Every year, more and more electric cars are sold all over the world. In 2021, 6.75 million electric cars were sold, i.e. 120% more than in 2020. If not for the shortage of semiconductors, the result would have been even more stunning. Today the overall number of sold electric cars in the world reaches almost 16 million, which is 8.5% of all vehicles.

For comfortable driving, electric cars require lots of charging points. The demand for the development of charging stations network makes companies from this segment quite appealing for investments. The leader of the segment is ChargePoint Holdings Inc. (NYSE: CHPT). This is the corporation that this article is devoted to.

What we know about ChargePoint Holdings

This company, founded in 2007, makes equipment and software for charging electric vehicles. As checked on 31 January 2022, Charge Point Holdings manages the world’s largest network of charging stations – 174,000 stations in 16 countries. 51,000 out of them are situated in Europe.

The company has carried out 13 rounds of investments, and the list of those eager to invest in its development features, among other companies, Daimler AG, BMW Siemens AG, Chevron Corp, Toyota Motor Corp, American Electric Power, Canada Pension Plan Investment Board, Singapore GIC, and Chevron Technology Ventures.

Note the participation of Canada Pension Plan Investment Board and Singapore GIC. Such large and conservative trusts investing in the company means that they consider ChargePoint promising.

Moreover, Canada Pension Plan Investment Board and Singapore GIC can now lobby the interests of the company in their home countries. This will not only let the American company increase its presence in the market but also step further away from the nearest rival – such as Blink Charging Co. (NASDAQ: BLNK).

Why ChargePoint is more attractive than Plug Power

An alternative investment to ChargePoint is Plug Power Inc. (NASDAQ: PLUG). This company develops hydrogen infrastructure.

However, with all the recent events, the price for gas in Europe has grown over 2,000 USD per thousand cubic meters. With such prices, hydrogen fuel loses appeal as it is still mostly produced from fossils.

Moreover, vehicles that work on hydrogen are really few, that is why car-making companies for now do not plan to invest in this sector billions of dollars.

In the market of electric cars, the situation is quite different as these vehicles are already made by all global car makers. According to the International Energy Agency (IEA), yearly sales volume of electric cars will have reached 25 million vehicles by 2030, and this is the most pessimistic forecast. If things go better, sales will have reached 46 million cars.

At which stage of development ChargePoint is

Analysts say that ChargePoint Holdings is still at the initial stage of its development, which is confirmed by the speed at which its income grows. In Q4, financial 2022, the revenue of the company reached 80.7 million USD, which is 90% more than in the same part of the previous financial year.

Normally, at the early stage of development, companies are losing but the speed of growth of their revenue is expressed in two-digit numbers. This happens because, aiming at capturing their part of the market, they invest large sums in marketing, research, and mergers.

In 2021, ChargePoint Holdings spent on research and development 93% more than in 2020, namely, 145 million USD.

How the quarterly report surprised Wall Street

The statistics for Q4 and the whole of the financial 2022 exceeded all expectations of experts. According to the report, the overall yearly revenue grew by 65% (compared to the previous year) to 242.3 million USD. Meanwhile, quarterly revenue from mains charging systems grew by 109% to 59.2 million USD.

ChargePoint Holdings provides free services of setting up the equipment and software to legal entities, in exchange asking for a subscription to services. Over November-January, the revenue from selling subscriptions grew by 57% to 17.2 million USD.

The management forecasts that in February-April 2022, the revenue might reach 72-77 million USD and over the whole financial year – 450-500 million USD. Market players like such optimistic forecasts, and the share price grew by 8%, testing the resistance level of 15 USD.

