This article is devoted to such an idea as a split of stocks, its influence on the stock price and on how attractive they are for investors

What is a stock split

A stock split is an increase in the number of stocks of the issuer in circulation that entails a decrease in the stock price but not in the general capitalization. This is a wide-spread market practice, naturally supported by the company’s desire to make their expensive shares more affordable to a wide range of investors.

Many actively developing companies are interested in an in-flow of extra money that new investors can bring. However, not every investor can afford promising and expensive stocks.

Hence, to make stocks cheaper and more affordable, the split procedure is run to. As a result, the number of stocks increases and their price drops proportionally. This makes the stocks more affordable to investors.

For example, if a company increases the number of its shares five times, i.e. carries out a split of 5:1, investors can have 4 extra shares per each they already have.

At the same time, the price of one share decreases proportionally: if initially a share cost $1,000, after the split it will cost $200. Hence, each shareholder of this issuer will have 5 times as many shares but their total price will not change.

Critical points of stock splits

The split coefficient that shows how much the number of stocks changes after the procedure, is normally anything between 2:1 and 10:1. In the split procedure, there are three main dates:

- The day of announcement. To get started, the company makes a public announcement of its plans for a stock split and all the details that investors need to know. This information usually includes the split coefficient and the day when the split is to happen.

- Register closing day: this is an important day when the list of the company’s shareholders is settled. These people will get extra shares after the split.

- The split day is the day when new stocks appear on the investors’ broker accounts and start trading at the new price.

What is a reverse split?

There is another procedure known as the reverse split that also changes the number if stocks in portfolios. It is also called stock consolidation.

By this procedure, the stocks that investors hold are changed by a proportionally smaller number of stocks. For example, a reverse split of 1:3 makes every three shares into one. This means that if you used to hold 30 shares of the company, after a stock consolidation you will have only 10 but the price of each share will grow three times.

For example, if the stocks did horrible, trading low under a dollar, a reversed split can raise their price.

How does a split influence the stocks and investors?

On the whole, a stock split is interpreted as a good event for the issuing company, though it does not influence its capitalization directly. A split means that the company is developing, doing well, and the growth of its shares confirms it. Carrying out a split, the company signals that it wants to make its shares more attractive and affordable to private investors.

A decrease in the price makes the shares more affordable to investors and more liquid. The history of splits shows that the growth of stocks after a split usually exceeds the growth of major stock indices. Hence, after a split, the portfolio of an investor can have a significant profit, if the shares keep growing.

Most shares demonstrate positive dynamics right after the split was announced and even before it is over. After the split, the shares might start a temporary consolidation, sometimes up to several months. First of all, this is because large institutional investors might start taking the profit upon selling the now affordable stock to individual investors.

Some famous companies (Apple, Microsoft) have had several splits over their history. However, there are such dinosaurs that reject any idea of split regardless of their extremely high stock price.

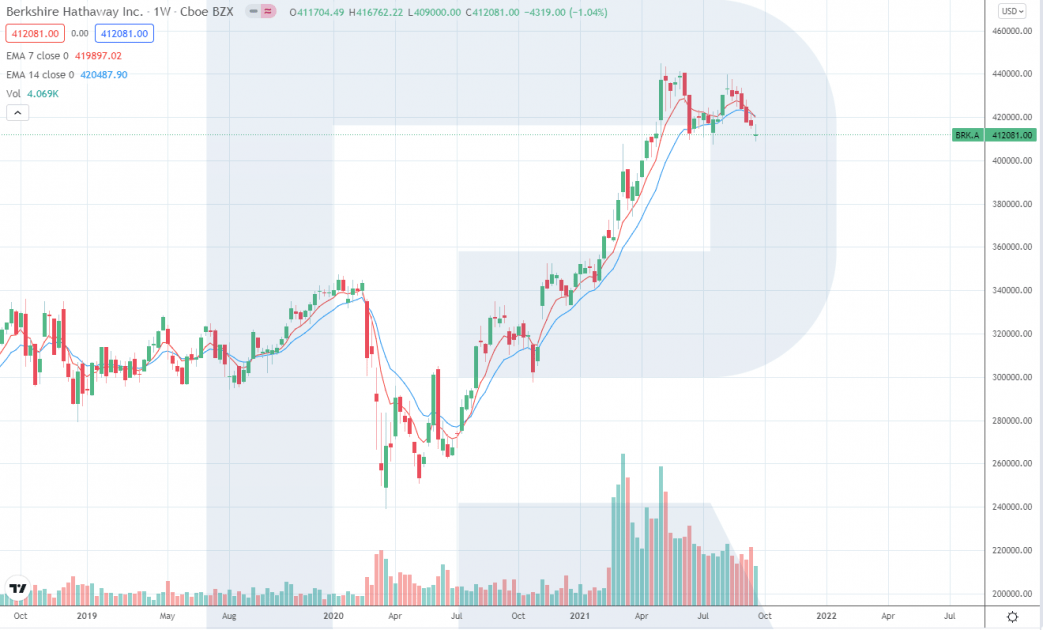

A bright example is a Warren Buffett’s holding company Berkshire Hathaway (NYSE: BRK.A). Its shares have never been split. Today one class A share of the company costs about $412, 000.

Examples of stock splits

Take a look at the examples of splits of two famous US companies.

