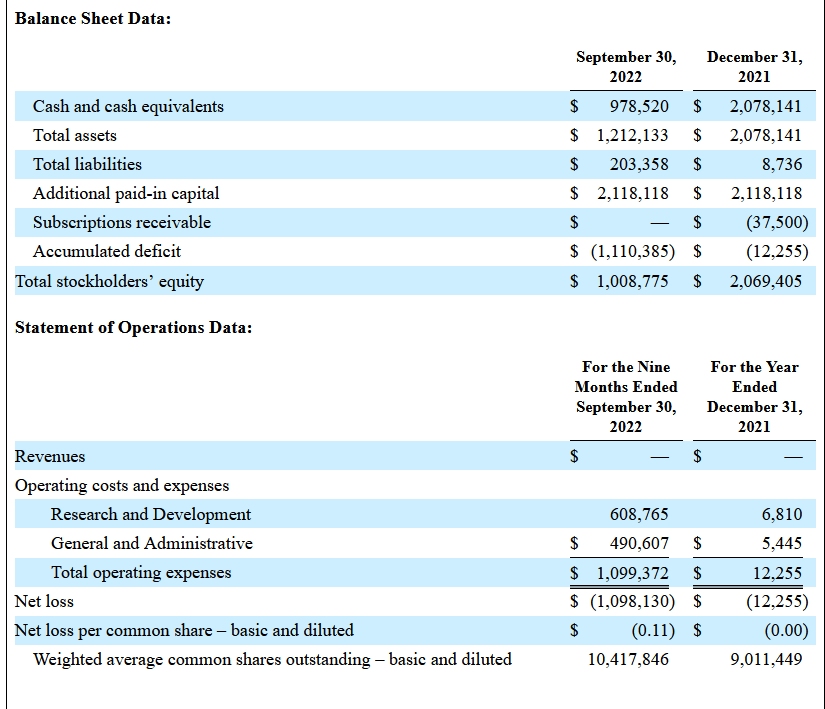

As the NFT Gaming Company Inc. was not generating revenue at the time of writing, we will look at its cost structure. In 2021, the company spent 6,800 USD on research and development. In the period January – September 2022, the figure grew to 608,800 USD. The operating expenses amount in 2021 was 12,300 USD, while in Q1-Q3 of the previous year, the indicator increased to 1.1 million USD.

As of 30 September 2022, the corporation had USD 978,500 in its accounts, with total liabilities of USD 203,400.

NFT Gaming Company’s strengths and weaknesses

Strengths:

- Qualified management

- High growth rate of the addressable market

- Monetisation of the product through NFT

- The rise in popularity of the NFT

- The popularity of the Polygon blockchain

- The development of metaverses

Weaknesses:

- Strong competition

- No revenue

- The issuer is not planning to pay out dividends

What we know about the NFT Gaming Company’s IPO

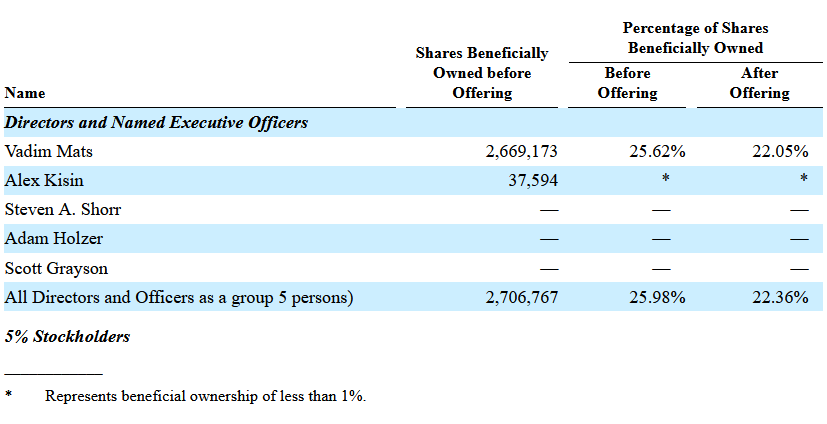

Laidlaw & Company (UK) Ltd. is the underwriter of the IPO of The NFT Gaming Company Inc. The issuer plans to sell 1.68 million common stocks at the offered average price of 4.15 USD per unit. The gross proceeds from the sale of stocks will amount to USD 6.97 million, excluding the sale of options by the underwriter. The company might reach a capitalisation of USD 50.23 million. The firm does not generate revenue, so it is difficult to analyse it through classical multiples.

Invest in American stocks with RoboForex on favorable terms! Real shares can be traded on the R StocksTrader platform from $ 0.0045 per share, with a minimum trading fee of $ 0.5. You can also try your trading skills in the R StocksTrader platform on a demo account, just register on RoboForex and open a trading account.

The post The NFT Gaming Company IPO: NFT Monetisation of Video Games appeared first at R Blog – RoboForex.