Tech analysis of ChargePont Holdings shares

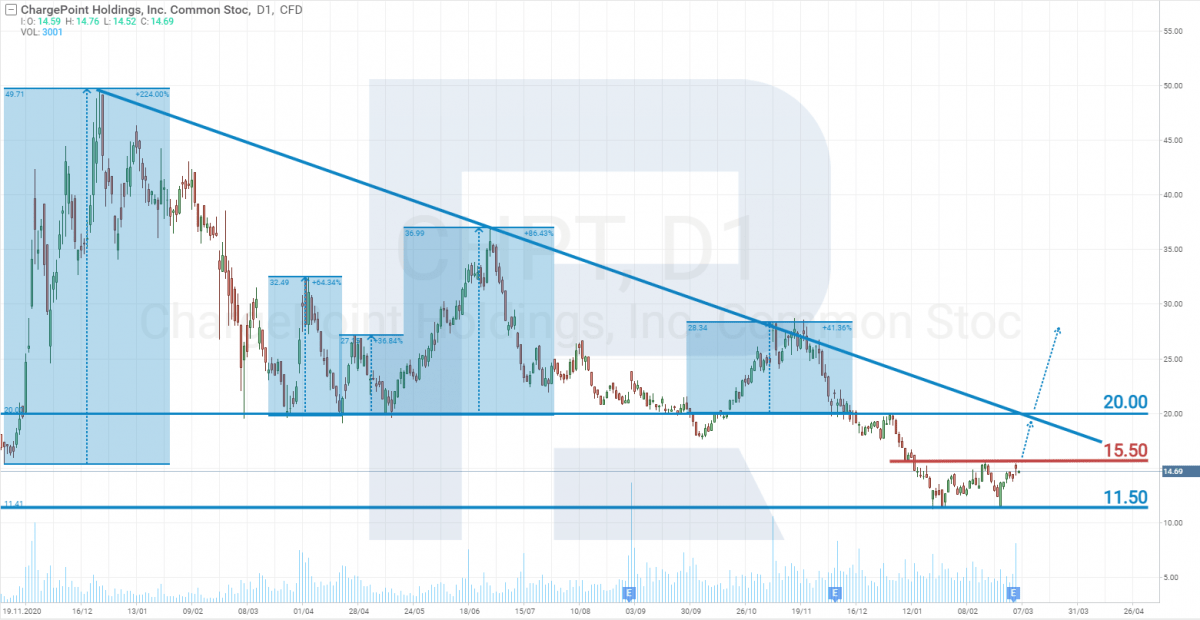

ChargePoint Holdings shares are trading in a downtrend, and here is an explanation of why it is normal. After the agitation of 2020, the shares of the corporation grew by 220% to 50 USD, and the capitalization reached 16.5 billion USD. However, the revenue at that time only reached 40 million USD.

To compare: the capitalization of ROKU Inc. (NASDAQ: ROKU) is now 16.7 billion USD, while its quarterly income is 865 million USD, and the net profit is 23 million USD.

The share price of ChargePoint Holdings did not stay at such levels for long and started descending gradually. The first strong support level at which market players started buying the shares was at 20 USD and stayed there for long. The quotations tested it 4 times, bouncing off each time and then rising by 30-85%.

In October 2021, the price tries to break through the support level for the first time. The shares dropped to 17.5 USD, after which it recovered, and the quotes rose to 28 USD again. At that time, we published the first article about the company in our blog and recommended buying the shares if they break through the level of 20 USD. Finally the level was broken through in December 2021; they tried to recover but failed.

At the beginning of 2022, the US stock indices headed down, and the market was generally pessimistic. Investors tried to include in the prices the expectations of a possible increase in the interest rate by the Fed and the beginning of cutting down on the balance of the US Central bank. With all this, the shares of ChargePoint Holdings dropped to 11.5 USD, and a new support level formed there.

Now the resistance level of 15.5 USD should be noted, and a breakaway of this will be the first signal for possible growth of the price to 20 USD. And then, if the quotations manage to rise over 20 USD, the trend might reverse and start a long-term uptrend. This breakaway will mean a breakaway of the descending trendline.

Closing thoughts

ChargePoint Holdings is the leader in the market of electric car chargers. The growth in the sales of electric cars will provoke stable increased demand for the produce of the company.

Currently, investments in ChargePoint Holdings can be regarded as long-term. The risk here is an increase in the interest rate of the Fed that will make the debts of the company also grow. For now, this is the only weak point.

Invest in American stocks with RoboForex on favorable terms! Real shares can be traded on the R StocksTrader platform from $ 0.0045 per share, with a minimum trading fee of $ 0.5. You can also try your trading skills in the R StocksTrader platform on a demo account, just register on RoboForex and open a trading account.