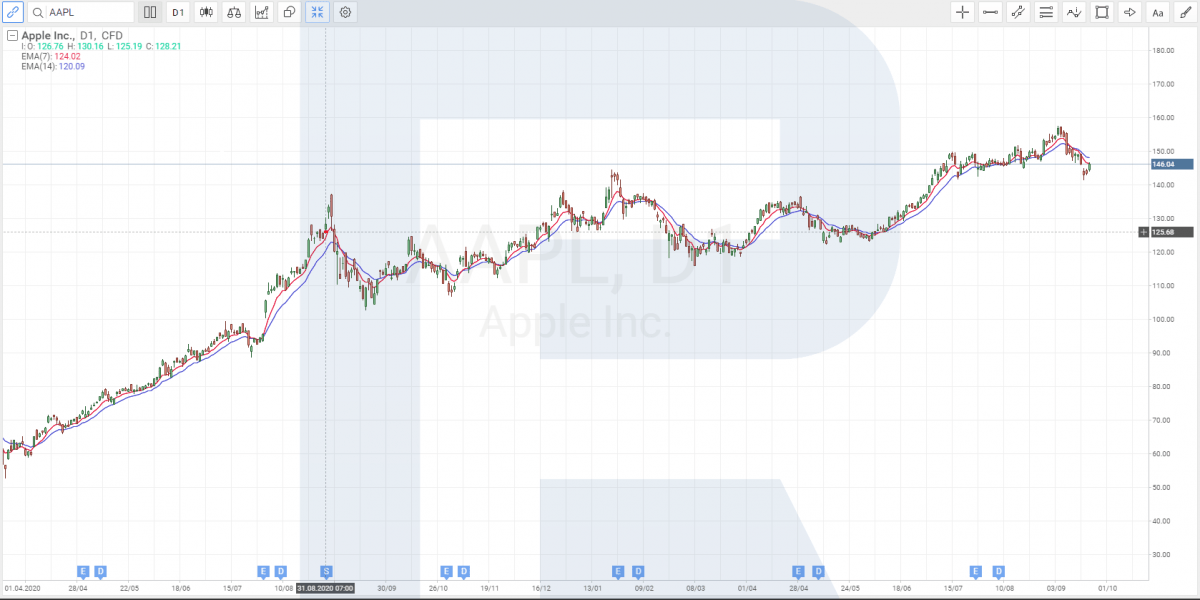

Stock split of Apple

Apple (NASDAQ: AAPL) had its fifth stock split on August 31st, 2020. The split coefficient was 4:1, so the number of shares grew 4 times.

After the split, the stock price was corrected from roughly $500 to $125. Later on, the price rested between $110-130 for some time, and then growth continued.

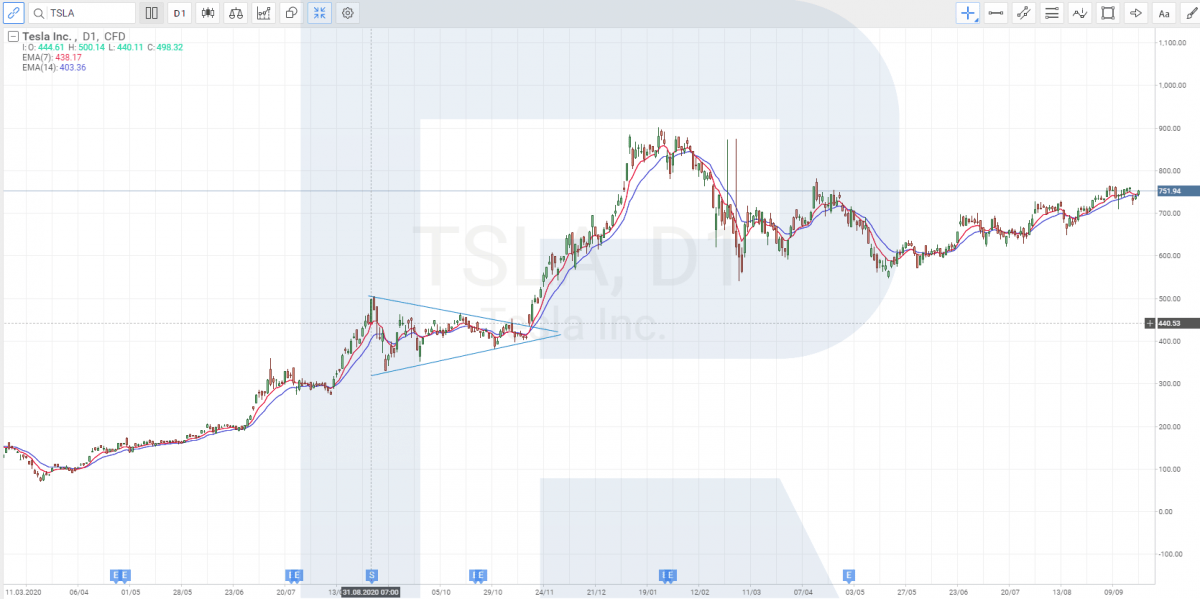

Tesla split

Elon Musk’s company Tesla (NASDAQ: TSLA) carried out its first stock split on August 31st, 2020 as well. After a split of 5:1 was announced on August 12th, the company’s shares sky-rocketed by almost 50% by the end of the month. After the split was over, the share price corrected from anout $2,200 to $440. They kept on growing after a short consolidation.

Bottom line

A stock split is a wide-spread way to decrease the stock price of successful and developing companies in order to increase their availability to private investors. Though it does not change the basics if the business or market capitalization, history shows that investors may hope for a probable growth in the price of their portfolios.

Invest in American stocks with RoboForex on favorable terms! Real shares can be traded on the R Trader platform from $ 0.0045 per share, with a minimum trading fee of $ 0.25. You can also try your trading skills in the R Trader platform on a demo account, just register on RoboForex.com and open a trading account.

The post What Is Stock Split and How Does It Influence Stock Price? appeared first at R Blog – RoboForex.