This article focuses on Millennium Group International Holdings Limited, which plans to go public and list on the NASDAQ exchange on 29 March under the ticker MGIH. The company manufactures and sells diverse types of printing and packaging products.

Today we will talk about the issuer’s business model, its financial situation, and the outlook for its addressable market. We will also list its strengths and weaknesses, name its main competitors, and look at the details of its IPO.

Millennium Group International Holdings in brief

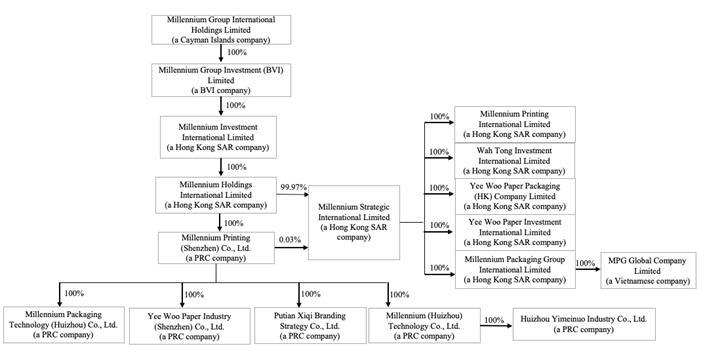

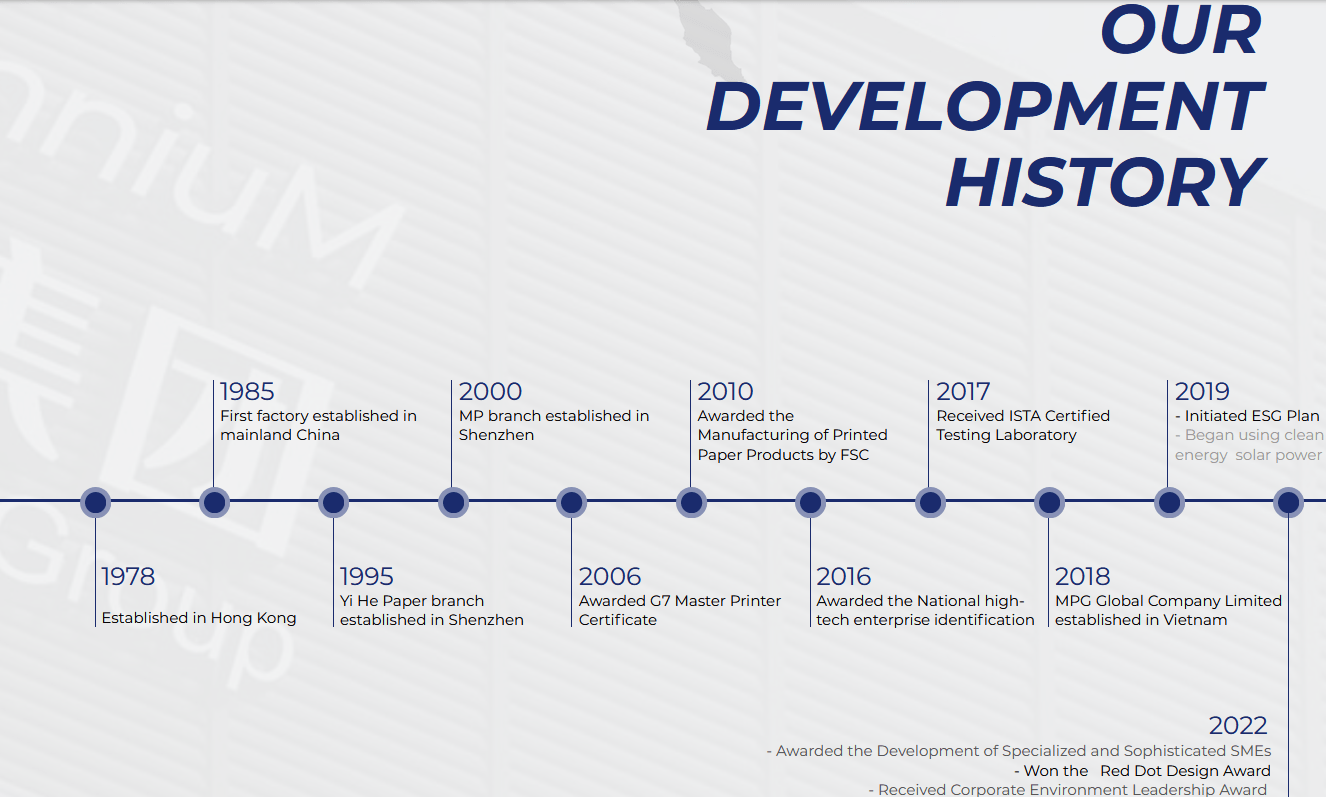

Millennium Group International Holdings Limited is a manufacturer of paper-based printing and packaging products. This international holding company was established in 1978 and is registered in the Cayman Islands. Its head office is in Hong Kong, China. Initially, the firm engaged in the manufacture and sale of corrugated paper. Ming Hung Lai, a third-generation member of the Lai family who founded the holding company, has been the Chairman of the Board of Directors since 2007.

Millennium Group International Holdings Limited mainly works in the Chinese and Vietnamese markets. The production facilities are in Guangdong province, China. In Vietnam, the company is still using subcontractors but has already started building its own production facilities.

The Chinese market accounts for almost 80% of the holding company’s revenues, which indicates a low level of business diversification. To optimise the business model, management is planning to expand its presence in other markets in Southeast Asia.

The issuer supplies end-to-end packaging design and manufacturing services, including design development, quality control, and finished product testing and delivery. Customers can order external and internal packaging of any complexity and in various materials.

As at 30 June 2022, Millennium Group International Holdings Limited had raised an investment of 32.1 million USD. The main investor is YC 1926 (BVI) Limited.

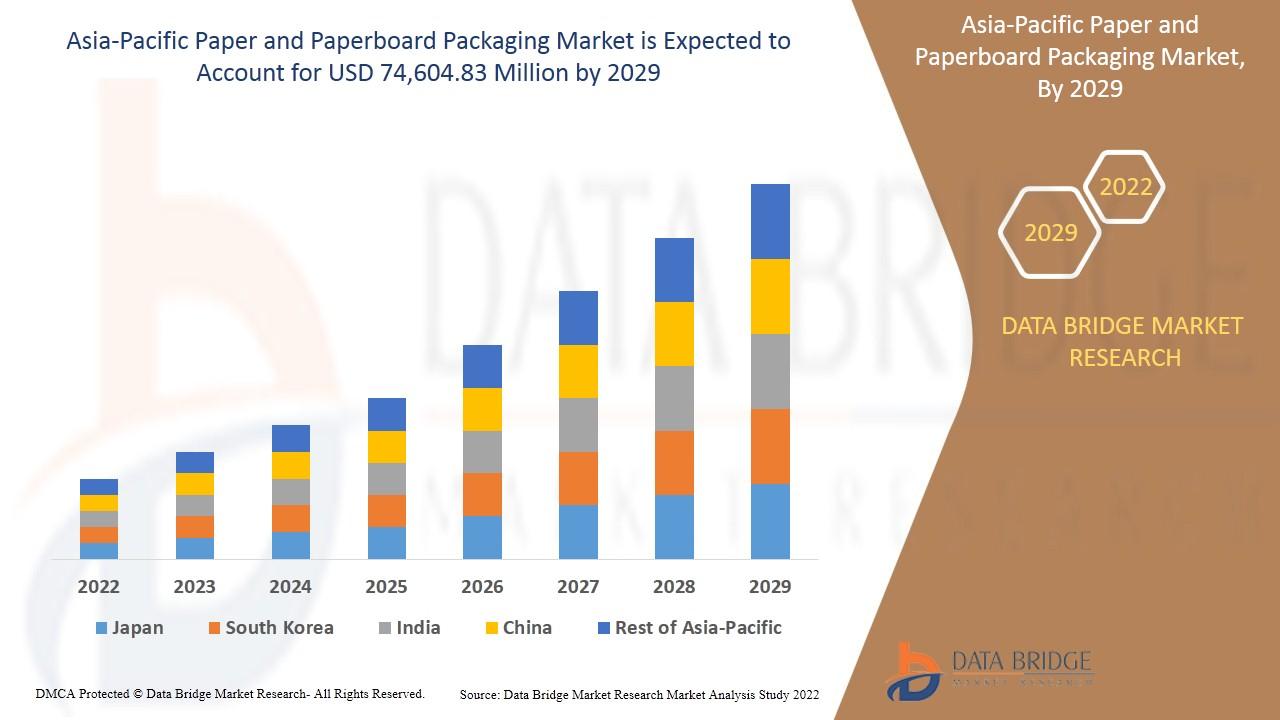

Prospects for the addressable market for Millennium Group International Holdings

According to Data Bridge Market Research, the paper packaging market in Asia Pacific will reach 74.6 billion USD by 2029. The projected compound annual growth rate (CAGR) from 2022 to 2029 inclusive is 5.9%.

Main competitors:

- International Paper Company

- WestRock Company

- Mondi plc

- Sonoco Products Company

- Stora Enso Oyj

- Svenska Cellulosa AB SCA

- Rengo Co., Ltd.

- Nippon Paper Industries Co., Ltd.

- Fedrigoni S.P.A.

- Mayr-Melnhof Karton AG

Millennium Group International Holdings’ financial performance

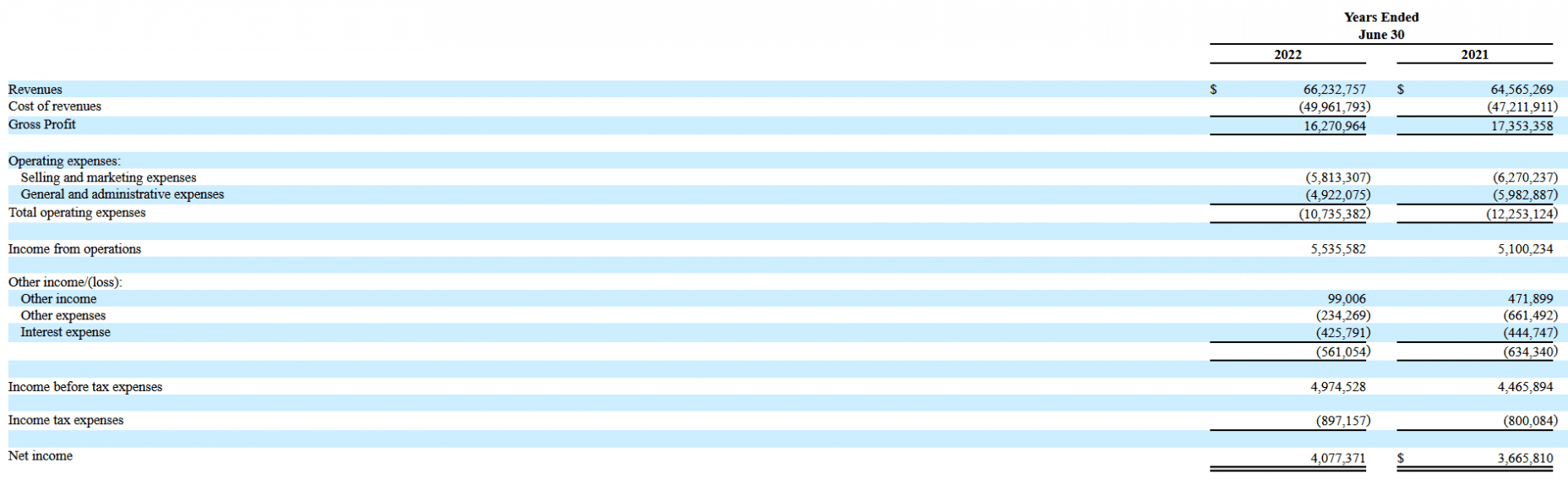

The net profit of Millennium Group International Holdings Limited for the period July 2021 to June 2022 inclusive reached 4.08 million USD, an increase of 11.23% over the statistics for the same period 2020-2021. Revenue for the fiscal year 2022 increased by 2.58% to 66.23 million USD.

As at 30 June 2022, Millennium Group International Holdings Limited’s net cash flow was positive and had reached 1.6 million USD. During the same period, the company had 19.4 million USD in its accounts, with total liabilities reaching 25.9 million USD.

Strengths and weaknesses of Millennium Group International Holdings

Strengths:

- A promising addressable market

- A long history and a strong reputation

- Qualified management

- The family nature of the business

- Revenue growth

- Net profit growth

Weaknesses:

- Strong competition

- Dependence on the legal framework of the PRC

- Low level of business diversification

What we know about the IPO of Millennium Group International Holdings

The underwriters of the IPO of Millennium Group International Holdings Limited are Revere Securities, LLC and R.F. Lafferty & Co., Inc. The issuer plans to sell 1.5 million ordinary shares at an average price of 4 USD per unit. Gross proceeds from the sale of the securities will amount to 6 million USD, excluding the sale of options by the underwriter. The firm’s market capitalisation could reach 45 million USD.

There issuer’s P/S (capitalisation/revenues) multiplier might reach 0.67. The average P/S value of paper packaging firms is 1.1. The upside (growth potential) of these stocks during the lock-up period could reach 64.18% ((1.1/0.67-1) *100%).

Invest in American stocks with RoboForex on favorable terms! Real shares can be traded on the R StocksTrader platform from $ 0.0045 per share, with a minimum trading fee of $ 0.5. You can also try your trading skills in the R StocksTrader platform on a demo account, just register on RoboForex and open a trading account.

The post IPO of Millennium Group International Holdings: Paper Packaging Business in the Asian Market appeared first at R Blog – RoboForex.